Key Observations:

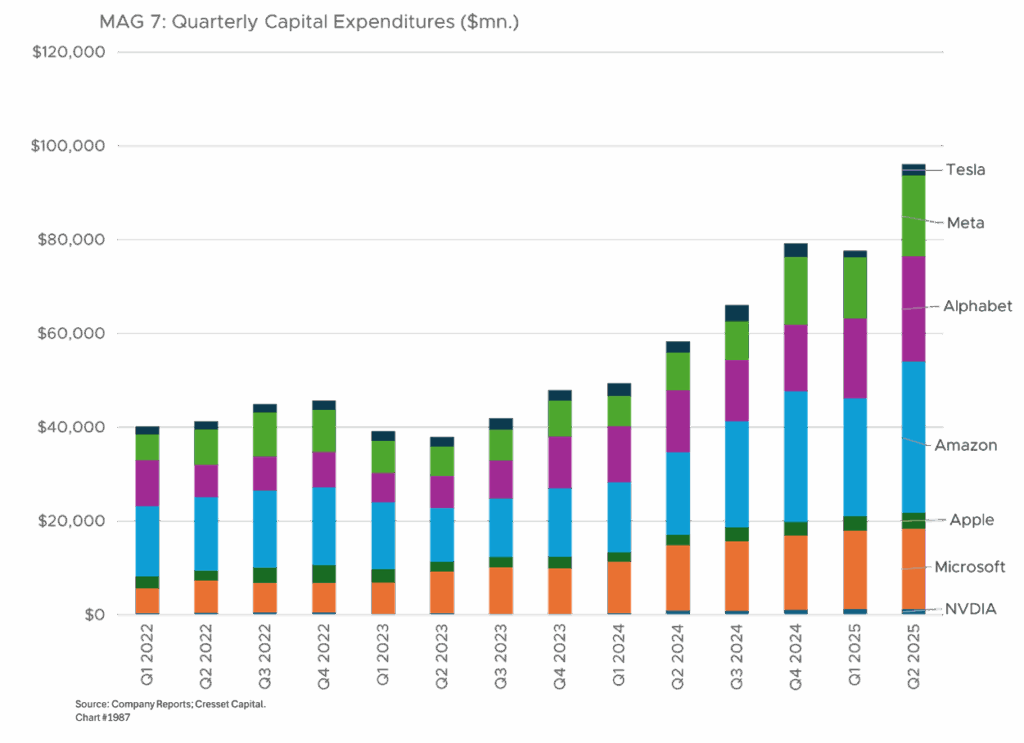

- AI investment projected at $3.3 trillion in the 2025-28 period

- Software spending at levels not seen since late 1990s Internet take off

- “Big Beautiful Bill” Act creates incentives and multiplier effect for capex

- Business spending and capital expenditure lead to productivity gains, higher living standards

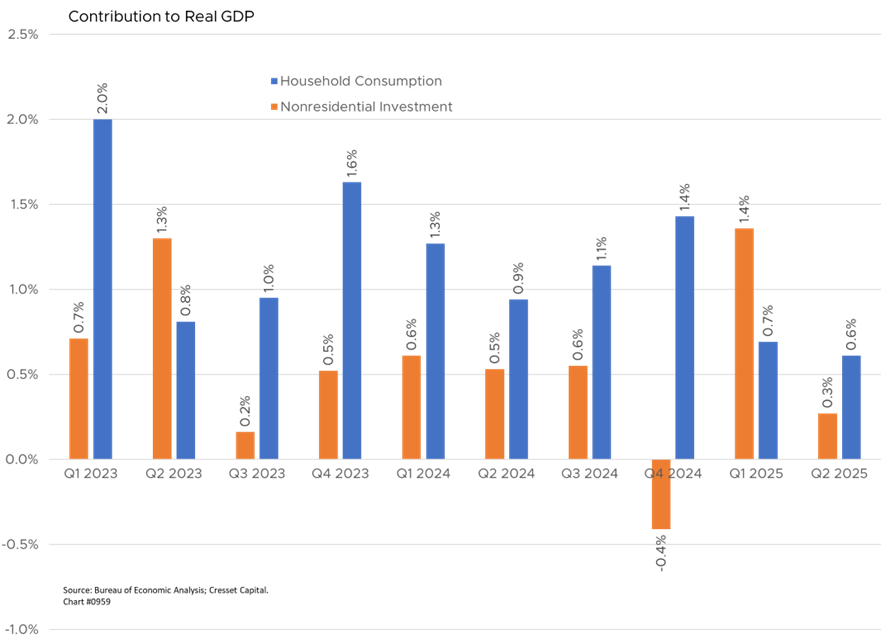

Business spending and capital investment are expanding rapidly, with AI software and infrastructure driving much of the momentum. These outlays have emerged as a key engine of economic growth this year, a positive signal for the long-term outlook. While consumer spending traditionally underpins economic expansion, improvements in living standards are often more closely tied to business investment. So far this year, nonresidential investment has contributed 1.7 percentage points to US real GDP growth, surpassing the 1.3 percentage point contribution from household consumption. This is a notable development for an economy typically characterized by its heavy reliance on consumer demand.

AI Spending Projected at $3.3 Trillion in 2025-28 Period

AI-related spending accounted for a 50bps year-over-year difference in annualized GDP growth for H1 2025. Moreover, AI investments are expected to contribute as much as 50bps of US gross domestic product growth both this year and next year. Business spending is directly and measurably boosting economic growth and, even more important, raising potential growth.

Big Tech companies like Google, Microsoft, Amazon, and Meta are projected to spend nearly $400 billion this year on capital expenditures as they build out their artificial intelligence infrastructure. Analysts project an additional $2.9 trillion in spending from 2025 to 2028 on chips, servers, and data-center infrastructure, representing an unprecedented level of business investment in an economy that has historically relied on consumer spending.

Software Spending at Levels not Seen Since Late 1990s Internet Take Off

Software contributed about 0.4% to Q2 2025 GDP growth – nearly four times its historical quarterly contribution. Data center construction and energy spending are solid but not enough to “shift the dial” in the way software and, to a lesser extent, equipment-related spending has done so far. Business software investments are proving to be a particularly powerful engine of economic growth, showing how corporate technology spending is leading the economic expansion.

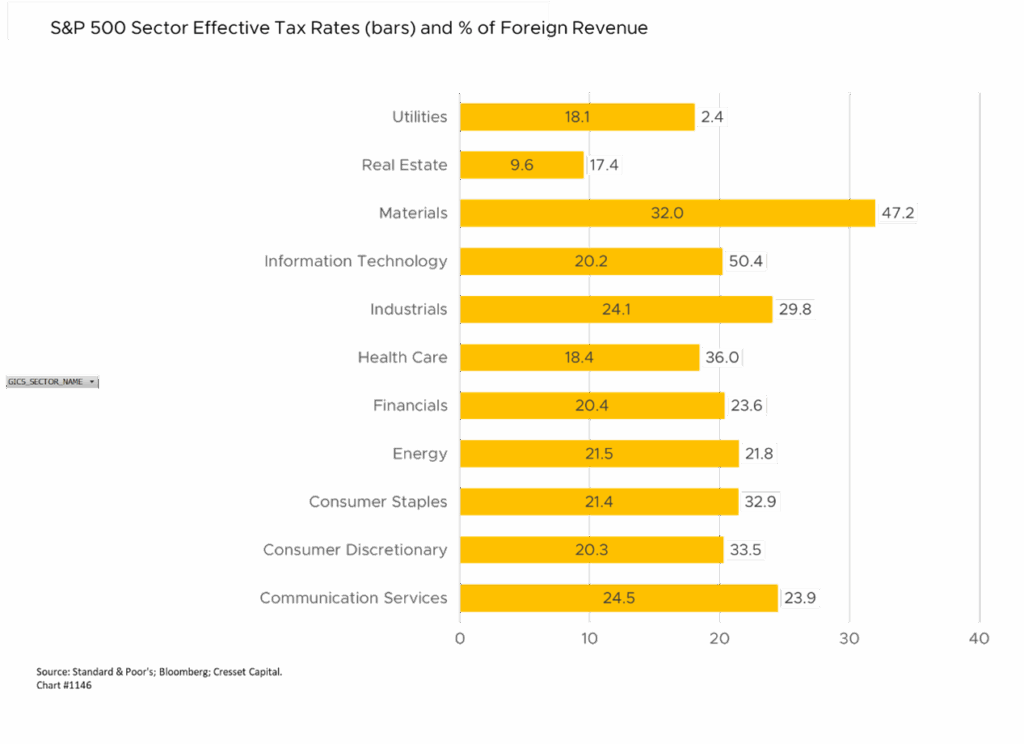

“Big Beautiful Bill” Act Creates Incentives and Multiplier Effect for Capex

The Act provides tax relief for companies that front-load investments, which creates immediate cash flow benefits for businesses making large capital expenditures. This tax incentive structure encourages companies to accelerate their investment timelines rather than spreading spending over longer periods. Moreover, the tax relief mechanism frees up cash flow to increase spending beyond what companies might have originally planned. This creates a multiplier effect whereby the initial tax benefits enable companies to pursue even larger investment projects, amplifying the overall economic impact. Tech and healthcare companies are well positioned in the current environment, as both businesses are capital intensive and sport relatively low effective tax rates.

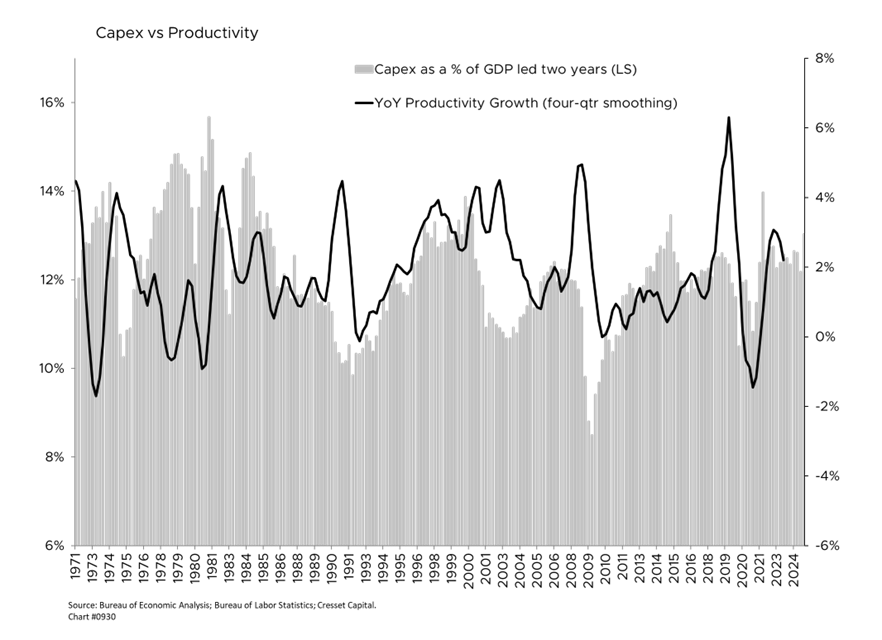

Business Spending and Capital Expenditure Lead to Productivity Gains

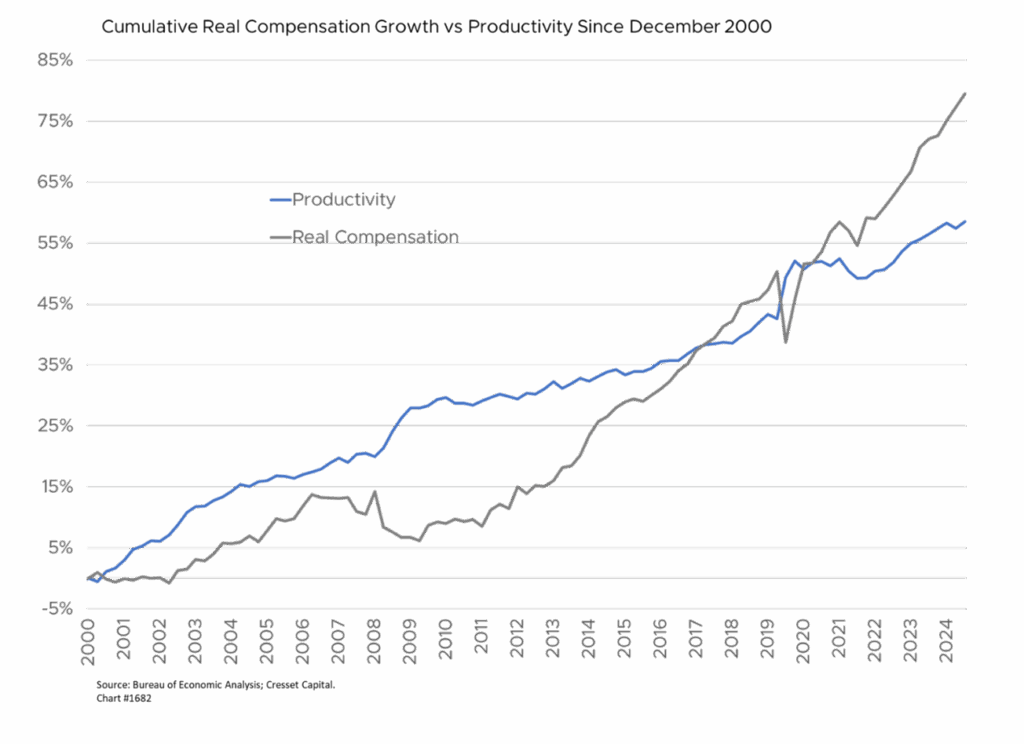

Business spending and capital investments are higher-quality contributors to US economic growth. Unlike household spending, business investment tends to enhance economic productivity – in other words, the ability to generate a higher living standard without inflation. AI-powered productivity gains have the potential to drive economic growth, keep interest rates low, and raise both household incomes and living standards.

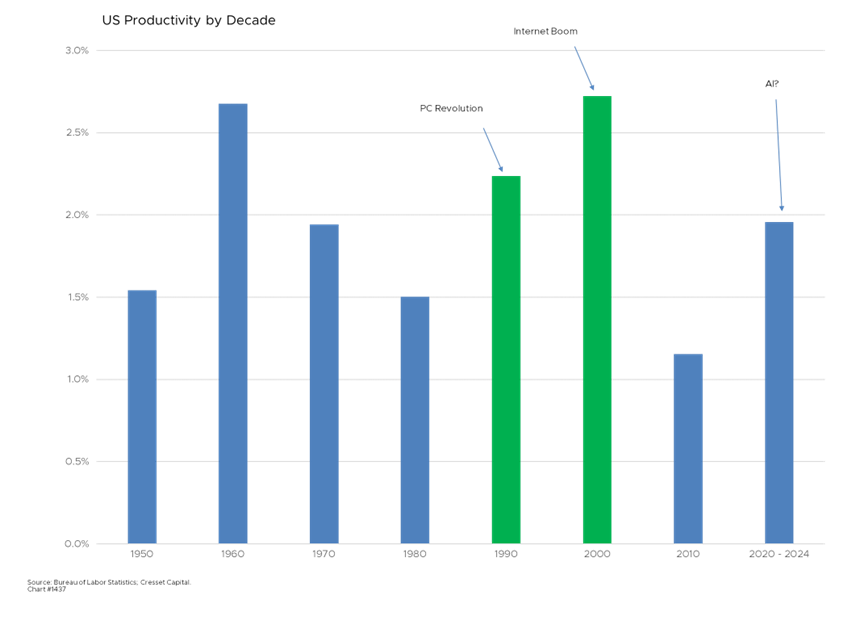

Capex-related innovation has boosted productivity in previous decades. The personal computer was developed during the 1980s, and its benefit was felt in the 1990s as companies rolled out desktop computing. The same could be said for the Internet, which was developed in the 1990s but wasn’t incorporated into the economy until the 2000s. In both cases, productivity surged by over two percent annually in each of those decades.

Bottom Line:

Productivity gains, supported by capital investment and business spending, benefit both firms and workers. Higher productivity enables employers to increase wages without raising prices, resulting in stronger real incomes. When pay grows faster than the cost of living, overall standards of living rise. For this reason, sustained business investment is a trend worthy of broad support.