Key Observations

- Labor availability has improved materially, easing wage pressure without triggering widespread layoffs.

- AI is slowing hiring and reshaping roles through productivity gains rather than driving mass job losses.

- AI infrastructure investment is generating jobs while concentrating profits and economic power.

- Immigration restrictions are emerging as a binding constraint on labor supply in key industries.

- Policy uncertainty is delaying business expansion and accelerating automation.

We are one-third of the way through Q4 earnings season, with S&P 500 companies reporting strong results and double-digit year-over-year earnings gains for the fifth consecutive quarter. While profit results matter, management commentary offers more valuable insights into future trends, particularly regarding labor markets, hiring patterns, artificial intelligence (AI) adoption, and immigration policy impacts. We analyzed earnings call transcripts to identify emerging themes shaping the employment landscape. Now that the Bureau of Labor Statistics has postponed the January jobs report, it’s important to take the pulse of the labor market through company management.

Cooling Pressures and Improving Labor Availability

Labor market sentiment among corporate management has improved notably as conditions have softened in recent months. Labor availability has materially improved across sectors; restaurants no longer report the labor shortages that previously drove elevated hiring and retention bonuses. The staffing environment represents the most favorable conditions experienced since before COVID-19, with wage pressures moderating across markets.

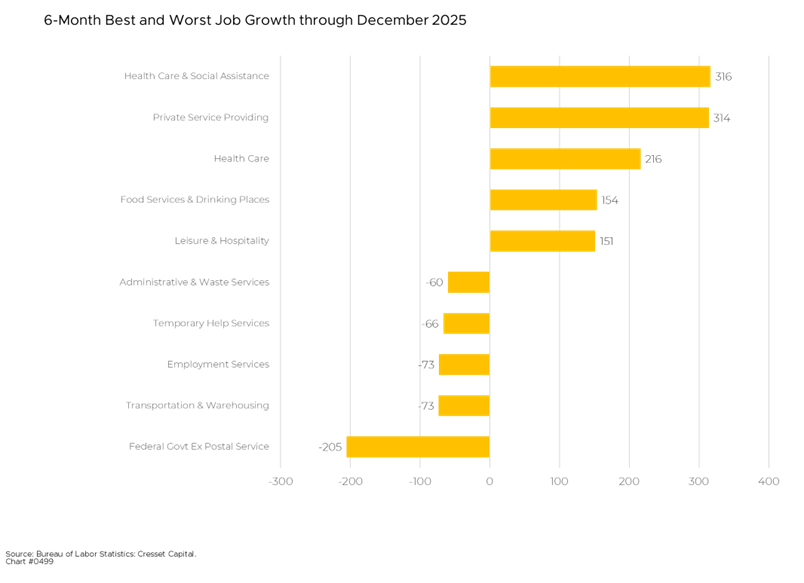

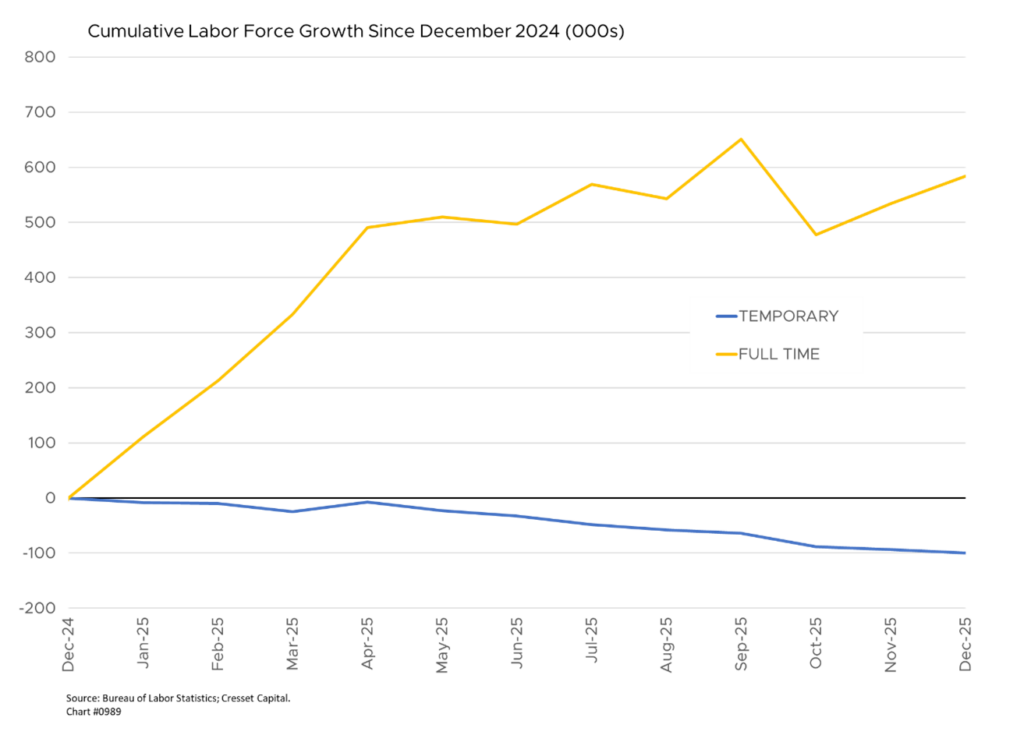

Companies are managing headcounts through hiring freezes, slower replacement cycles, and attrition rather than outright layoffs. AI adoption is limiting new hiring in some entry-level roles, reflecting clear reluctance to add labor. Private sector employment declined in November, particularly among small businesses and in sectors including construction, manufacturing, and professional services.

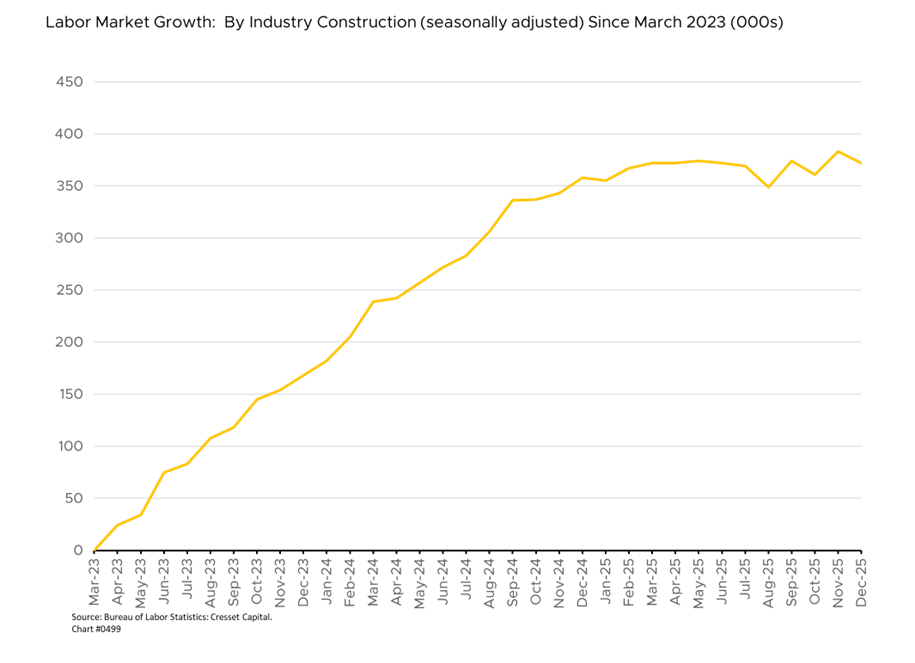

Despite improved overall availability, pockets of tightness persist. Certain skilled roles and immigrant worker shortages continue to create bottlenecks. Construction labor costs are projected to rise 4–5% year-over-year in 2026, with shortages exacerbated by immigration restrictions and ICE enforcement. Management teams project labor inflation ranging from 2–4% this year, and some expect stability while others anticipate continued pressure, depending on the industry. Turnover remains low, and productivity improvements are offsetting price discounting in some sectors. Employee retention gains and operational efficiencies are contributing to labor productivity improvements and wage leverage, particularly among restaurant operators.

AI’s Expanding Role in Reshaping Work

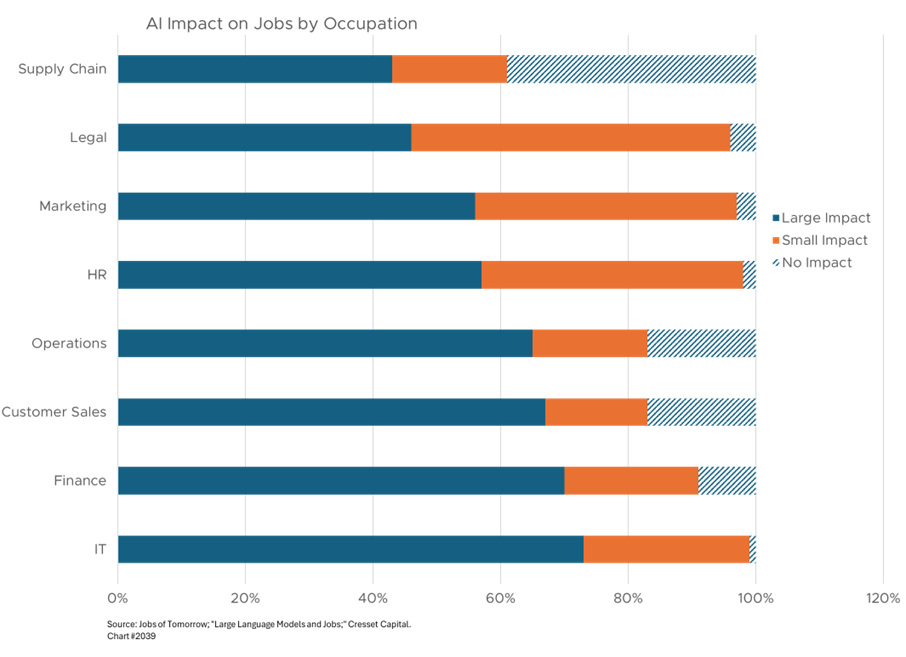

Business leaders are making bold predictions about AI’s displacement potential. Ford’s CEO recently suggested AI could replace half of white-collar workers, while IBM’s CEO foresees up to 10% U.S. job displacement, while also anticipating that technology and productivity gains will create new roles. Anthropic, an AI safety and research company, estimates that half of all entry-level jobs could be eliminated within five years, noting that business use of their models focuses primarily on task automation rather than augmentation.

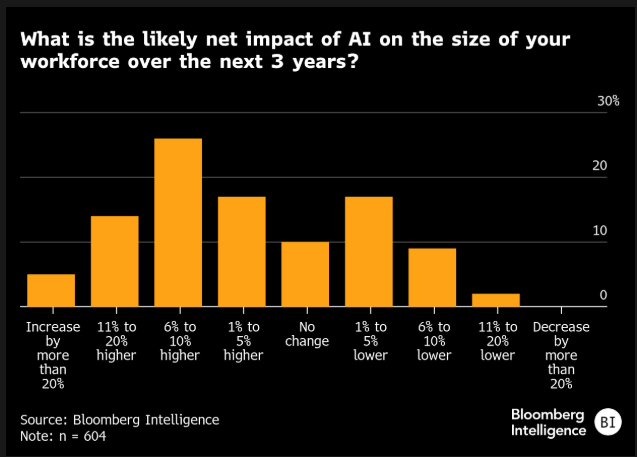

AI has been cited as the driver behind over 10,000 announced job cuts in the past month, contributing to rising overall layoff figures. Nearly 60% of banks surveyed anticipate AI will result in smaller workforces over the next 3–5 years, with nearly a quarter predicting 5–10% employment decreases, implying 200,000 U.S. banking jobs could be at risk. Singapore-based bank DBS has already announced plans to cut up to 4,000 contract and temporary staff after implementing AI tools.

Despite the troubling proclamations, most CEOs still believe AI primarily augments human labor rather than substitutes for it, with most companies expecting little to no headcount change over the next three years. AI is increasingly viewed as a net employment catalyst rather than reducer, with 62% of auto executives expecting workforce growth due to AI, particularly in data and software roles.

AI adoption has been cited as limiting new hiring by boosting productivity and, in some cases, serving as a substitute for entry-level roles. AI technologies have made it more challenging for entry-level job seekers to find employment, as companies prioritize upskilling existing employees over new hires. A potential explanation for summer weakness in youth employment, including internships and entry-level roles, is that employers are integrating AI and automation, which also reduces demand for temporary or lower-skilled workers.

AI primarily affects knowledge workers performing routine cognitive tasks, like data entry clerks, basic customer service representatives, and junior-level content creators. Companies are deploying AI assistants for document review, initial customer inquiries, and routine coding tasks. However, complete job elimination remains relatively limited. More commonly, AI is changing job composition: paralegals now manage AI document review systems rather than conducting manual searches; marketing teams oversee AI content generation rather than writing from scratch.

The most vulnerable positions combine routine work with lower skill requirements. Call centers are reducing headcount as chatbots handle straightforward queries. Basic bookkeeping roles face pressure as AI automates reconciliation and categorization. Yet these job losses haven’t created mass unemployment. In fact, the unemployment rate remains near historic lows.

Where AI Is Creating Jobs and Concentrating Power

Meanwhile, AI is driving substantial job creation in certain segments like AI engineers, machine learning specialists, and prompt engineers, all roles that barely existed five years ago. Beyond pure tech, companies need AI ethics officers, training data specialists, and integration consultants. Even traditional industries are creating AI-adjacent positions: healthcare systems hire clinical AI coordinators; law firms employ legal technology specialists.

Thanks to hundreds of billions spent on the infrastructure buildout of data centers, chip manufacturing, and power generation, blue-collar opportunities abound. Taiwan Semiconductor Manufacturing Company (TSMC)’s Arizona facilities, Nvidia’s supply chain expansion, and massive data center construction projects are creating manufacturing and construction jobs, particularly in regions offering tax incentives.

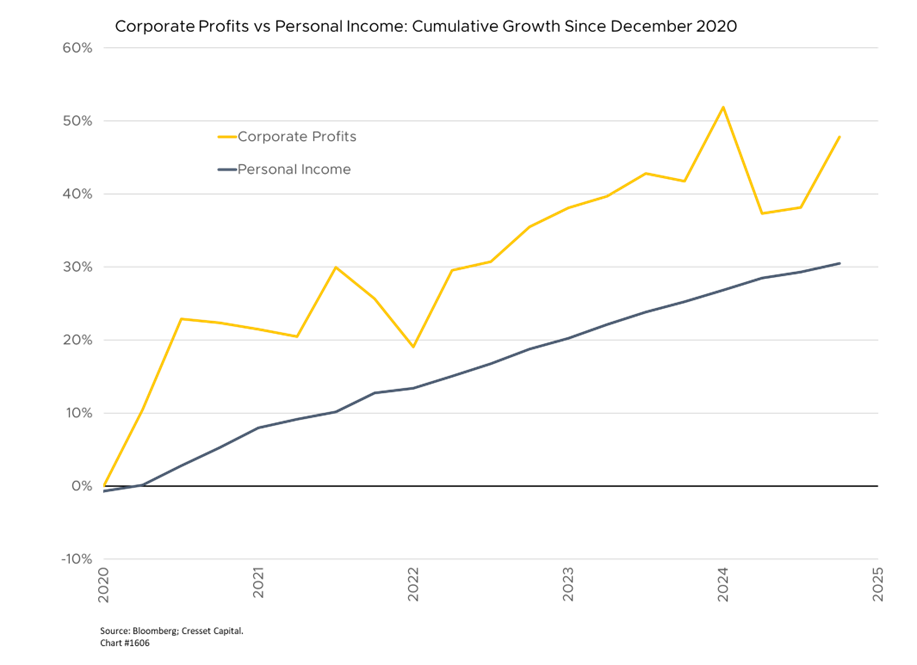

Perhaps AI’s most significant labor market impact is enabling companies to extract more output from existing headcounts rather than hiring additional workers. This manifests in slower job growth during economic expansions and reluctance to backfill departing employees. Corporate profit margins expand while wage growth remains moderate, a dynamic favoring capital over labor.

This productivity boost appears across sectors: software developers produce more code, analysts generate more reports, and designers create more iterations. Companies tout efficiency gains to shareholders while workers experience intensified expectations and workload compression.

Immigration Policy and the Shrinking Labor Pool

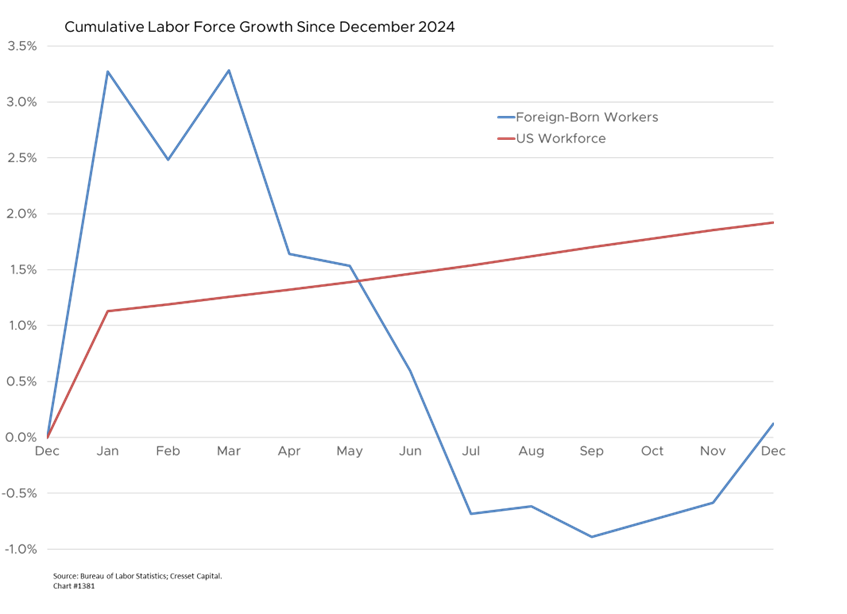

U.S. immigration policy is reducing the labor market’s speed limit, with sharp declines in immigration slowing labor force growth. Net immigration is expected to plummet from 2.8 million in 2024 to 400,000 in 2025. This decline has partially offset weakening labor demand, but tighter immigration enforcement may signal deteriorating labor conditions ahead.

Labor supply in hospitality, agriculture, construction, and manufacturing has reportedly faced strain in several regions due to recent immigration policy changes. Trump’s focus on stricter enforcement and potential deportation operations threatens labor availability in construction, agriculture, hospitality, and food processing, or industries where undocumented workers represent meaningful workforce portions. Construction firms are already expressing concern about project timelines and costs if labor pools contract sharply. Agricultural producers warn of crop losses if seasonal worker programs face restrictions or if enforcement actions reduce available labor during peak harvest periods.

The H-1B visa program, crucial for technology and specialized professional roles, faces potential restrictions despite tech industry lobbying. Any reduction in skilled immigration could constrain companies’ ability to fill engineering, data science, and research positions, potentially slowing innovation and forcing more offshore development.

Farm worker availability is expected to decline as domestic employees age and younger generations show less interest in agricultural work. Competing jobs in warehouses and distribution centers offer better conditions and flexibility for comparable or higher pay, making it difficult to replace workers lost to immigration enforcement. Stricter enforcement also poses risks to the senior housing sector, where labor shortages could impact margins.

A meaningful decline in immigration visa approvals and increased deportations under the Trump administration may signal tighter labor conditions, potentially impacting real estate investment trusts (REITs) with development pipelines through higher labor costs and yield compression.

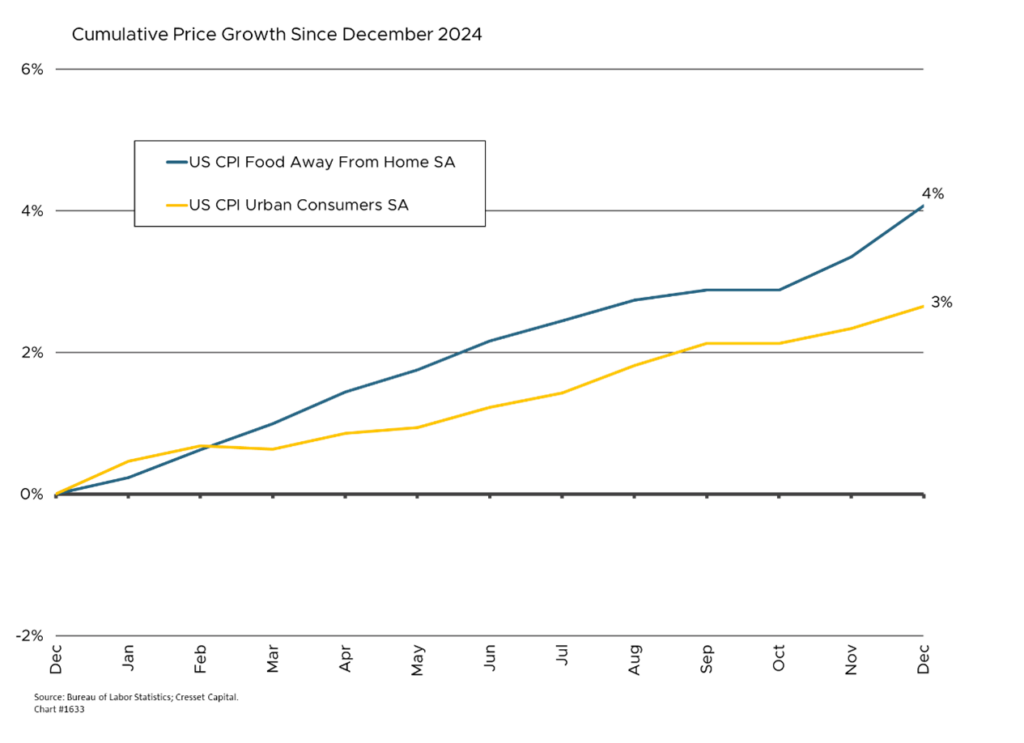

Reduced immigration is expected to benefit native-born workers through tighter labor markets and upward wage pressure, particularly in lower-skilled positions. Restaurant workers, construction laborers, and service industry employees should see improved bargaining power if labor supply contracts. However, this dynamic carries inflation implications. Labor-intensive industries facing worker shortages typically pass costs to consumers. Restaurant prices, construction costs, and agricultural products could see accelerated inflation if businesses cannot access sufficient workers at prevailing wages. The Fed’s inflation fight becomes complicated if supply-side price pressures emerge from immigration restrictions rather than demand-side overheating.

Policy Uncertainty Is Freezing Hiring and Accelerating Automation

Immigration policy uncertainty is affecting business planning and capital allocation. Companies in affected industries are delaying expansion plans, reconsidering facility locations, and exploring automation investments more aggressively. This acceleration toward labor-replacing technology may ultimately reduce total employment more than immigration policy directly achieves.

Small businesses, particularly in border states and immigrant-heavy metro areas, face acute challenges. Unlike large corporations with sophisticated HR and legal resources, small construction firms, restaurants, and service businesses have limited ability to navigate complex compliance requirements or absorb sudden labor supply shocks.

What These Labor Shifts Mean for Investors

These dynamics suggest several investment themes. Companies successfully implementing AI will enjoy margin expansion without concomitant revenue growth, representing a powerful earnings catalyst. Meanwhile, labor-intensive businesses face competitive pressure from AI-enabled rivals operating with leaner structures.

The widening skills gap creates opportunities in education technology and workforce retraining. Companies providing AI tools for small and medium businesses should see sustained demand as competitive pressures force broader adoption.

Importantly, AI’s labor market impact remains concentrated in specific sectors and roles. Manufacturing, construction, healthcare provision, and skilled trades show minimal direct disruption.

Immigration policies create both risks and opportunities for investors. Companies with heavily immigrant-dependent business models, like restaurant chains, construction companies, or agricultural processors, face operational and margin pressures. Conversely, automation and robotics companies may see accelerated adoption as businesses seek labor alternatives.

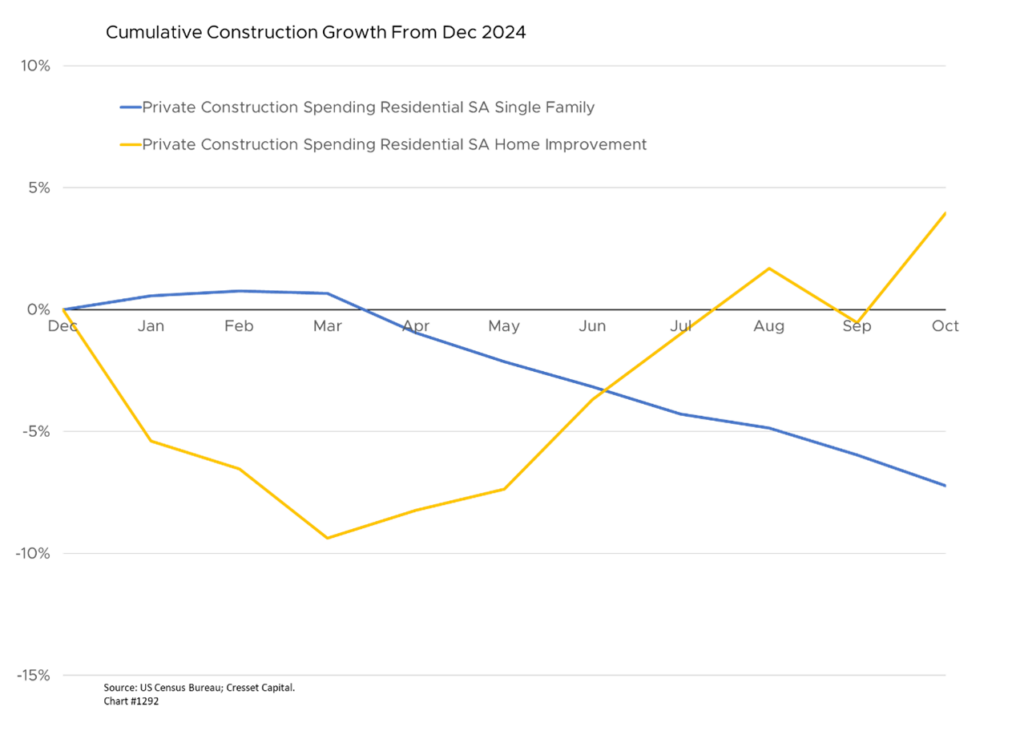

Residential construction could slow further if labor constraints tighten, affecting homebuilders and related suppliers and exacerbating housing affordability challenges. Additionally, agricultural commodity prices could face upward pressure from production constraints.

Bottom Line

Corporate America faces diametric challenges. Companies leveraging AI will ride a productivity wave to higher earnings growth. The industries that are positioned to benefit include banking and financial services, retail and consumer goods, technology and telecommunications, as well as life sciences. Meanwhile, labor-intensive businesses that require low-skilled and foreign-born workers could come under margin pressure. Those industries include agricultural, construction, food processing, leisure and hospitality, and certain sectors of healthcare.