Key Takeaways

- AI valuations are elevated, but grounded in real profits, unlike the dot-com era.

- Over $400B in annual infrastructure spending contrasts with limited enterprise ROI.

- Big Tech’s cash-funded capex gives the cycle resilience, but concentration risk looms.

- Margin pressure from competition and custom chips signals the peak of profit expansion.

- Investor sentiment has turned cautious; sector rotation toward cyclicals may persist.

- The next 12–18 months will test whether AI investment is foundational or excessive.

The artificial intelligence (AI) investment landscape presents a nuanced picture that defies simple bubble characterization. While valuations appear frothy and speculation is widespread, today’s AI cycle differs meaningfully from the dot-com era. Profitable operations, robust cash generation, and measurable revenue growth underpin the sector’s strength. However, a critical divergence has emerged between massive infrastructure spending, $400+ billion annually, and limited enterprise monetization success, creating significant risks for 2026 equity markets.

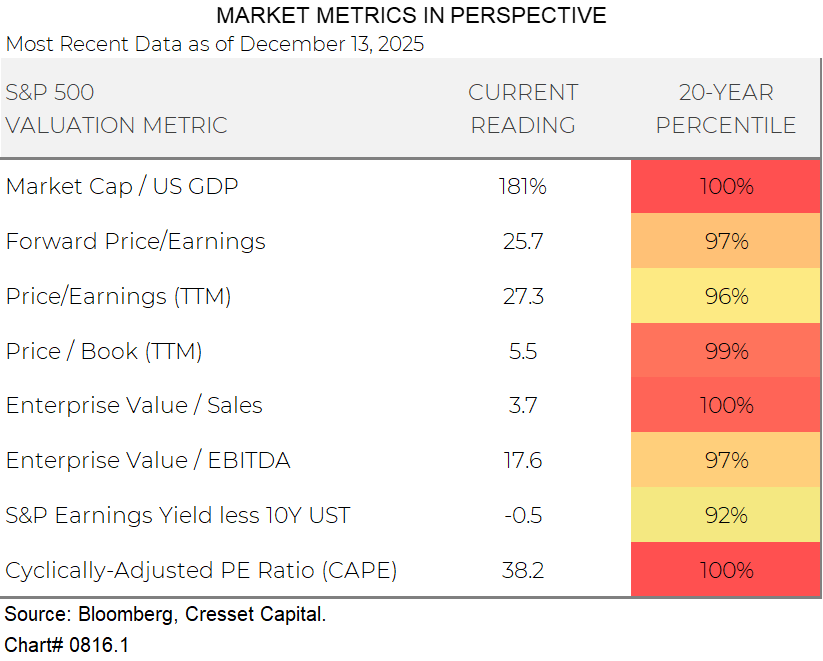

Valuations: High, But Not 2000 All Over Again

AI sector valuations are elevated, but remain structurally different from dot-com peak levels. NVIDIA trades at about 44–47 times past earnings and 24–26 times expected earnings, well below Cisco’s 472 times earnings at the market peak in March 2000. The “Magnificent Seven” trade at roughly 28 times expected earnings, about half the tech sector’s valuation during the dot-com era. Meanwhile, the S&P 500 trades at around 26 times expected earnings, near a 20-year high.

Crucially, today’s AI leaders generate substantial profits. NVIDIA delivered $99 billion in trailing twelve-month profit with 53% net margins, while the Mag 7 collectively enjoy 25%+ net margins versus the S&P 500’s 13%. This profitability foundation distinguishes the current cycle from late-1990s speculation which was based on PE-to-Growth Rates (PEG Ratio).

The $400B Question: Can AI Spending Pay Off?

The most concerning dynamic, however, centers on the infrastructure-to-revenue disconnect. Hyperscalers committed nearly $400 billion in 2025 capital expenditure, while enterprise AI generates approximately $100 billion in actual revenue. An MIT study found that 95% of Generative AI pilot programs fail to achieve business value, and only 5% of enterprises report significant EBIT impact from AI investments, despite widespread adoption. 78% of organizations surveyed now use AI in some capacity.

This pattern echoes historical infrastructure over-investment cycles. During the dot-com era, $500 billion in fiber optic investment created physical foundations for Web 2.0’s eventual dominance, although most capacity remained “dark” for years. The key differentiator today is the sources of funding. AI infrastructure is funded by more than $200 billion in annual mega cap tech free cash flow rather than an over reliance on debt, providing greater staying power through disappointment cycles.

Too Few Buyers: The Hidden Concentration Risk

Concentration in the AI ecosystem is a concern. NVIDIA derives 85% of revenue from six customers, with the top four accounting for nearly 60% of sales. This hyperscaler dependency creates binary risk, where any capital expenditure pullback from Microsoft, Amazon, Google, or Meta would cascade through NVIDIA’s results and broader AI supply chains.

Moreover, big tech’s combined free cash flow is shrinking as increased capex consumes operating cash. While hyperscaler management teams maintain aggressive spending guidance, investor patience may wane if monetization metrics fail to improve materially.

Peak Margins, Rising Competition

NVIDIA’s gross margins peaked at 78.4% and are declining toward management’s “mid-70s through FY2027” guidance, suggesting the extraordinary profit expansion phase has peaked. Competition from AMD’s MI300X series, custom hyperscaler chips from Google’s TPU, Amazon’s Trainium, and Microsoft’s Maia, along with efficiency gains in AI architectures, will pressure margins over time.

Investor Sentiment Turns Cautious

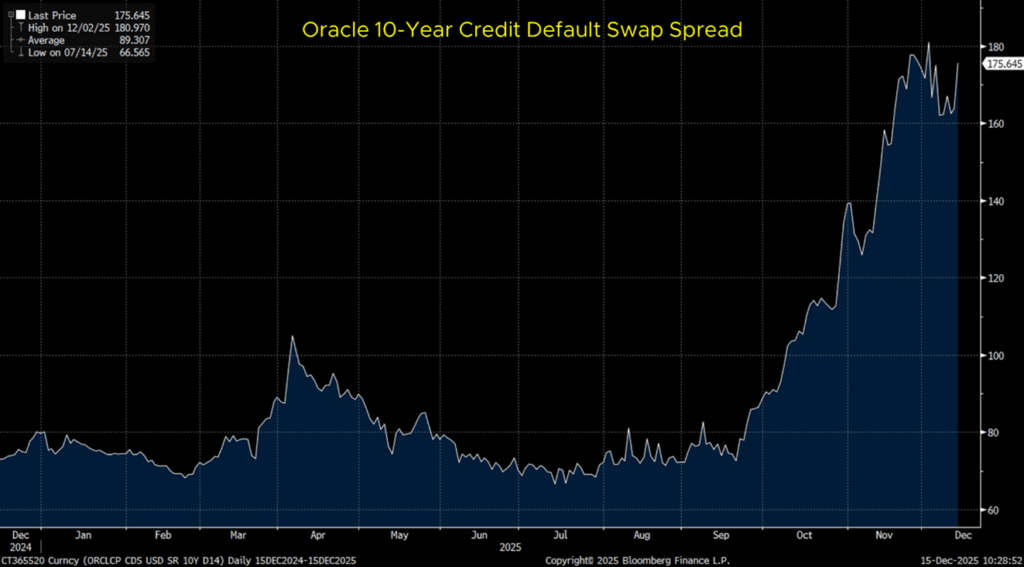

Recent market sentiment shifted notably in December, as investors worry the AI boom has become a bubble. Oracle’s earnings report and elevated capital spending guidance revived bubble fears, triggering broad retreat. Investors rotated out of AI and broadened their exposure to materials, industrials, financials, and healthcare, a sector rotation we believe could have staying power on the back of lower financing costs from an easier Fed.

2026: Testing the AI Thesis

The AI infrastructure being built will prove viable even if near-term monetization disappoints, following historical patterns where over-investment eventually enables subsequent innovation cycles. Position for compute demand growth through diversified infrastructure rather than concentrated applications bets.

Given inherent uncertainty in AI monetization timelines and competitive dynamics, avoid leveraged positions or companies dependent on continuous capital market access for AI strategy execution. Oracle’s 10-year credit default swap spread recently spiked to nearly 180 on investors’ concerns the company will be forced to borrow to achieve their capex aspirations. It’s trading at roughly the same spread as the Country of Romania.

Bottom Line: Cycle, Not Collapse

The AI investment landscape sits at a critical inflection point entering 2026. While the AI sector shows familiar signs of a bubble, lofty valuations, heavy capital inflows, and speculative behavior, its strong profits, consistent revenue growth, and cash-funded infrastructure investments point to a selective correction rather than a systemic collapse.

The next 18 months will reveal whether today’s infrastructure buildout becomes a platform for lasting innovation, or one of the largest capital misallocations in market history. Investors should position defensively through diversified infrastructure exposure while avoiding highly leveraged plays until monetization metrics demonstrate sustainable improvement.

The AI thesis requires monitoring a multi-year monetization horizon. Success depends on enterprise ROI improvement of installed AI platforms and meaningful adoption rates. We believe collective valuations will become justified, although it should be noted there will be winners and loser among today’s leaders. There’s a small risk that if pilot failure rates persist, the sector could face a bear market with applications companies most vulnerable. The next four quarters of earnings guidance will provide critical data points.