Key Observations:

- Our two-track economy gives conflicting signals to monetary policymakers, stressing the dual mandate

- Contradictory policies needed to address divergent economy

- Stock ownership reinforces wealth concentration, which translates directly into consumption behavior

- Systemic risks could emerge if current divergence trends continue

The Federal Reserve is confronting an unprecedented policy dilemma as it embarks on its latest easing cycle. High-income households are driving robust consumer spending through asset wealth gains while lower-income wage earners face deteriorating job prospects and persistent inflation pressures. This K-shaped economy creates fundamental tensions within the Fed’s dual mandate framework, rendering traditional monetary policy transmission mechanisms increasingly ineffective and generating profound implications for investment strategy.

Our Two-Track Economy Gives Conflicting Signals to Monetary Policymakers

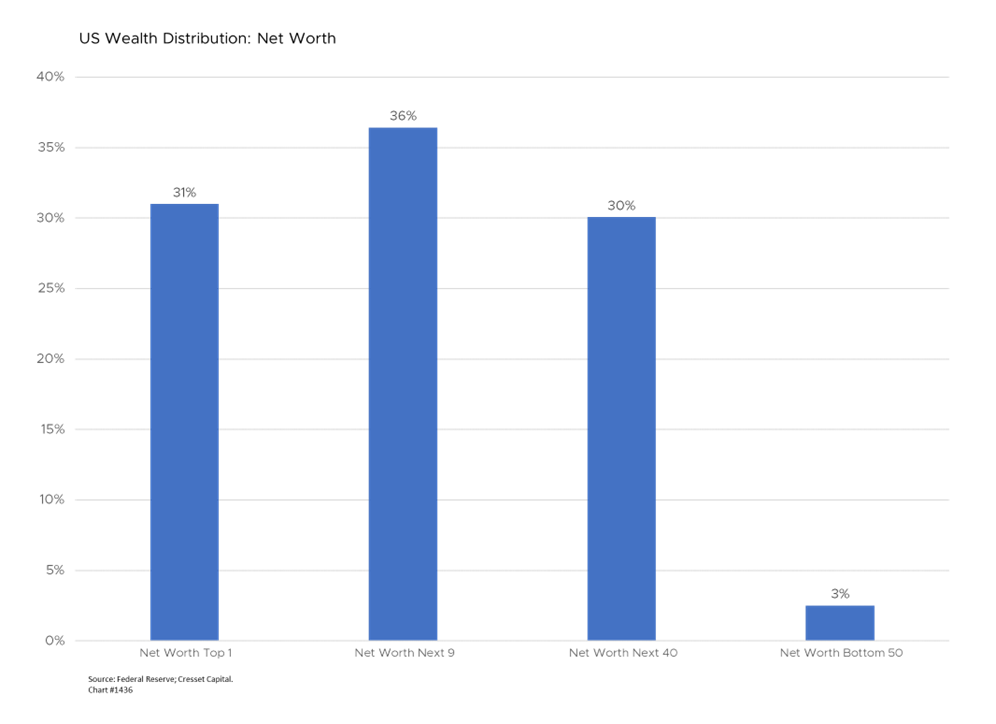

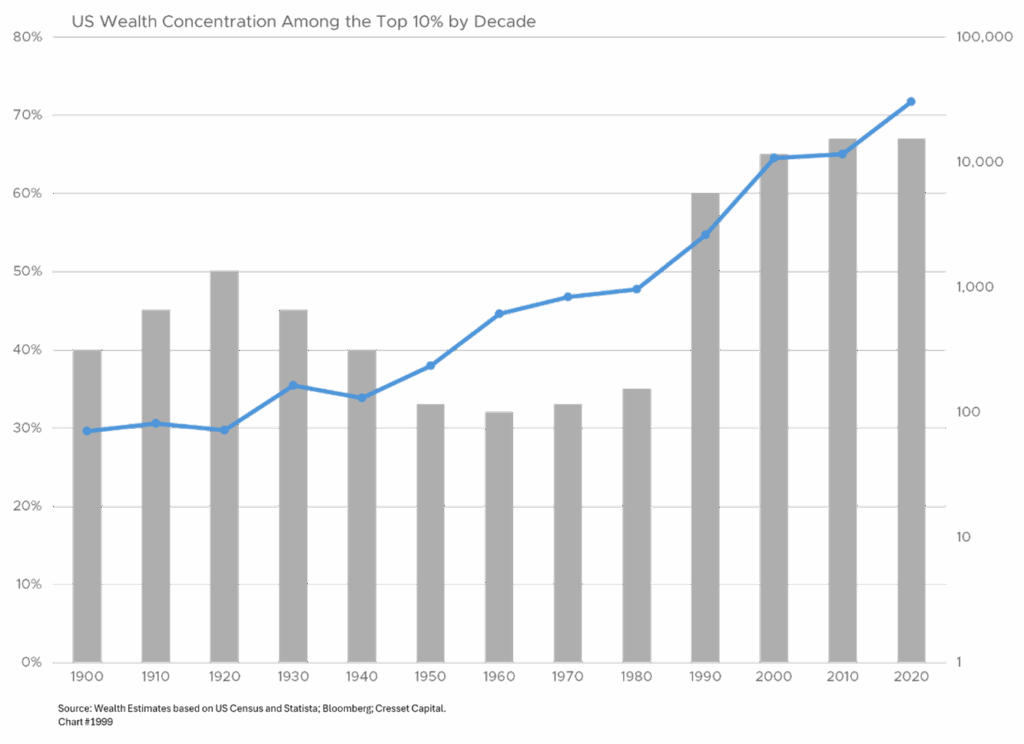

Asset-owning households demonstrate remarkable resilience, with the top 10 per cent controlling 67 per cent of total wealth and 89 per cent of stock market wealth, according to Federal Reserve data, enabling sustained consumption even amid economic uncertainty. Meanwhile, recent college graduates face 5.3 per cent unemployment with 41 per cent underemployment – the highest since 2021 – while real wages have declined 0.7 per cent cumulatively since 2021 despite recent improvements. This divergence creates a two-track economy in which traditional economic indicators provide conflicting signals about appropriate monetary policy responses.

The Wealth Divide Translates Directly Into Consumption Behavior

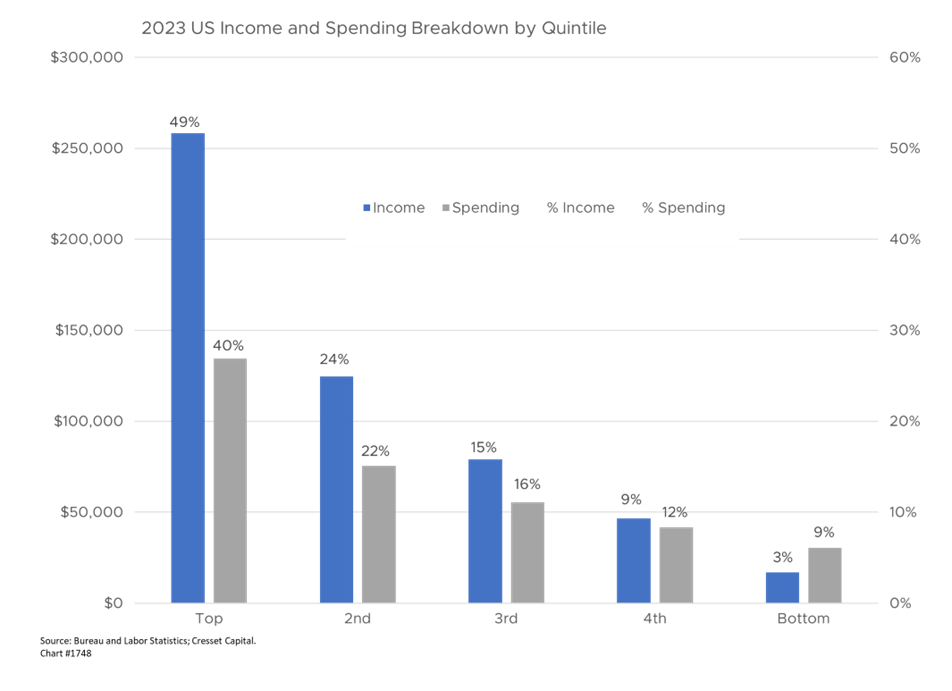

Eighty-seven per cent of households earning over $100,000 own stocks compared to just 28 per cent of households earning below $50,000, making for vastly different exposure to asset price appreciation. The S&P 500’s second-quarter gain generated $5.8 trillion in household financial asset increases, primarily benefiting wealthy households which account for approximately 50 per cent of total consumer spending.

Lower-income households face disproportionate inflation-related costs, despite recent wage gains outpacing headline inflation. Though wages grew 4.2 per cent compared to 2.7 per cent inflation through July, the cumulative inflation damage to living standards since 2021 remains significant. That’s because lower-income families allocate a higher share of their incomes to spending on essential goods, like housing (32.9 per cent of expenditures), transportation (17 per cent), and food (12.9 per cent), making these families more vulnerable to price increases in necessities.

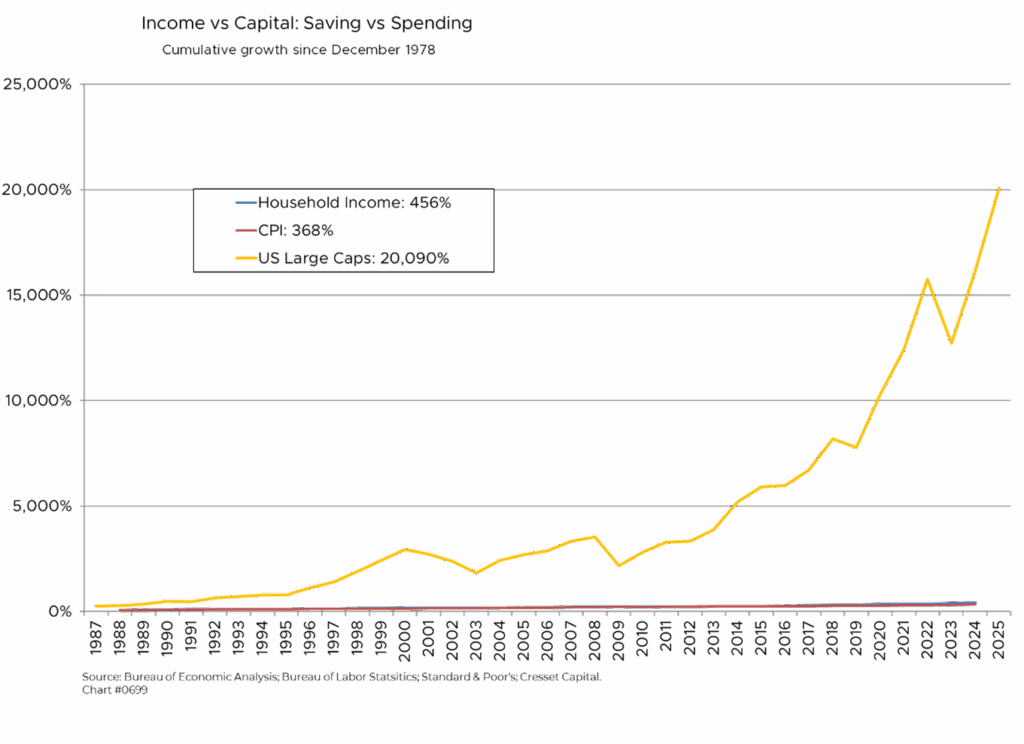

Stock Ownership Reinforces Wealth Concentration

Stock ownership is the core income bifurcation mechanism. While 84 per cent of college graduates hold equities, only 42 per cent of Americans with a high school education or less participate in the stock market. This educational divide mirrors the income divide, creating self-reinforcing wealth concentration as asset appreciation outpaces wage growth across most sectors. Over the years, wealth, as represented by equity market appreciation, has expanded exponentially more than income. Between 1978 and today, household income has grown by 456 per cent, outpacing cumulative inflation of 368 per cent over that timeframe. Wealth, as represented by US equities, mushroomed by a gargantuan 20,000+ per cent in the interim, driving a wedge between income and wealth.

Monetary Policy Transmitted Via Credit and Wealth Channels

The Federal Reserve’s monetary policy operates through multiple transmission channels, but the wealth effect channel disproportionately benefits asset holders. For every dollar of increased stock market wealth, consumer spending rises 2.8 cents annually, according to a recent National Bureau of Economic Research study, a mechanism that primarily flows through households with substantial investment portfolios.

Real estate markets demonstrate similar dynamics. Existing homeowners benefit from both equity appreciation and low locked-in borrowing costs. The effective mortgage rate for current loans outstanding is 4.1 per cent, substantially below today’s 6.8 per cent borrowing rate, making it unlikely mortgage rates in the near term will fall far enough to move the needle on housing. Meanwhile, the median home price reached $410,800 last quarter, creating substantial wealth effects for existing owners while pricing out potential first-time buyers who lack sufficient assets for a down payment.

Dual Mandate Stressed; Divergent Economy Needs Contradictory Policies

The Fed’s dual-mandate framework faces unprecedented stress when different economic segments require contradictory policy responses. The July FOMC minutes revealed deep divisions among committee members, as a “majority of participants judged the upside risk to inflation as the greater of these two risks” while others “considered downside risk to employment the more salient risk.”

Traditional monetary transmission mechanisms work unevenly across income groups, creating policy distortions. The wealth channel primarily affects asset-owning households, while credit channels remain constrained for lower-income borrowers. That’s because lower interest rates create a feedback loop through which asset appreciation fosters further asset accumulation while wage dependence limits wealth-building capacity. High-income households can leverage asset gains to purchase additional assets, while lower-income households struggle to enter asset markets due to elevated prices relative to wage income.

Fed communications increasingly acknowledge the Fed’s dilemma. Chairman Powell’s August 2025 framework review speech explicitly recognized that “risks to inflation are tilted to the upside, and risks to employment to the downside challenging situation.” This represents a fundamental challenge to the assumption that full employment and price stability can be achieved simultaneously through uniform policy tools.

Investment Flows Support K-Shaped Economy Thesis

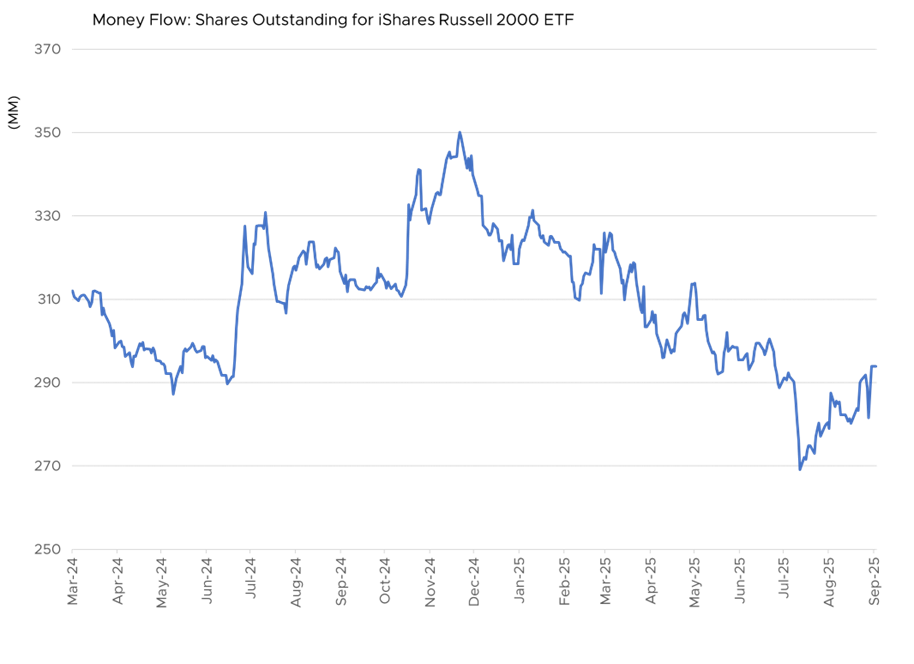

Financial services companies benefit structurally from increased savings flows from wealthy households, while traditional consumer discretionary companies serving middle-income segments face headwinds from stagnant wage growth. Small-cap equities appear particularly vulnerable as smaller companies lack access to capital markets and face wage pressures without corresponding productivity gains. Institutional flow patterns support this K-shaped thesis. The S&P 500 ETFs attracted $150 billion in 2024, demonstrating flight-to-quality dynamics within equity markets. Meanwhile, small cap funds experienced outflows throughout most of 2025, indicating institutional recognition of the concentration trends.

Three historical episodes provide relevant parallels and warnings:

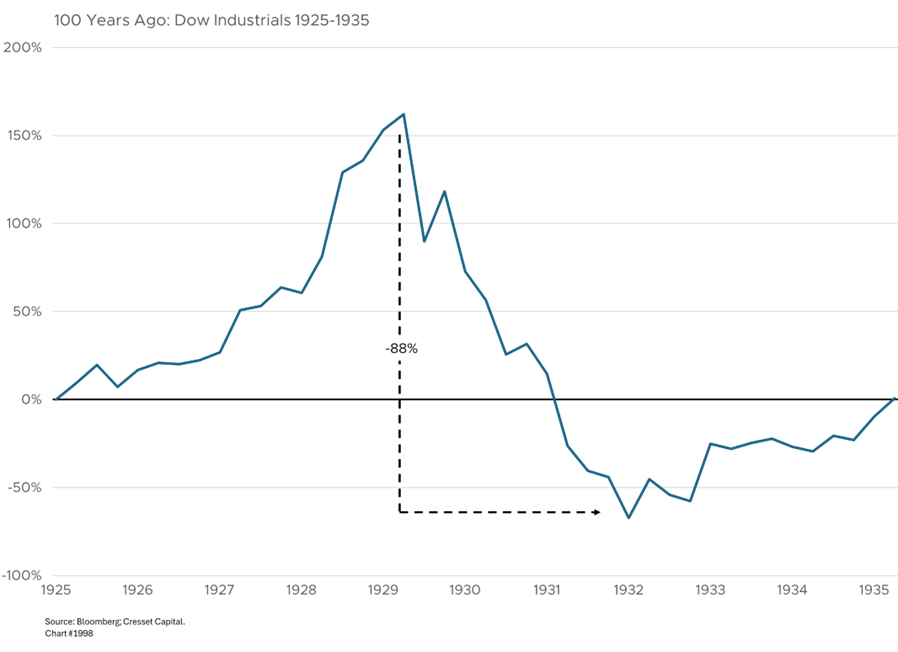

1. The 1920s asset boom demonstrated how prolonged monetary accommodation can create unsustainable wealth concentration. Stock prices rose over 200 per cent from 1923-1929 while consumer prices remained stable, creating similar K-shaped conditions that ended with the 1929 crash and subsequent depression.

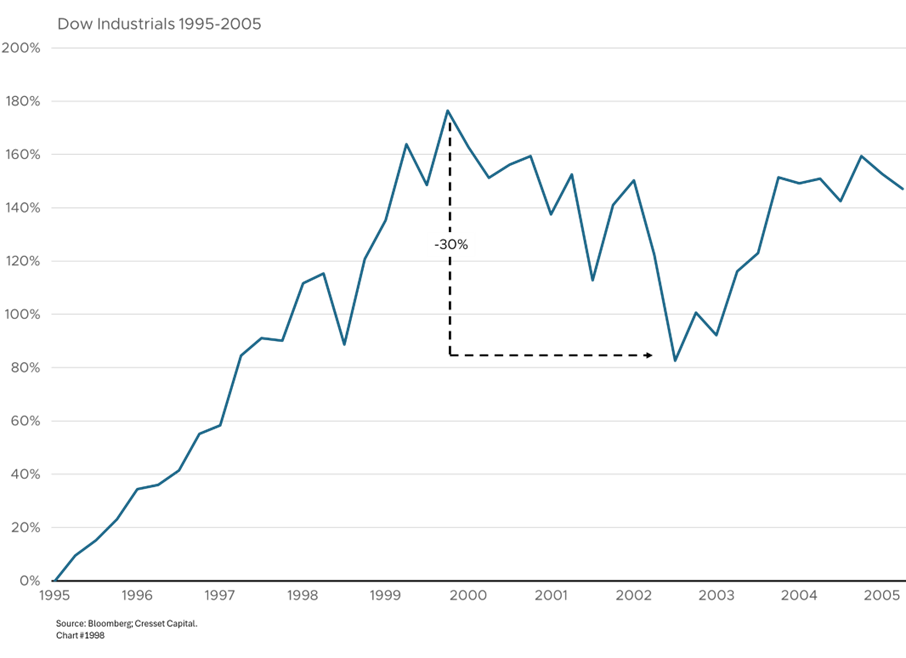

2. The early 2000s dot-com bubble showed how asset price inflation could occur alongside low consumer price inflation during periods of monetary accommodation. Despite Fed Chairman Greenspan’s warnings about “irrational exuberance,” the Fed did not use monetary policy preemptively to combat the bubble, leading to its eventual decline.

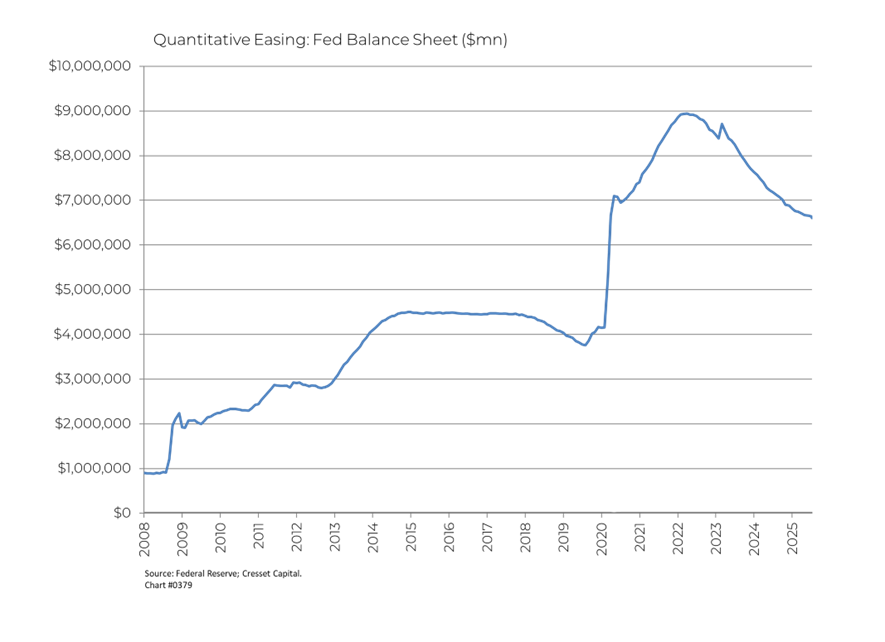

3. The most relevant K-shaped comparison is the post-2008 quantitative easing period, in which explicit asset price targeting created severe wealth divergence. According to Pew Research, every dollar of aggregate wealth gains from 2009-2011 went to the richest seven per cent of households, while the bottom 93 per cent experienced declining net worth. This period demonstrated how unconventional monetary policies can achieve macroeconomic stability while exacerbating distributional inequalities.

The Fed’s balance sheet policies create additional transmission problems. While quantitative easing successfully prevents deflationary spirals, it operates primarily through asset price channels that benefit wealthy households disproportionately. Recent Fed research acknowledges that “fiscal policy is in many ways better suited than monetary policy to stabilize the economy, because it can be more precisely targeted toward different households.”

Systemic Risks Could Emerge if Current Divergence Trends Continue

Fed research demonstrates that rising wealth inequality increases household mortgage leverage and corporate debt levels, creating financial stability vulnerabilities. Social history suggests extreme inequality leads to populist political backlash and policy uncertainty that disrupts markets. Wealth concentration in financial assets also creates potential for cascading effects if asset prices decline sharply. With the top 10 per cent owning 89 per cent of stock wealth, any significant market correction would disproportionately impact the households driving current consumption growth, potentially creating rapid demand destruction.

The Federal Reserve’s current predicament represents more than a typical policy challenge; it reflects fundamental structural changes in how monetary policy transmits through an increasingly unequal economy.

Bottom Line:

The K-shaped economy requires a quality-oriented, diversified investment strategy. History has shown that wealth-driven growth is unsustainable, particularly when asset bubbles correct. While historical precedents offer some guidance, the scale and persistence of current bifurcation trends create novel risks requiring adaptive investment strategies. Success will likely favor quality positioning balanced with defensive holdings against the systemic risks inherent in this two-track economic structure. High-quality bonds, for example, could offer a risk offset to overvalued equities.