Business Exit Planning

Essential Strategies for Entrepreneurs

Planning for the exit is one of the most important decisions you will make as an entrepreneur. Subscribe for the latest thought leadership and resources for business owners.

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.

Top Articles on Exit Planning

For more exit planning insights, subscribe to Entrepreneurial Edge.

1.

2.

3.

4.

5.

6.

- CEO Founders: A 10-Point Checklist for Selling Your Business

- 6 Things Business Owners Wish They Knew Before Selling

- Structure Your Estate Before Selling Your Business

- Business Exit Strategies for Female CEO Founders

- Changing Domicile: How To Change State Tax Situs

- Selling a Family Business: 3 Key Steps for a Successful Buyout

Exit Planning at Cresset

Family is a key consideration when planning your exit. Cresset President and Chief Operating Officer Susie Cranston reflects on her personal experiences as she emphasizes the importance of understanding the multi-generational impact of selling a business.

Even if you know what to consider before selling your business, navigating the thought process can be difficult. Cresset Co-Founder & Co-Chairman Avy Stein offers strategic insight on preparing for an exit for a private equity-owned business.

The sale of a business is often seen as the culmination of an entrepreneur’s journey, but in reality, life continues far beyond this milestone. Watch as Cresset’s Head of Family Governance Whitney Webb shares key strategies to help you prepare for the next phase of life.

With an undertaking as big as a business exit, you want to be prepared before, during, and after the transaction. Learn more as Cresset Co-Founder & Co-Chairman Eric Becker shares strategies to help you optimize towards your goals in a business sale.

Lending offers versatile solutions that enable you to retain ownership of your business while continuing to expand it until you’re ready to sell. Alex Penning, Cresset’s Head of Banking & Lending, explains how strategic lending can serve as a bridge, helping you reach the optimal valuation at the ideal time for your exit.

The interests of the seller and buyer often diverge, making it crucial for business owners to plan ahead with their wealth advisor and tax strategist to navigate the complexities of a sale. Watch as Cresset’s Head of Tax, Oleg Ikhelson, shares how early and strategic planning can significantly reduce tax liabilities by addressing both estate and income tax considerations.

Early pre-transaction planning is key to navigating the complexities of an exit process successfully. From setting up trust structures and addressing tax implications to maximizing your exit potential, an experienced advisor can help optimize outcomes at every stage. Listen as Noel Campbell, Cresset Director and Wealth Advisor, shares insights on how thoughtful, strategic planning can help families achieve their long-term goals.

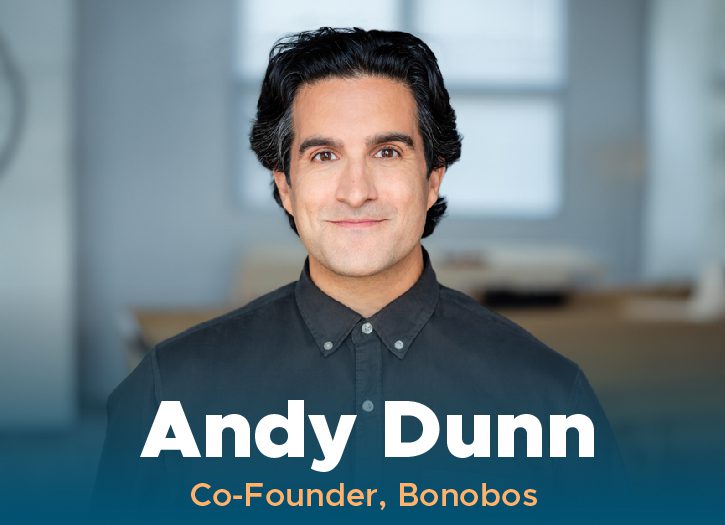

Lessons from Successful Entrepreneurs

Hear from some of the world’s most successful entrepreneurs on how they scaled their businesses. Join us at our next event.

In The News. In The News. In The News. In The News. In The News. In The News.

1.

2.

3.

4.

- Family Business Magazine: "6 Things Family Business Owners Wish They Knew Before Selling"

- Next Avenue: "Creating a Succession Plan for Your Business"

- They Got Acquired: "How to prepare your personal finances before selling your company"

- Family Business magazine: "Dealing with conflicting emotions after selling your family business"

Getting Started with Business Exit Planning

Exit Strategy Definition

Importance Of Exit Strategy In Business

How Exit Planning

Advisors Can Help You

Frequently

Asked

Questions

When should I start exit planning?

Start exit planning as early as possible, ideally several years before you intend to sell your business. By beginning early, you’ll have ample time to assess your options, optimize your company’s value, and address any vulnerabilities or gaps. Early planning allows for a smoother transition, maximizes potential returns, and provides the flexibility to adapt strategies based on changing circumstances in the market or personal goals.

Do I need an exit planning advisor?

It is important to have an exit strategy in place before selling your business. Develop a comprehensive exit strategy tailored to your goals and assemble a team of trusted advisors. Streamline processes, understand what your company is worth, identify the motivation for the sale, strengthen key relationships, and ensure proper documentation of assets and liabilities to enhance your company’s attractiveness to potential buyers or successors.

How do I prepare my business for an exit?

It is important to have an exit strategy in place before selling your business. Develop a comprehensive exit strategy tailored to your goals and assemble a team of trusted advisors. Streamline processes, understand what your company is worth, identify the motivation for the sale, strengthen key relationships, and ensure proper documentation of assets and liabilities to enhance your company’s attractiveness to potential buyers or successors.

How do I know when it is the right time to sell my business?

Selling a business is never about finding the perfect moment. If you keep waiting for your company to become slightly more profitable or to grow a bit more, you may never take the leap. Instead, make the decision when it aligns with your goals. Consider more than just the financial gains from the sale, factor in your desired time frame for enjoying the rewards of your hard work and fulfilling your long-term objectives.