Key Observations:

- Global investor reaction so far muted

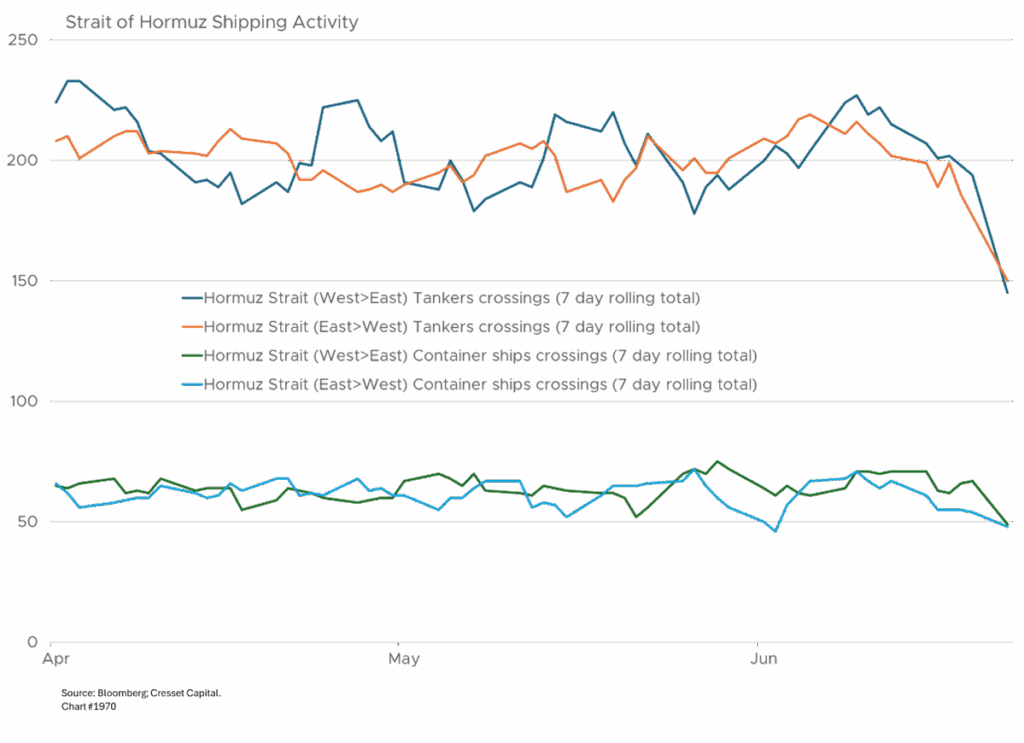

- Iranian parliament hopes to close Strait of Hormuz

- China would be most affected by Hormuz blockade

- Iran Has Options for Retaliation, but Actions Would Have Consequences

- Future Scenarios: De-escalation, Escalation or Regime Change

The United States launched “Operation Midnight Hammer” over the weekend, a massive military strike against three key Iranian nuclear facilities: Fordow, Natanz, and Isfahan. The operation involved more than 125 aircraft, including seven B-2 Spirit stealth bombers that dropped 14 GBU-57 Massive Ordnance Penetrator (MOP) bombs, weighing 30,000 pounds each, marking the first operational use of these bunker-busting weapons. The Pentagon called it “the largest B-2 operational strike in U.S. history”.

The US strikes came after Israel had been conducting military operations against Iran for over a week, beginning with surprise attacks on June 13. Iran had repeatedly warned of “irreparable damage” if the US joined Israel’s war against the Islamic Republic. The conflict represents a dramatic escalation from proxy warfare to direct confrontation between major powers.

Global Investor Reaction so far Muted

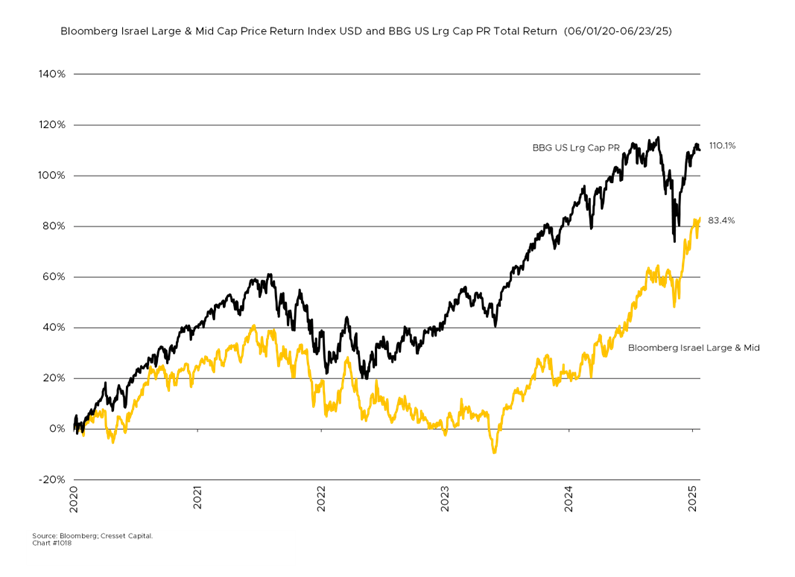

The escalating hostilities don’t appear to be moving the needle for global investors. US equities and market volatility are largely unchanged as of Monday morning. Meanwhile, the Israeli stock market hit an all-time high. Oil markets have reacted, with Brent crude futures rising by more than nine per cent on Sunday, touching levels not seen since late 2022.

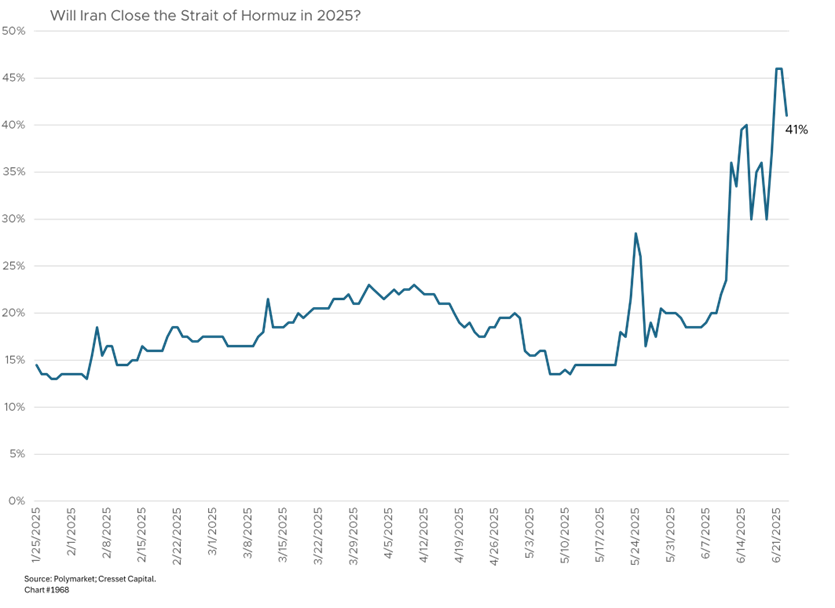

Iranian Parliament Hopes to Close Strait of Hormuz

Iranian Foreign Minister Abbas Araghchi condemned the strikes as violations of international law, warning of “everlasting consequences” and stating that “Iran reserves all options to defend its sovereignty.” Iran also announced that any American civilian or military personnel in the region are now considered legitimate targets.

In response to the US strikes, Iran’s parliament voted overwhelmingly on Sunday to approve the closure of the Strait of Hormuz, a critical maritime passage through which approximately 20 per cent of the world’s oil passes daily. However, it should be noted that the final decision rests with Iran’s Supreme National Security Council, headed by an appointee of Supreme Leader Khamenei.

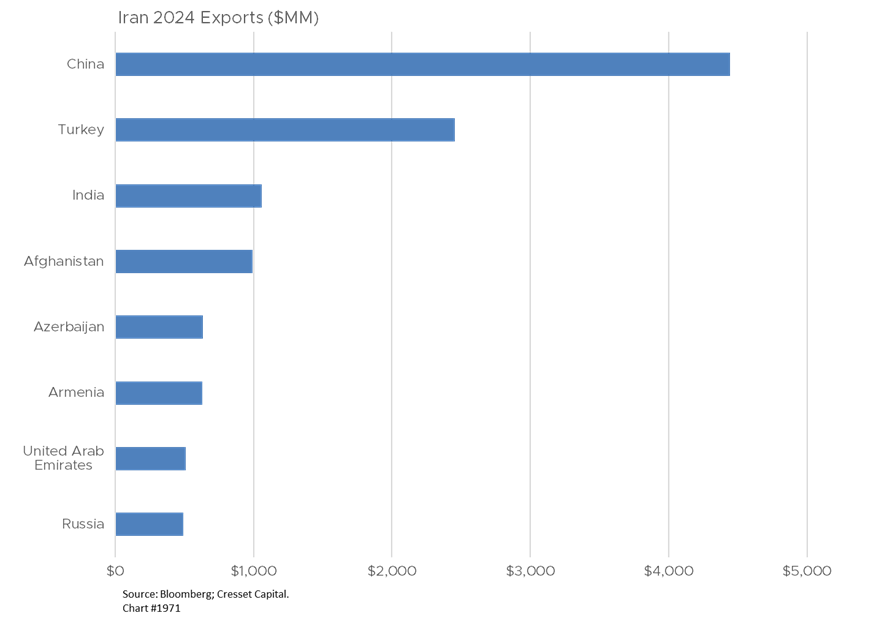

China Would Be Most Affected by Hormuz Blockade

China, Iran’s largest export destination, imported nearly $4.5 billion of crude from Iran last year. China would be most affected if Iran were to close the Strait to all shipping. US Secretary of State Marco Rubio called on China to discourage Iran from closing the Strait of Hormuz, noting China’s dependence on the waterway for oil imports. Vice President JD Vance described any attempt to close the strait as “economically suicidal” for Iran, stating “their entire economy runs through the Strait of Hormuz”.

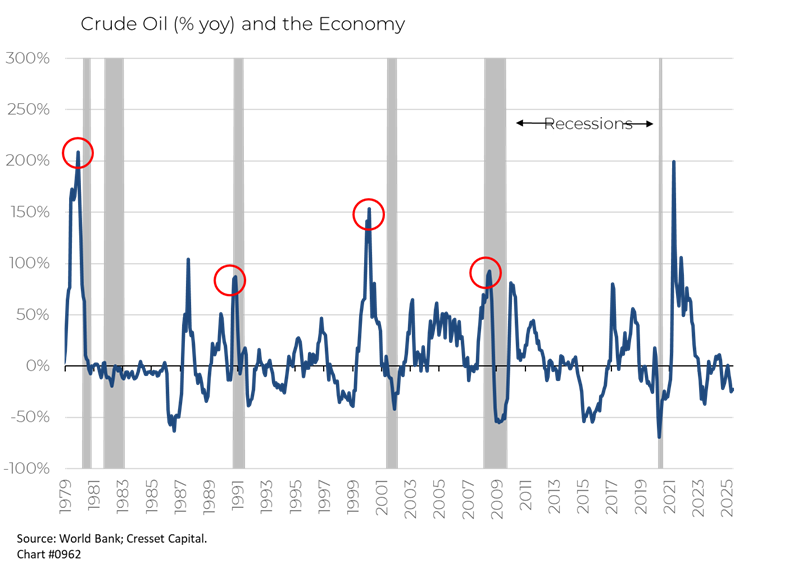

Analysts predict oil prices could surge above $100/bbl if Iran blocks the Strait of Hormuz for a prolonged period. During the Arab oil embargo of 1973-74, prices roughly quadrupled, while the Iranian revolution of 1979 and subsequent Iran-Iraq war resulted in oil prices more than doubling.

Iran Has Options for Retaliation, but Actions Would Have Consequences

The Iranian military has several options for retaliation, including maritime warfare. Iran could harass shipping, lay mines, or use fast-attack boats to disrupt traffic through the Strait of Hormuz either directly or through its Houthi proxies. The country could target US interests in the region, either directly or through proxies. Roughly 40,000 US troops are stationed in the Middle East. Iran maintains sophisticated cyber capabilities that could target US or Israeli infrastructure.

Future Scenarios: De-escalation, Escalation or Regime Change

We believe there are potentially three broad scenarios that could play out going forward:

- De-escalation. Iran could seek diplomatic resolution, leading to reduced oil prices and market stability. That outcome seems remote at this point.

- Escalation. Iran could retaliate against oil infrastructure or US targets, potentially causing economic and financial market disruption.

- Regime change. Internal instability in Iran could lead to unpredictable outcomes. Israel’s and US’s military missions were designed to rid Iran of its nuclear weapon capabilities, not regime change. Without an opposition party initiative, regime change in Iran is unlikely, at least in the near term.

The situation remains highly volatile, with Trump warning that “there are many targets left” and threatening greater force if Iran retaliates. The destruction of Iran’s nuclear capabilities represents a potential turning point in Middle Eastern geopolitics, with implications for global energy markets, international law, and regional stability that could persist for years to come.

The immediate focus for policymakers and investors remains on Iran’s next moves, particularly whether Supreme Leader Khamenei will authorize closure of the Strait of Hormuz, which would likely trigger a broader international response and potentially catastrophic economic consequences worldwide.

Bottom Line:

Energy prices represent the transmission mechanism between the Middle East hostilities and the global financial markets. Oil price spikes have historically served as a tax rather than an inflation catalyst in the US. Thanks to domestic production, the US does not rely on oil imports from the Middle East. It should be noted, however, that besides the pandemic, our last four recessions were preceded by meaningful year-over-year energy price spikes.