Key Observations:

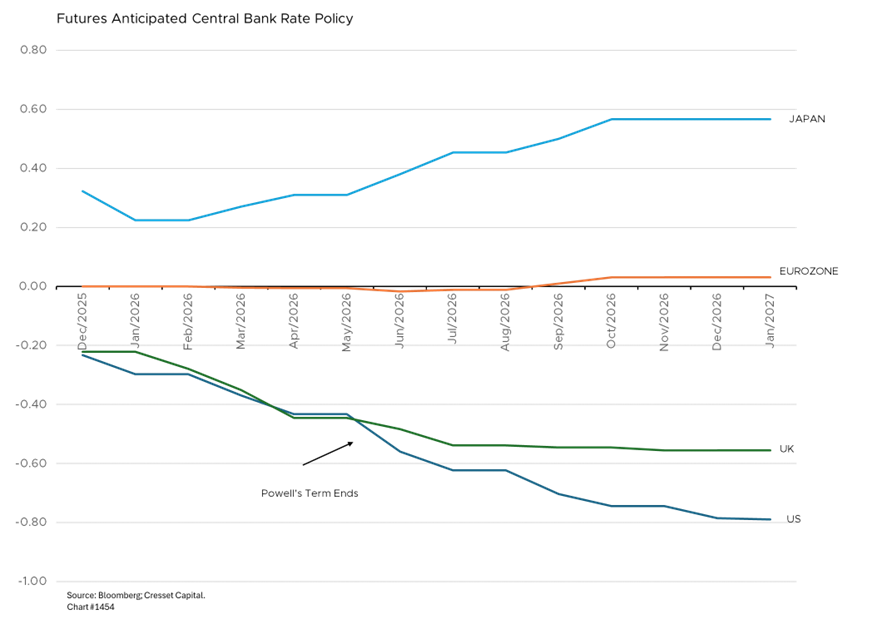

- Dovish monetary policy—perhaps accelerated rate cuts—in store irrespective of who replaces Powell

- Fed must provide compelling economic justification for policy moves to assure markets of its independence

- Our 2026 outlook for fiscal stimulus in Q1 and easier monetary policy in Q2 sets the stage for positive equity returns on a 12-month view

The collision of aggressive fiscal stimulus with a Federal Reserve leadership transition creates an unusual investment landscape for 2026 – one offering significant opportunity but requiring nimble portfolio positioning. The “One Big Beautiful Bill Act” (OBBBA), signed into law in July 2025, injects an estimated $50 billion in additional tax refunds into consumer pockets in early 2026, while new Fed leadership arriving in May could accelerate rate cuts. Midterm election dynamics add headline risk, but historical patterns favor double-digit equity returns in post-midterm periods.

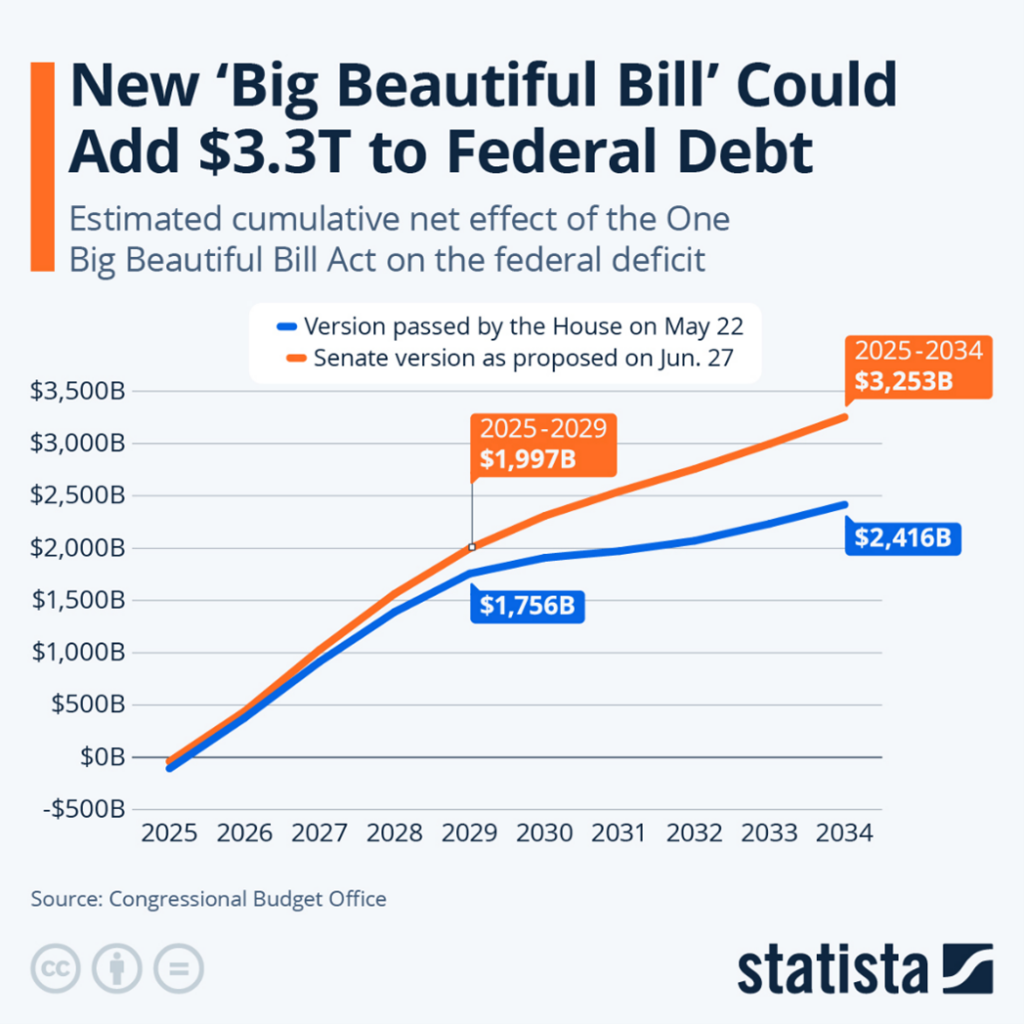

OBBBA Brings Meaningful Tax Benefits for Individuals, and Deficit Expansion

The OBBBA represents the largest tax legislation since 2012, adding $3-4 trillion to deficits over ten years, according to the Congressional Budget Office (CBO). Some key provisions taking effect in 2026: a permanent extension of 2017 tax rates; enhanced standard deductions, including $32,200 for married couples filing jointly; SALT deductions expanding from $10,000 to $40,000; and temporary tax exemptions for tips and overtime income.

Economists project asurge in tax refunds in Q1 2026 will serve as a new round of stimulus checks. CBO estimates real GDP growth will accelerate to 2.2 per cent in 2026, up from 1.4 per cent in 2025, though this boost fades as temporary provisions expire after 2028. They project fiscal impulse to peak mid-decade before spending cuts kick in.

Easier Monetary Policy Likely in Store Irrespective of Who Replaces Powell

Meanwhile, on the monetary front, Jerome Powell’s term as Fed Chairman expires May 15, 2026, with Kevin Hassett leading a field of five on the short list and holding odds of approximately 75 per cent as his successor. Easier monetary policy is likely to ensue, since Hassett and other potential Trump appointees favor more aggressive rate cutting, potentially conflicting with the Fed’s inflation targets.

The current Fed median forecasts only one 25bps cut in 2026 to 3.4 per cent, while markets are pricing in two to three cuts. This divergence could resolve dramatically depending on who becomes chairman. The combination of fiscal stimulus and aggressive Fed easing could raise rate hike expectations in late 2026.

New Fed Chairman Could Employ Yield Curve Management Strategies

The prospect of the incoming Fed chairman implementing balance sheet policy like “Operation Twist” is a possibility in an environment in which high intermediate rates are impeding housing affordability and inhibiting the Treasury to term out its debt. This would involve selling short-term Treasury while purchasing longer-dated bonds to flatten the yield curve. This unconventional tool, previously deployed during the 1960s and in 2011, aims to reduce long-term borrowing costs without significantly expanding the balance sheet.

Several factors support this possibility. Hassett has advocated for more aggressive rate cuts and supports lower interest rates, suggesting openness to unconventional monetary policy. Additionally, persistent yield curve inversions and elevated long-term rates despite Fed funds cuts could justify such intervention.

However, significant obstacles exist. Current inflationary pressures from potential tariff policies could constrain dovish actions. The Fed’s credibility regarding political independence faces scrutiny, making dramatic policy shifts risky and possibly sparking backlash in the financial markets. Any twist operation would likely require compelling economic justification beyond political pressure in order to reassure markets of Federal Reserve independence. Furthermore, the effectiveness of “Operation Twist” in today’s deeper, more liquid Treasury markets remains questionable.

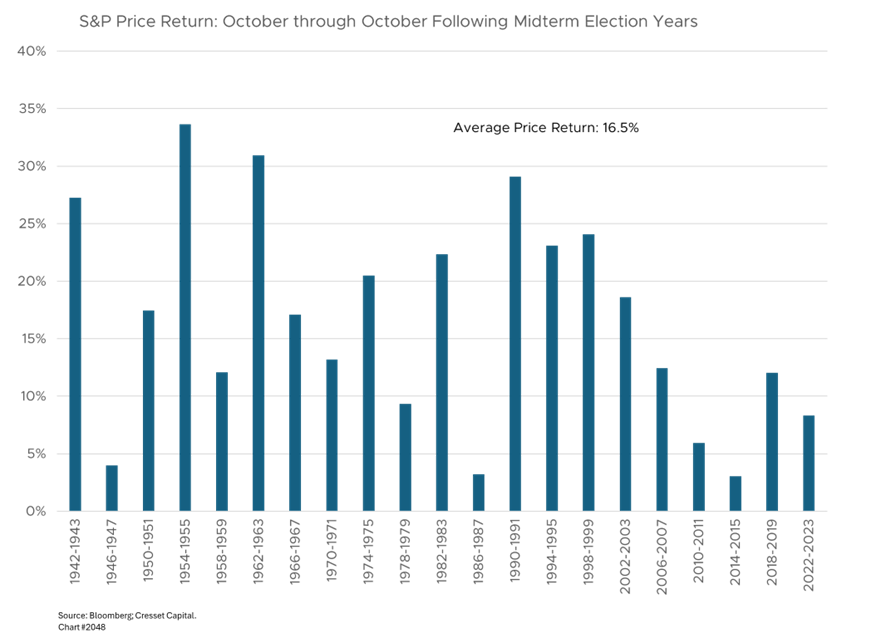

S&P 500 Has Returned 16.5% on Average in the 12 Months Post-Midterms Since 1942

Historical data show midterm years produce average peak-to-trough declines of 20.6 per cent in the S&P 500, with a fractionally negative median price return. The 12 months following midterms average a price return of 16.5 per cent. The S&P 500 has not posted a negative return in the October-to-October period following midterms since 1942.

Equities would benefit from fiscal and monetary stimulus. We anticipate market broadening as smaller and cheaper equity sectors enjoy an outsized impact from lower financing costs. Examples of sector beneficiaries include financials, thanks to deregulation; defense, due to a 13 per cent proposed budget increase; and industrials, because of AI data center buildouts. Healthcare and energy also offer value amid continued AI infrastructure spending.

We believe fixed-income positioning should emphasize intermediate duration of 5-10 years, locking in elevated yields before Fed cuts materialize. Long-maturity Treasurys could be vulnerable if investors sense a lack of Fed independence, while municipal bonds offer compelling opportunities beyond 10-year maturities.

Private credit strategies will benefit from an easier Fed and higher-than-anticipated inflation expectations. We believe lower nominal yields will be offset by narrower spreads since higher inflation increases coverage ratios.

Bottom Line:

Part of Cresset’s 2026 outlook is based on front-loaded fiscal stimulus in Q1, combined with dovish Fed policy in Q2. Notwithstanding historical headwinds in midterm election years, we believe a diversified portfolio of equities, bonds and alternatives will provide ballast against policy-driven volatility while capturing the upside from coordinated monetary and fiscal accommodation.