Key Observations:

- Black Friday spending set new records of $11.8B online (+9.1%) and $18B total U.S. online sales, yet in-store activity declined modestly.

- Discounting surged, particularly in electronics (average 28%), reflecting price sensitivity and retailer competition.

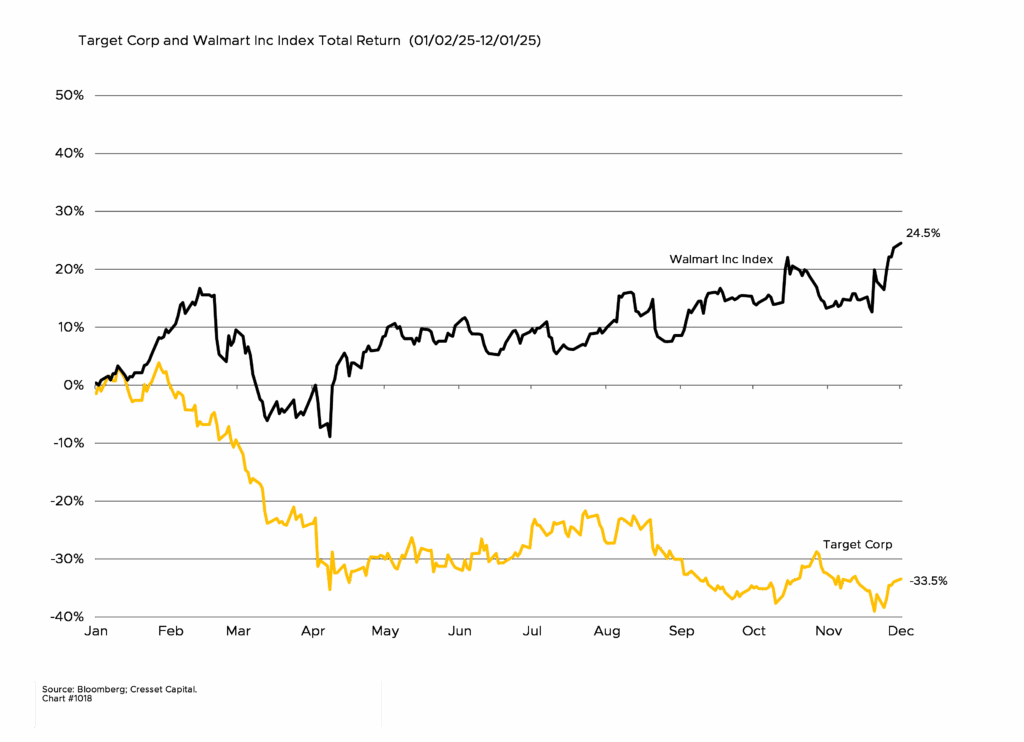

- Consumers remain selective, prioritizing essentials and value; discount retailers like TJX, Ross, and Burlington outperformed.

- Gen Z shoppers reshaping retail, emphasizing affordability, authenticity, and experience over brand loyalty.

- AI reshaped shopping behavior, tripling product referrals and influencing when and how consumers buy.

- Macro backdrop remains mixed, with nominal spending strength tempered by inflation, buy-now-pay-later usage, and tariff-related cost pressures.

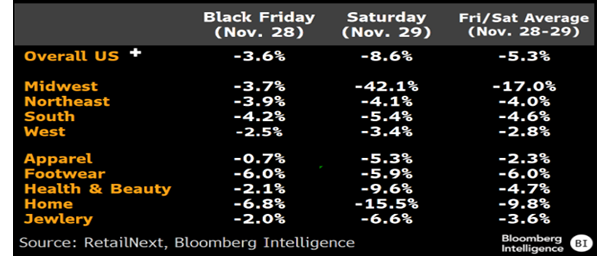

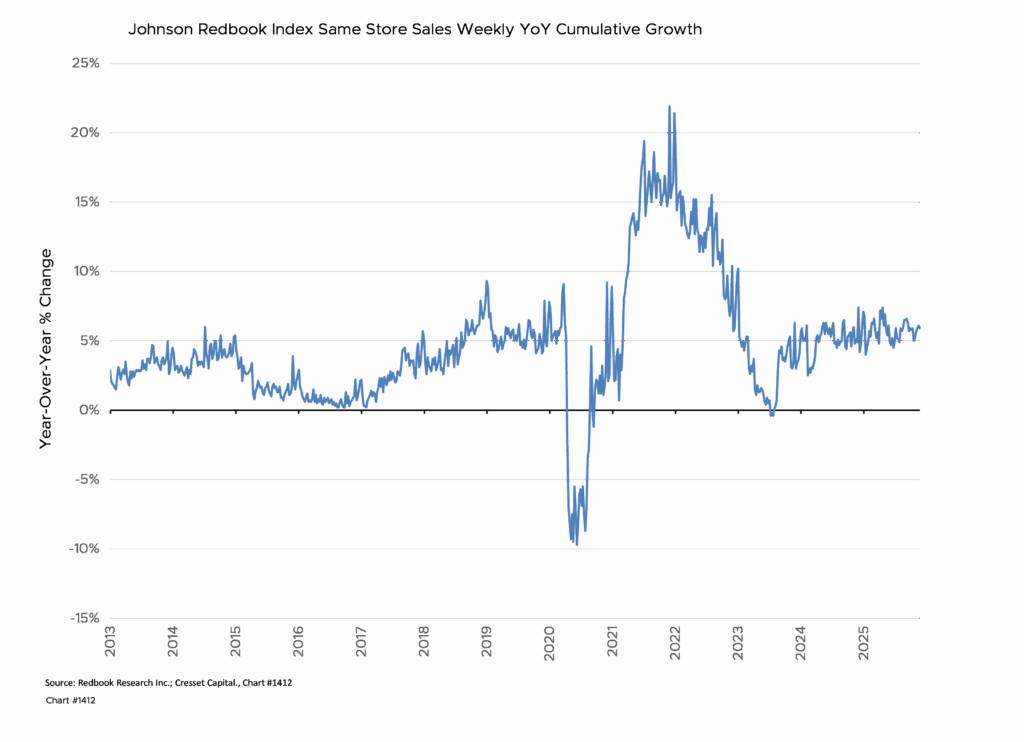

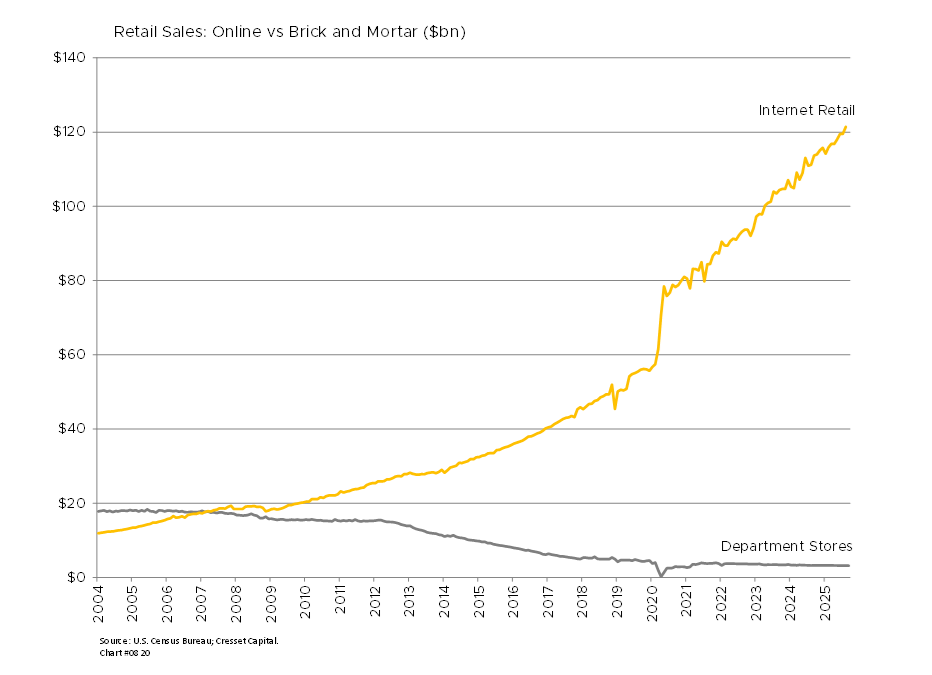

Black Friday kicked off the 2025 Christmas selling season with a bang, as online spending reached new highs, even though in-store traffic was mixed. Consumers spent $6.4 billion online over Thanksgiving weekend, a 5.3% increase from a year prior, while Black Friday online sales rose 9.1% to $11.8 billion, according to Adobe Analytics. Salesforce estimated that U.S. online spending reached $18 billion on Black Friday and $79 billion globally. Meanwhile, Mastercard SpendingPulse recorded total Black Friday sales up 4.1%, with online purchases growing more than ten percent and in-store sales rising 1.7%. Retail platform Shopify separately reported that its merchants generated $6.2 billion in Black Friday gross merchandise volume, a 25% increase from last year, suggesting that digital channels continue to capture an increasing share of holiday demand, even as physical stores remain relevant in specific categories and locations. Yet, Bloomberg data suggests in-store spending trailed last year across all categories, although the Midwest was beset with a significant snowstorm.

Deep Discounting Meets Tariff-Driven Price Pressures

Discounting played an unusually prominent role this year, with average price reductions on electronics reaching 28%, reflecting both retailer competition and consumer sensitivity to price. Early promotional campaigns, which have increasingly stretched into early November, did not appear to dampen Black Friday activity; shoppers continued to respond to incremental deals. At the same time, tariffs constrained markdowns in certain categories. Video game consoles, however, maintained higher prices and a lack of meaningful discounts on older hardware, reflecting the pricing effects that import duties are having on certain consumer electronics, according to Bloomberg.

Economic Anxiety Shapes a More Selective Shopper

Economic anxieties are weighing on buying decisions. Households are facing the combined pressures of inflation, rising interest rates, and renewed tariff impacts against a backdrop of a softening labor market. The lingering effects of a 43-day federal government shutdown likely weighed on sentiment as well. Despite these challenges, shoppers remained engaged yet selective. Consumers were deliberate in their purchases, with more attention to promotions, and increasingly willing to trade down to value-oriented retailers. Discount chains TJX, Ross, and Burlington enjoyed solid traffic, while big-box retailers reported mixed results. Walmart benefited from strength in essentials, while Target continued to see softness in discretionary categories.

In-Store Traffic Continues Its Slow Decline

In-store traffic continued its long decline, though the drop was moderate. This year recorded a 3.6% year-over-year decline in Black Friday foot traffic according to RetailNext, while Sensormatic reported a 2.1% slide. These numbers represented an improvement relative to earlier weeks, suggesting that meaningful in-store demand persists, particularly in higher-quality malls and value-focused stores. Observations from multiple malls across the country described steady crowds, even if consumers were more cautious once inside.

Gen Z Emerges as a Pivotal, Price-Conscious Consumer Group

Young adults are an important and emerging consumer segment. Despite an expected 23% reduction in holiday spending this year and the highest rate of credit card delinquencies among generational cohorts, young shoppers remain highly engaged with retail, especially in brick-and-mortar stores. For many, malls offer a blend of shopping, socializing, and entertainment rather than purely transactional experiences. Gen Z purchasing decisions reflect a careful weighing of cost, quality, authenticity, and emotional resonance. This has resulted in a growing embrace of “dupes,” affordable alternatives to brand-name goods, and a declining attachment to traditional brand loyalty. Retailers attempting to reach this cohort are shifting toward experiential marketing, membership-driven engagement, and curated assortments that balance affordability with aspirational appeal.

AI Is Quietly Transforming How Consumers Shop

Artificial intelligence has played a notably larger role in holiday shopping so far this year. AI-powered search and recommendation tools, deployed through platforms such as Amazon, Walmart, Target, and a broad array of third-party agents, reshaped how consumers discovered products and evaluated deals. Referrals from chatbots to retail sites increased threefold over the last 12 months. With AI increasingly mediating both the timing and nature of purchases, the new technology is already having a structural change in the consumer decision-making process.

So far, the data suggests that the U.S. consumer remains a stabilizing force for the economy, though signs of strain are apparent. Record spending, particularly online, will likely support Q4 GDP, yet the underlying drivers, like higher prices, buy-now-pay-later usage, selective consumption, and elevated promotional activity paint a consumer who is stretching rather than expanding their financial capacity. Tariff-related cost pressures may also contribute to firmer goods inflation, complicating any prospective shift toward monetary easing.

Bottom Line:

Today’s consumer dynamics imply heightened dispersion within the retail sector. Retailers with cost advantages, strong digital ecosystems, and value-oriented assortments appear positioned to outperform, while mid-tier discretionary retailers may face ongoing margin pressure and traffic problems. More broadly, the holiday season’s early results reinforce a late-cycle narrative: spending remains intact for now, but the foundation is weakening, and the trajectory into 2026 will depend heavily on labor market conditions, interest rates, and the durability of household balance sheets.