Key Observations:

- The U.S. labor market is cyclically slowing, but its ongoing structural transformation complicates traditional analysis and policy responses

- Skills gaps are wide and growing and AI will disrupt faster than other automation waves

- Comprehensive tariff implementation adds uncertainty, especially for small firms

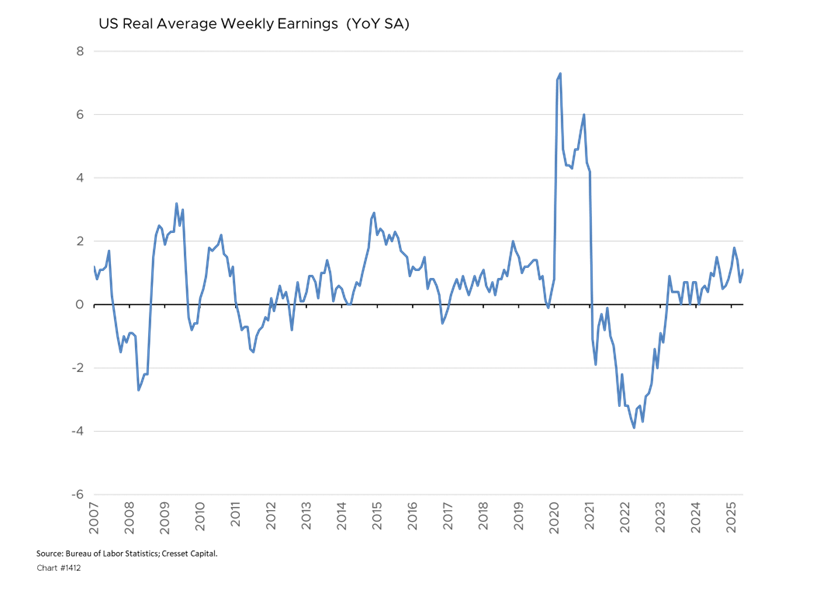

- A positive development in recent data: Wage gains are above inflation despite cooling jobs growth

- Investment positioning should reflect a rebalancing environment, emphasizing defensive sectors and quality companies

Executive Summary

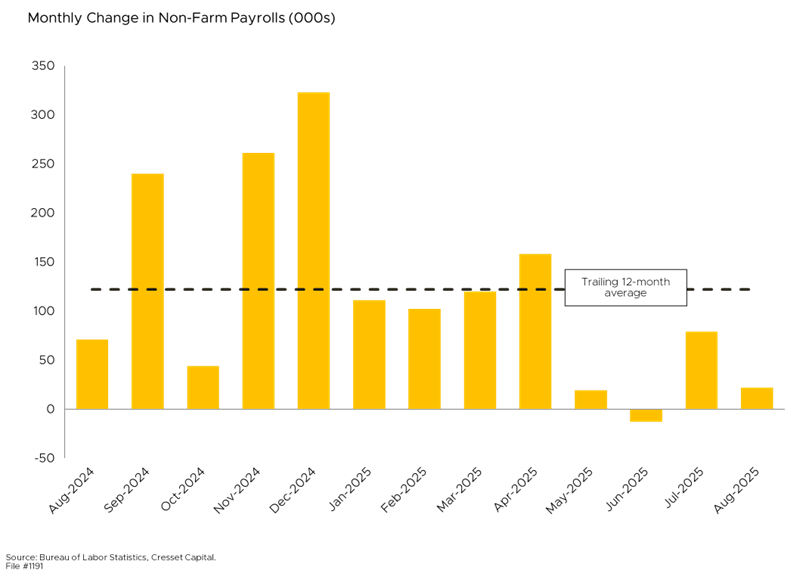

The U.S. labor market is exhibiting unmistakable signs of cooling. Job creation slowed to just 22,000 positions added in August, its weakest monthly performance since the pandemic, while unemployment rose to 4.3 per cent. This represents a dramatic deceleration from the robust hiring of recent years, with employment growth averaging only 29,000 jobs over the past three months compared to 167,000 monthly in 2024.

However, beneath this surface cooling lies a more complex story of structural transformation driven by technological disruption, demographic shifts, and significant policy headwinds that are reshaping the American workforce. The combination of tight monetary policy, immigration restrictions reducing labor supply, and widespread skills mismatches creates a unique economic moment in which traditional metrics might not fully capture underlying dynamics.

Labor Market Fundamentals Reveal Systemic Weakness

The August 2025 employment report delivered across-the-board disappointment, falling dramatically below economists’ expectations of 75,000 net new jobs. More troubling, revisions showed June lost 13,000 jobs, marking the first net decline since December 2020. Combined with downward revisions to the July numbers, the data reveal a pattern of systemic weakness that has persisted through the summer months. Three-month average job creation has plummeted to just 29,000, in effect zero growth for an economy of this size, representing a fundamental shift from the tight labor market that characterized the post-pandemic recovery.

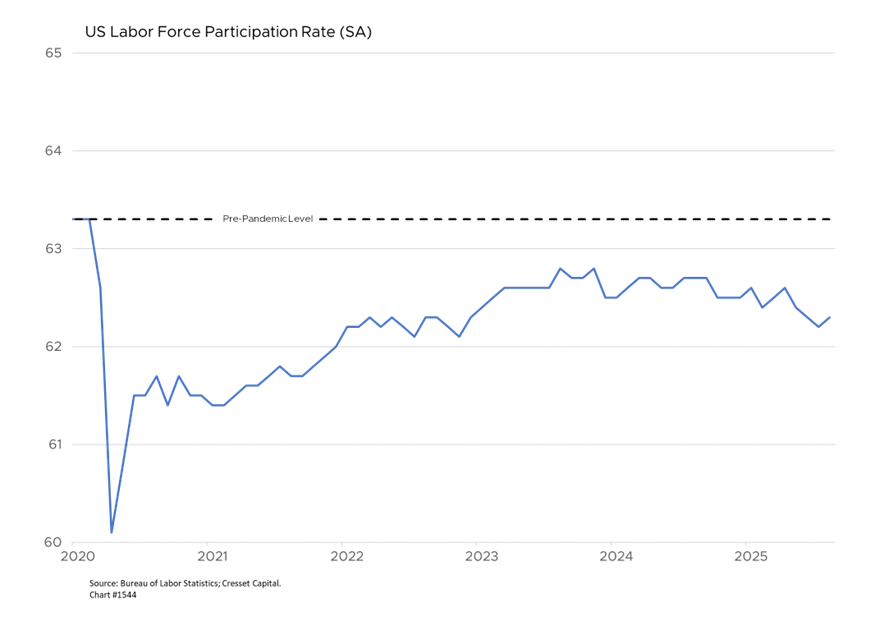

The Labor Force Participation Rate Has Stagnated

Labor force participation has stagnated at 62.3 per cent, showing year-over-year declines of 0.4 percentage points, while the employment-to-population ratio remains unchanged at 59.6 per cent, also declining 0.4 percentage points annually. More troubling indicators include long-term unemployment increasing by 385,000 workers over the past year, and 722,000 additional people not in the labor force now wanting jobs. These metrics collectively paint a picture of an economy struggling to generate meaningful employment opportunities.

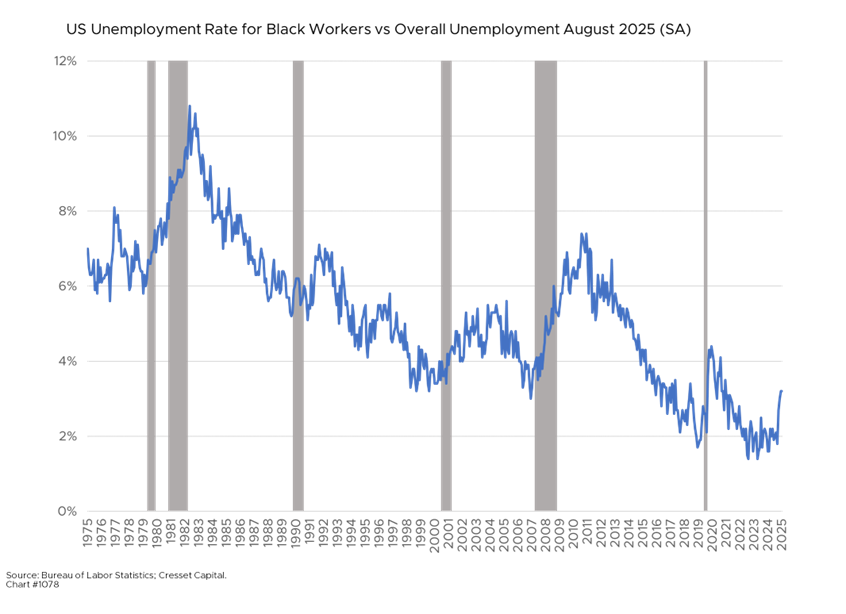

Some Persistent Demographic Unemployment Disparities Have Widened

The demographic breakdown reveals persistent disparities that have widened in some cases. Black unemployment stands at 7.5 per cent compared to 3.7 per cent for white workers, reaching its highest level since October 2021. Teenagers, meanwhile, face a 13.9 per cent unemployment rate, while college graduates experience just 2.5 per cent unemployment versus 5.8 per cent for those without high school diplomas. These patterns suggest that while the overall labor market has cooled, the benefits of employment remain unevenly distributed across demographic groups, with educational attainment continuing to provide significant protection against joblessness.

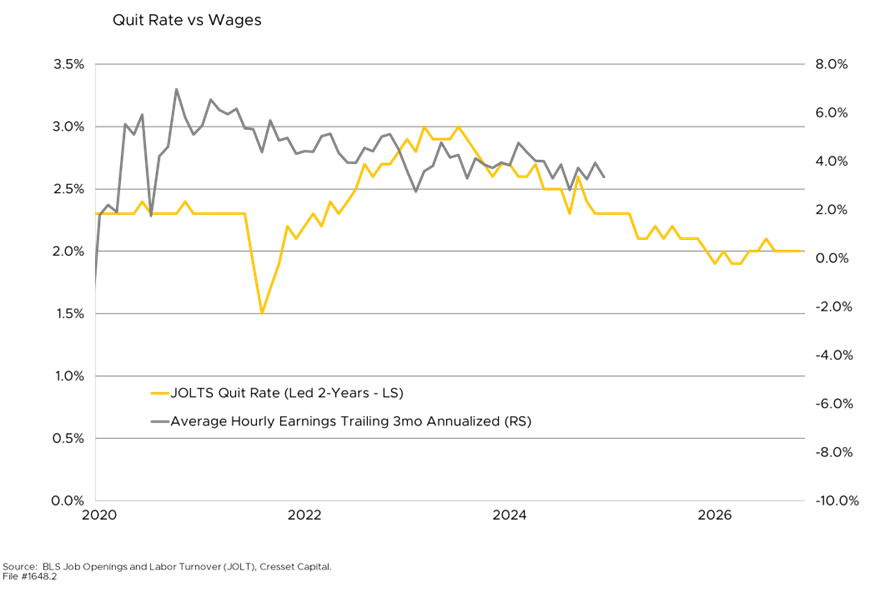

Wage Gains Above Inflation Despite Cooling Jobs Growth

Despite cooling job creation, the good news is wage growth remains above inflation, with average hourly earnings increasing 3.7 per cent annually while real wages have grown 1.3 per cent year-over-year for 18 consecutive months. The Employment Cost Index shows total compensation costs rising 3.6 per cent annually, indicating that employers continue competing for workers even as hiring slows. However, this aggregate picture masks significant variation, with only 57 per cent of American workers seeing paychecks grow faster than inflation, highlighting the uneven distribution of wage gains across the workforce.

Reduced Labor Market Dynamism Creates Challenges for New Entrants

The Job Openings and Labor Turnover Survey (JOLTS) reveals fundamental shifts in labor market power dynamics. Job openings declined to 7.2 million in July, pushing the job-to-unemployment ratio below one for the first time since 2020. That’s down from the post-pandemic peak of more than two job openings per unemployed person. The quit rate, meanwhile, has stabilized at two per cent, well below the three per cent peak of late 2021, suggesting workers are holding onto positions due to economic uncertainty. A decelerating quit rate tends to lead to lower wage growth.

The low job turnover environment is creating unusual challenges for new labor market entrants, like recent college graduates and those seeking career advancement. While job security has improved for existing workers, the reduced dynamism limits opportunities for wage gains through job switching and makes it harder for unemployed individuals to find new positions. The shift represents a fundamental change from the worker-favorable conditions of 2021-2022 to an environment in which employers regain bargaining power.

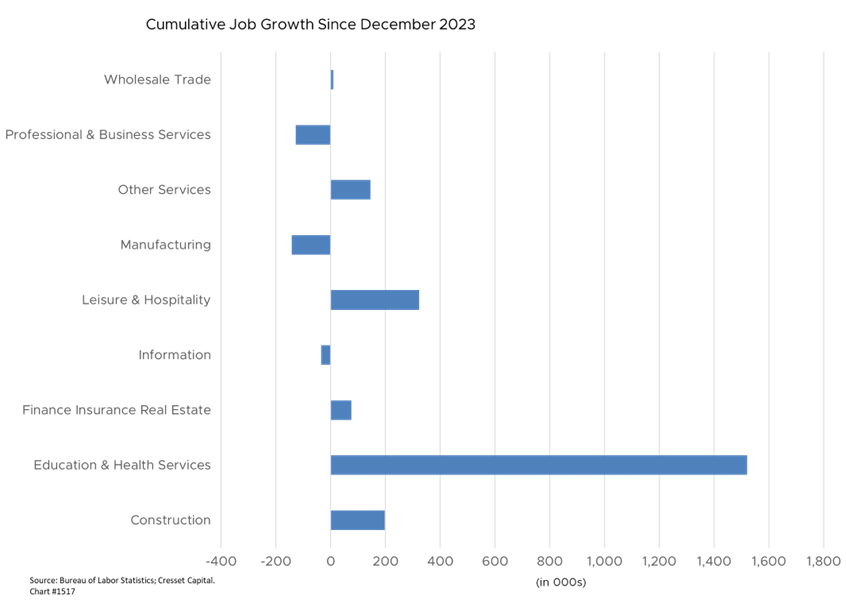

Healthcare Driving Job Gains, Manufacturing Faces Headwinds

Healthcare, a sector insulated from trade disputes, continues driving national job growth, adding 31,000 positions in August despite slowing below its 12-month average of 42,000. The sector is projected to post 2.3 million net new jobs through 2033, representing one-third of all expected job gains as demographic aging accelerates. Healthcare and social assistance added 46,800 jobs in August, accounting for virtually all job growth last month. Unfortunately, this concentration of job creation in government-dependent sectors suggests underlying economic weakness masked by public spending.

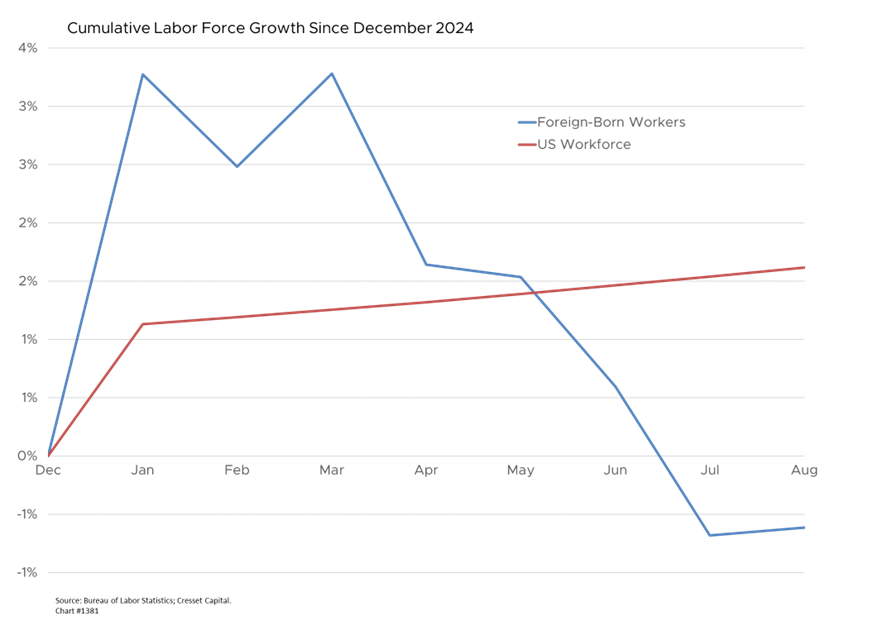

Manufacturing faces significant headwinds, losing 12,000 jobs in August and shedding 78,000 positions since the beginning of 2025. The trend aligns with policy impacts. Construction employment, a sector that relies on foreign-born workers, lost 7,000 jobs in August, while professional and business services declined 17,000 positions. Transportation equipment manufacturing lost 15,000 jobs partly due to labor disputes. Manufacturing, construction and transportation are most exposed to Trump’s tariff regime, facing challenges from federal spending cuts, tariff uncertainty creating cost pressures, and supply chain disruptions.

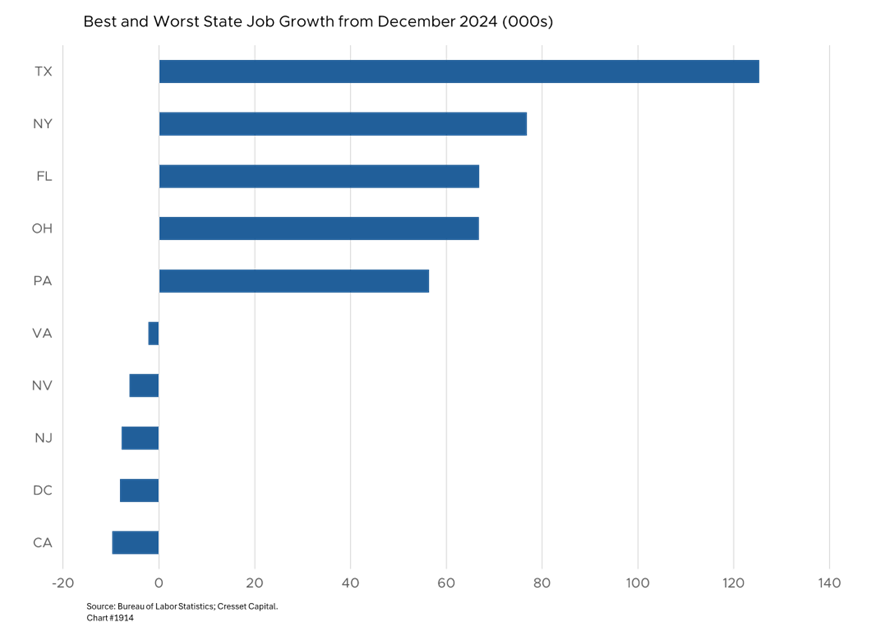

Federal employment, meanwhile, suffered the most dramatic decline, falling by 15,000 jobs in August alone and down 97,000 since its January peak. This reflects policy choices rather than economic conditions, with the DOGE initiative targeting substantial federal workforce reductions. Including contractors, the potential impact could reach nearly one million jobs given typical 2:1 contractor-to-employee ratios. The concentration of these cuts affects specific geographic regions disproportionately, particularly the Washington DC metropolitan area where federal employment represents 10 per cent of local jobs.

The technology sector presents a mixed picture: while federal research positions are 27 per cent below pre-pandemic levels due to funding cuts, private sector AI and data science roles continue showing strong demand. Computer and mathematical occupations are projected as among the fastest growing, though geographic concentration in major metropolitan areas limits benefits to rural communities.

Regional Employment Disparities Have Become More Pronounced

The Southeast and Southwest lead national employment growth, with Texas alone adding 232,500 jobs over the past year and Florida contributing 142,300 positions. In contrast, Michigan’s unemployment rate reached 5.3 per cent, and California maintains the highest state unemployment rate at 5.5 per cent.

Long-standing structural disadvantages continue to affect rural employment, which is stuck below 2007 levels, compared to urban areas that have enjoyed stronger job gains. Rural labor force participation has declined 2.6 percentage points since 2007, as these areas face greater challenges attracting high-skill job creation due to infrastructure limitations and demographic trends. The federal government workforce reduction creates additional concentrated regional impacts, particularly affecting areas dependent on government employment, like Washington DC and its surrounding communities.

Federal Reserve policy remains restrictive with rates held at 4.25-4.5 per cent, though growing internal dissent suggests potential changes ahead. FOMC minutes reveal concerns that “downside risk to employment had meaningfully increased,” and markets are pricing in three quarter-point rate cuts through year-end. The central bank faces difficult tradeoffs with core inflation at 2.7 per cent while employment data weakens, creating a perilous environment in which rate cuts may be necessary to support employment while exacerbating inflation pressures.

Immigration Policy Changes Constraining Labor Supply

Net immigration is running at an annualized 600,000, down one-third from late 2024. The deportation of approximately 1.2 million workers has created acute labor shortages in agriculture, construction, and services, sectors in which immigrants comprise 45 per cent, 30 per cent, and 24 per cent of the workforce, respectively. Economic modeling projects immigration restrictions could reduce GDP by six per cent and wages by five per cent over 10 years, with middle-income households facing a lifetime income loss of $22,000.

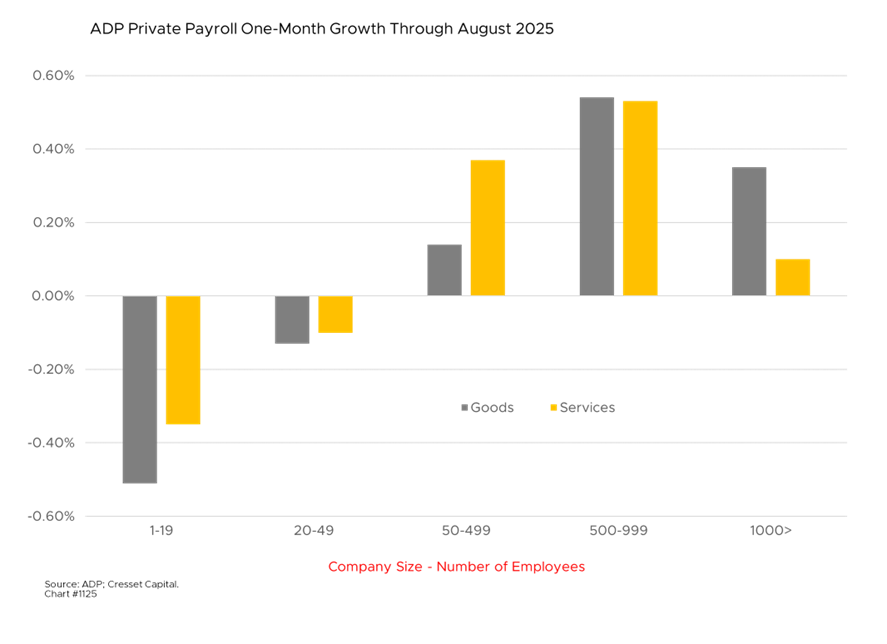

Comprehensive Tariff Implementation Adds Uncertainty, Especially for Small Firms

The 10 per cent baseline tariff on all countries and reciprocal tariffs of 11-50 per cent on 57 targeted countries are generating cost pressures that contributed to manufacturing job losses. Caterpillar estimates it faces $1.8 billion in additional costs, Deere projects $600 million in tariff expenses, and Ford is bracing for $2 billion in trade-related costs. Yale Budget Lab projects unemployment rate increases between 0.3-0.7 percentage points by 2026 because of tariff policy.

Small companies face disproportionate impact from the economic slowdown. Job openings at small firms fell to their lowest level since July 2020, with unfilled positions dropping to 32 per cent. Small businesses, which drive broad-based IT and general hiring, are pulling back due to tariff uncertainty and higher input costs, restricted access to immigrant labor that many depend on for operations, limited resources to navigate policy uncertainty, and difficulty accessing credit for expansion.

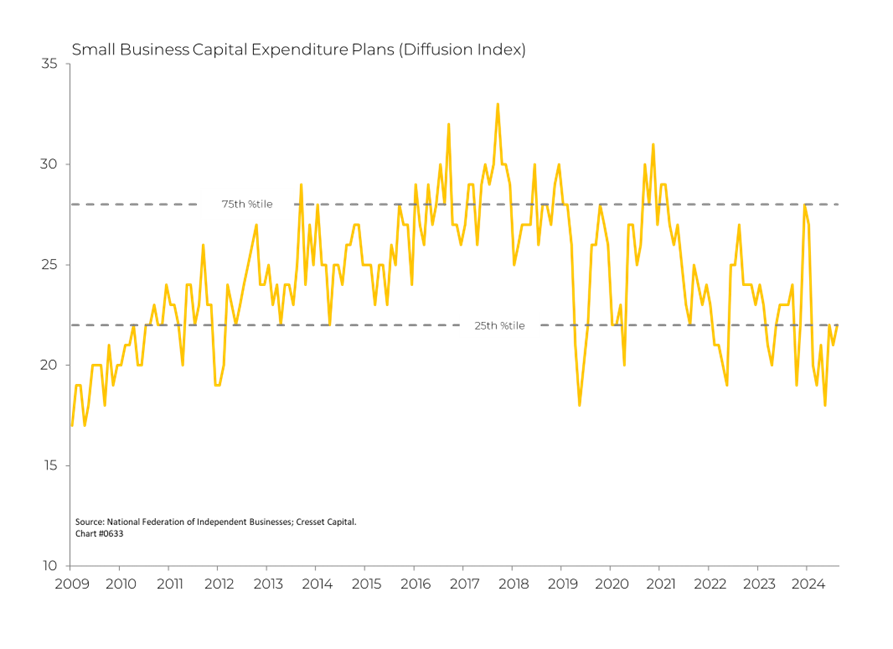

Trade Uncertainty Paralyzing Capital Investment Outside AI-Related Infrastructure

Companies delaying hiring and expansion plans while awaiting clarity on trade policy. This creates a negative feedback loop that could intensify economic weakness as small businesses, which traditionally drive job creation, retreat from growth initiatives. The Institute for Supply Management survey shows “all decision making is currently dominated by tariff considerations,” highlighting how policy uncertainty has become the primary constraint on business expansion.

Skills Gaps Wide and Growing; AI Will Disrupt Faster Than Other Automation Waves

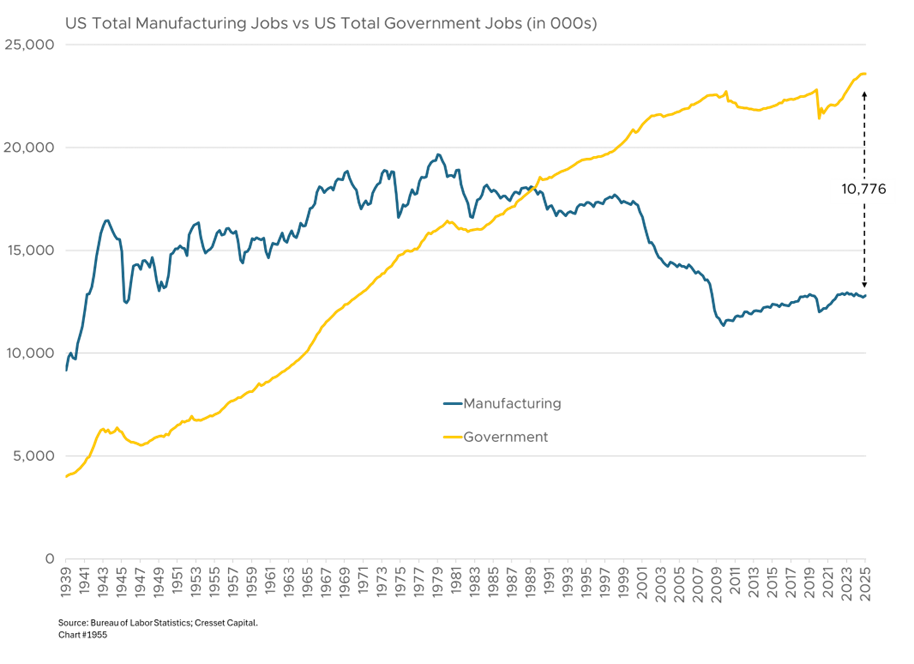

Eighty-seven per cent of companies report existing or imminent skills gaps, creating an $8.5 trillion annual drag on global productivity according to Korn Ferry analysis. The healthcare sector faces the most acute shortages, with projections of 15 million unfilled positions by 2030 driven by demographic aging. Technology companies report widespread shortages, with 76 per cent of IT companies experiencing gaps, particularly in cybersecurity where demand has increased 31per cent. Manufacturing faces a projected need for 3.8 million workers by 2033 with potential shortages of 1.9 million positions. Until 1989, Americans held more manufacturing jobs than government jobs. In 1940, more than twice as many Americans were employed in manufacturing companies than were employed in the government. Now, nearly 11 million more Americans are employed by federal, state and local governments than are employed in manufacturing. This is a huge challenge in an economy hoping to lean into manufacturing.

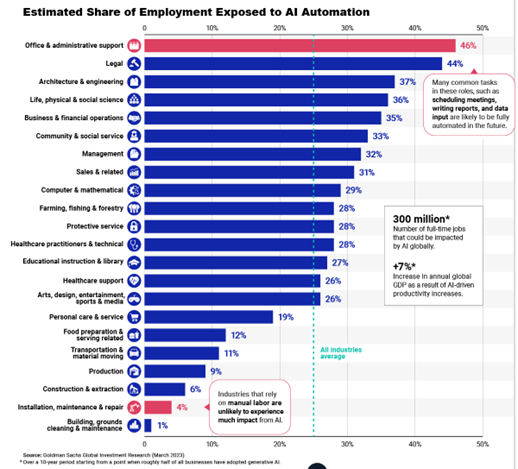

The impact of artificial intelligence on jobs is expected to materialize faster than previous automation waves, with up to 30 per cent of current work time potentially automated by 2030. Unlike previous technological disruptions that primarily affected routine manual tasks, generative AI targets cognitive and creative work concentrated in educated urban areas. This represents a geographic reversal from historical automation patterns, potentially affecting white-collar workers in major metropolitan areas rather than traditional manufacturing communities.

McKinsey analysis suggests 12 million workers may need occupational changes over the next five years, with 39 per cent of current skill sets becoming outdated. Job categories expected to grow include healthcare providers, STEM professionals, managers, educators, and creative roles, while office staff, production workers, and customer service representatives face displacement risks. The World Economic Forum projects 85 million job roles could be displaced with 97 million new roles being created, indicating net job creation with proper investment in transitions.

Remote Work Has Stabilized into Permanent Shift from Pre-Pandemic Patterns

Forty-four per cent of workers have hybrid arrangements, 20 per cent are fully remote, and 36 per cent are fully on site. This represents a permanent shift from pre-pandemic patterns, with geographic dispersion effects beginning to moderate regional labor market imbalances, though benefits remain concentrated among high-skill occupations. The persistence of remote work arrangements provides some offset to regional disparities but cannot fully account for the structural challenges facing rural and manufacturing-dependent communities.

Implications for Investors

In this environment, macro investors will find several key themes across asset classes. In fixed income markets, the labor market deterioration supports long-duration positioning, though tariff-driven inflation risks limit the scope for aggressive easing. We expect the yield curve to steepen, as short rates fall faster than long rates. Treasury yields tumbled following the August jobs report, with markets pricing in a more aggressive easing cycle, though the effectiveness of monetary policy remains a concern given the structural nature of current economic challenges.

Equity markets favor defensive positioning, with healthcare and government-dependent sectors offering relative stability. Industrial and trade-exposed companies face margin compression and earnings downgrades as tariff costs pressure profitability. Small-cap stocks are particularly vulnerable given their domestic exposure and financing constraints, while large multinational corporations may have better resources to navigate trade disruptions. We recommend high-quality companies with strong cash flow generation.

Currency markets suggest dollar weakness as growth concerns outweigh rate differential advantages, particularly as rate cut expectations increase. However, tariff policies could create periodic strength as trade partners retaliate with their own currency interventions, creating volatility in foreign exchange markets. Commodity markets will likely face headwinds, as agricultural and industrial metals confront both demand destruction and supply chain disruptions. Energy markets remain volatile given geopolitical tensions and domestic production constraints.

The Federal Reserve projects unemployment rising to 4.5 per cent by Q4 2025 before stabilizing around 4.4 per cent through 2027. GDP growth is expected to slow to 1.4 per cent in 2025, with monetary policy providing two-to-three quarter-point rate cuts in both 2025 and 2026. Leading indicators also suggest continued weakness, with Indeed’s Job Posting Index declining consistently since its March 2022 peak. The NFIB Small Business Index has declined since December 2024, and Regional Federal Reserve surveys are confirming pessimistic business condition outlooks.

The data suggests the US economy is entering a period of below-trend growth with elevated policy uncertainty. The combination of restrictive trade policies, immigration enforcement, and monetary tightening creates multiple headwinds that standard fiscal or monetary responses may struggle to address. Cheaper financing costs through lower rates create an offset. Downside risks include further deterioration in business confidence, tariff escalation, policy uncertainty paralyzing investment, and intensifying skills mismatches.

The U.S. labor market is cyclically slowing although the labor market’s structural transformation complicates traditional analysis and policy responses. While current unemployment remains relatively contained and real wages are growing, the dramatic slowdown in job creation and persistent skills mismatches signal deeper challenges ahead. The convergence of demographic aging, technological disruption, and policy-induced labor supply constraints creates a unique economic environment in which traditional relationships between growth, employment, and wages might not hold.

Success in navigating this transition will require policy responses scaled to match the transformation underway, comparable to post-WWII investments in human capital development. Critical priorities include modernizing workforce development systems for technological change, addressing geographic disparities in automation impacts, supporting worker transitions with enhanced job skills training support, and coordinating immigration, trade, and monetary policy responses.

Bottom Line:

Without coordinated responses, current labor market cooling threatens to become structural with lasting impacts on American competitiveness and prosperity. The next several months will be critical in determining whether current weakness represents a cyclical adjustment or the beginning of secular slowing. We are encouraged by the level of business spending and investment and its longer-term impact on productivity. Investment positioning should reflect a rebalancing environment, emphasizing defensive sectors, and quality companies, while remaining alert to policy pivots that could alter the trajectory. The stakes of getting these decisions right extend far beyond traditional employment metrics to the fundamental question of whether technological advancement becomes a broad prosperity driver or an inequality amplifier.