Key Observations:

- Rapid Trade Deals with UK and China Suggest More Pragmatic Administration Stance

- Both the US and China Need a Deal

- Cresset’s Recession Scenario Probability Revised Down to 30 per cent

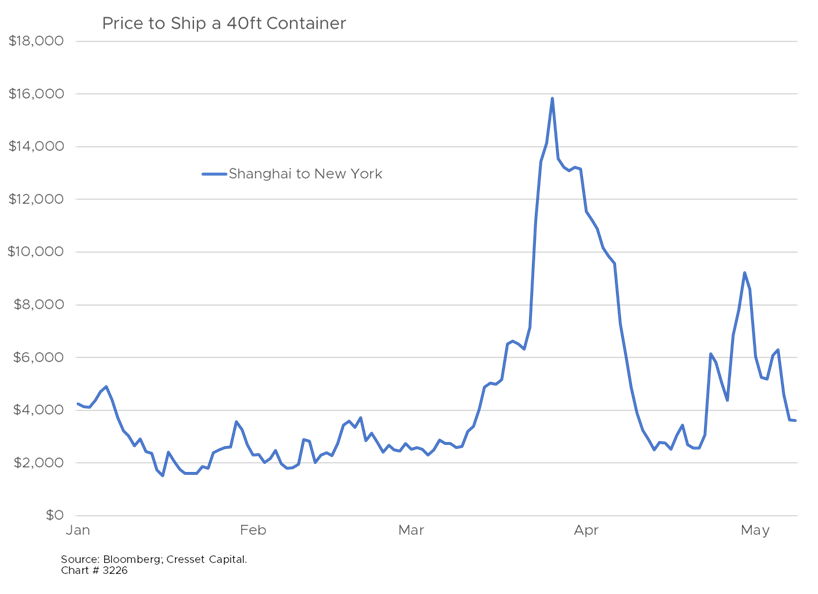

The US and China announced they had reached a significant trade deal on Monday, resulting in a 90-day reduction of tariffs. This ceasefire in the global trade war sent markets soaring, with the Dow rallying more than 1,000 points on Monday. The agreement will slash tariffs on Chinese exports from 145 per cent to 10 per cent, while the US will maintain a 30 per cent tariff that includes a 20 per cent component aimed at pressuring China to restrict the flow of fentanyl. In our view, the deal takes the worst-case scenario – a global trade war – off the table. The threat of such escalation had sent imports skyward and shipping rates lower.

Rapid Deals with UK and China Suggests Less Aggressive Approach

The China announcement follows last week’s “conclusive” agreement with the UK and represents President Trump’s second trade win in just four days. This shift suggests Trump might be backing away from the draconian tariffs he announced on April 2, which were quickly postponed after a massive Wall Street sell-off.

Both the US and China Need a Deal

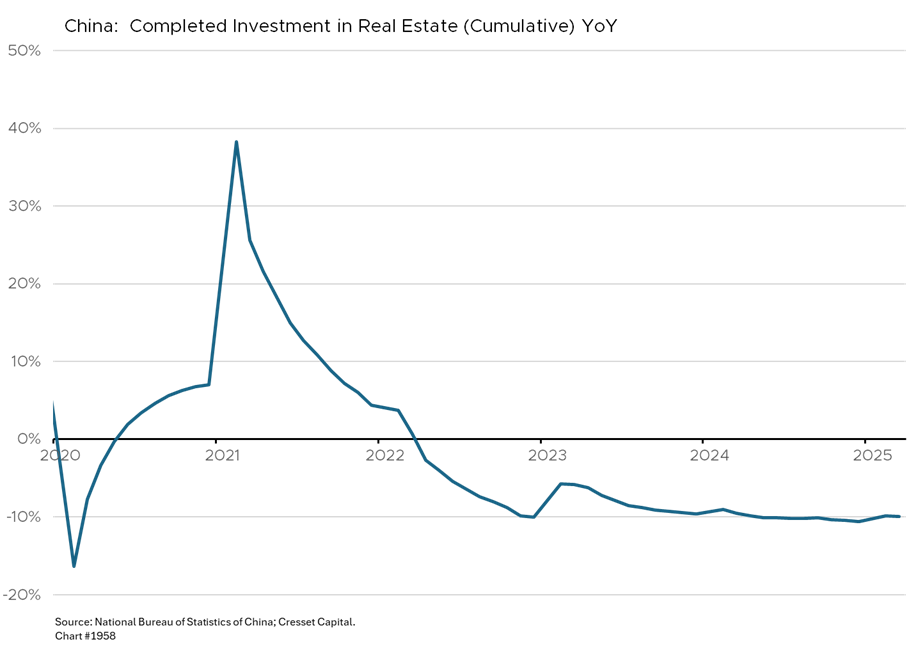

China’s economy is struggling to grapple with a deflating housing bubble that rivals the size of 2008 US housing bust that set off the financial crisis. Chinese households have few safety nets and thread-bare retirement benefits, so they save nearly half their incomes and stash much of it in domestic residential real estate. As a result, domestic demand has collapsed. Meanwhile, Beijing has recently channeled capital into building manufacturing facilities. This rising manufacturing capacity coupled with lackluster domestic demand means China must rely on exports for growth.

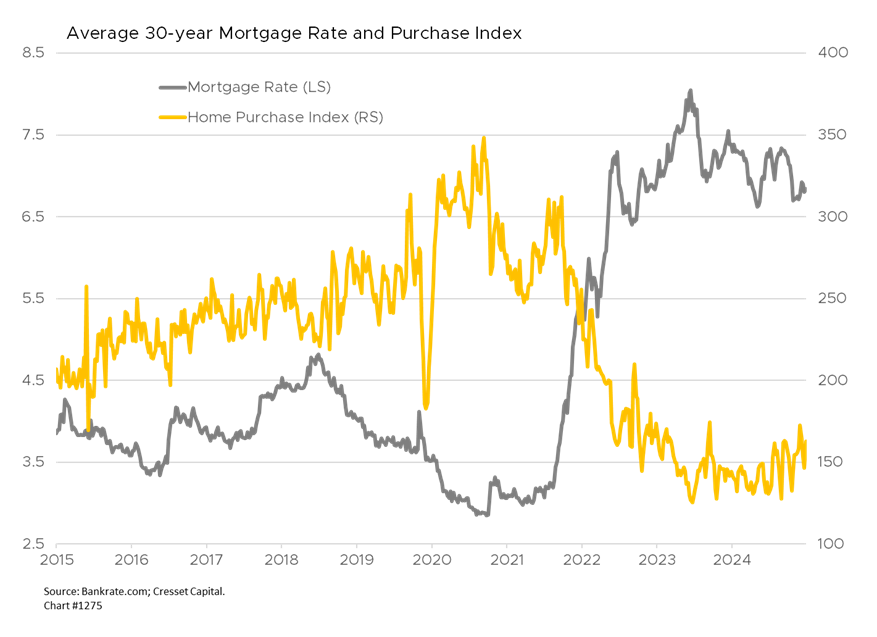

US consumers have enjoyed low-priced Chinese imports for decades, which have helped keep inflation at bay and interest rates tame for nearly 40 years. But that trend reversed a few years ago in the aftermath of the COVID pandemic. Inflation rose to levels not seen since the 1980s and high mortgage rates have largely frozen the US housing market, as housing affordability plunged to its lowest level in decades.

Cresset’s Recession Scenario Probability Revised Down to 30 per cent

The prospect of a global trade war prompted us to raise our recession scenario probability from 20 per cent to 40 per cent. Prohibitively onerous tariffs would have created supply chain dislocations echoing those of the pandemic lockdowns, sending prices higher and growth lower. Such an environment stymies the Fed, whose mandate is to balance price stability with full employment. We have reduced our recession scenario probability to 30 per cent in response to the trade détente.

Bottom Line:

The US-China trade agreement represents a significant de-escalation of tensions but is more a temporary truce than a permanent resolution to the trade war. This deal, combined with the recent UK agreement, suggests President Trump might be moderating his aggressive tariff approach in response to the negative market reactions to his April “Liberation Day” announcement. We are also comforted by the shift from hardliner Pete Navarro to Treasury Secretary Scott Bessent as trade negotiations leader, because it signals a more pragmatic economic stance.