Key Observations:

- Jobs creation has been much weaker than expected, or previously indicated

- Sharply lower economic growth now dependent on AI spending

- Inflation creeping up again largely due to higher import prices

- Risk of recession if current trends continue

The US economy is showing signs of strain as President Trump’s trade and immigration policies begin taking effect. Multiple economic indicators released recently paint a murky picture of growth, rising inflation, and weakening employment.

Jobs Creation Has Been Much Weaker than Expected, or Previously Indicated

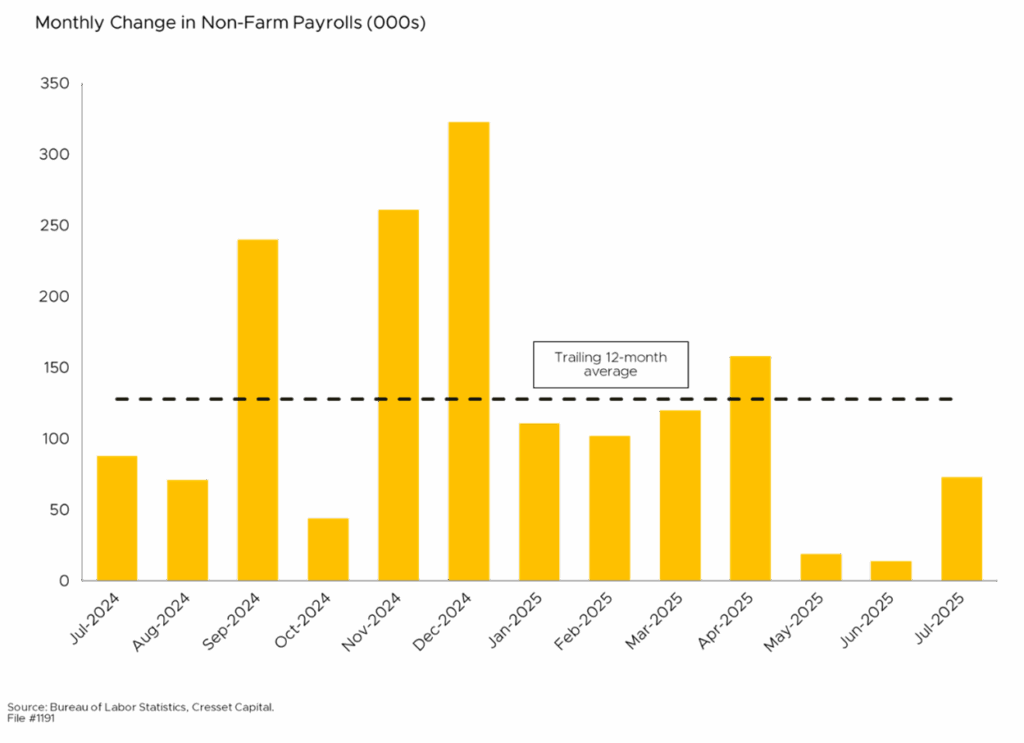

The most notable development was Friday’s jobs report, which revealed that US employers added only 73,000 jobs in July, far below the expected 104,000. More troubling, however, were massive downward revisions showing that job creation in May and June was much weaker than initially reported, with May being revised from 144,000 to just 19,000 jobs and June from 147,000 to 14,000 jobs. This totaled to a combined 258,000 fewer jobs than previously indicated, with employment growth averaging just 35,000 over the past three months, its worst showing since the pandemic.

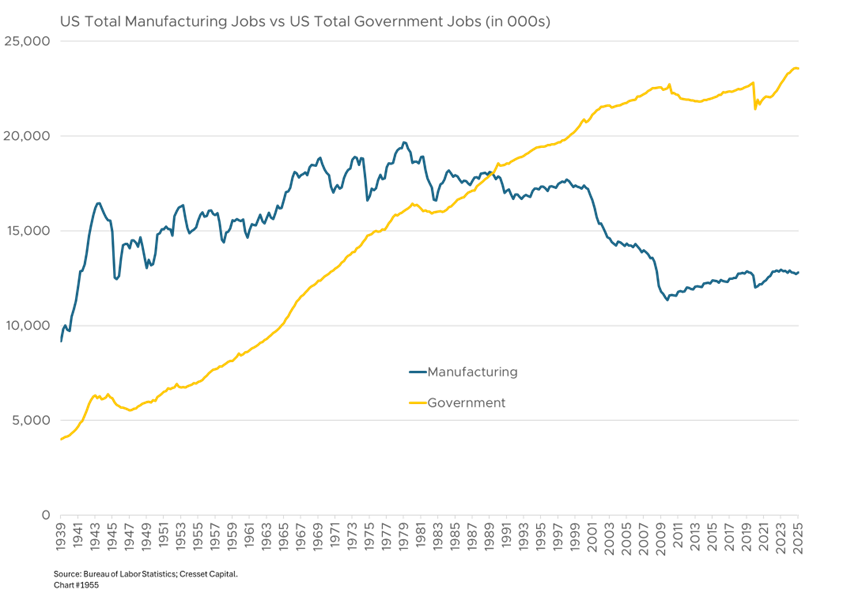

Manufacturing was hit particularly hard, with employers shedding 37,000 manufacturing jobs since Trump’s tariff launch in April, undermining the White House’s desire for a factory revival. Beginning in 1989, government workers, including state and local government, exceeded the number of manufacturing workers for the first time in our nation’s history. Today, there are more than 10 million workers on government payrolls than those in manufacturing jobs. While we don’t expect a manufacturing renaissance to transpire in just a few months, recent trends have been disappointing.

Sharply Lower Economic Growth Now Dependent on AI Spending

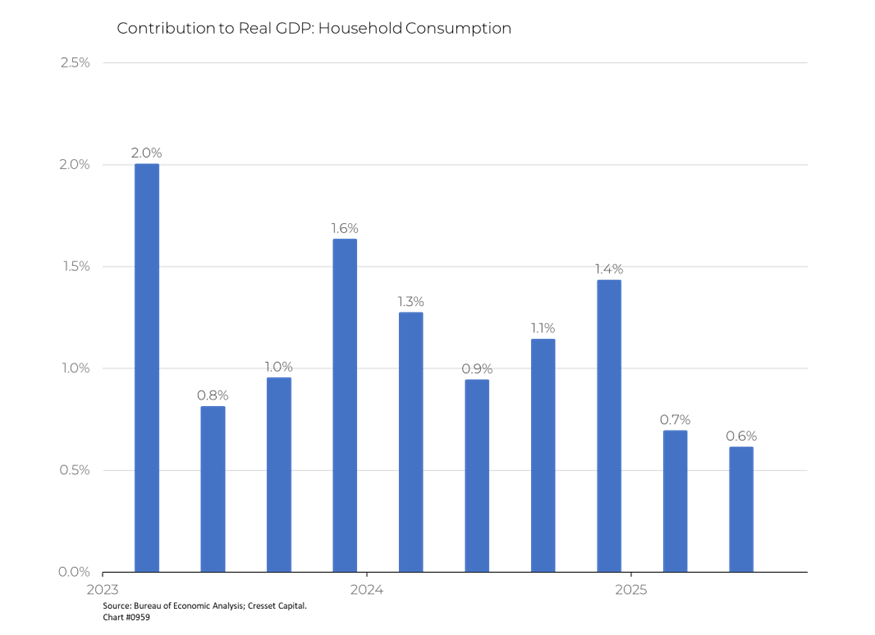

Growth has decelerated significantly, with GDP expanding at just a 1.2 per cent annualized rate over the first half of 2025, down from 2.8 per cent growth in 2024. Growth has been highly dependent on AI infrastructure spending, which contributed more to economic expansion than all consumer spending combined over the past six months. Consumer spending contributed 0.6 per cent to growth last quarter, about half its run rate over the previous year. A steep drop in imports was a big contributor also. Economists are forecasting a tepid 1.5 per cent annualized GDP growth for 2025, which would represent our weakest year since the pandemic.

Inflation Creeping up Again Largely Due to Higher Import Prices

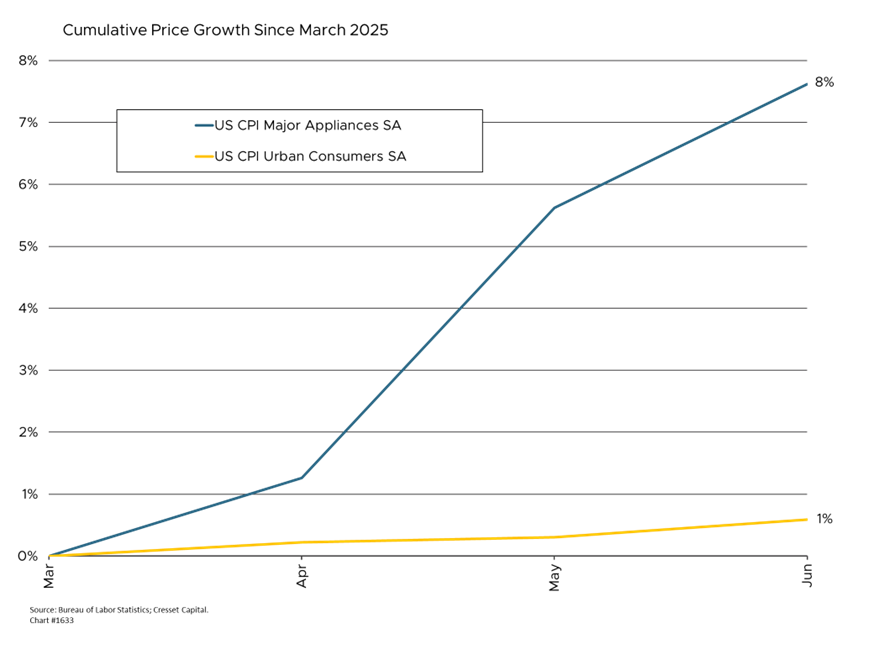

Rising inflation is adding a pressure point, complicating Fed decisions. Consumer prices rose 2.6 per cent in June compared to a year earlier, up from 2.2 per cent in April, with goods prices climbing at a 3.7 per cent annualized rate in the second quarter. Price increases have been concentrated in trade-sensitive goods such as home furnishings and electronics, strongly suggesting Trump’s tariffs are driving the inflationary surge. Economists are projecting 2.8 per cent inflation this year.

Companies Now Benefit from Immediate Expensing for Capital and R&D Investments

On the flip side, President Trump’s “One Big Beautiful Bill” Act is delivering substantial cash windfalls to major corporations through three key provisions that dramatically alter how businesses can expense costs for tax purposes. Companies can now fully and immediately expense most depreciable assets such as equipment, machinery, and other capital investments acquired after January 19, 2025, rather than spreading depreciation over multiple years. The legislation also reinstates upfront expensing for US research and development costs and allows companies to accelerate the expensing of previously unamortized R&D already on their books. This creates both ongoing benefits for new R&D and one-time windfalls from existing investments. Relaxed limits on deducting interest expenses provide additional tax savings, particularly benefiting companies with higher debt loads.

It is estimated that Meta Platforms could see up to $11 billion in cash tax savings this year, while Amazon could save $15.7 billion, according to The Wall Street Journal. AT&T expects $1.5-2 billion in 2025 savings and $2.5-3 billion annually through 2027.

Risk of Recession if Current Trends Continue

While unemployment remains relatively low at 4.2 per cent, economists warn of rising recession risks if the current trends continue. The combination of slowing growth and rising inflation – stagflation – poses unique challenges for policymakers. Consumer spending has begun to weaken as households face mounting debt and higher prices, with many businesses reporting softening demand and increased caution about future investment.

Bottom Line:

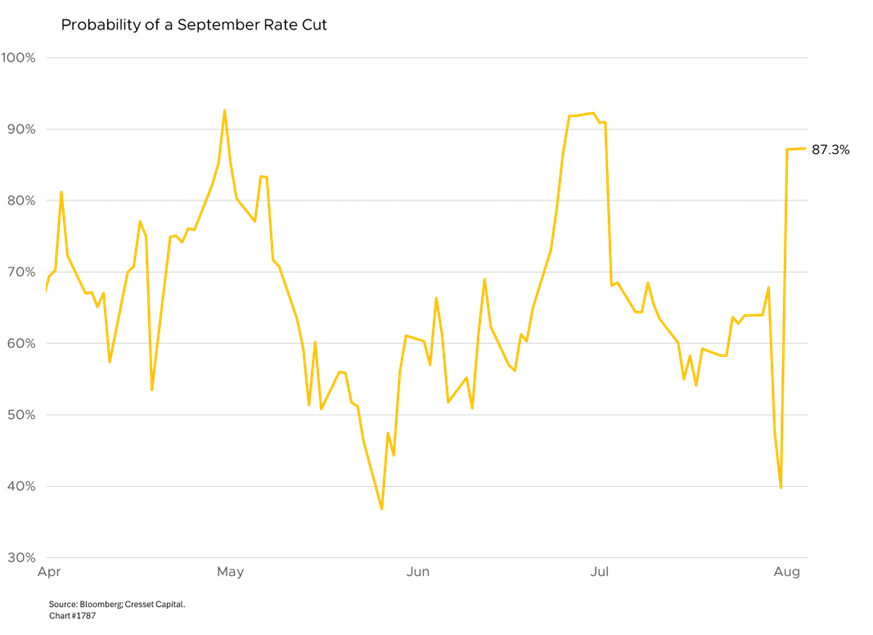

The deteriorating economic picture is intensifying pressure on the Federal Reserve to cut interest rates. However, a implementing rate-cutting strategy is not that simple, since policymakers must also weigh higher pricing pressure and corporate spending incentives. Adding to the uncertainty, Fed Governor Adriana Kugler’s unexpected resignation gives Trump an opportunity to install a more dovish policymaker. The odds of a September rate cut have spiked to nearly 90 per cent. We expect a September rate cut, but the path of the economy will determine whether the Fed is “one and done”.