Key Observations

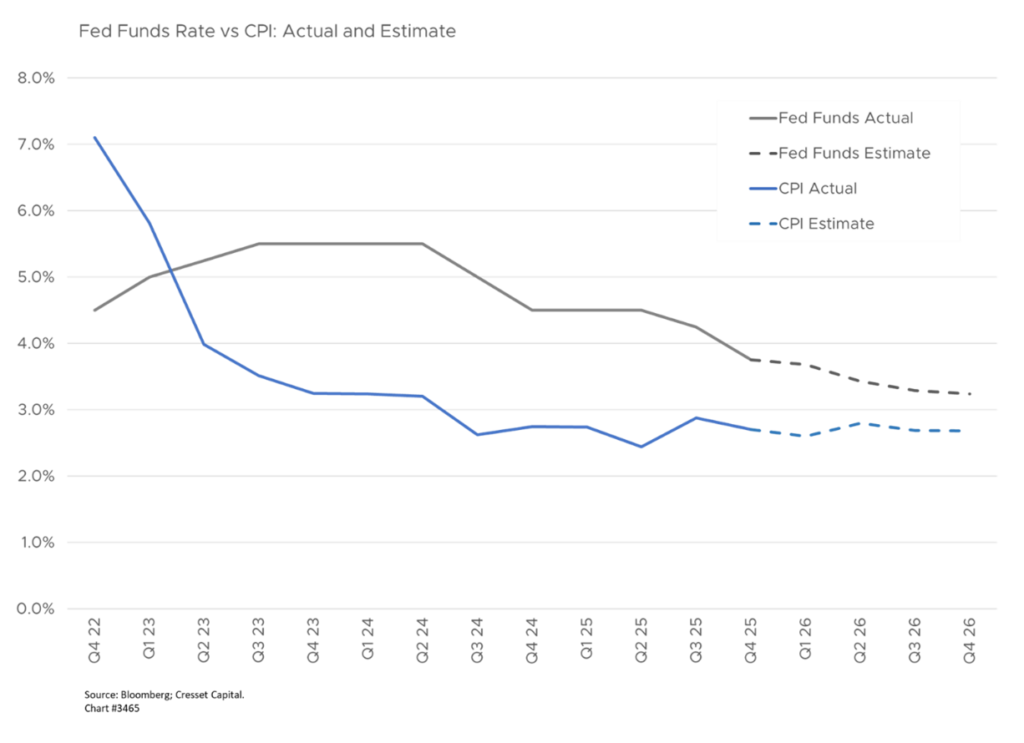

- Reacceleration risk is fading as the likelihood of aggressive monetary easing under a new Fed chair declines.

- Fiscal stimulus remains meaningful, but its impact is tempered by a resilient economy and a more patient Fed.

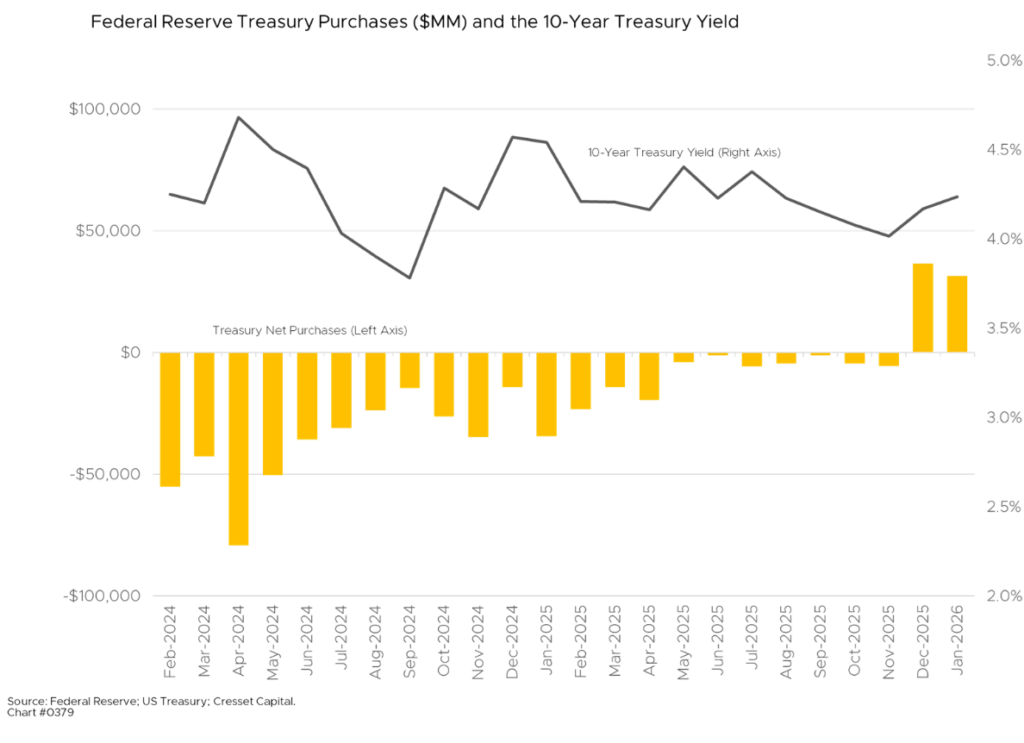

- Kevin Warsh’s skepticism of quantitative easing reduces the probability of balance sheet expansion.

- The macro backdrop increasingly resembles a “Goldilocks” environment for risk assets.

- Equities appear better positioned than bonds as earnings growth is supported without renewed inflation pressure.

We are reducing the likelihood of our “Reacceleration” scenario from 30% to 20% in our outlook for 2026 in response to Kevin Warsh’s likely appointment to Federal Reserve chair in May. We are raising our “Moderating Growth with Easing Inflation” from 50% to 60% as a result.

When Fiscal Stimulus Meets a Resilient Economy

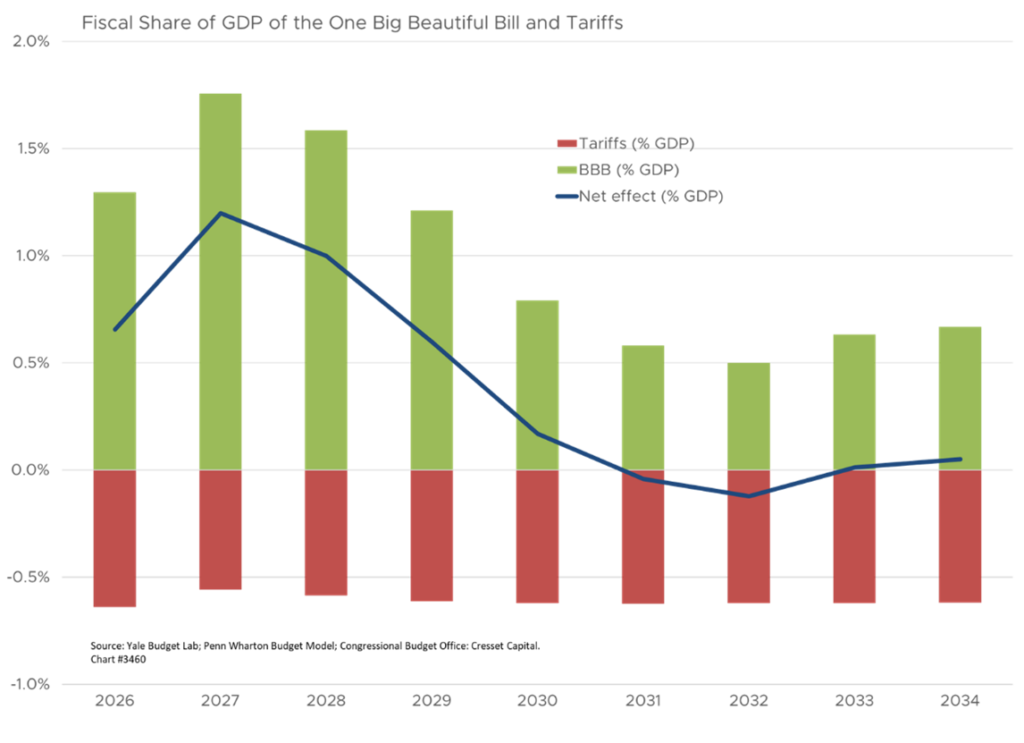

Reacceleration risk stemmed from our double-barreled stimulus theme with a fiscal boost in Q1 from the One Big Beautiful Bill Act (OBBBA) incentives, combined with monetary stimulus from a new dovish Fed chair, in the second half of the year.

We estimated that tariff exemptions plus the GENIUS Act’s tax cuts could inject $800 billion into the economy in 2025, $500 billion from tariff relief and $300 billion from tax cuts, representing about 3% of GDP.

This substantial fiscal stimulus arrives as the economy shows resilience, with steady employment, healthy consumer spending, and inflation stabilizing toward the Fed’s 2% target. The combination creates a “Goldilocks” scenario for risk assets, with growth strong enough to support earnings but not so strong as to reignite inflation.

Why a Warsh Fed Changes the Equation

However, the potential appointment of a dovish Fed chair in May raised concerns that unnecessary rate cuts or renewed purchases of Treasuries and mortgages to support housing could reaccelerate growth and inflation.

Yet Warsh has held a longstanding criticism of quantitative easing and believes the Federal Reserve’s balance sheet should be reduced significantly. He was a reluctant skeptic of the first round of quantitative easing (QE1) and considered an exit from QE as early as 2009. In 2011, Warsh was the only Fed governor to question the expansion of record monetary stimulus before resigning after five years at the central bank. Given his history, it’s unlikely the Fed would expand its balance sheet under a Warsh Fed.

Bottom Line

The analysis suggests this environment favors equities over bonds, as the stimulus supports earnings growth while the Fed maintains its patient approach. However, the sustainability depends on whether tariff exemptions materialize and how markets digest the fiscal expansion’s long-term implications for deficits and debt.