Key Observations:

- Q2 earnings strong but outlook cloudy, particularly for agriculture and consumer goods

- Worry that massive AI spending won’t deliver proportional revenue growth

- Rising deposit rates and delinquencies pressure banks

- Travel and hospitality resilient despite trade and economic headwinds

- Housing market still struggling with affordability, but rentals are thriving

- Monetary easing could be a solution to keep fundamentals moving forward

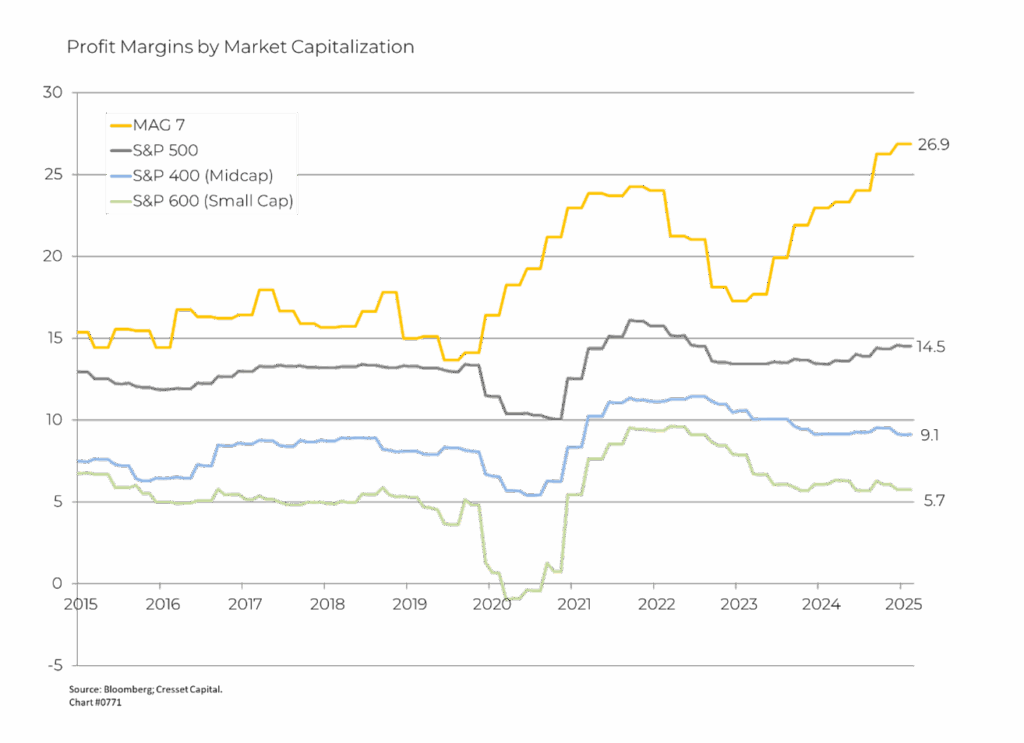

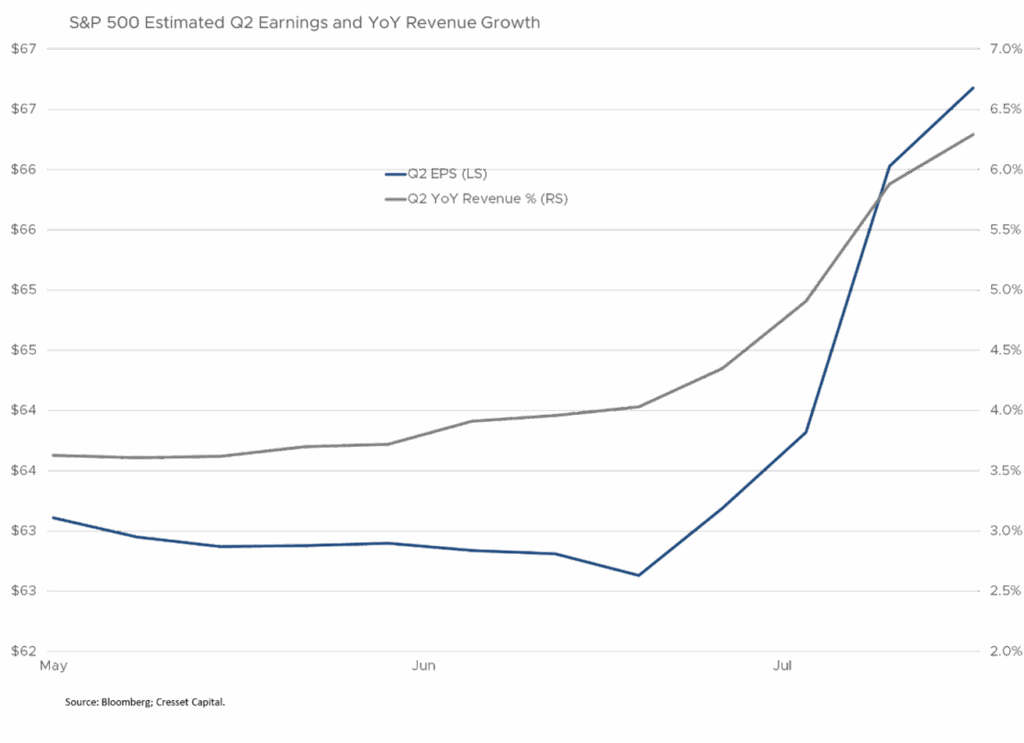

Second quarter earnings season is wrapping up, with results presenting mixed signals for corporate America. Businesses and households are grappling with a changing landscape, particularly with respect to trade. While earnings broadly exceeded expectations, with S&P 500 companies posting approximately 11 per cent profit growth and 80 per cent of reporting companies beating forecasts, underlying year-over-year revenue growth remained tepid at 6.2 per cent, slightly below the five-year average of 6.7 per cent. This divergence suggests profits are being driven more by cost-cutting and one-time items rather than by business expansion. Sifting through the earnings reports offers insights into the underlying health of the economy, particularly at a time when both fiscal and monetary policies are evolving.

Tariffs Cloud Outlook, Particularly for Agriculture and Consumer Goods

President Trump’s tariff regime is creating significant profit pressures across multiple sectors, with agricultural companies bearing the heaviest burden. These sweeping trade policies have raised trade-weighted average US tariff rates to 15.2 per cent, their highest since World War II, compared to just 2.3 per cent in 2024, inflating costs for American businesses.

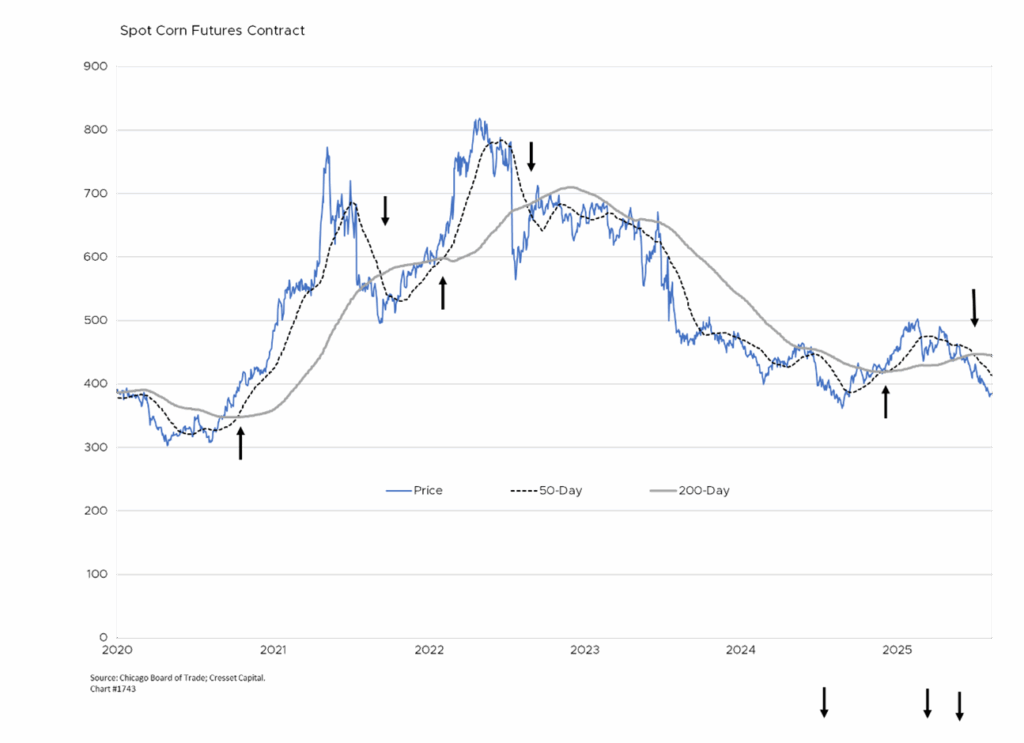

Agriculture faces a perfect storm: farmers, who largely support Trump, are experiencing a profit squeeze as tariffs raise costs for imported tractors, fertilizers, and other inputs while crop prices remain at pandemic-era lows. Lamb Weston, one of the world’s largest producers of french fries and other frozen potato products, saw its shares tumble 28 per cent after missing expectations. Fertilizer imports plunged 20 per cent due to tariffs on key suppliers like Morocco, China, and Saudi Arabia. CF Industries, the world’s largest producer of anhydrous ammonia, reported “incredibly low inventory” requiring rebuilding, while AGCO warned of price increases on tractors. Corn prices have fallen to their lowest level in nearly a year.

Meanwhile, consumer goods companies are struggling with uncertainty about cost absorption. Amazon expressed confusion about “where the tariffs are going to settle, particularly in China” and uncertainty about “who’s going to end up absorbing those higher costs.” Air Products & Chemicals noted that while their business isn’t directly affected, “our customers are, and sometimes, our suppliers are.”

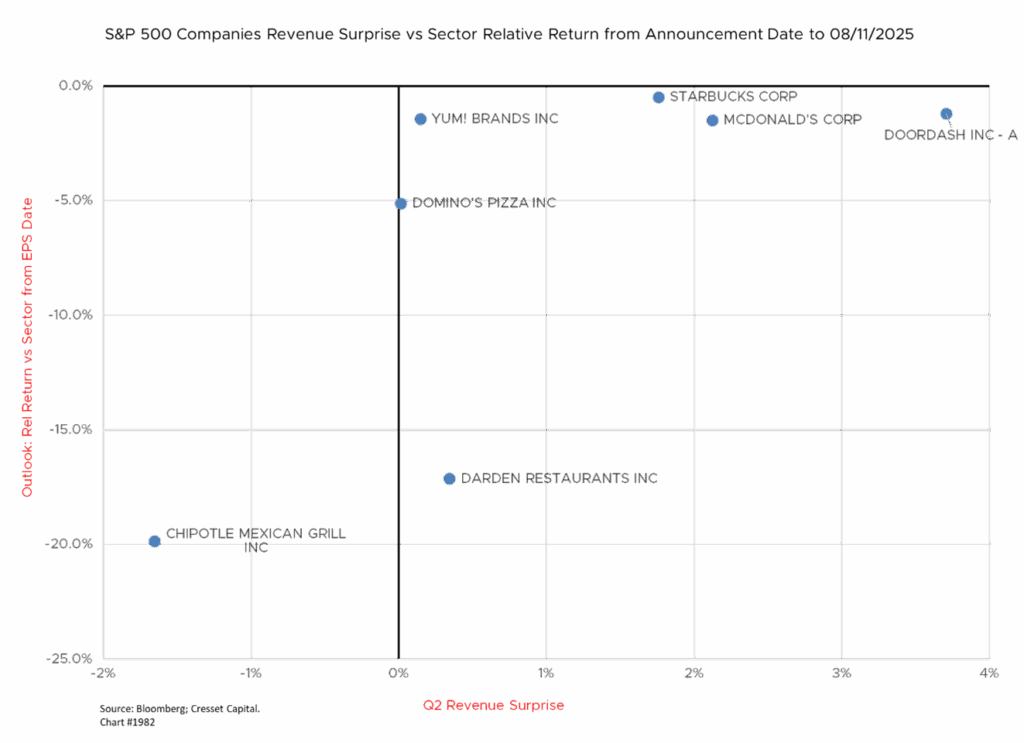

Low-Income Consumers Aren’t the Only Ones Pulling Back

A dominant theme across multiple sectors was consumer pullback, affecting both low-income and affluent shoppers. McDonald’s reported customers ordering cheaper items and visiting less frequently, while Starbucks and Chipotle saw cooling sales growth. Other restaurant chains from IHOP to Denny’s raised warning flags, reporting declining traffic as Americans increasingly eat at home to save money, with restaurant visits down one per cent year over year. The impact extended beyond fast food and household income as luxury brands like Louis Vuitton and Gucci also experienced disappointing sales.

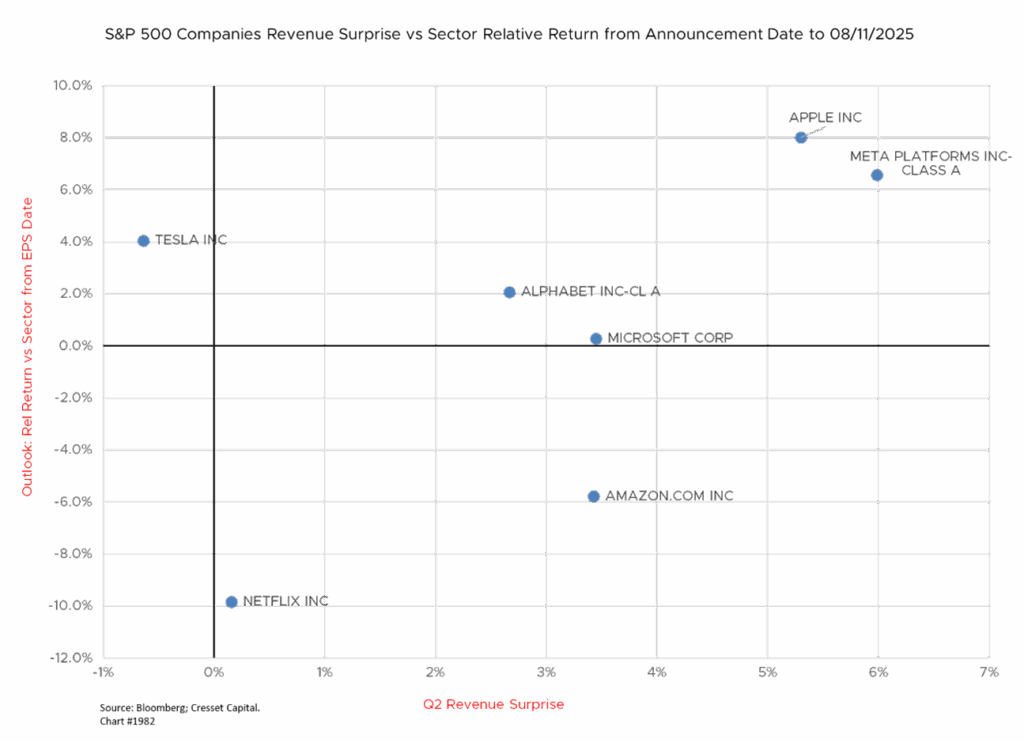

Concern That Massive AI Spending Won’t Deliver Proportional Revenue Growth

Massive AI infrastructure spending continues unabated, with tech giants believing the risks of underinvestment outweigh overinvestment concerns. Alphabet’s CEO emphasized that during transformative periods companies must spend aggressively or risk being left behind. This represents billions of capital expenditures across data centers, chips, and AI capabilities. However, market reactions suggest skepticism emerging over AI monetization timelines. Investors appear to be increasingly demanding concrete evidence that these investments will translate into proportional revenue growth, rather than accepting promises of future transformation.

Netflix emerged as a standout, posting $11.1 billion in revenue and demonstrating successful diversification into live programming, from boxing matches to talent competitions. This suggests that mature platforms with diversified content strategies can find sustainable growth paths beyond pure technology plays.

The broader AI ecosystem benefits continue, with chip makers and data center components remaining strong despite individual stock volatility. This indicates the AI transformation is creating value across the supply chain. The sector appears to be maturing from an “invest at any cost” phase to more mature evaluation of AI business models, and companies will have to demonstrate clear customer value and sustainable competitive advantages from their AI implementations.

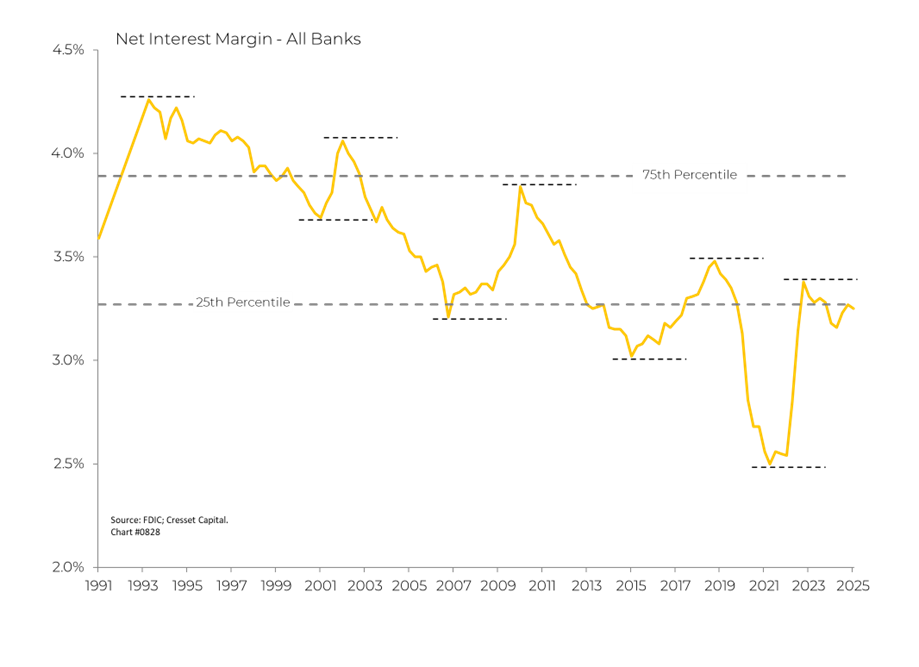

Rising Deposit Rates and Delinquencies Will Pressure Banks

The banking sector faces a fundamental transformation that extends far beyond recent regulatory changes. Since the 1960s, banks have steadily retreated from traditional lending, with direct bank loans declining from 55 per cent to 35 per cent of private lending. This shift reflects deeper technological and market forces rather than just post-2008 regulations, as banks increasingly sell loans to others while buying debt securities at market prices.

The transformation has made banks more resilient by reducing dependence on funding long-term, illiquid loans with short-term deposits. They now hold safer slices of securitized debt while pushing riskier portions to investors with longer horizons. However, this evolution has complicated regulatory oversight, as credit easily migrates to non-bank lenders, requiring policymakers to cast wider nets for financial stability monitoring.

Current earnings pressures are mounting from multiple directions. Banks are being forced to offer higher deposit rates after years of paying essentially nothing, squeezing profit margins. Higher interest rates mean fewer mortgage refinancings, while consumers are spending heavily on credit cards and carrying larger balances – though more borrowers are falling behind on payments.

Investment banking and trading revenue showed signs of improvement at major banks like Goldman Sachs and JPMorgan, providing some offset to margin pressures.

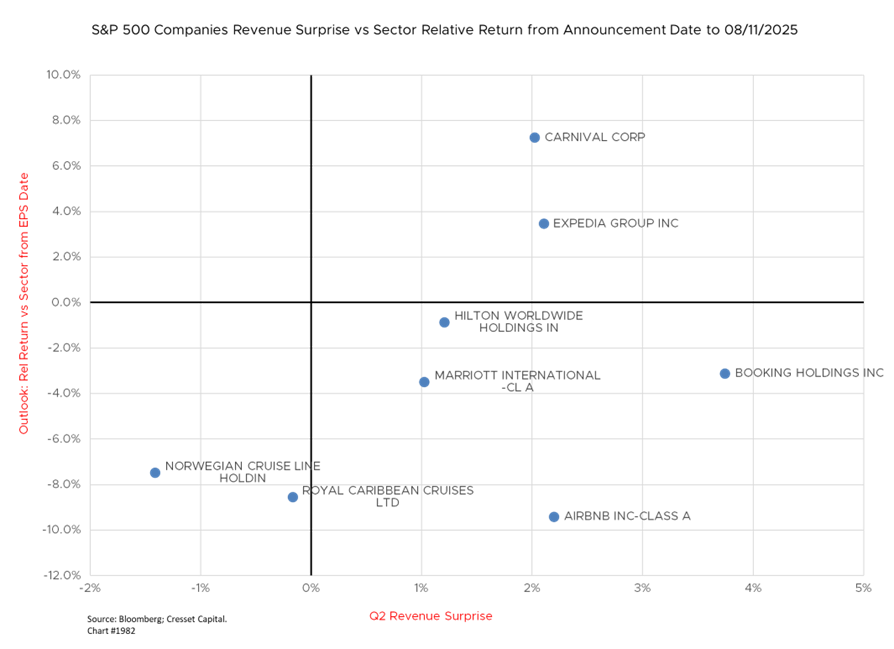

Travel and Hospitality Resilient Despite Trade and Economic Headwinds

Despite policy uncertainties, established brands with strong customer loyalty continue to demonstrate remarkable operational resilience and pricing power. Disney’s parks business was a standout performer, with domestic parks revenue jumping 10 per cent to $6.4 billion and operating income surging 22 per cent to nearly $1.7 billion, and marking record revenue at Walt Disney World despite new competition from Universal’s Epic Universe. Airbnb posted strong second-quarter results, beating estimates with 13 per cent revenue growth to $3.1 billion and 16 per cent net income growth to $642 million. However, the company warned of “tough months ahead” as Trump’s trade policy affects international bookings, particularly noting that Canadian travel to the US remained soft as travelers preferred Mexico and Europe.

Cruise operations were strong, with Disney’s fast-growing cruise business set to expand with two new vessels launching later in 2025, despite cost pressures from the launches. While Disney’s parks demonstrated pricing power and sustained demand, broader travel booking patterns show consumers making reservations closer to departure dates, which suggests cautious spending behavior. Netflix’s expansion into live sports programming, including boxing matches that generated millions of viewers, indicates entertainment companies are finding new ways to capture travel and leisure spending through alternative experiences.

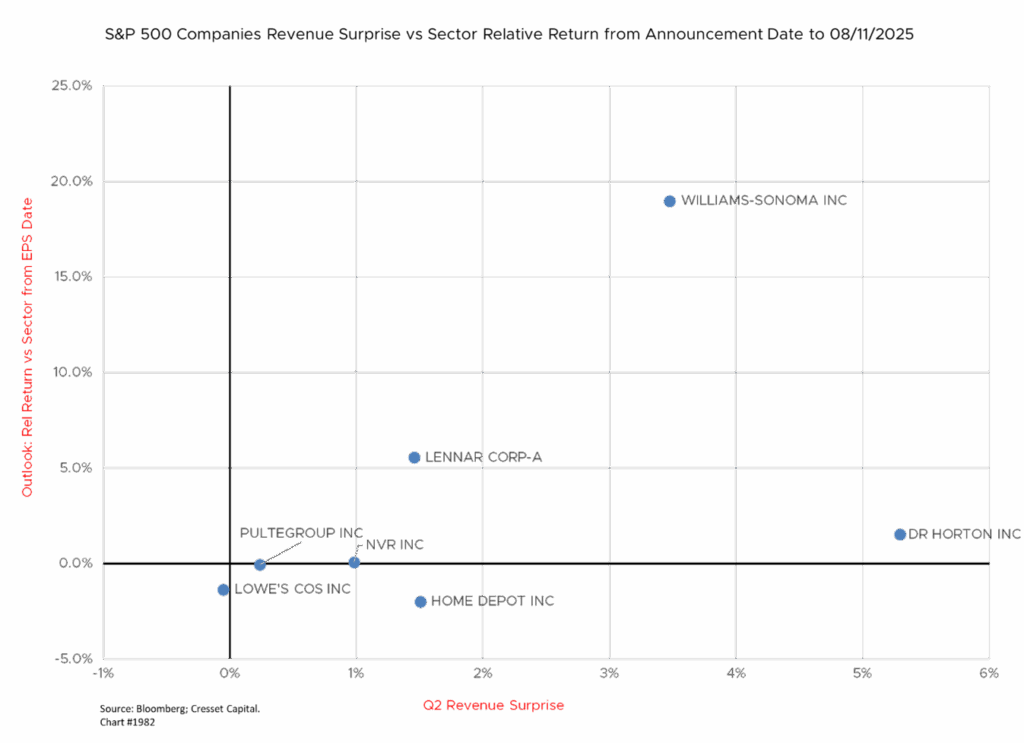

Housing Market Still Struggling With Affordability, but Rentals Thriving

The housing market remained sluggish throughout the first half of 2025, with homes changing hands at a slower pace than usual due to persistently high buying costs. A housing market rebound “failed to take shape in the first half of the year,” according to Zillow’s earnings report. Investors anticipate ongoing challenges in the housing market through 2025, with structural affordability issues persisting due to high costs and economic uncertainty. The housing market narrative reflects the broader economic theme seen throughout the earnings reports.

While overall market conditions remain challenging, companies that can adapt their business models and capture additional value from existing transactions are managing to grow despite headwinds. Homebuilders, for example, beat analysts’ revenue expectations. And real estate marketplace Zillow managed to outperform the broader residential real estate market, reporting 15 per cent revenue growth. The company’s revenue beat estimates at $655 million, driven by a 41 per cent increase to $48 million in mortgage volume growth due to higher purchase loan origination. Zillow expects continued strong growth in its rental segment, with management stating they “expect quarterly year-over-year rental revenue growth to keep accelerating throughout 2025, with a clear path toward the billion-dollar-plus revenue opportunity.”

Bottom Line:

Second-quarter earnings season suggests markets could soon face increased volatility, with strong current profits now seemingly at odds with deteriorating economic fundamentals. Employment reports point not only to softer job growth, but to flatter consumer spending and weaker manufacturing as well. Companies continue to generate profits, but their sustainability appears increasingly worrisome based on both quantitative metrics and qualitative management commentary. The combination of consumer pullback, trade policy uncertainty, and sector-specific pressures points to a potentially challenging environment ahead, particularly as markets enter the historically weaker August-September period. Monetary easing could be a solution to keep fundamentals moving forward.