Key Observations:

- In May US equities had best monthly showing since late 2023

- Buyers shunning long-dated US Treasurys on fiscal concerns

- US labor market growth positive but softening

This week, we highlight three important charts that provide insight into the performance of the equity and bond markets, and the evolving labor market.

In May US Equities Had Best Monthly Showing Since Late 2023

In May 2025, US stocks delivered their strongest monthly performance since late 2023, with the S&P 500 rising over six per cent despite ongoing trade war uncertainties. The tech-heavy NASDAQ Composite surged 9.6 per cent, while the Dow Jones Industrial Average gained 3.9 per cent. Both the S&P 500 and the NASDAQ moved into positive territory for the year after plunging in early April due to tariff fears.

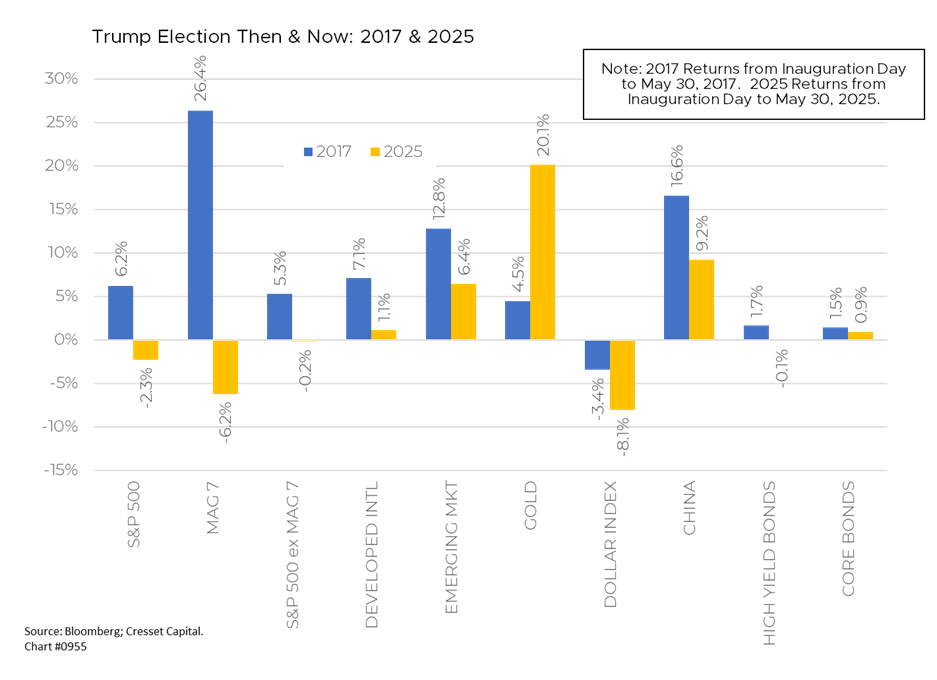

The rally was fueled by President Trump’s decision to back away from some of his most severe tariff threats. Markets gained momentum starting April 9 when Trump announced a 90-day pause on sweeping tariffs he had imposed on major trading partners during his “liberation day” announcement. Additional boosts came from a US-UK trade deal and a temporary US-China agreement to cut tariffs for 90 days. Notwithstanding May’s rally, so far this year all markets, with the exception of gold, are trailing their counterparts in Trump 1.0 Inauguration Day through May 2017 returns.

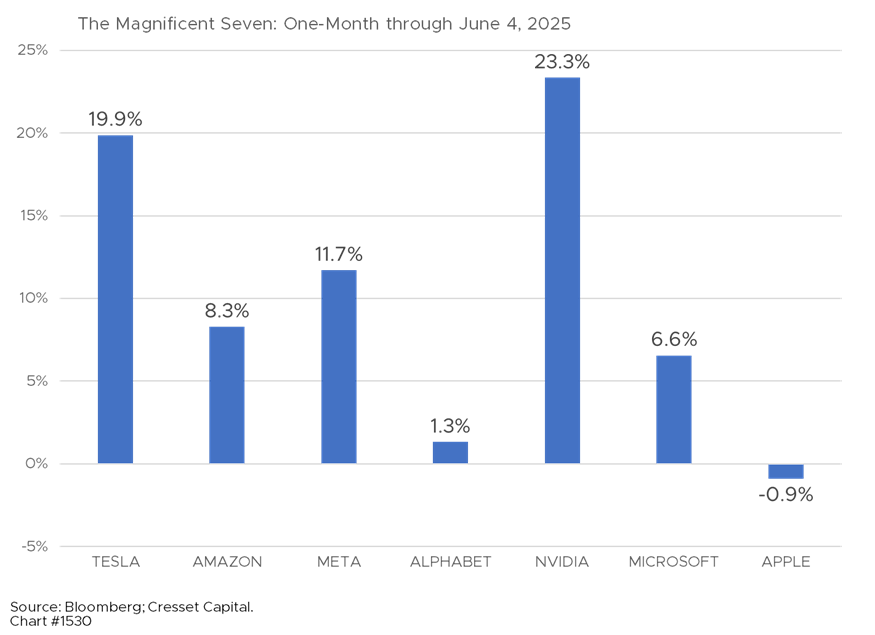

Technology stocks, particularly the “Magnificent Seven” (which includes Meta, Tesla, and Nvidia) led the charge. Nvidia reported nearly 70 per cent quarterly revenue growth, highlighting the sector’s strength. Encouraging inflation data also supported the rally, with the Fed’s preferred price gauge showing only a modest increase to 2.1 per cent annually, just above its two per cent target.

Buyers Shunning Long-Dated US Treasurys on Fiscal Concerns

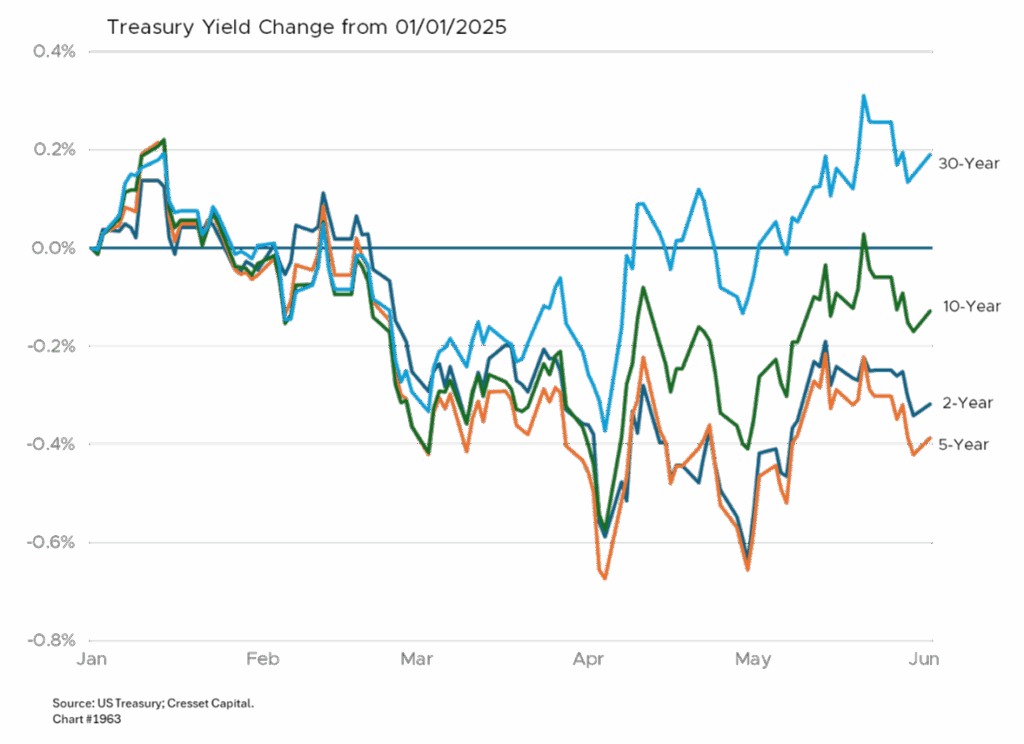

A “buyers’ strike” appears to be underway in the US 30-year Treasury bond market, with major investment firms avoiding long-dated government bonds. The 30-year Treasury has been a stark underperformer this year, with yields rising while shorter-term bonds (2-, 5-, and 10-year) have seen yields fall. This divergence is rare: it last occurred in 2001. The 30-year yield reached 5.15 per cent last month, approaching levels not seen since 2007.

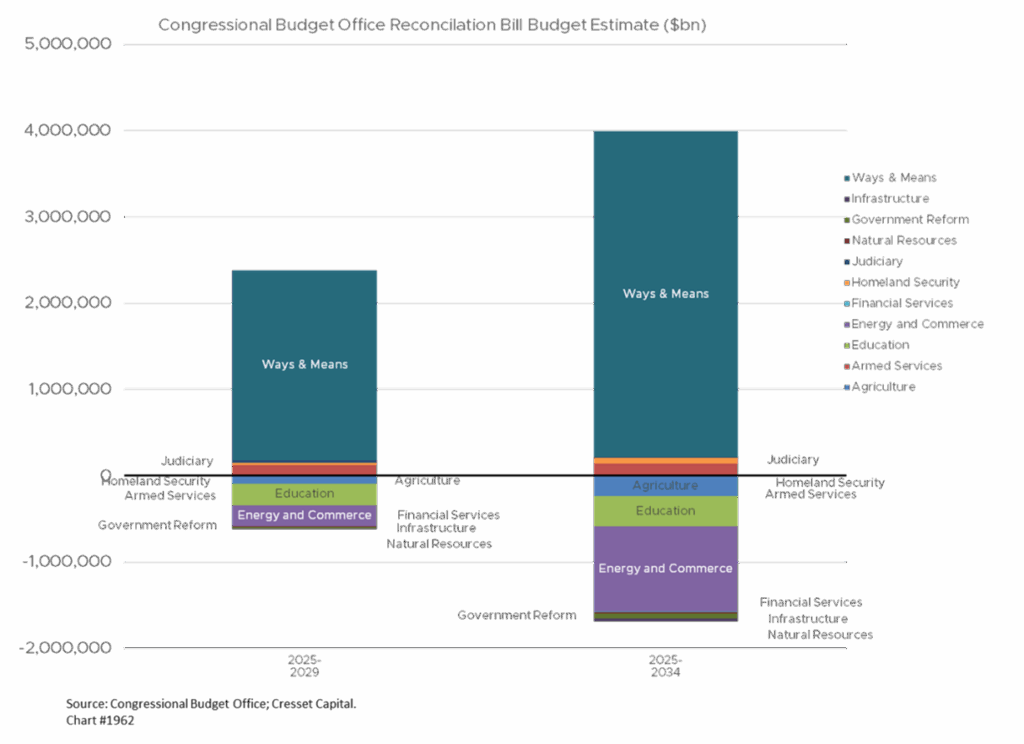

Investment managers are concerned about America’s swelling federal budget deficit and growing debt burden. The US recently lost its top credit rating from Moody’s, and Trump’s proposed tax bill could add $3.3 trillion to the deficit over 10 years.

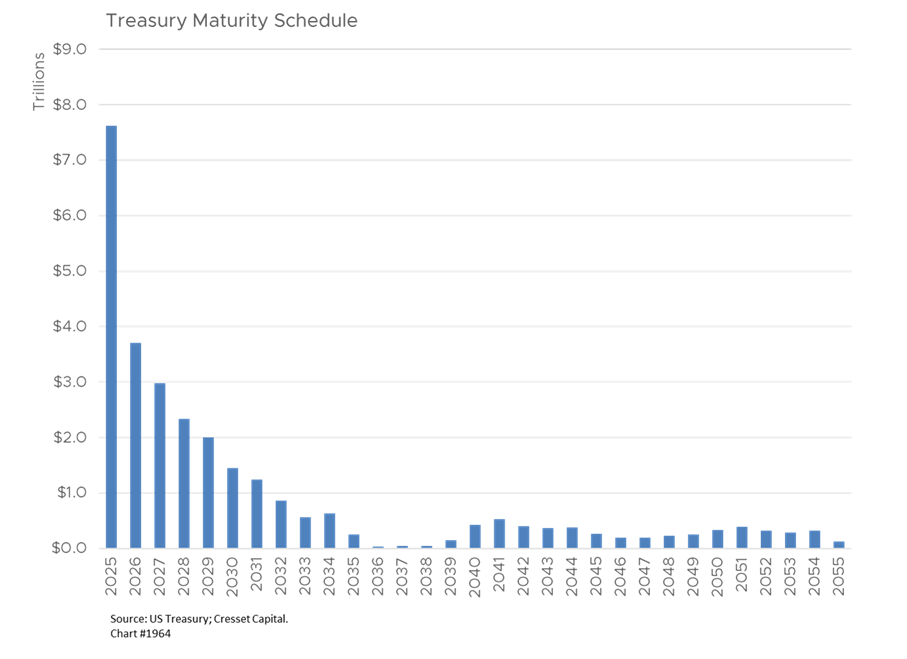

Speculation among market observers is growing that the Treasury could potentially scale back or halt 30-year auctions. However, Treasury officials maintain their commitment to issuing debt in a “regular and predictable manner.” The Yellen Treasury, motivated to keep interest expenses low, issued mostly short-term Treasury debt. Those maturities will weigh on bond buyers as the Treasury will be forced to refinance nearly $8 trillion in maturities coming due this year, on top of newly issued bills, notes and bonds.

US Labor Market Growth Positive but Softening

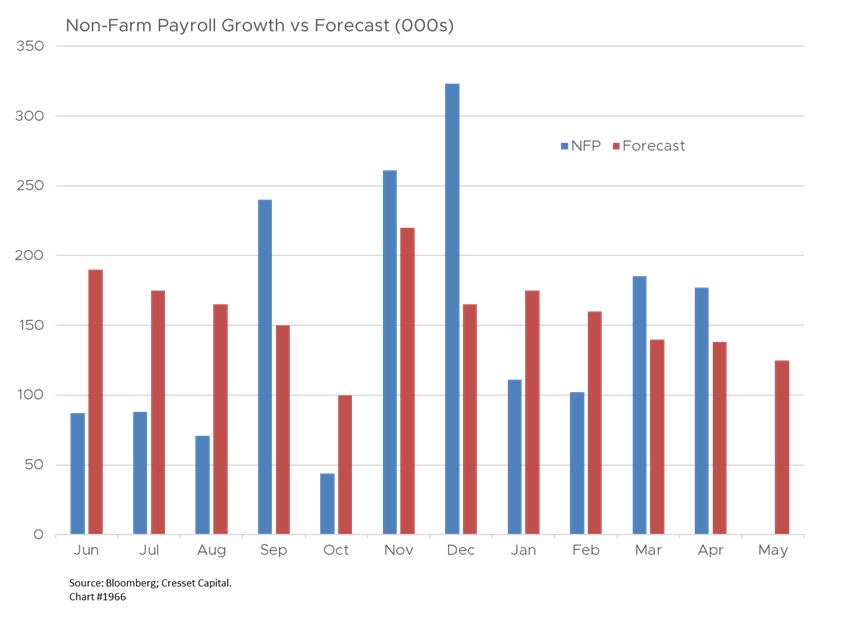

The May jobs report will be released on Friday and economists are anticipating 128,000 net new non-farm payrolls jobs were created last month, nearly 50,000 lower than the number created in April. While job growth is expected to remain positive, economists’ monthly projections have declined steadily since November, reflecting a softening labor market.

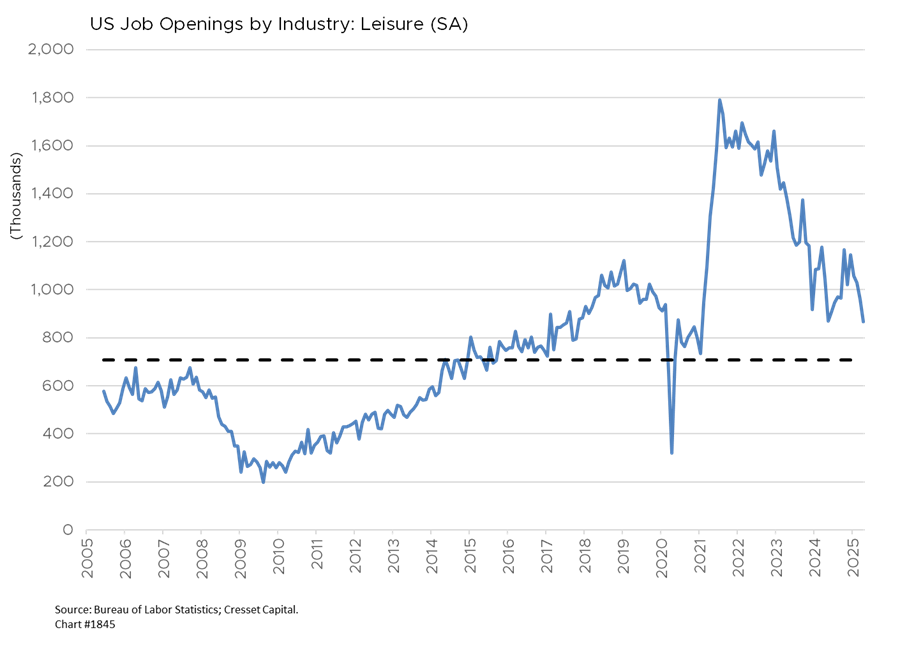

The primary weakness is expected in leisure and hospitality, which typically adds over 400,000 jobs in May but is forecast to decline by nearly 40,000 due to slow spring travel and reduced international tourism. Even accounting for Easter timing differences, hiring in this sector has lagged significantly compared to recent years.

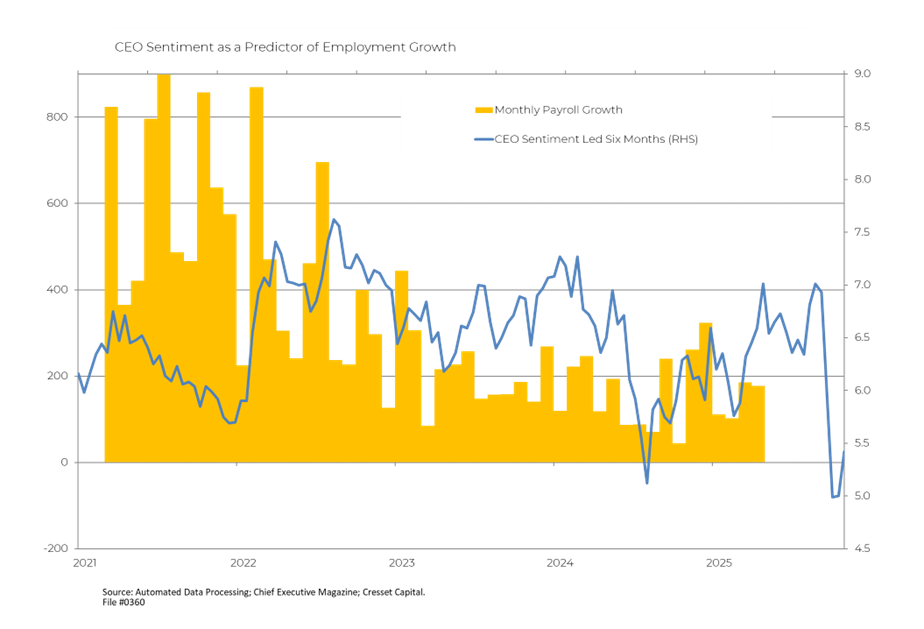

CEO sentiment, a useful leading hiring indicator, dropped the most in a decade in April, before rising incrementally in May. This gauge portends a slowdown in hiring over the next two quarters.

Bottom Line:

The data depicts a gradually slowing economy with a slight easing of inflation pressure. By moderating his tone, President Trump assuaged investor fears of a global trade war. While the stabilizing backdrop makes the Federal Reserve’s job a little easier, traders are still penciling in two rate cuts this year. We expect long-dated Treasurys will take their cue from the budget reconciliation process between the upper and lower chambers in Washington.