Key Observations:

- GENIUS Act regulatory framework for stablecoins unleashes institutional adoption

- It also positions the USD for continued dominance of international payments

- Broad industry transformation just beginning, with implications for the bond market

- Increased demand for short-term Treasurys will lighten US debt burden

The cryptocurrency industry achieved a historic milestone on July 18 as President Trump signed the GENIUS Act into law, establishing the first comprehensive federal regulatory framework for stablecoins in the United States. This landmark legislation signals a fundamental shift in how digital assets will integrate with traditional finance, with major implications for banks, money markets, and global monetary policy.

Stablecoins Aim to Preserve Consistent Purchasing Power

A stablecoin is a type of cryptocurrency designed to maintain a stable value, typically pegged to a reference asset like the US dollar, Euro, or gold. Unlike well-known cryptocurrencies such as Bitcoin or Ethereum, which experience significant price volatility, stablecoins aim to preserve consistent purchasing power through various mechanisms like fiat reserves, algorithmic controls, or collateralization. This makes stablecoins more suitable for everyday transactions, storing value, and serving as a bridge between traditional finance and the crypto ecosystem, while still retaining blockchain benefits like fast transfers and programmability. It should be noted that stablecoins aren’t investments, they’re mediums of exchange.

GENIUS Act Regulatory Framework for Stablecoins Unleashes Institutional Adoption

The legislation requires stablecoins to be fully backed by liquid assets such as Treasury bills (and, potentially, money market funds), imposes disclosure requirements, and establishes oversight mechanisms. Crucially, it prohibits stablecoin issuers from paying interest to holders, protecting banks from direct competition for deposits.

Goldman Sachs and Bank of New York Mellon announced plans to tokenize money-market funds from major asset managers including BlackRock and Fidelity. Fiserv, a technology company servicing the banking community, plans to launch its own stablecoin platform for approximately 3,000 regional and community banks, democratizing access to digital currency infrastructure.

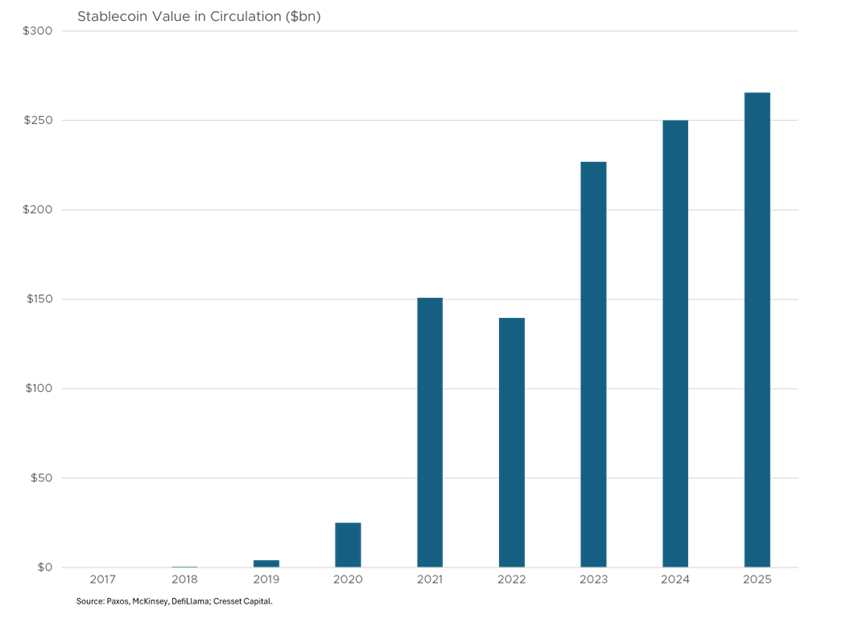

The stablecoin market has already reached $270 billion in circulation, with projections suggesting explosive growth ahead. Standard Chartered forecasts the market will reach $2 trillion within three years, while Citigroup projects $1.6 trillion by 2030. This represents growth of nearly 700% from current levels, driven by regulatory legitimacy and institutional adoption.

Opportunities and Threats for Retail, Payment Processors and Traditional Banks

Retail giants Amazon and Walmart are reportedly exploring their own stablecoins, which could function like enhanced gift cards while cutting out traditional payment processors like Visa and Mastercard. The potential to bypass the typical two per cent transaction fees charged by card networks presents significant cost savings for merchants. Analysts estimate that Walmart pays $2 billion in credit card processing fees annually.

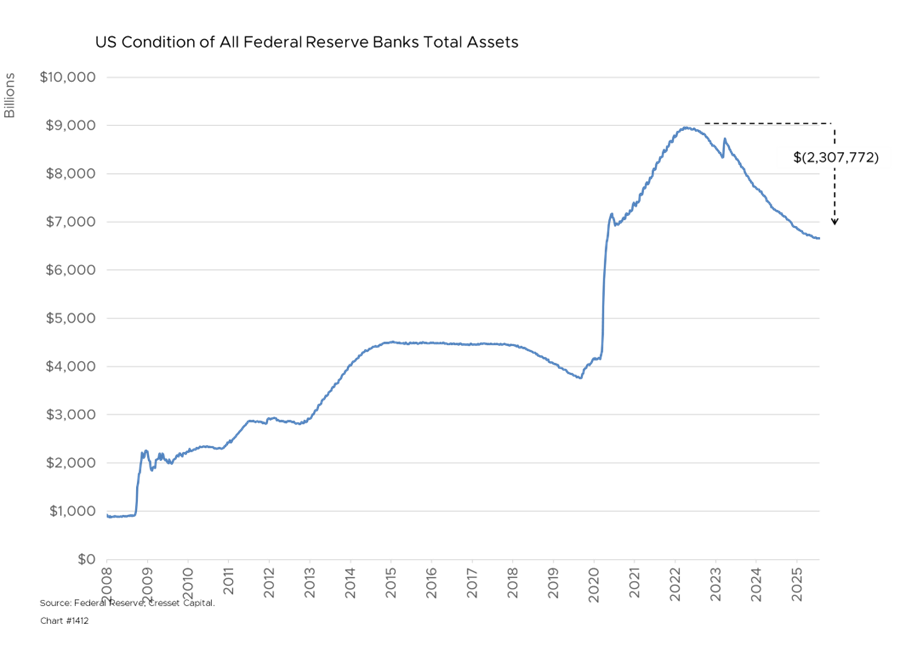

Traditional banks face both opportunities and threats from the stablecoin revolution. While major banks are positioning themselves as custodians and service providers for stablecoin reserves, the Treasury Department warns that stablecoins could trigger up to $6.6 trillion in deposit outflows from commercial banks. Regional and community banks would be hardest hit since they rely heavily on consumer deposits to fund lending operations. Deposit disintermediation would accelerate a trend already in place. Since its peak in 2022, bank balance sheets have shrunk by $2.3 trillion.

GENIUS Act Positions Dollar for Continued Dominance of International Payments

By requiring regulated stablecoins to be backed by the US dollar, the GENIUS Act positions the greenback for continued dominance in international payments, creating new geopolitical tensions. Meanwhile, the European Central Bank is advancing its digital Euro project, while China continues expanding its central bank digital currency. The Bank for International Settlements, an international financial institution that fosters cooperation between central banks, has warned that unregulated stablecoin growth could threaten financial stability and monetary sovereignty worldwide.

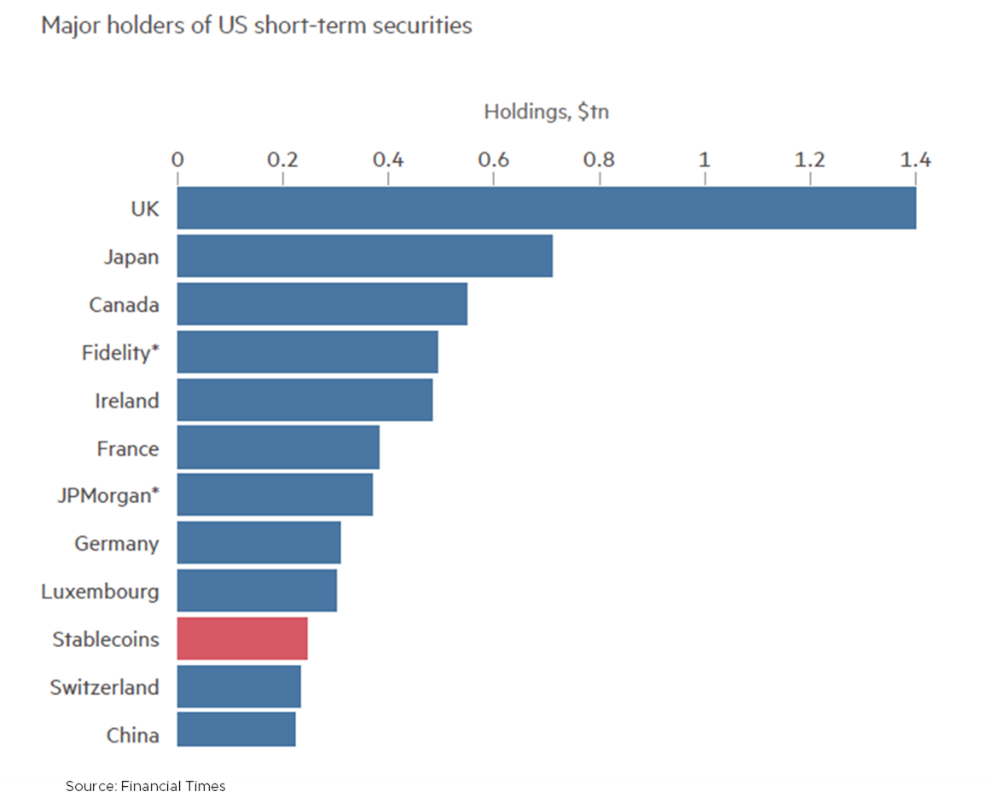

We will be watching for stablecoins’ impact on monetary policy and inflation. The tokens require massive purchases of short-term Treasury bills as backing, making stablecoin issuers among the largest buyers of government debt. Stablecoin operators now hold more short-term US debt than China, fundamentally altering Treasury market dynamics. The new legislation ushers in increased demand for short-term Treasury obligations.

The GENIUS Act specifically requires stablecoins to be backed by assets maturing in 93 days or fewer, creating concentrated demand at the short end of the yield curve. Moreover, foreign stablecoin adoption could dramatically increase overseas demand for US Treasuries, particularly in emerging markets where citizens seek dollar-denominated assets to hedge against local currency instability and capital controls.

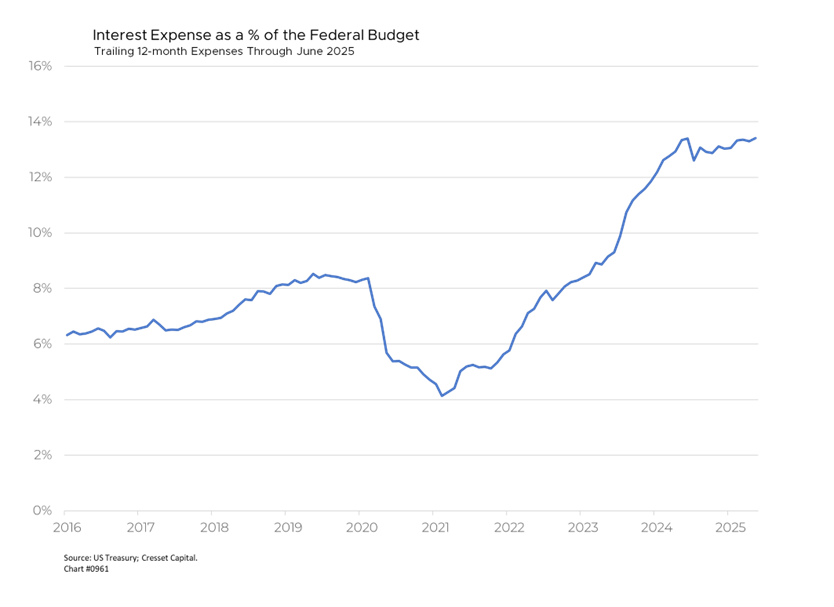

Increased Demand for Short-Term Treasurys Will Lighten US Debt Burden

Treasury Secretary Scott Bessent faces mounting pressure from the government’s $1 trillion annual interest bill. Stablecoins offer a potential solution to reducing government borrowing costs by creating new demand for government debt without requiring tax increases or spending cuts. The Treasury appears to be coordinating with stablecoin growth through “fiscal QE” tactics – dramatically increasing bill issuance to meet demand. We expect the Treasury, with the help of lower Fed benchmark rates and increased demand from stablecoin issuers, will use lower short-term rates to issue more Treasury bills while waiting for longer-term rates to decline, when they will term out the debt into intermediate-term notes and longer-term bonds.

Broad Industry Transformation Just Beginning, with Implications for Bond Market

The crypto industry’s legislative victories represent just the beginning of a broader transformation. Two additional bills are working through Congress: The Clarity Act, which would shift cryptocurrency oversight from the SEC to the more crypto-friendly Commodity Futures Trading Commission, and legislation banning Federal Reserve issuance of a central bank digital currency.

Longer term, as stablecoins become more integrated with traditional finance, their Treasury holdings could represent a permanent structural shift in bond market dynamics; one that reduces government borrowing costs in normal times but creates new vulnerabilities during periods of digital asset volatility or regulatory uncertainty.

The bond market could become the foundation for a new monetary system, with Treasury bills serving as the backbone for what could become a dominant form of digital currency. This transformation may prove as significant as the creation of modern monetary policy.

Bottom Line:

As stablecoins move from the crypto fringe into mainstream finance, they promise to reshape everything from international payments to monetary policy. The success of this experiment will depend on balancing innovation with stability, ensuring that the benefits of digital transformation don’t come at the cost of financial system integrity. The most significant implication might be the transformation of short-term Treasury markets from primarily serving monetary policy and government funding needs to supporting a parallel digital currency system. This creates new feedback loops between cryptocurrency adoption, government financing costs, and monetary policy effectiveness.