Key Observations

- Trade and tariff rhetoric is resurfacing as a meaningful source of market volatility and policy uncertainty.

- This week’s inflation and GDP data will help clarify the timing of the Fed’s next rate move.

- A Supreme Court case could have long-term implications for Federal Reserve independence and monetary policy.

- Global attention turns to Davos, where U.S. policy priorities and trade relationships are in focus.

- Despite near-term noise, economic growth and inflation appear to be normalizing.

Several issues overhang the market this holiday-shortened week. Here are the four most salient items on U.S. investors’ calendars.

Tariffs, Trade Tensions, and Rising Policy Uncertainty

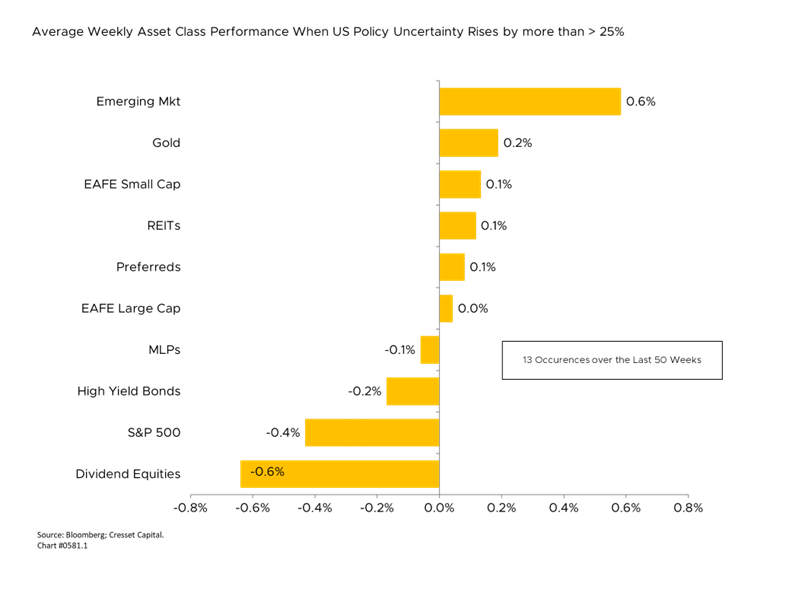

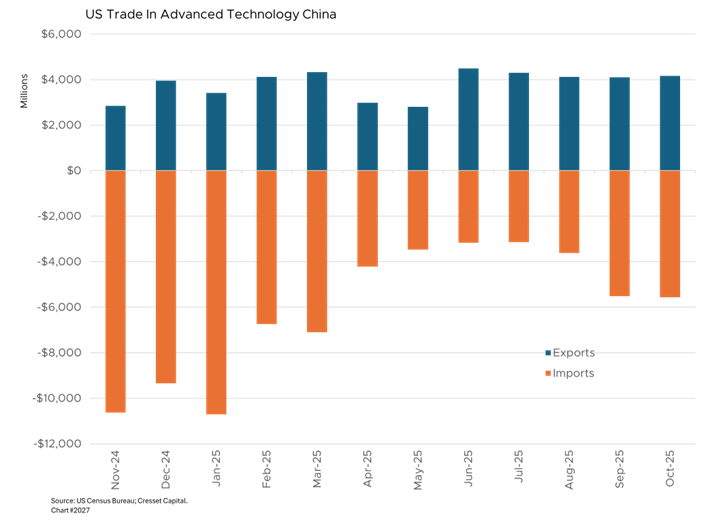

President Donald Trump threatened fresh tariffs on eight European countries if they oppose his plan to acquire Greenland, with escalating tariffs of up to 25 percent beginning in February. Trump’s tariff threats are “disruptive” and will put the dollar under pressure, raising the demand for gold. The uncertainty is already impacting markets, with gold and silver hitting record highs as investors seek safer assets. Adding to the mix, U.S. Commerce Secretary Howard Lutnick threatened major memory chipmakers with either a 100 percent tariff or requiring them to build products in America. Spikes in U.S. policy uncertainty tend to be coupled with gains in gold and emerging market equities.

Inflation and Growth Check: Key Signals for the Fed

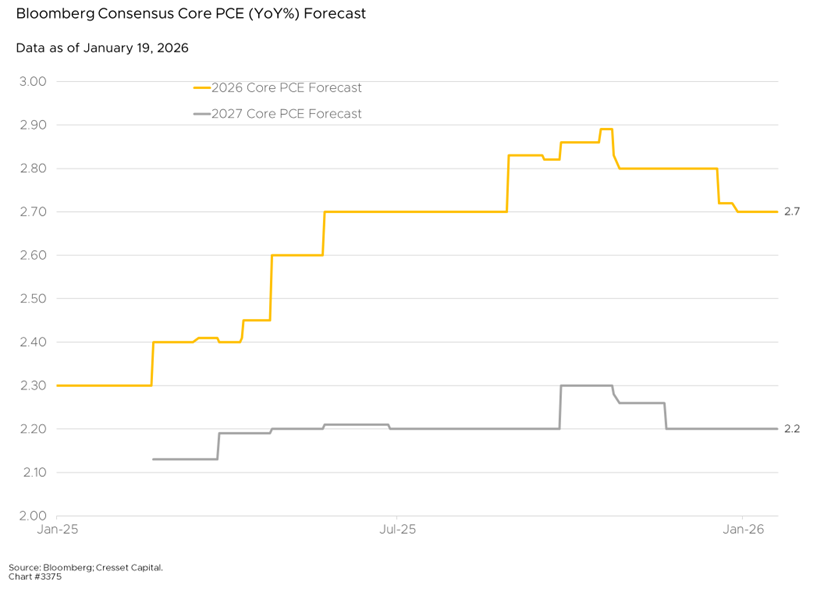

U.S. Personal Consumption Expenditures (PCE) inflation data will be watched this week, alongside U.S. gross domestic product numbers, as investors continue to gauge the likely timing of the next Federal Reserve interest-rate cut following recent signs of improvement in U.S. jobs data. These releases will be critical for assessing the Fed’s policy trajectory and economic strength. Analysts are anticipating 2.7% year-over-year PCE Core inflation and expect the U.S. economy to have grown at a 2.7% annualized rate in Q4 2025. Inflation is expected to trend toward 2.2% in 2027.

The Supreme Court Takes Up the Question of Fed Independence

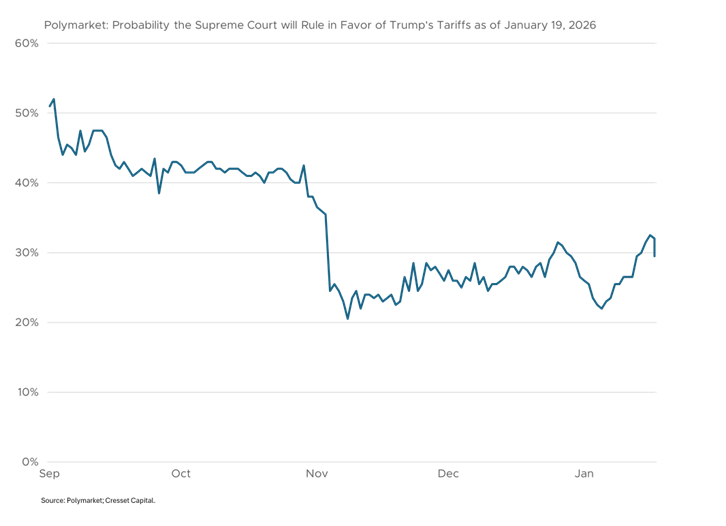

The Supreme Court will hear arguments on Wednesday in a case that could reshape how much control a president has over the Federal Reserve. The dispute, Trump v. Cook, stems from President Donald Trump’s attempt to remove Federal Reserve Governor Lisa Cook for alleged mortgage fraud. This case has significant implications for Fed independence and monetary policy autonomy. Also on the docket, although we most likely will not receive a ruling this week, is the decision surrounding the legality of Trump’s tariffs. Consensus expects they will be overturned by the court.

Davos Spotlight: The Trump Administration Signals Its Policy Priorities

President Trump delivered remarks at the World Economic Forum in Davos this week, and Treasury Secretary Scott Bessent met with Chinese Vice Premier He Lifeng. Trump administration officials plan to focus on economic growth, home ownership, and peace through strength. Trump is also set to meet with global CEOs, with U.S. policy in focus.

Bottom Line

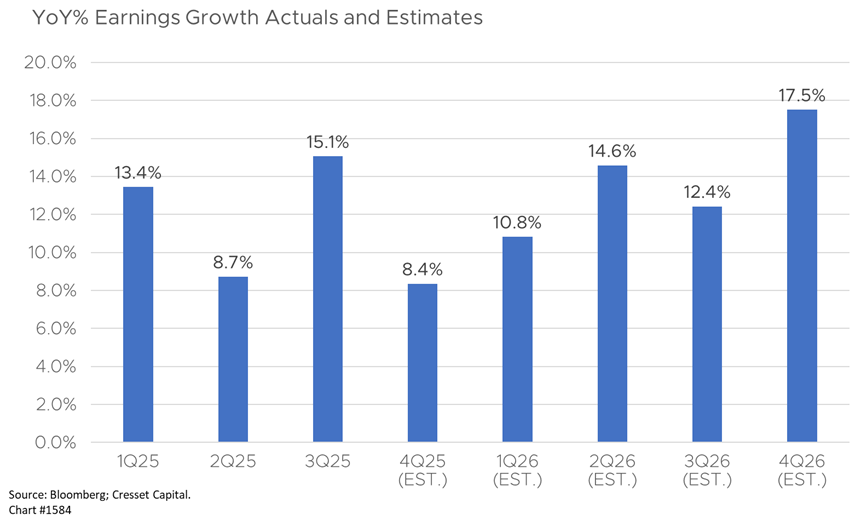

Behind the bluster, the U.S. economy and inflation are settling back toward their longer-term trends, Cresset’s “most likely” scenario for 2026. That’s good news for investors. Interest rates should drift lower, making current equity market valuations more reasonable. Meanwhile, we will be on the lookout for management outlooks as Q4 earnings season intensifies.