Key Observations:

- Rate cut debate amid shifting economic sands

- Broader policy uncertainty looms over Fed’s decision matrix

- Lack of official data could become a reason not to cut in December

- Insights into Fed strategy due this week when its October minutes are released

Fed policymakers are data dependent, but thanks to the government shutdown, there’s little data guiding policy. The Federal Open Market Committee (FOMC) is split over whether to cut interest rates at its December 2025 meeting or to hold firm amid persistent inflation and shaky economic signals. The outcome is seen as a toss-up as officials balance competing concerns around inflation, labor market health, and market stability.

Rate Cut Debate Amid Shifting Economic Sands

While the Fed has debated further rate cuts, the underlying economic landscape is far from crystal clear and officials have moved with caution. The central bank is navigating a delicate balancing act between its dual mandates – achieving price stability and maximum sustainable employment – amid shifting data, divergent views among policymakers, and external risks that complicate the outlook.

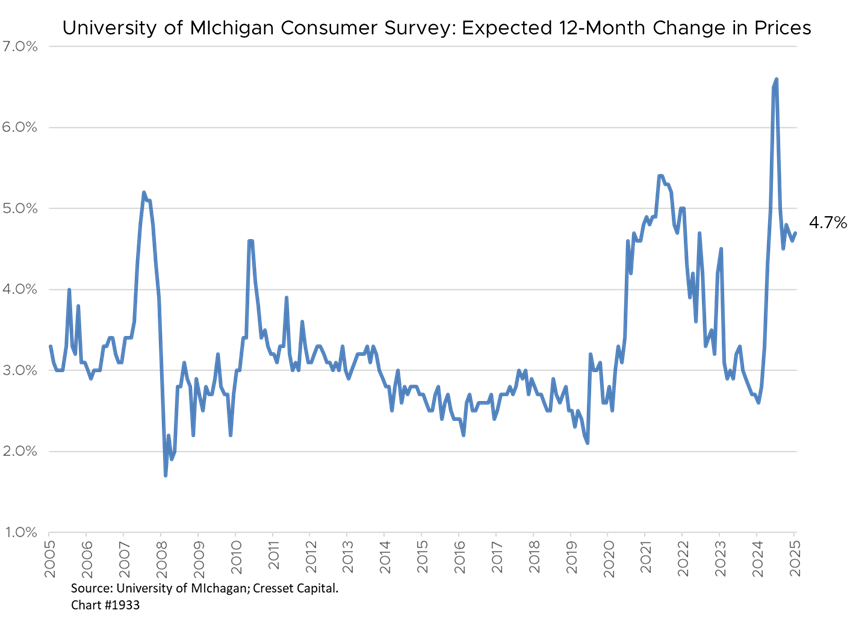

Some Fed officials, like Boston Fed President Susan Collins and Atlanta Fed President Raphael Bostic, are inclined to stand pat on rates due to inflation pressure and economic resilience. These officials point to steady consumer prices and limited recent jobs growth but see no immediate need to stimulate more, warning that easing too soon could reignite inflation. Their view has gained traction given the lack of fresh data during the recent government shutdown and the still-recent inflationary surges.

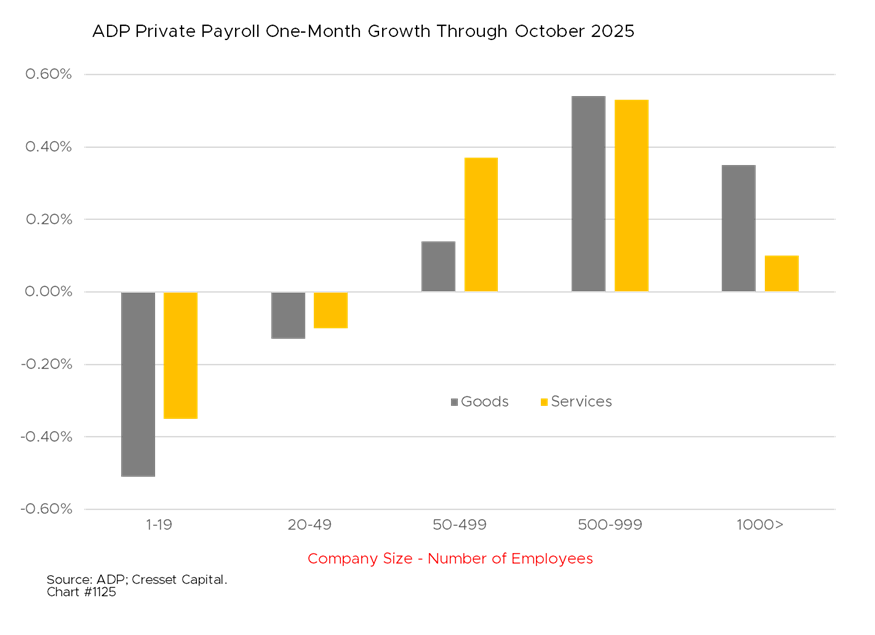

Others, however, argue for a rate cut to counter signs of labor market cooling and sluggish growth. Some view a small cut as necessary to support employment and prevent a sharper slowdown, especially with private sector hiring nearly stalling and some economic sectors already under strain.

Broader Policy Uncertainty Looms Over Fed’s Decision Matrix

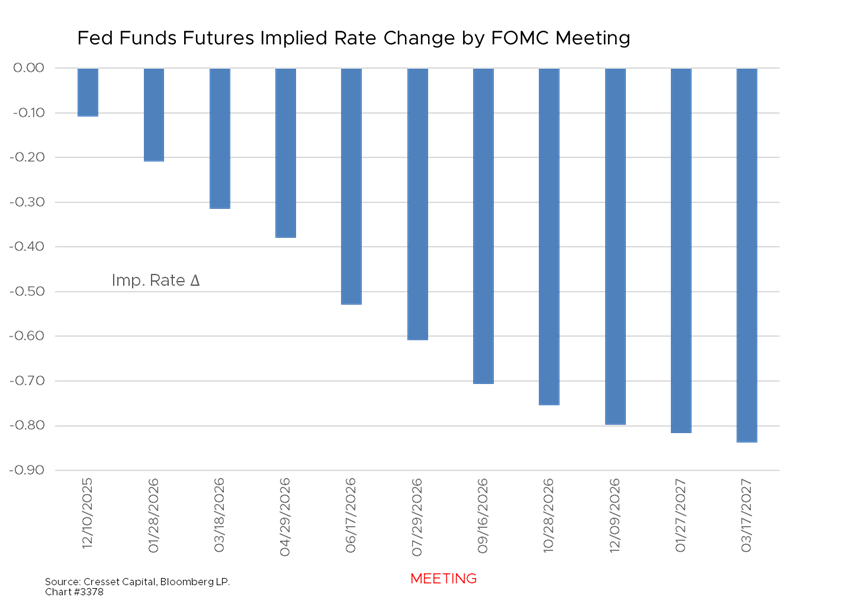

Risks around fiscal policy, trade/tariff shifts, regulatory changes and global spillovers also feed into the Fed’s process. Earlier minutes observed that policy uncertainty was one of the reasons officials raised their estimate of inflation risk and extended the neutral rate path. We will learn more about Fed strategy this week when they release their October minutes.

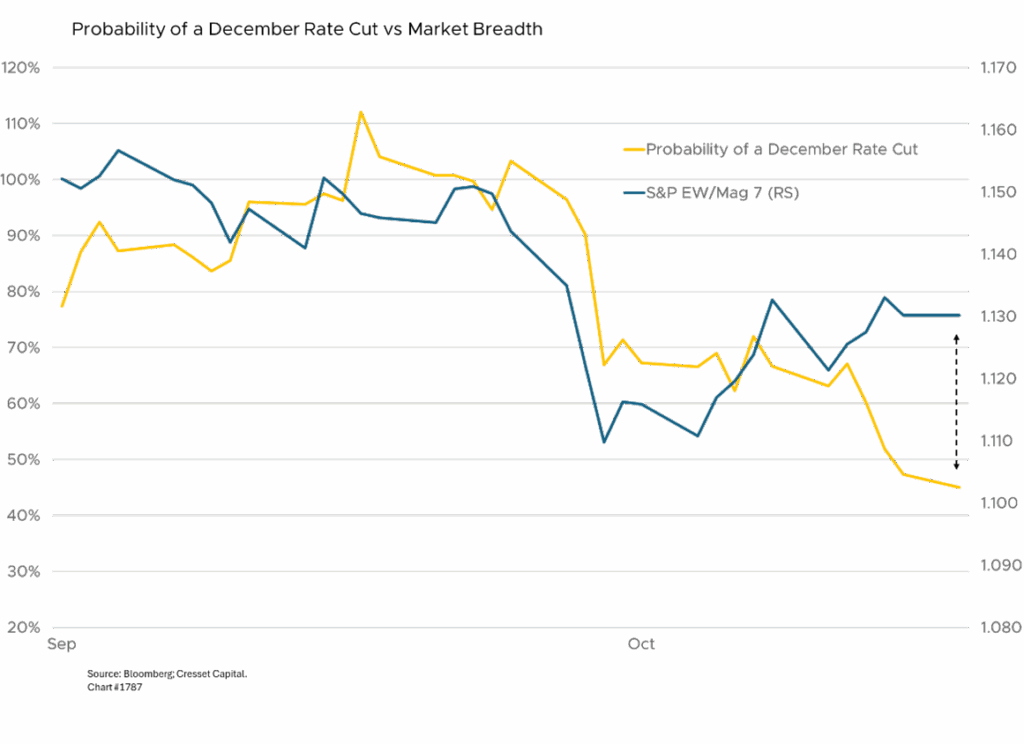

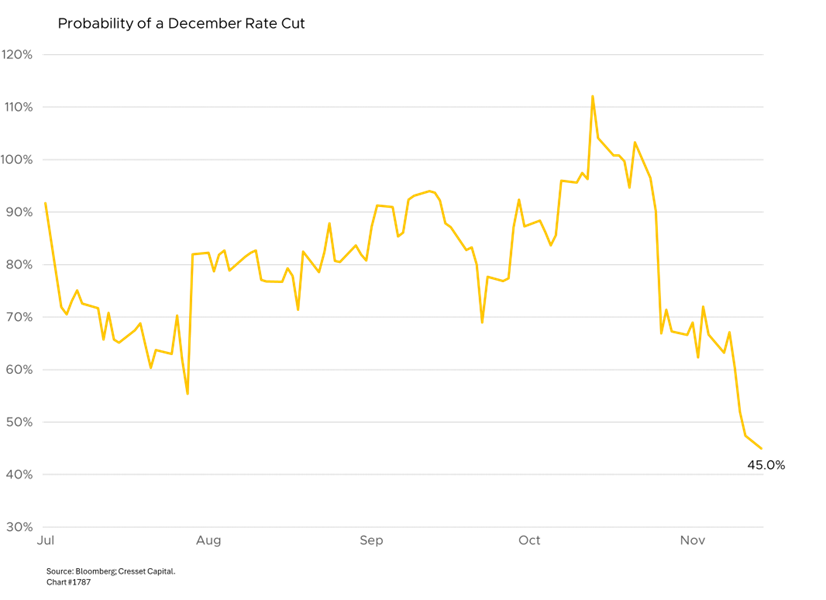

As of mid-November, market expectations for a December cut have dropped substantially, with probabilities retreating from a near certainty a month ago to about 45 per cent today. This reflects the uncertainty and highly data-dependent stance of the Fed, compounded by delayed economic reports and mixed messages from policymakers.

The FOMC’s policy tug-of-war has led to significant volatility in equity and bond markets, especially in rate-sensitive and growth sectors. The Fed’s “higher for longer” messaging has rattled markets, signaled elevated borrowing costs ahead, and increased caution among investors.

What Fed Policymakers Will Be Watching Before the December Meeting

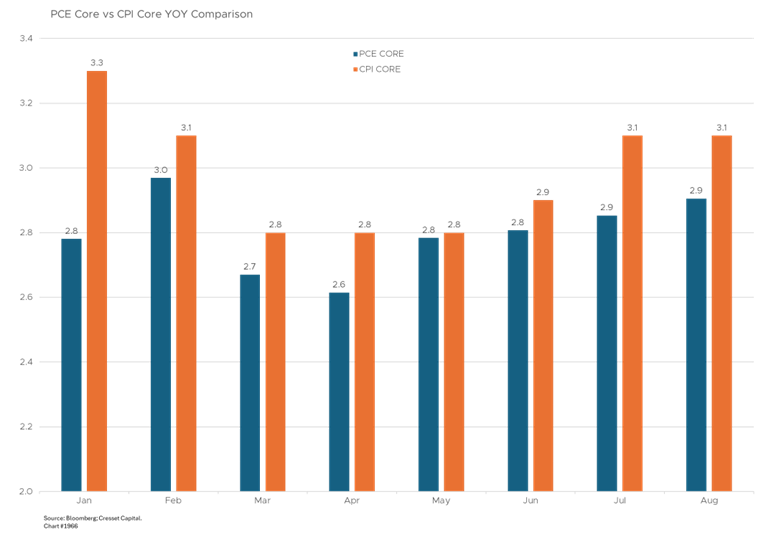

- Inflation trajectory: The Fed remains focused on its preferred gauge, the core personal consumption expenditures (PCE) price index, as well as services inflation. Some progress has been made, and inflation (net of tariff effects) is now close to the two per cent target. However, policymakers caution that it remains too early to conclude victory, as they scrutinize whether inflation, particularly services, is accelerating again, or continuing its downtrend.

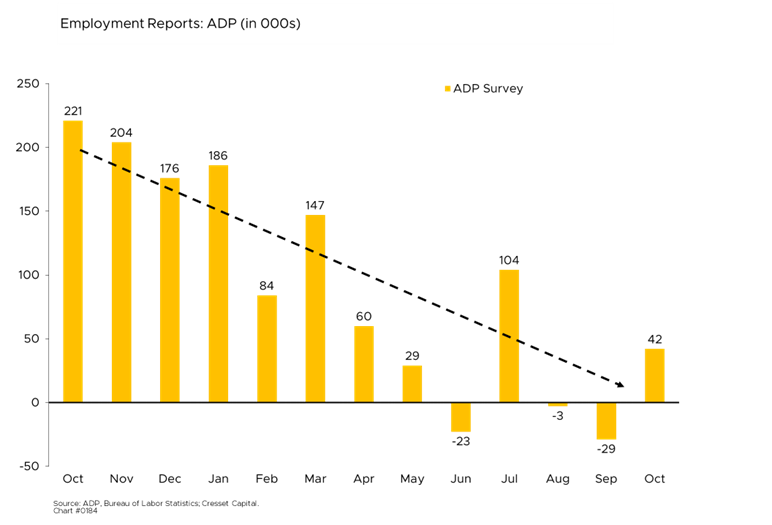

- Labor market weakness: Employment and labor-market tightness remain central. Metrics such as job openings, unemployment, wage growth and labor force participation matter for gauging whether the labor side of the mandate is overheating or losing steam. Labor markets, viewed through private payroll data processor ADP, have weakened more than anticipated. If labor conditions deteriorate materially, the Fed would lean toward easing; if instead conditions remain tight, the case for cutting wanes.

- Growth and financial conditions: Policymakers will assess how economic growth is evolving, whether there are signs of a slowdown or risk of recession, and whether financial conditions, credit spreads, housing, consumer borrowing, are tightening. A healthy economy might prompt patience; a marked slowdown could increase urgency.

- Data quality and timing: Given prior delays and missing data points, the Fed will examine the breadth and timeliness of incoming data. The lack of official data could be a reason not to cut in December since the Fed prefers to see consistent, reliable signals rather than making a move on a hunch.

- Risk balance and external shocks: The Fed will also consider upside risks to inflation, like trade/tariff shocks, supply chain disruptions, and downside risks to labor and growth. The balance of risks is fluid and influences whether it’s prudent to ease now or to wait. Chairman Powell has continually emphasized that the policy rate is “not on a preset course.”

Bottom Line:

Fed Chairman Jerome Powell is working to forge a policy consensus, but the split within the FOMC underscores the delicate balancing act between restraining inflation and supporting continued economic growth. This division is likely to persist until clear, updated economic signals emerge. Expanding market breadth – a wider range of stocks advancing versus a rally concentrated among a handful of mega caps – hinges on rate cuts. We believe the Powell Fed will be in no hurry to lower rates, recognizing Powell will be replaced by a policy dove in May when his term is up.