Key Observations:

- Homeownership has met a perfect storm of negative forces

- Surging insurance premiums, property taxes and construction costs add to burden

- Median home now out of reach for 75 per cent of Americans

- Rental market rebounding as ownership hopes fade; build-to-rent industry is surging

- Housing crisis has the potential to become a defining political issue

A big slice of the American dream is slipping away for young Americans, caused by an insidious blend of high housing prices, skyrocketing insurance premiums, and a supply and demand mismatch. The trend is not only creating intergenerational tension, but has the potential to reshape the political landscape.

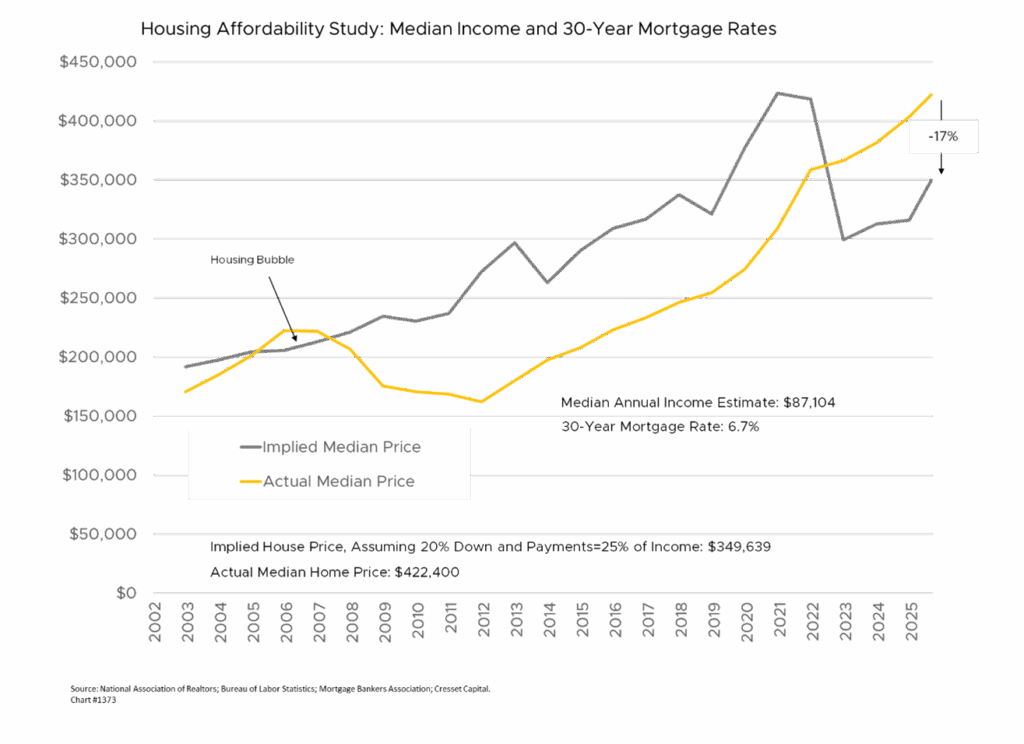

Median Home Now Out of Reach for 75 Per Cent of Americans

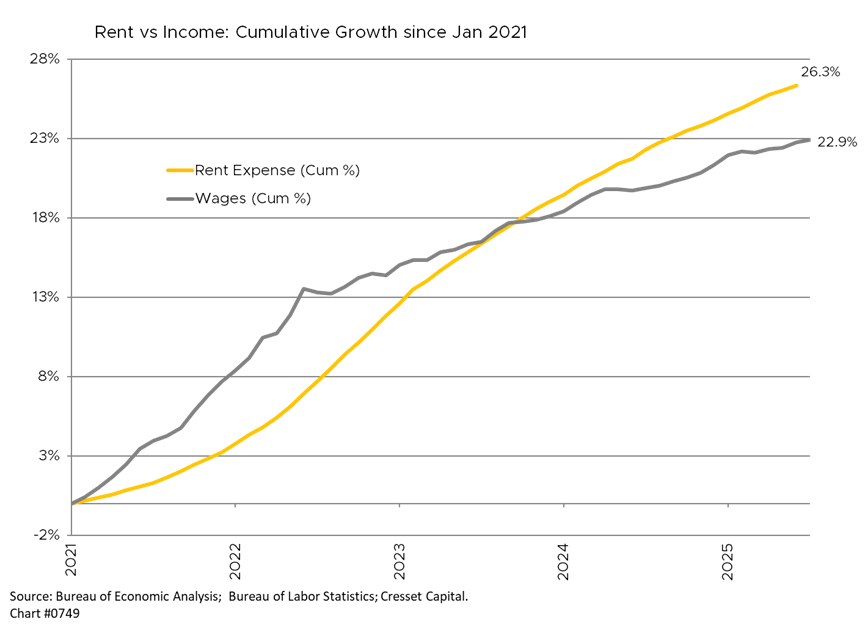

The share of Americans getting priced out of homeownership is increasing at record rates, with the annual income needed to afford monthly payments on a median-priced home jumping 60 per cent from $79,330 in 2021 to $126,670 in 2024, while the US median household income was only $80,610 in 2023. Using median income of $87,104 and applying today’s mortgage rate of 6.7 per cent suggests the median household can afford a $350,000 home. But here’s the problem: the median home price is now $422,400, according to the National Association of Realtors. Renting, meanwhile, was on average $908/month cheaper than buying a starter home as of June; the cost of owning is higher than the cost of renting in 49 of the 50 largest US metro areas.

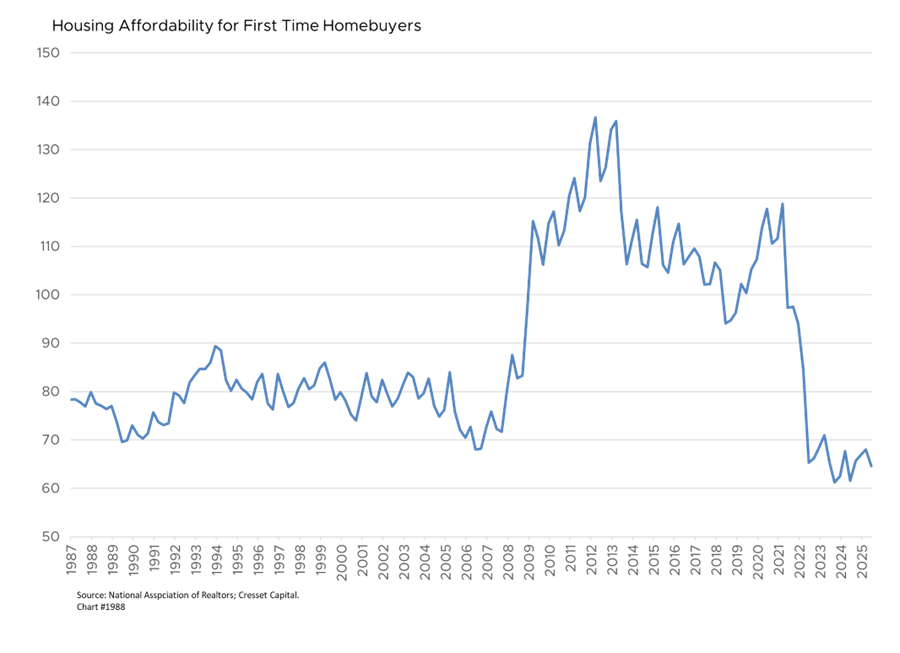

The median age of first-time homebuyers has risen dramatically to 38 from 28 in 1991, and the share of first-time buyers slid to 24 per cent in 2024 from 32 per cent in 2023, the lowest on record dating back to 1981. This generational shift has profound implications, as roughly 75 per cent of Americans now can’t afford the median home, effectively locking out entire demographics from what has traditionally been a cornerstone of American wealth-building.

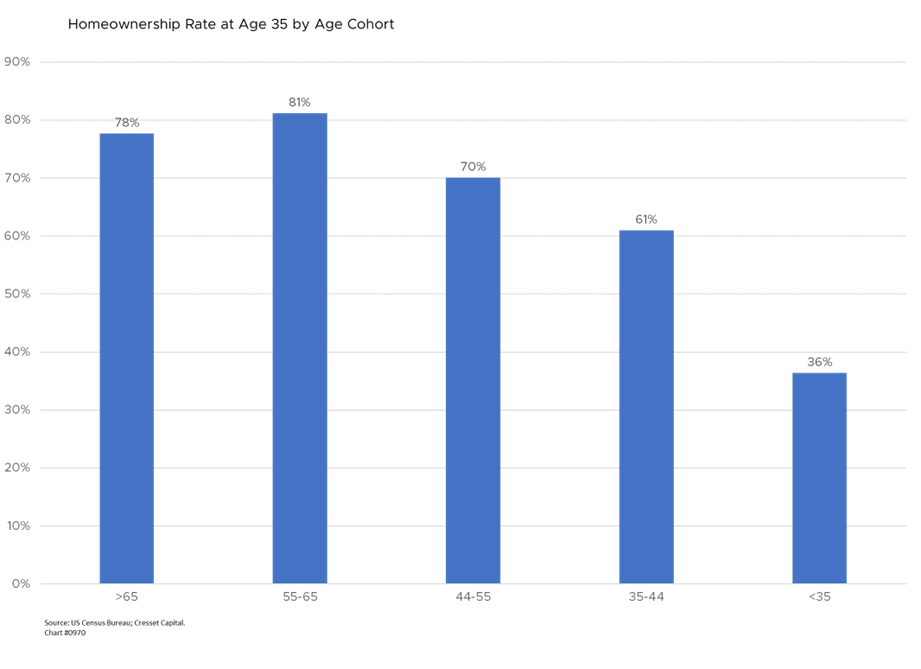

Moreover, the share of 35-year-old homeowners has declined over the generations. Seventy-eight per cent of Baby Boomers owned their own home by the time they were 35 years old. That share increased to over 80 per cent for Gen X Americans (today aged 55 to 65) but the share has steadily fallen to 36 per cent today for Gen Z.

Homeownership Has Met Perfect Storm of Negative Forces

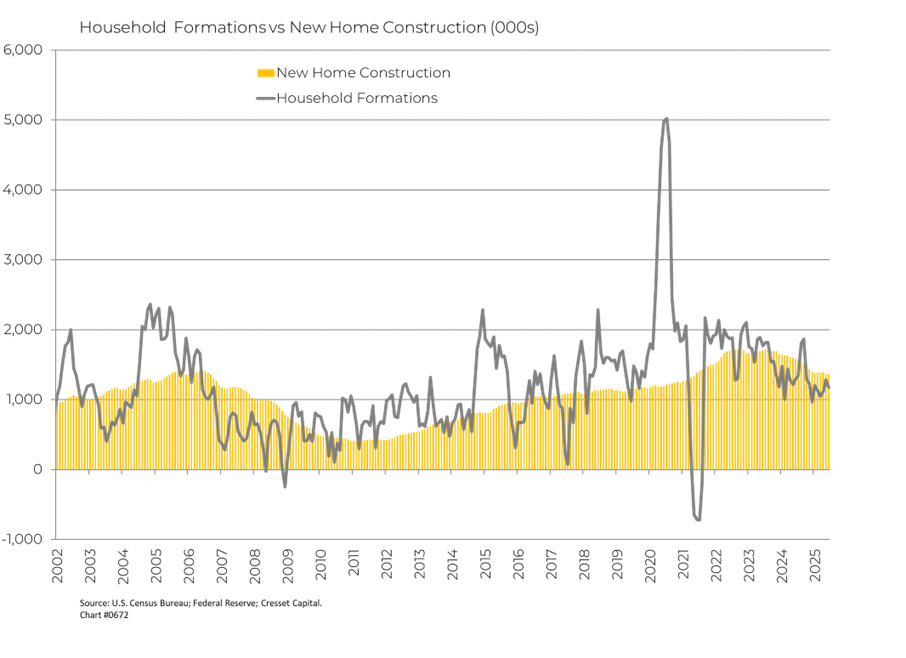

A lack of new construction since the 2008 financial crisis, the lock-in effect of homeowners unwilling to relinquish low-rate mortgages, plus government policies that make buying and building more expensive, are combining to thwart would-be homebuyers. The U.S. housing deficit grew to about 4.7 million units in 2023 as household formation outpaced new construction. Thankfully, that gap has been narrowing this year.

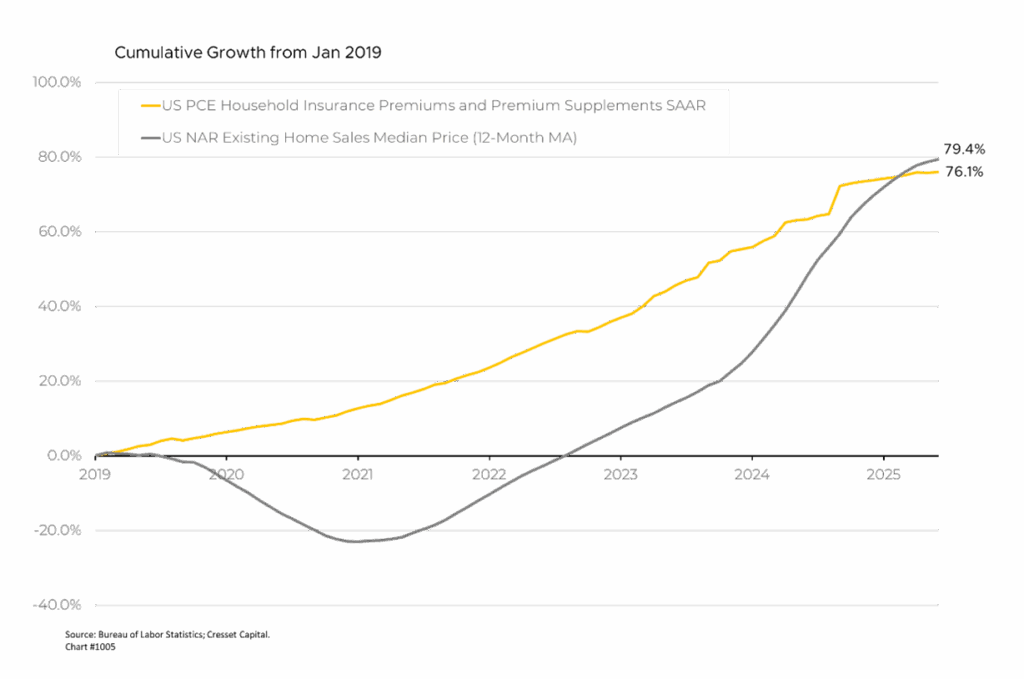

Surging Insurance Premiums, Property Taxes and Construction Costs Add to Burden

Climate change and extreme weather events have added significant costs to home insurance premiums, a key cost of homeownership. The average insurance bill has jumped 76 per cent across the U.S. since 2019, according to the Bureau of Labor Statistics, thanks to the growing prevalence of floods, wildfires, and other disasters. Property taxes, meanwhile, are also on the rise in many states, with property tax bills soaring almost 50 per cent from 2019 through 2024 in Florida, jumping 33 per cent in Dallas, and rising 32 per cent in Clark County, Nevada, according to Bloomberg.

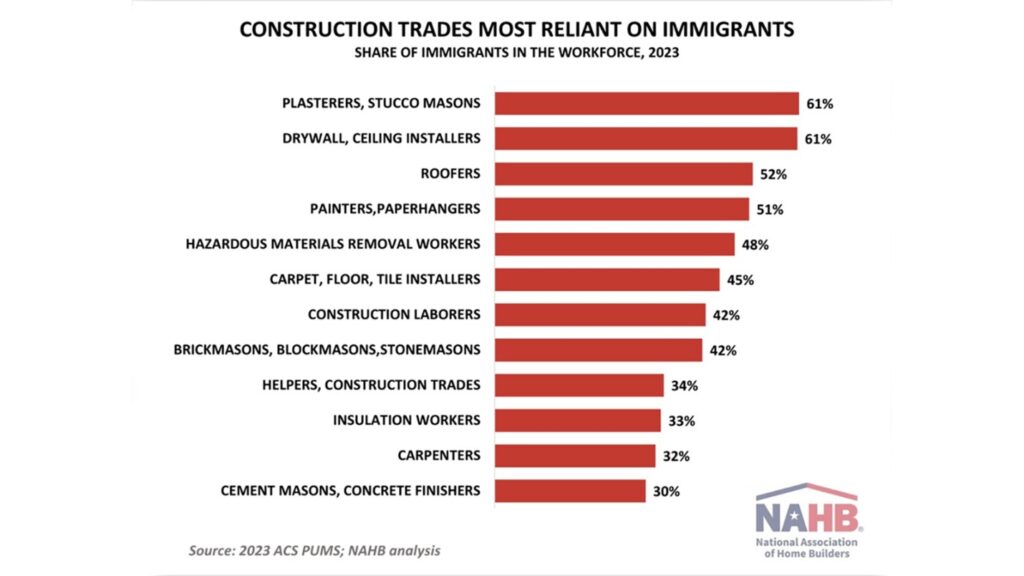

Trade tariffs are creating additional headwinds by making building materials more expensive than they had already become, especially since 2021. Major U.S. architecture and construction firm The Beck Group estimates that tariffs could contribute an additional 1.5 to 2.5 percentage points to construction costs in 2025 on top of their previously forecast 4.3 per cent increase for the year. In addition, immigrant workers – who comprise a large portion of plasterers, drywall installers, roofers and painters – are going into hiding for fear of arrest by U.S. Immigration and Customs Enforcement. Construction hiring has slowed to a trickle this year. Construction companies added just 2,000 net new employees in July, down from 30,000 last September.

Housing Is Local, so Crisis Impact Varies Nationwide

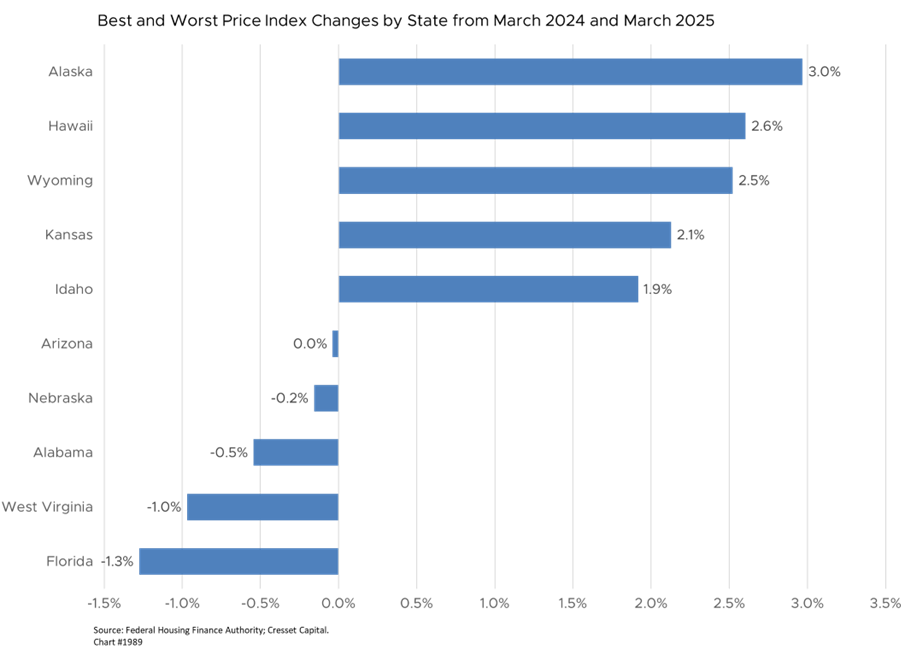

America’s housing market is flagging, with prices drifting down in the first half of the year in most cities, particularly in the South and West, though prices continue to creep up in the Northeast and Midwest. Home prices have dropped in 53 of the 150 metro markets tracked by John Burns Research & Consulting, as the slowdown spreads from early hotspots like Texas and Florida to other parts of the country.

Florida faces unique challenges: in the past year prices have fallen the most among the 50 states, in part due to high and rising home insurance premiums. The average homeowner’s premium is $11,000 in Florida vs an average $2,400 nationwide. Combined with the impact of expensive new condominium reserve rules imposed in response to the devastating Surfside collapse in 2021, the cost of staying in a home you already own, let alone buying a new one, are prohibitive for many. The Sunshine State has also suffered a sharp drop-off in demand from rich Canadians, the state’s largest group of foreign buyers behind China.

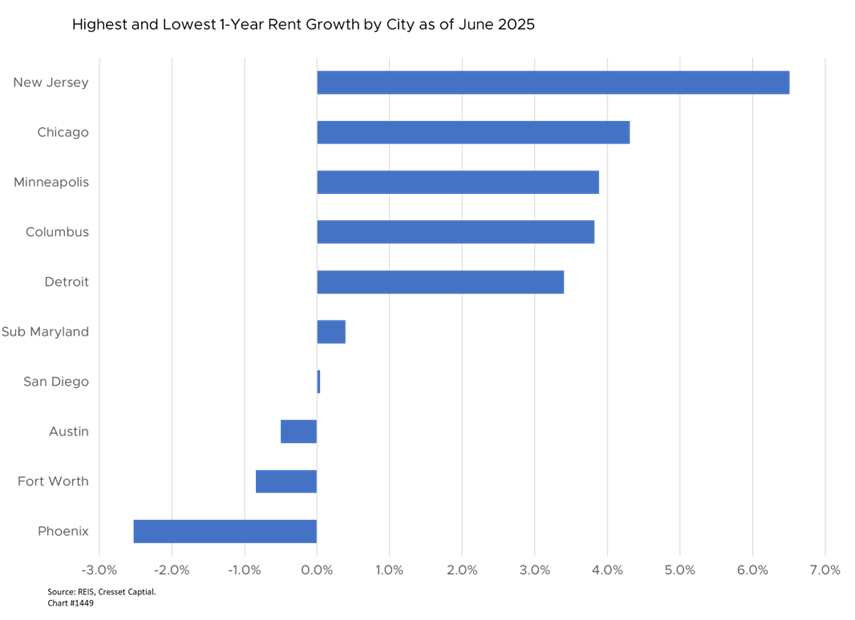

Rental Market Rebounding as Ownership Hopes Fade

With homeownership becoming increasingly out of reach, the rental market is experiencing a surge in demand. The number of renter households in the U.S. has reached a record 46 million, with at least 1.2 million of these being “trapped renters” who would like to buy. Over one-third of respondents to a Fannie Mae survey indicated they would rent instead of buy if they had to move, the highest share since October.

The shift in housing preferences is driving global rent increases after a period of moderation. Developed-economy rents are rising at an annual pace of five per cent or so, the fastest sustained increase in decades. Rental inflation is slow to adjust to changes in the economy due to long-term contracts, making it particularly stubborn for central banks to try to control overall inflation.

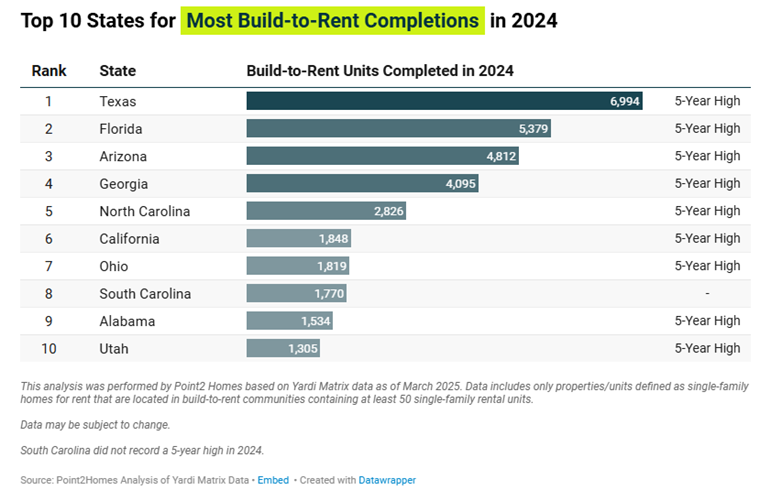

Renters Starting to Outnumber Buyers, Build-to-Rent Industry Surging

Suburbs are being transformed, with renters beginning to outnumber new buyers in traditionally homeowner-dominated areas. Among the roughly 1,500 suburbs studied, 203 had renter majorities in 2023, with much of the growth reflecting a surge in the build-to-rent industry, according to The New York Times. Build-to-rent reached an all-time high in 2024 with 39,000 new single-family rentals completed, a 16 per cent increase over 2023 and dramatically higher than the typical 6,000-7,000 units that came to market in pre-pandemic years.

Developers are responding to increased rental demand as homeownership becomes less affordable. The trend is reshaping suburban landscapes, transforming traditionally owner-dominated areas into renter-majority communities and providing institutional investors with opportunities in America’s housing environment.

Housing Crisis Becoming Defining Political Issue

Housing is inherently political because it is both a financial asset and a basic human need. With roughly 75 per cent of Americans now unable to afford the median home, the generational political divide between Boomers and young Americans extends beyond housing to encompass broader wealth distribution questions.

The home ownership moat is creating a powerful new political constituency of the disaffected. Politicians like Zohran Mamdani in New York City are gaining traction with socialist proposals like rent freezes and massive public housing programs, appealing particularly to younger, college-educated voters who feel economically squeezed. Housing will likely become a political hot button issue, with generational divides intensifying as many voters under 40 view the system as fundamentally broken. This could drive support for populist candidates across the political spectrum, potentially reshaping both major parties as housing affordability becomes a defining issue determining electoral outcomes and policy priorities nationwide.

Moreover, about one in five Gen Z and Millennial home buyers relied on gifts from family to help with their down payment, according to Redfin. This trend suggests a growing inequality, as homeownership increasingly depends on generational wealth rather than personal financial wherewithal.

Further exacerbating affordability challenges for domestic buyers, foreign real estate investment is returning. Sales to non-U.S. citizens hit $56 billion in the year through March, a 33 per cent increase from the previous year and its first increase in eight years.

Bottom Line:

The housing system is in transition; traditional pathways to homeownership have broken down, forcing millions into extended or permanent renting and creating the potential for political backlash and social tensions. The crisis reflects not simply supply and demand, but climate change, immigration policy, trade, generational wealth gaps, and the broader transformation of the American economy. Without comprehensive policy responses addressing multiple dimensions of the crisis simultaneously, we believe the situation will worsen and have a negative impact on America economically, socially and politically.