Key Observations

- Government shutdown delays have created a historic backlog of data, heightening volatility as releases cluster together.

- Labor data disruptions and falling consumer confidence point to uneven economic momentum.

- Fed policy expectations remain fluid, with markets toggling between a pause and a December cut.

- Investors should focus on balance sheet strength, dividend resilience, and disciplined risk management amid uncertainty.

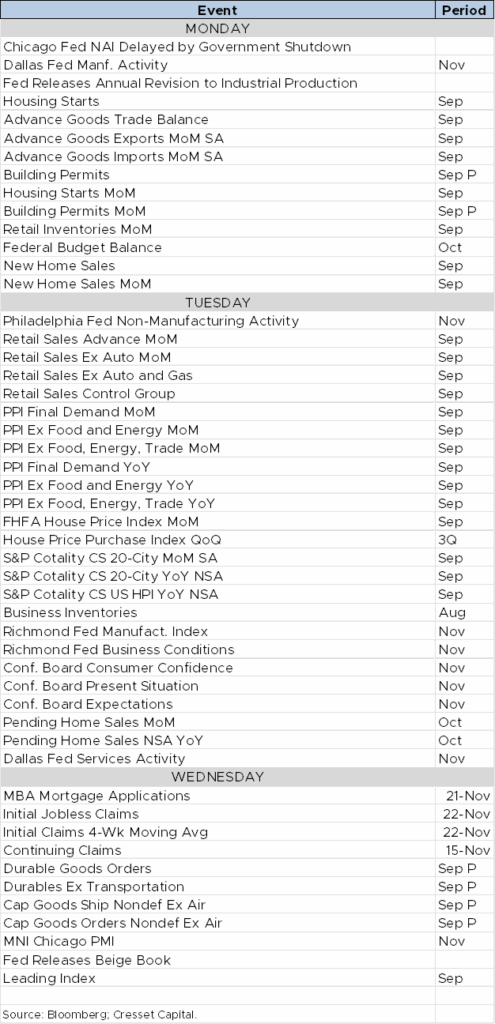

The Week’s Data Deluge: Navigating Critical Crosscurrents for Fed Policy and Markets

As we enter a holiday-shortened Thanksgiving week, not only will investors feast on turkey, stuffing and the trimmings, they will also gorge by a deluge of data, most of which was delayed by the recent government shutdown. All this is among mounting uncertainty about Federal Reserve policy direction. This convergence of factors creates a unique environment where data interpretation becomes both more critical and more complex than usual.

The prolonged government shutdown has created an unprecedented backlog of economic releases, leaving investors and monetary policymakers flying blind during a crucial period. Key reports that would normally inform Fed decision-making, including third-quarter GDP revisions, October retail sales, and the Producer Price Index, are arriving within a 36-hour period. This compressed timeline means markets must digest what would typically be weeks of data in a matter of days, potentially amplifying volatility as investors recalibrate their views rapidly.

The delay has particular significance for Federal Reserve officials preparing for their December 9-10 meeting. Without the usual cadence of data releases, the Fed has been forced to rely more heavily on alternative indicators and anecdotal evidence. This shift toward “softer” data sources, including regional Fed surveys and business contacts, may provide a more nuanced picture of economic conditions during the shutdown period.

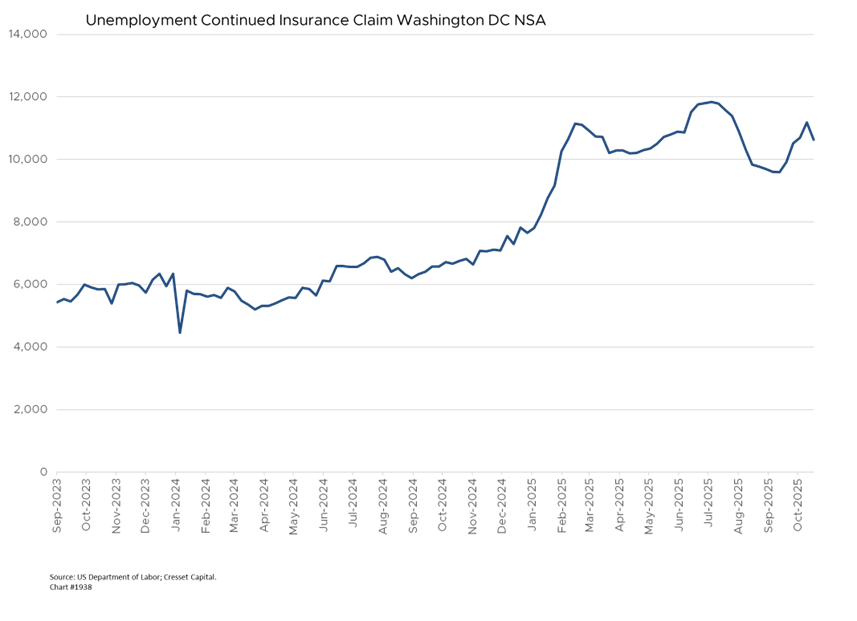

Perhaps nowhere is the data disruption more consequential than in the labor market. With October and November employment reports delayed until after the Fed meeting, officials must piece together labor market conditions from fragmented sources. Initial jobless claims data suggest a weakening job market, particularly around Washington D.C. where claims spiked reflecting federal workers who took early retirement packages.

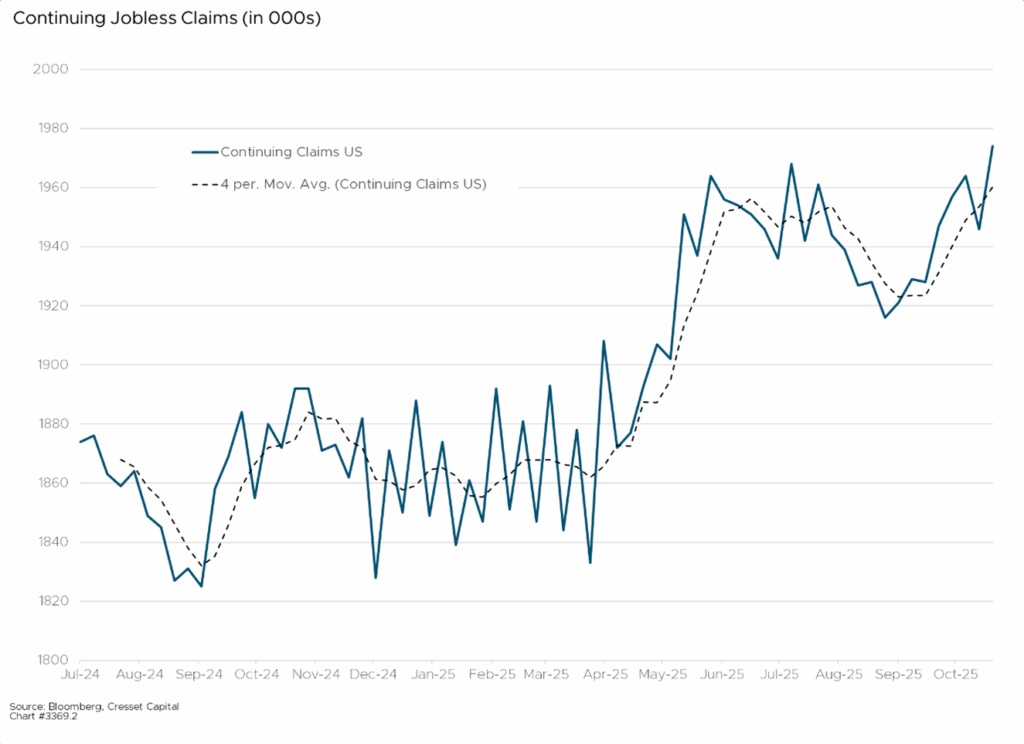

The broader labor market narrative appears increasingly complex. While headline unemployment jumped to 4.4% in September, this move was largely driven by increased labor force participation, typically a positive sign. However, continued claims have remained elevated, suggesting that while people are entering the workforce, those who lose jobs are having difficulty finding new employment. This dynamic points to a labor market that’s cooling but not necessarily weakening dramatically.

The labor market evolution has important implications. A gradual cooling that avoids sharp deterioration supports the “soft landing” narrative that has underpinned much of this year’s market performance. However, any significant downturn could quickly shift Fed policy expectations and undermine investor expectations.

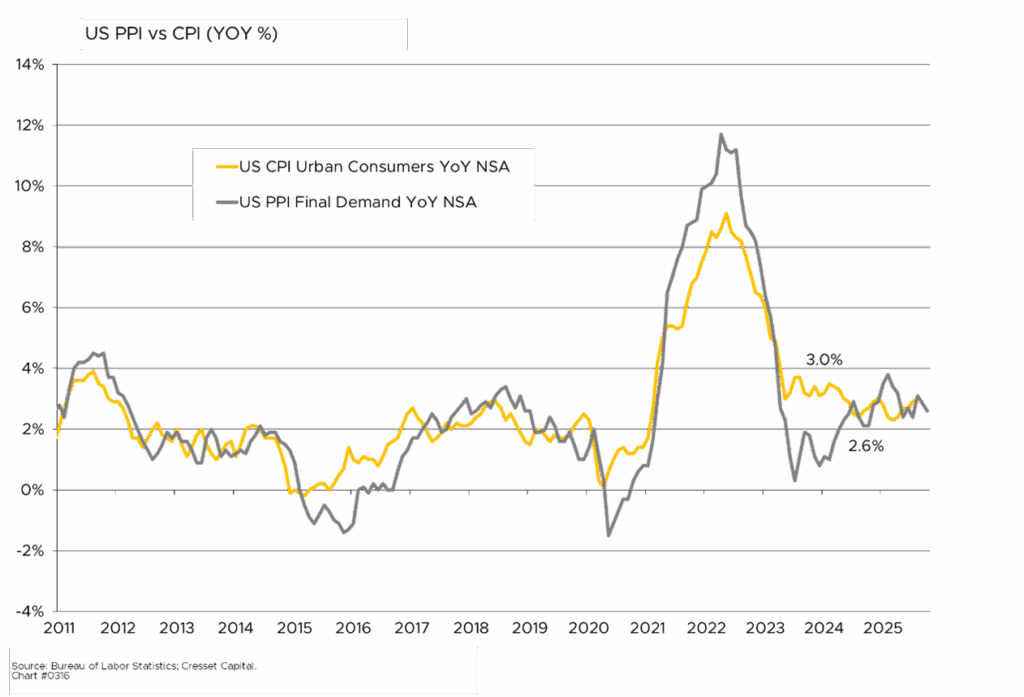

September PPI rose 0.3% as expected, driven by an 11.8% surge in gasoline prices, pushing the annual rate to 2.7%. While core PPI disappointed at 0.1% monthly, the annual rate remained elevated at 2.9%. This maintains pressure on the Fed’s inflation mandate even as growth concerns mount. The PPI tends to lead CPI, the consumer price index.

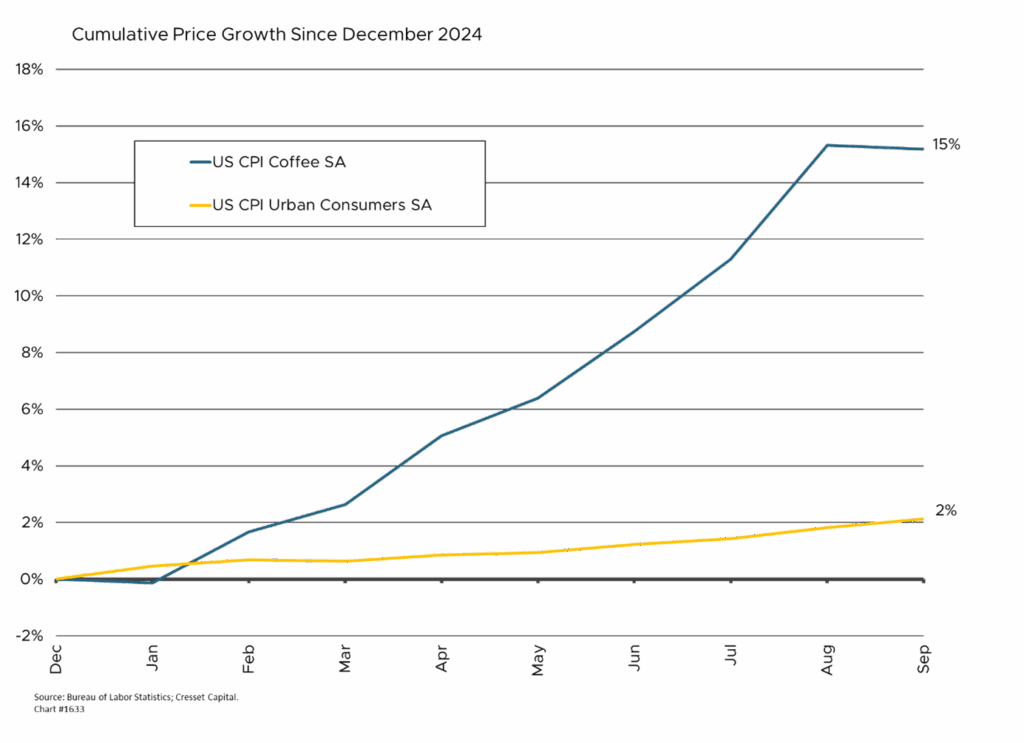

The inflation picture is further complicated by recent tariffs, which are beginning to show up in price data. While the direct impact appears modest so far, the cumulative effect of trade policy changes may be building underlying price pressures that could persist into 2026. This dynamic creates a challenging backdrop for Fed policy, as officials must distinguish between temporary trade-related price increases and broader inflationary momentum. The price of coffee, a ubiquitous morning staple that is not grown in the U.S., is 15% higher this year due largely to tariffs.

September retail sales rose just 0.2% versus expectations of 0.4%, marking a clear deceleration from August’s 0.6% pace. More concerning, the control group that feeds into GDP calculations declined 0.1%—the first contraction in five months. This weakness was broad-based, with five of thirteen categories posting declines, particularly in discretionary spending areas like electronics, sporting goods, and clothing. The bifurcated consumer dynamic you’ve been tracking is clearly visible: while restaurants maintained momentum (+0.7%), goods spending faltered as lower-income consumers pulled back.

Meanwhile, consumer confidence plummeted 6.8 points to 88.7 in November, the largest drop since April and well below all economist estimates. The expectations component hit its lowest level since April, while present conditions fell to a one-year low. Critically, the employment differential (jobs plentiful minus hard to get) dropped to one of the lowest levels since the pandemic, suggesting labor market deterioration is beginning to bite consumer psychology.

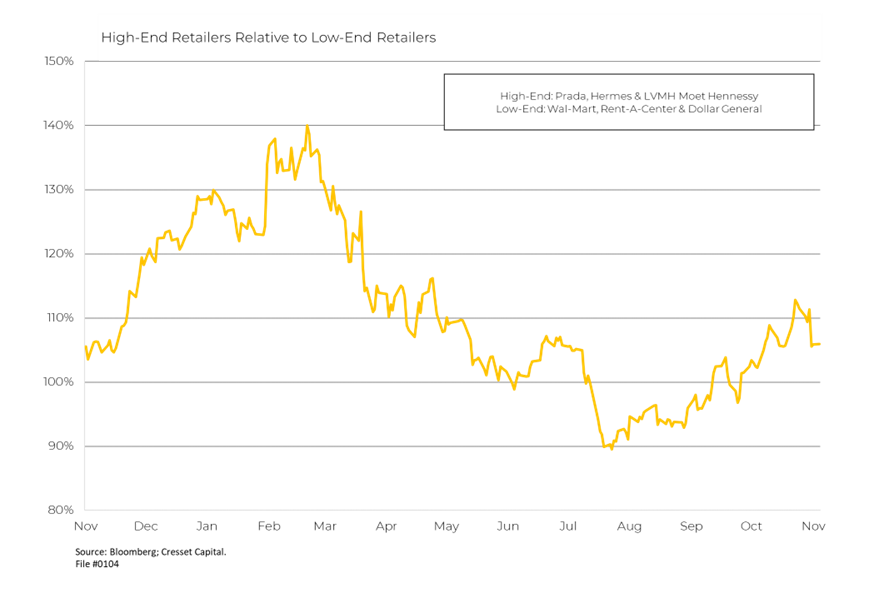

This bifurcated consumer dynamic has important investment implications. Companies with exposure to higher-income demographics may continue to outperform, while those dependent on mass-market consumers could face ongoing pressure. After underperforming for most of the year, high-end retailers bottomed in July and are now outperforming low-end retailers. The holiday shopping season will be particularly telling, with early retail earnings suggesting cautious optimism but also heightened focus on value and discounting. Our first indication will arrive on Black Friday later this week.

Fed Policy Recalibration

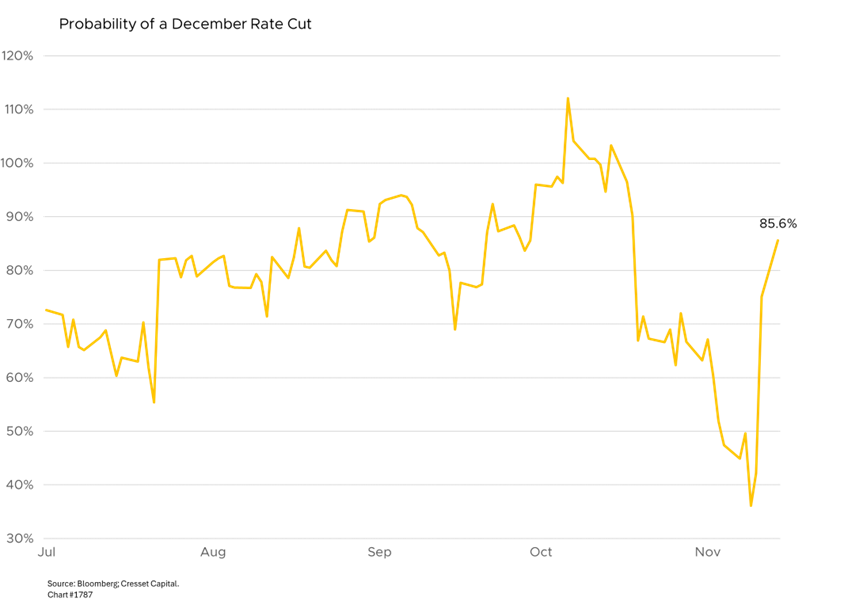

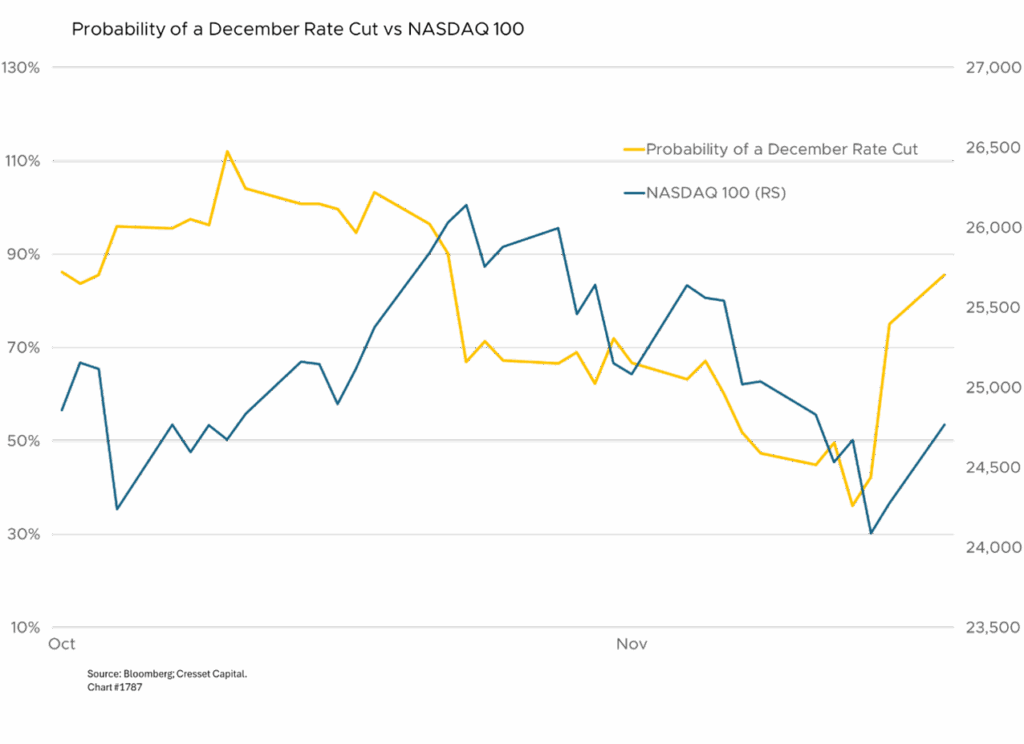

The confluence of delayed data and evolving economic conditions has created unusual uncertainty around Fed policy direction. Markets have oscillated between expecting a December rate cut and pricing a pause, with odds shifting dramatically based on sparse data points and Fed official commentary.

New York Fed President John Williams’ recent comments suggesting room for “near-term” rate cuts provided some clarity, pushing December cut probabilities above 80%. However, this shift may prove temporary if incoming data suggests economic resilience that reduces the urgency for accommodation.

The Fed’s challenge is compounded by the need to balance multiple objectives in an election aftermath environment. While traditional economic indicators remain the primary focus, officials must also consider financial stability implications of prolonged uncertainty and the potential economic effects of changing policy directions under new leadership.

The current environment presents both opportunities and risks for investors. The November market pullback, with the S&P 500 down 3.5% and the Nasdaq falling over 6%, has created more attractive entry points for quality growth names, particularly in technology. However, elevated volatility suggests maintaining disciplined position sizing and risk management.

The AI theme will be tested during this data-heavy period. While valuations have moderated from earlier peaks, the sustainability of AI-driven capex spending depends partly on broader economic momentum. Companies reporting strong AI-related investments may find support, while those showing signs of pulling back could face pressure.

Fixed income markets offer relative stability during this uncertain period. The potential for Fed accommodation, combined with flight-to-quality dynamics during volatile periods, supports maintaining duration exposure. However, the persistence of inflation risks argues against aggressive duration extension.

Looking ahead, investors should prepare for continued volatility as markets digest the data backlog and refine Fed expectations. The key will be distinguishing between temporary disruptions from the shutdown and underlying economic trends that will persist into 2026.

The week’s data deluge will likely provide more clarity on whether the economy is achieving the elusive soft landing or facing more significant challenges. Either outcome has distinct investment implications, from sector rotation opportunities to broader asset allocation adjustments.

Bottom Line:

Maintain flexibility and focus on high-quality companies with strong balance sheets. Dividend-oriented stocks are not as overvalued as mega cap tech and would enjoy an outsized benefit of lower rates while maintaining a lower volatility. The data deluge ahead will test market resilience and provide crucial insights into the economic trajectory that will shape investment returns in the months ahead.