Key Observations:

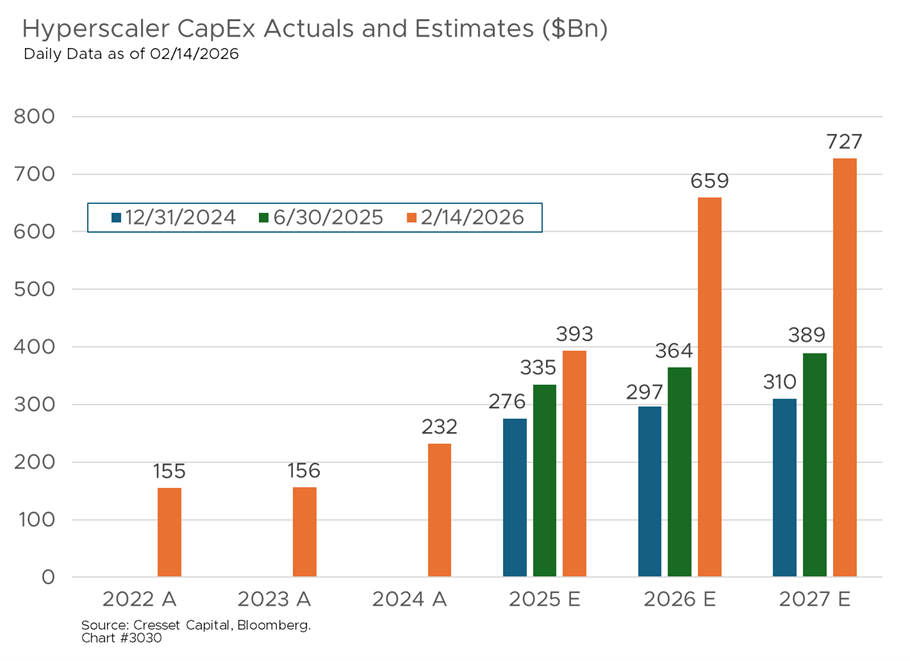

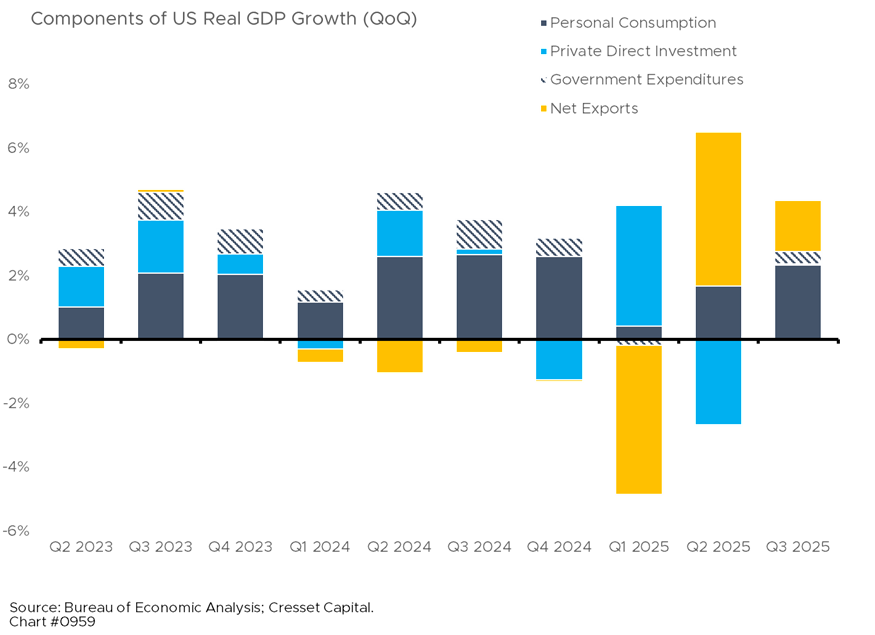

- AI capex is contributing roughly one-third of GDP growth, driven by a handful of hyperscalers.

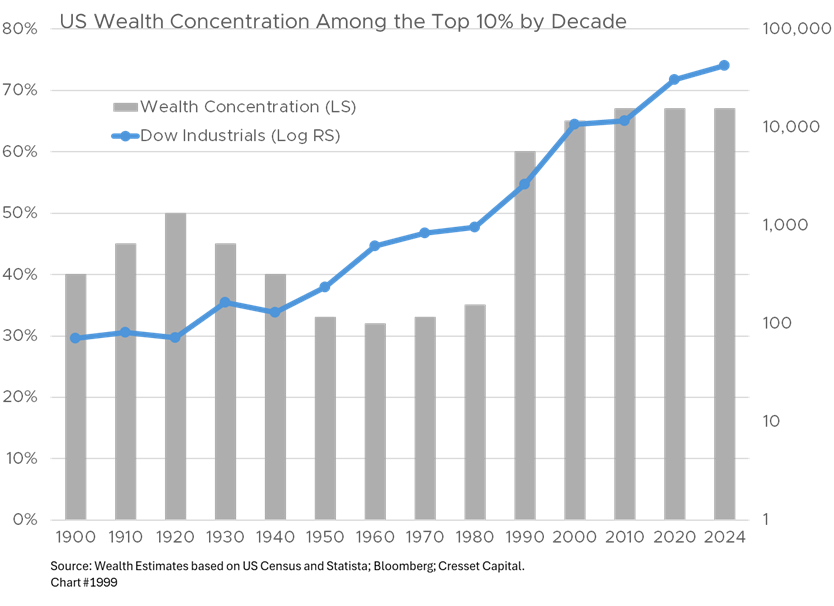

- The top 10% of earners now account for nearly half of all consumer spending.

- The top 20% of households own ~70% of financial assets, amplifying wealth effects.

- The bottom 80% are facing slowing real spending, depleted savings, and rising delinquencies.

- Equity markets and consumer spending are increasingly tied to AI-driven valuations.

- Forward guidance, not earnings beats, is driving market price action.

The U.S. economy sits atop two increasingly narrow pillars. On the investment side, artificial intelligence (AI) capital expenditure has become the dominant driver of business spending growth, with technology investment contributing roughly a third of overall GDP growth in 2025. On the consumption side, the top 10 percent of earners now account for nearly half of all consumer spending — the highest share in decades — fueled by equity market wealth effects that are themselves tied to the same AI-driven technology companies. These twin concentrations are not independent risks; they are deeply intertwined, creating a reflexive loop in which AI investment inflates asset values, asset values underwrite consumer confidence among the wealthy, and their spending props up an economy whose broader foundations are quietly eroding.

An Unprecedented and Lopsided Investment Cycle

The scale of AI-related capital spending is without modern precedent. U.S. technology companies are expected to deploy upwards of four trillion dollars in cumulative AI capital expenditure through 2030, financed by a combination of operating cash flow and an accelerating corporate debt binge. In any given quarter, the hyperscaler capex announcements from a handful of firms, with Microsoft, Alphabet, Amazon, and Meta chief among them, move GDP-level needles on nonresidential fixed investment. The top ten companies in the S&P 500 now represent approximately 40 percent of the index’s total market capitalization, with most of that concentration residing in AI-adjacent businesses.

This creates a lopsided investment cycle. While AI spending has been a genuine boom to semiconductor manufacturers, data center real estate investment trusts (REITs), electrical equipment suppliers, and the construction trades, it has simultaneously crowded out capital allocation in other sectors. Semiconductor and dynamic random-access memory (DRAM) prices have surged, creating cost pressures for non-AI technology buyers and industrial firms. More fundamentally, the economy’s investment growth has become dependent on the continued willingness of a small number of companies to spend aggressively on infrastructure whose revenue-generating capacity remains largely unproven at enterprise scale.

The risk is not that AI fails entirely, but that the gap between infrastructure spending and realized revenue forces a recalibration of investment timelines. Business models built on optimistic execution assumptions are vulnerable to a deceleration in spending, and the systemic risk compounds because so many downstream companies rely on AI models developed by a narrow set of providers. A flaw in a widely deployed model, a geopolitical disruption to chip supply, or simply an earnings miss from a key hyperscaler could cascade through financial markets in ways that far exceed the direct economic impact.

Two Consumers, One Economy

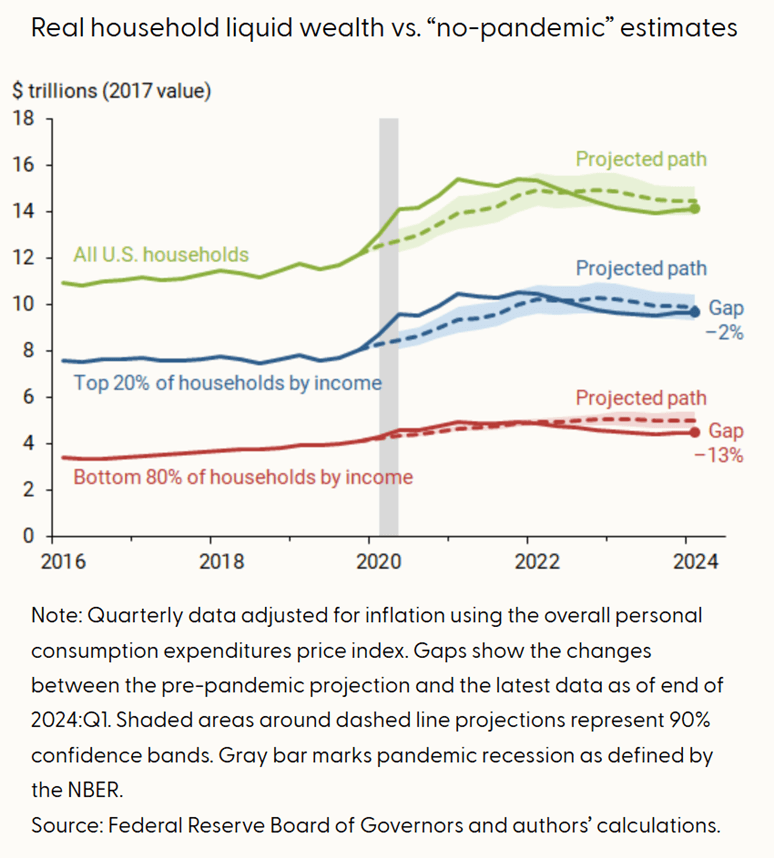

Meanwhile, the demand side of the economy is equally concentrated. The top 20 percent of households by income own nearly 70 percent of financial assets in the United States. Their spending contributed approximately 1.1 percentage points to GDP growth in 2025, representing more than half of total consumption growth, driven overwhelmingly by the appreciation of equity portfolios dominated by technology holdings. Wealthy households continue to spend freely on luxury goods, travel, experiential services, and high-end real estate. Hotels, airfare, and recreational services have all benefited from high-income consumer demand.

The bottom 80 percent of households tell a markedly different story, where spending growth has barely kept pace with inflation. Liquid savings balances for the lowest income quintile have fallen below pre-pandemic levels. Consumers are shifting from credit to debit, reducing discretionary purchases, buying fewer items per shopping trip, and visiting stores more frequently to manage cash flow on a near-real-time basis. Credit card and student loan delinquencies have surpassed pre-pandemic benchmarks, with student loan delinquencies reaching record levels in late 2024. Lower-income borrowers are maxing out credit lines at more than double the rate of their higher-income counterparts. This is a K-shaped consumption pattern in its most pronounced form: the top of the income distribution is thriving on paper wealth while the broad middle is contracting in real terms.

Why Concentration Creates Fragility

This relationship creates macroeconomic fragility. High-income households have a meaningfully lower marginal propensity to consume than middle-income households. An additional dollar of equity wealth generates far less spending than an additional dollar of wage income. The demand gap left by weakening middle-class consumption cannot be fully offset by luxury spending, regardless of how robust asset markets progress.

These two vulnerabilities are connected through a self-reinforcing feedback mechanism. AI capex drives technology earnings, technology earnings drive equity valuations, equity valuations drive household wealth for the top quintile, and that wealth drives discretionary spending. If AI investment disappoints, whether through investor reassessments, a shift in corporate confidence, or an exogenous shock, the cycle flips from virtuous to viscous. Equity markets correct, household wealth contracts among the cohort responsible for half of all consumer spending, and the economy loses both its investment engine and its consumption engine simultaneously. This is not a tail risk; it is the central structural vulnerability of the current expansion.

Portfolio Implications: Breadth vs. Dependency

The concentration of growth in AI capex and top-quintile spending has several actionable implications for portfolio positioning. First, investors should recognize that the current expansion is more fragile than headline GDP suggests. The bottom 80 percent of households are reining in spending, drawing down savings, and falling behind on credit obligations. When incremental growth is driven primarily by AI capex and affluent consumption, the economy is not broadening; it is concentrating risk in a self-reinforcing loop with little margin for error.

There may be some relief. While economic breadth is narrowing, earnings growth is broadening, with a growing share of companies enjoying profit growth for the first time in years. More S&P 500 firms than usual are beating Wall Street estimates this quarter, although investors are looking past quarterly results toward bigger-picture risks, particularly around AI monetization and how much of the capex cycle translates into earnings. Beating a lowered bar isn’t enough when forward multiples are already pricing in a lot of good news.

Financials are showing real strength; investment banking revenues are running seven percent above last year, driven by solid fixed income and equity trading activity. Semiconductors remain the standout growth story, with chip equipment firms projecting 20%+ revenue growth into 2026 as AI-related demand pushes the industry toward a $1 trillion total addressable market. Memory shortages are creating pricing power for logic manufacturers, a positive margin dynamic worth watching.

Guidance, however, is driving price action more than profit results. Several high-profile names saw sharp selloffs after issuing 2026 outlooks that missed by meaningful margins. Meanwhile, even modest guidance improvements are being rewarded aggressively, a sign the market is starving for confidence in forward earnings trajectories.

Bottom Line

The U.S. economy is not in crisis, but it is in a state of concentrated dependency that elevates the cost of being wrong. Meanwhile, corporate earnings are fine, although “fine” may not be enough at current valuations. Investors are repricing risk around guidance quality and forward visibility, not backward-looking beats. In this environment, earnings upside needs to come with conviction on the outlook, or it won’t matter. We recommend focusing on the incremental certainty of quality companies, particularly those with growing dividends. Additionally, private investments and real assets may offer partial insulation from the AI-equity-wealth feedback loop. Real estate with pricing power, as well as private credit strategies tied to non-cyclical cash flows, can provide portfolio ballast if the twin pillars of AI capex and wealth-driven spending prove less durable than markets currently assume.