Key observations:

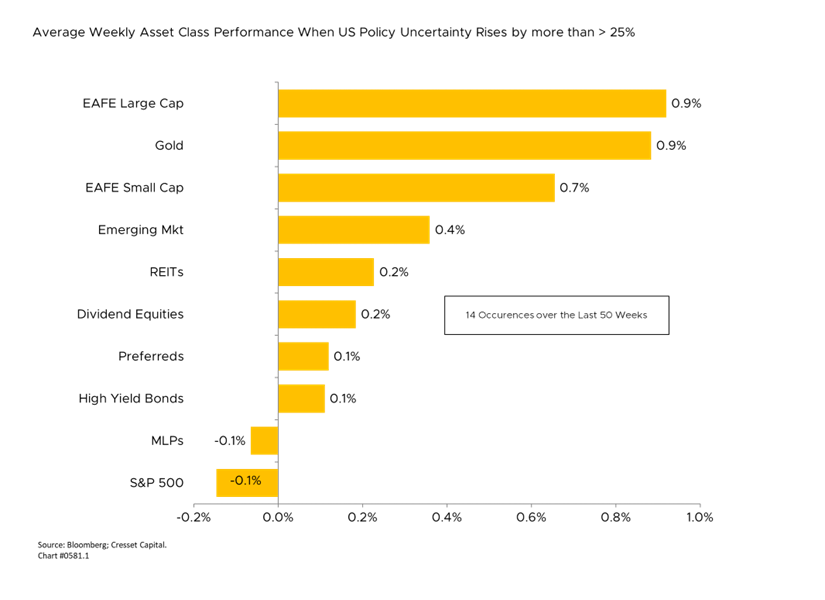

- Policy uncertainty remains a defining risk for U.S. markets as tensions between the White House and the Federal Reserve escalate.

- The “Sell America” narrative has reemerged, but recent activity reflects currency hedging, not broad liquidation of U.S. assets.

- The U.S. economy continues to show resilience, supported by strong consumer balance sheets and record AI-driven capital spending.

- Fed independence concerns pose a more serious long-term threat than tariff policy, particularly amid elevated inflation.

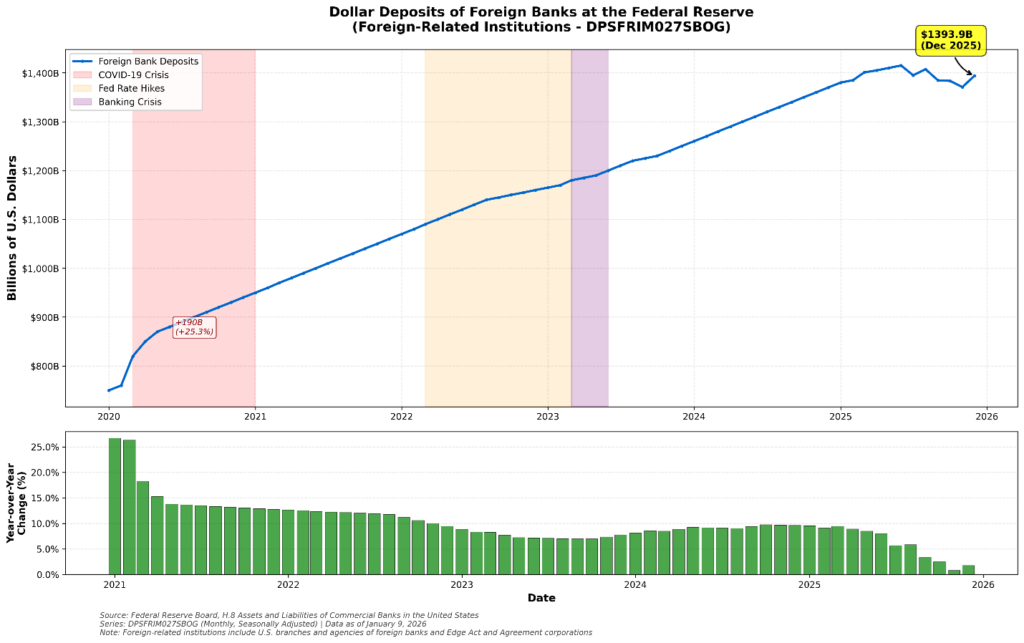

- Foreign banks have quietly withdrawn nearly $400 billion in dollar deposits, raising the risk of pressure on the U.S. currency.

- With both fiscal and monetary stimulus expected in the first half, inflation risks remain skewed to the upside in the second half of the year.

The “Sell America” narrative has resurfaced following the Trump administration’s escalation of tensions with the Federal Reserve. Chair Jerome Powell’s disclosure that the Fed received grand jury subpoenas from the Department of Justice, which he characterized as stemming from policy disagreements, has reignited concerns about central bank independence.

Capricious policies continually overhang the U.S. investment landscape, and Monday’s market reaction exemplifies the risk. The dollar spot index fell 0.3%, its largest decline since the Christmas break, while S&P 500 futures dropped 0.5–0.6% and ten-year Treasury yields rose three basis points to 4.20%, on track for the highest close since September. The 30-year yield meanwhile climbed to 4.85%, and gold surged to all-time highs as investors sought safe-haven assets.

Markets Defied the Noise in 2025

Despite recurring policy uncertainty spikes, U.S. equities defied skeptics last year. The S&P 500 gained 17%, ending near record highs despite the “Liberation Day” tariff shock in April that briefly triggered a sharp selloff. The index rebounded 38% from its April lows. The dollar fell over 8% for the year, representing its steepest annual decline since 2017.

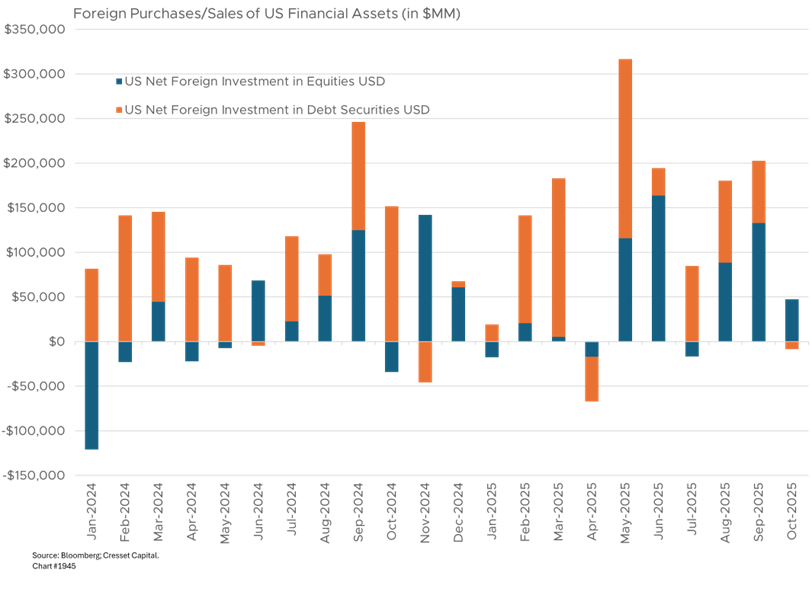

“Sell America” trade activity last year was focused on the dollar, not U.S. assets. Foreign investors, rather than blanket selling, were buying U.S. assets on a hedged basis, shifting currency exposure rather than abandoning Treasuries and equities entirely.

The U.S. Economy Still Shows Resilience

Several factors complicate the “Sell America” narrative. First, the U.S. economy continues to exhibit resilience, with consumer spending supported by wealth effects among higher-income households. Massive business spending, thanks to artificial intelligence (AI) investments, alongside softening job growth, could lead to substantially higher productivity.

Meanwhile, AI-related capital expenditures approaching $400 billion annually, has created powerful support for U.S. technology equities. The top 10 names in the S&P 500 represent 40% of its market capitalization, more than double the concentration a decade ago. This concentration represents both a source of strength and vulnerability.

Third, flow data suggests diversification away from U.S. assets has been modest. Citigroup noted that Europe recently experienced its first inflows since 2018, although it reversed less than 10% of prior outflows. The thesis that President Trump could reverse course suggests that policy disruptions have created noise without fundamentally upsetting economic activity.

Fed Independence: The Critical Risk

Nonetheless, Fed independence represents a uniquely different risk than tariff policy. Where tariff policy targets international relationships, Fed independence strikes at the foundation of domestic financial markets. Inflation pressure makes this a particularly inopportune time for markets to worry about Fed autonomy. Historical parallels to the Nixon-era Fed interference that contributed to 1970s inflation are not lost on investors.

Foreign banks have been shedding dollar deposits at the Fed and reducing overall U.S. exposure since July, with nearly $400 billion withdrawn. This has gone largely unnoticed because it coincided with broader reserve shrinkage, but the concentrated nature of foreign bank withdrawals warrants attention. If these flows continue, they could pressure the dollar without offsetting portfolio or direct investment inflows.

Policy Risks Tilt Toward Inflation

U.S. policy uncertainty is a new environmental risk investors continually face. While uncertainty surrounding trade policy appears to be primarily impacting currencies like the dollar and gold, policies that undermine the Federal Reserve’s independence have broader implications, particularly in an elevated inflationary environment. Given our outlook for double-barreled stimulus, a fiscal boost in Q1 from the One Big Beautiful Bill Act, combined with monetary stimulus from the new Fed chairman in Q2, inflation is a heightened risk in the second half.

Bottom Line

The “Sell America” trade has repeatedly proven premature, yet the underlying concerns are not unfounded. U.S. policy unpredictability, elevated valuations, and nascent foreign capital rotation warrant measured portfolio diversification. However, the structural advantages of U.S. markets, dollar reserve status, Treasury liquidity, and AI-driven growth, suggest any pullback could present buying opportunities rather than the beginning of sustained capital flight. The prudent approach is gradual geographic diversification while maintaining core U.S. exposure, with heightened attention to Fed leadership developments and foreign bank flow data as leading indicators of sentiment shifts.