Key Observations:

- Financial markets are positioned aggressively for Fed easing

- Labor, inflation data challenge Fed, tariffs add more complexity

- Fed Rate Cuts Face Structural Headwinds That Could Limit Their Economic Impact

- Economic implications of cuts depend on their underlying motivation: proactive, or reactive

- Pace and Magnitude of Cuts Have Historically Determined Sector Rotation Dynamics

Executive Summary

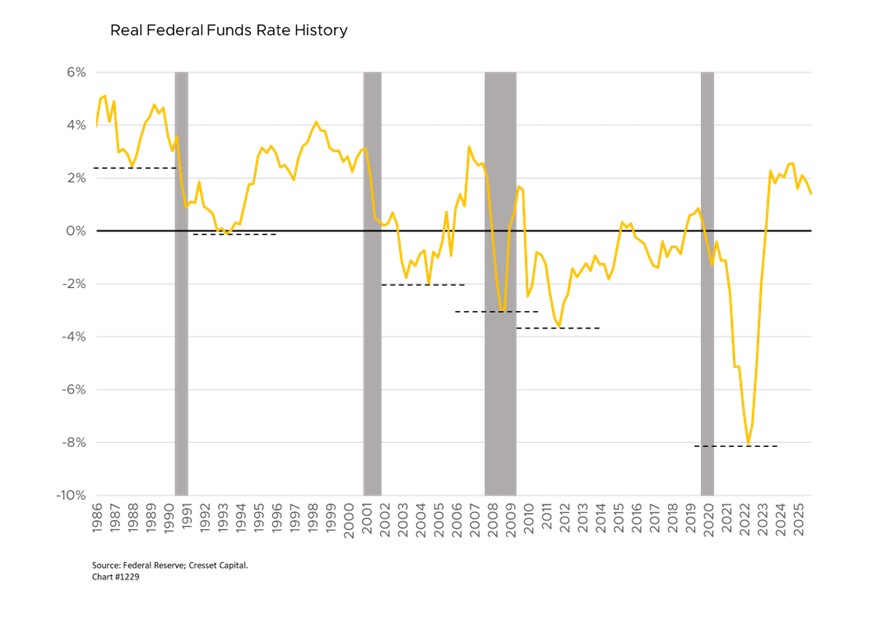

The Federal Reserve appears poised to initiate its first rate-cutting cycle since December 2024, and markets are pricing in the virtual certainty of easing at this week’s meeting. This monetary policy shift would occur against a backdrop of deteriorating labor market conditions, persistent inflation concerns, and elevated asset valuations. The implications for markets and the broader economy will largely depend on whether rate cuts reflect proactive policy normalization or reactive measures to prevent economic contraction.

Labor, Inflation Data Challenge Fed, Tariffs Add More Complexity

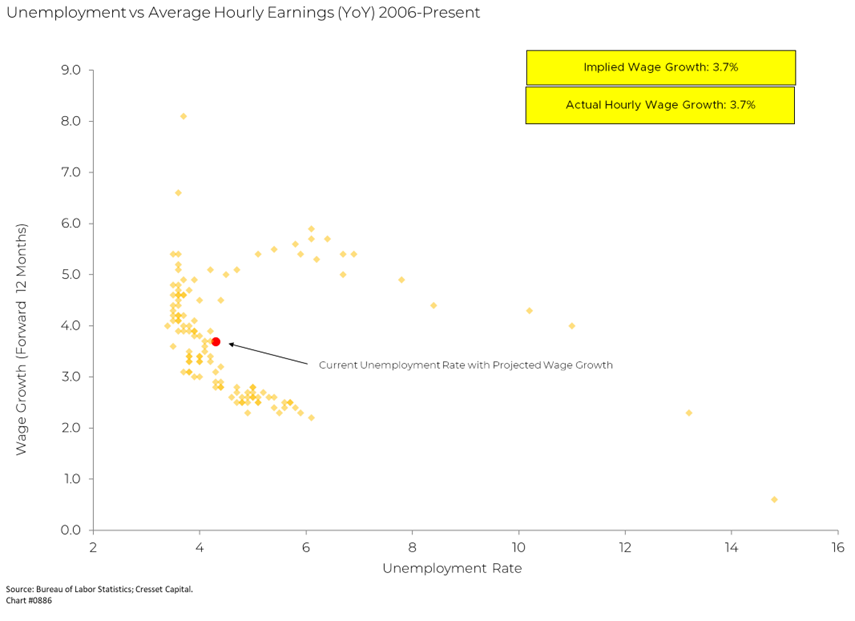

The Federal Reserve has a dual policy mandate: maintaining full employment while managing price stability. This economic balancing act is difficult to maintain, as today’s economic environment suggests with its weakening labor conditions and elevated pricing pressures.

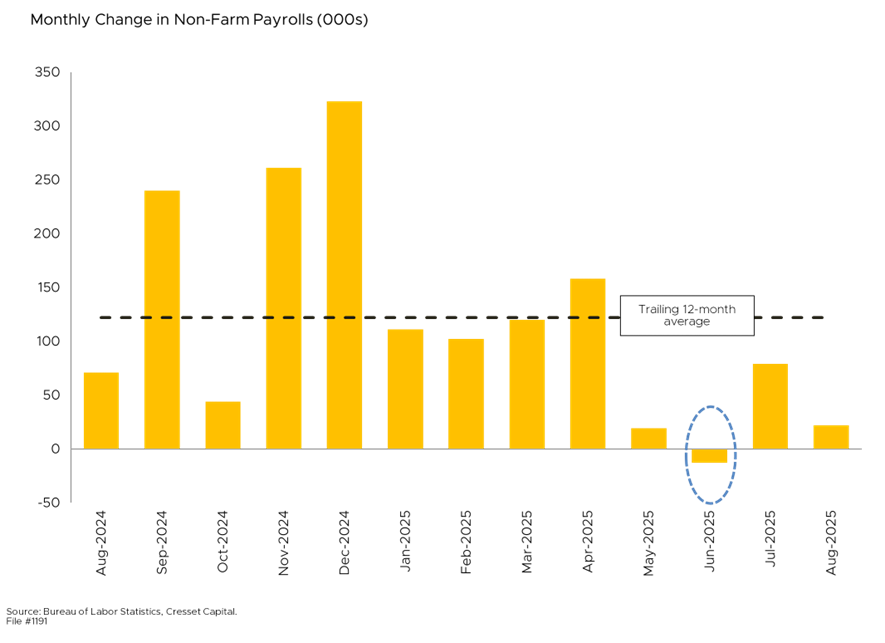

Weekly unemployment claims reached a four-year high, while comprehensive Bureau of Labor Statistics revisions revealed the economy created 911,000 fewer jobs over the 12-month period ending in March than initially reported. Most concerning, June showed an outright decline of 13,000 jobs, the first negative print since the pandemic.

This deterioration represents more than statistical noise. The labor market’s cooling trajectory suggests the Fed’s restrictive policy stance could be constraining economic activity beyond desired levels. With the Fed funds rate currently at 4.25-4.5%, real rates – overnight rates adjusted for inflation – remain elevated even as economic momentum shows signs of flagging. Current labor trends indicate the employment leg of the Fed mandate may be at risk, providing clear justification for policy recalibration.

Inflation, meanwhile, presents a more nuanced picture that complicates the easing decision. Core PCE inflation, the Fed’s preferred pricing gauge, has risen steadily since April, while headline CPI reached 2.9% in August. The breadth of price increases has expanded, with more goods and services experiencing upward pressure in recent months. The producer price index (PPI) weakened last month after a strong July.

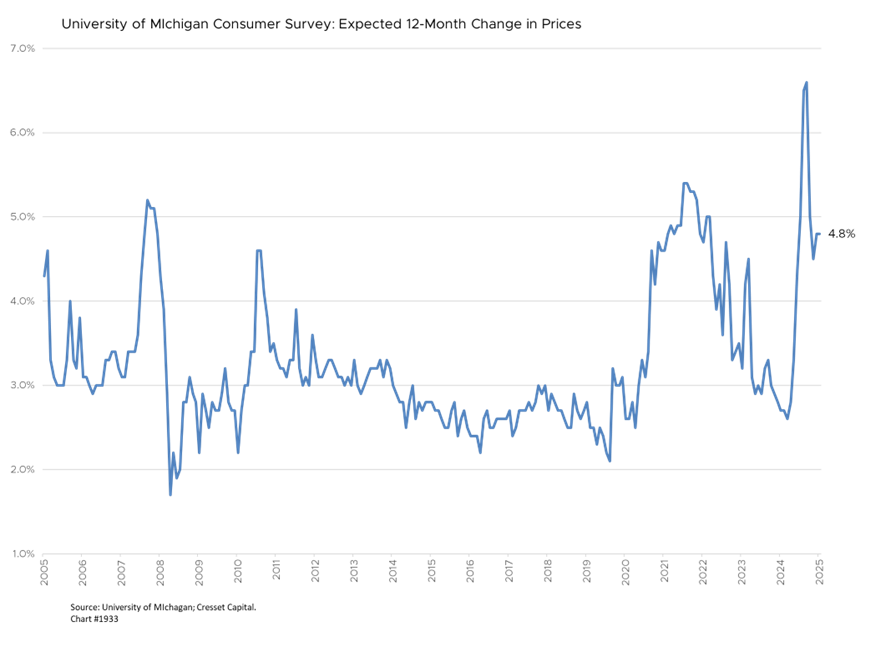

Trump administration tariffs add another layer of complexity. While some Fed officials characterize these as one-time price level adjustments, there remains meaningful risk of broader inflationary spillovers as company inventories diminish and cost pass-through accelerates. Consumer inflation expectations remain stubbornly high at 4.8 per cent according to University of Michigan surveys, suggesting potential erosion of hard-won credibility gains.

This inflation backdrop constrains the Fed’s ability to ease aggressively, even as employment conditions deteriorate. The central bank must balance immediate labor market concerns against longer-term price stability objectives.

Financial Markets Are Positioned Aggressively for Fed Easing

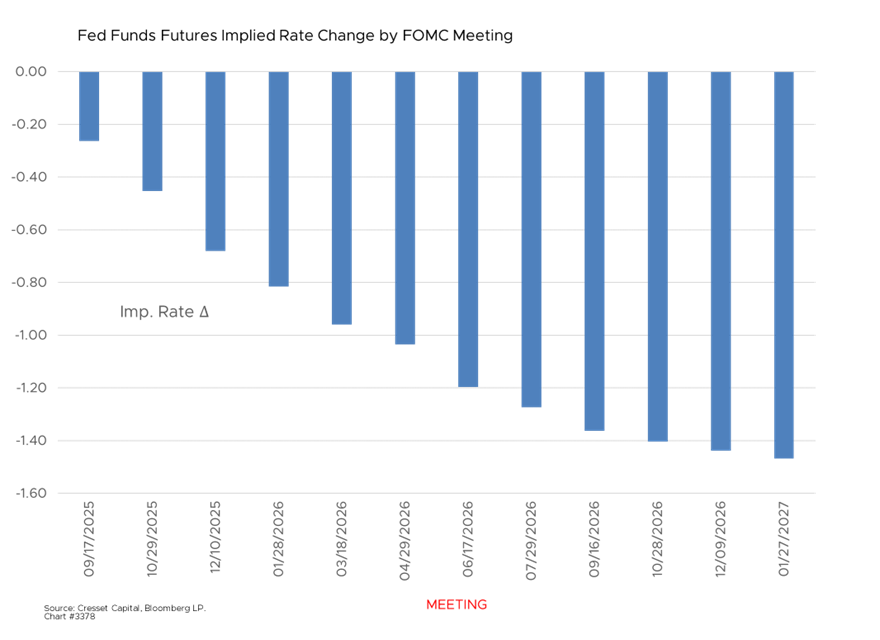

Treasury curves have steepened dramatically, with 10-year yields falling below four per cent for the first time since April while short-term rates remain anchored near current Fed policy levels. This configuration suggests markets expect not just initial rate cuts, but a sustained easing cycle. Fed funds futures expectations confirm that view.

Equity markets continue trading near record highs despite economic deterioration, reflecting investor confidence that Fed policy support will offset growth headwinds. The S&P 500’s resilience suggests markets view potential rate cuts as primarily supportive rather than symptomatic of deeper economic problems.

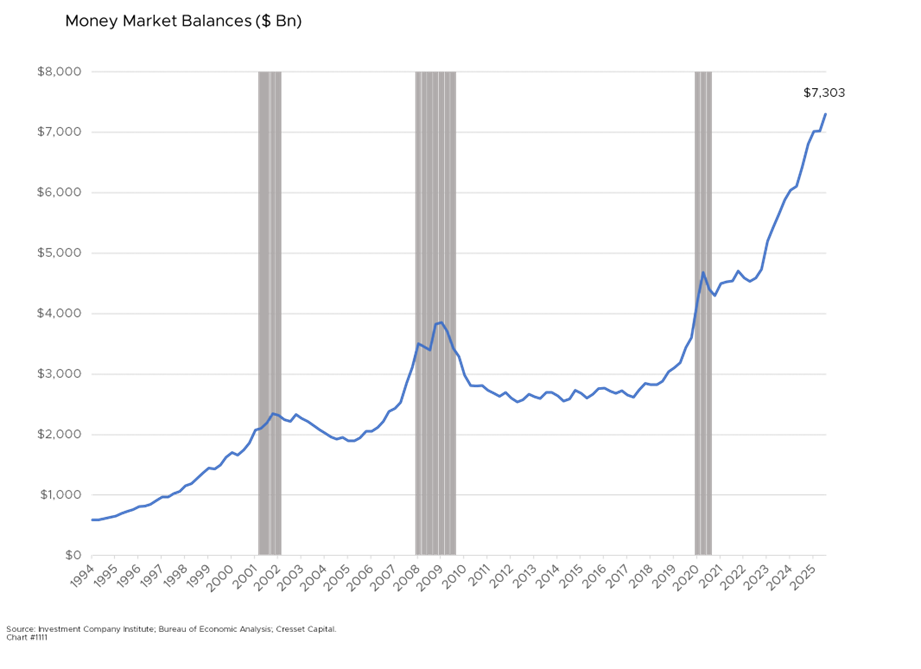

Meanwhile, money market funds have attracted record inflows, reaching $7.3 trillion in assets. This “wall of cash” is emblematic of both attractive current yields and investor caution about risk asset valuations. Contrary to Wall Street conventional wisdom, historical evidence suggests these balances tend to remain elevated until rates approach zero, limiting the stimulative effect of modest rate reductions.

Fed Rate Cuts Face Structural Headwinds That Could Limit Their Economic Impact

Housing represents a critical transmission channel, yet mortgage rate sensitivity to Fed policy has diminished significantly. With $13.4 trillion in mortgages locked at much lower fixed rates from previous years, rate cuts provide limited relief to existing homeowners. Even with mortgage rates having declined to an 11-month low of 6.53 per cent, housing activity remains constrained by near-record home prices and elevated insurance costs. Affordability improvements from rate cuts are largely offset by price appreciation and regulatory cost increases.

Corporate financing presents another challenge. Many companies have already refinanced debt at favorable rates during previous easing cycles, reducing their sensitivity to current rate changes. This could limit the stimulative effect of cuts on business investment and employment decisions.

Pace and Magnitude of Cuts Have Historically Determined Sector Rotation Dynamics

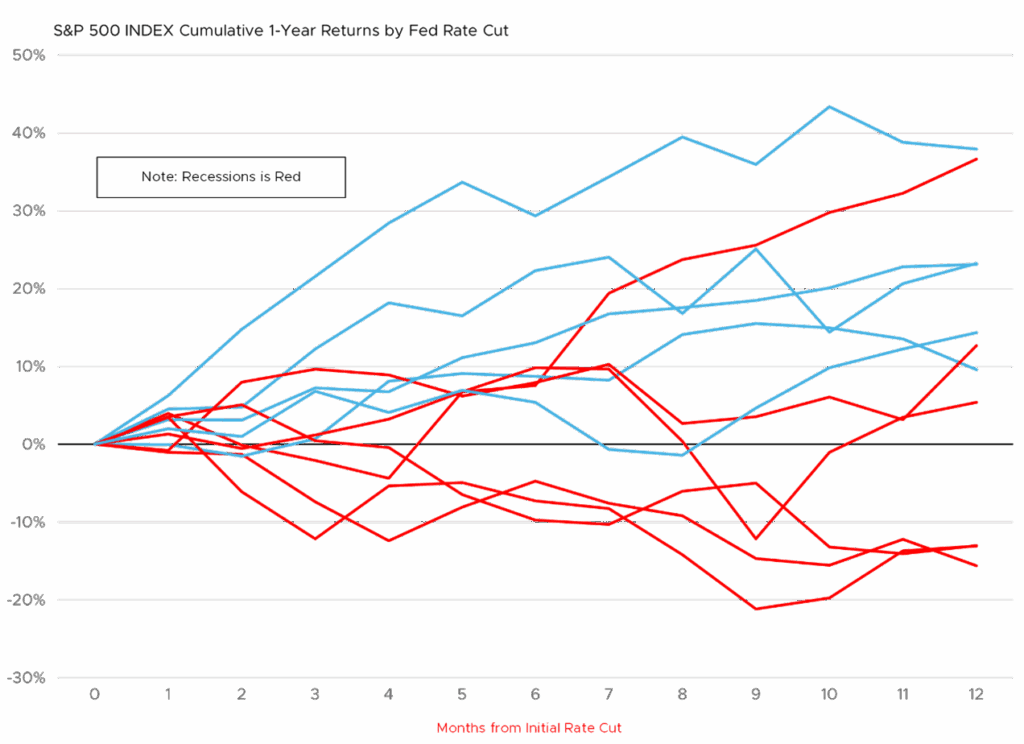

Easing expectations have already begun reshaping market leadership patterns. If the Fed implements gradual, measured cuts while avoiding recession, growth-oriented equity markets will flourish, as companies benefit from lower discount rates applied to future cash flows and improved financing conditions.

However, if labor market deterioration accelerates and forces more aggressive Fed response, defensive positioning becomes more attractive. Treasury bond markets have historically provided better risk-adjusted returns during periods of economic uncertainty, even as rate cuts theoretically boost equity valuations.

Credit markets face complex crosscurrents. While rate cuts support bond prices mechanically, questions remain about duration positioning and credit quality considerations. The yield curve’s current configuration suggests substantial easing expectations are already embedded in pricing.

Economic Implications of Cuts Depend on Their Underlying Motivation

If the rate cuts represent proactive policy normalization as inflation approaches target levels, they could support continued expansion and business confidence. Alternatively, if the Fed is forced to respond to accelerating economic weakness, the stimulative effect of rate cuts could prove insufficient to prevent broader deceleration. The lag between monetary policy implementation and real economic impact suggests current conditions could deteriorate further before any policy support becomes effective.

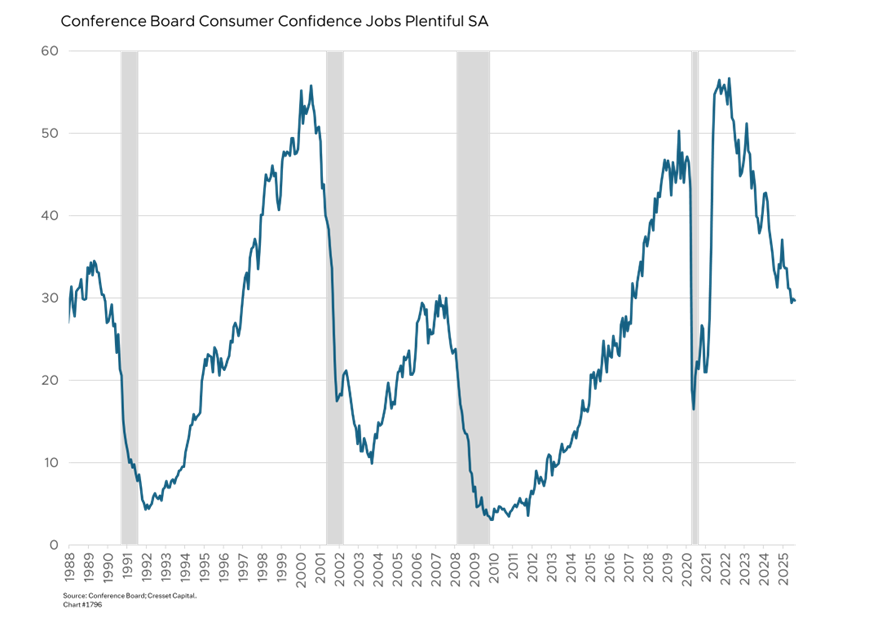

Consumer spending patterns provide insights into the economic trajectory. Despite rate cut expectations running high, consumer confidence has declined, and job-finding expectations have fallen toward recession levels. This suggests households might increase precautionary savings rather than boost consumption in response to lower rates.

Strategic Outlook

The Fed faces an uncomfortable policy choice between addressing clear labor market deterioration and managing persistent inflation pressures. A measured 25bps easing program appears most likely, balancing acknowledgment of economic risks with maintenance of anti-inflation credibility.

However, the more significant consideration involves forward guidance and the projected path of future policy adjustments. Markets will scrutinize the FOMC’s updated dot plot projections along with Chairman Powell’s press conference commentary for signals about the easing cycle’s likely rate path.

Bottom Line:

The key question is whether the Fed can engineer a successful “soft landing” or whether deteriorating fundamentals will require more aggressive policy responses. We are optimistic the economy will avoid recession, but economic data demonstrate meaningful downside risks that must be monitored. The interaction between Fed policy effectiveness, labor market evolution, and inflation persistence will likely determine whether rate cuts prove supportive for risk assets or merely delay more significant economic and market adjustments.