Recorded December 14, 2021

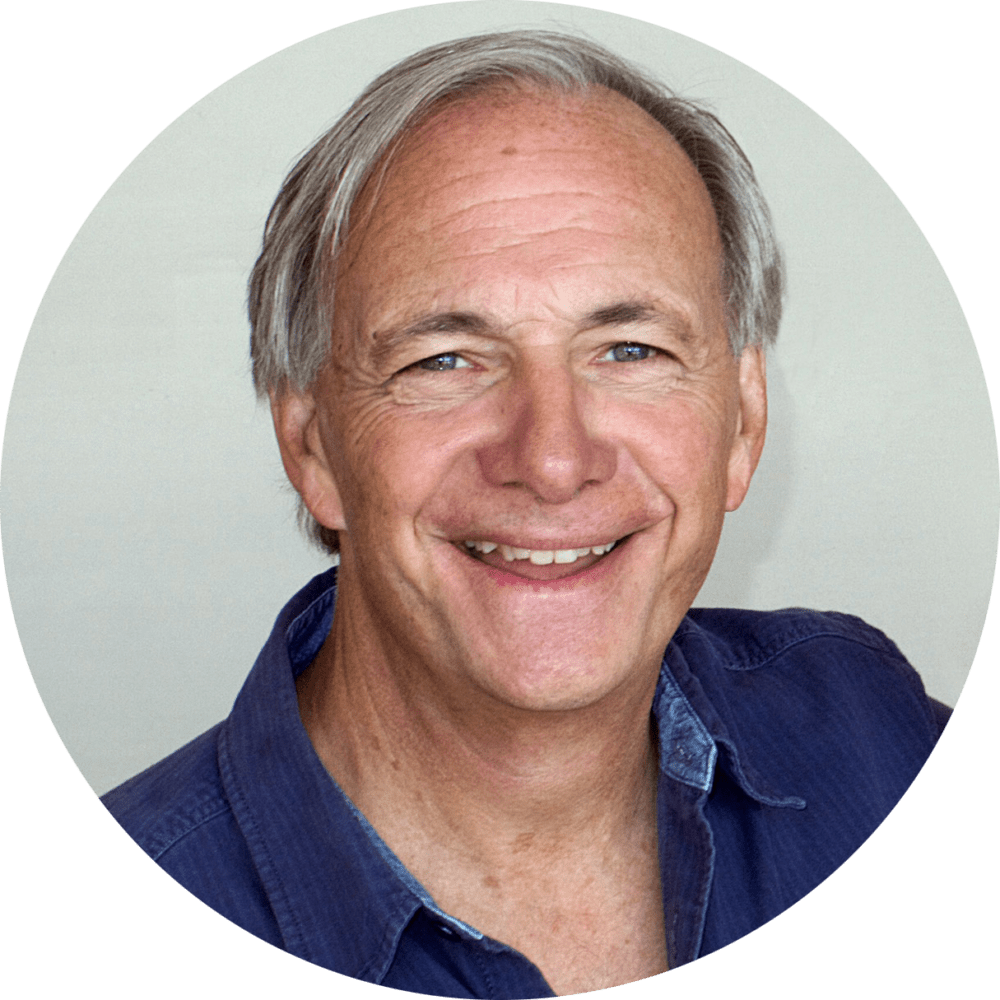

As China rises to challenge the US and we face a shifting world order, we are simultaneously encountering a unique convergence of events including huge debts, near-zero interest rates, massive money printing, plus major political conflicts and enormous wealth disparities in numerous countries. What does it all mean and what should we be doing about it? Legendary billionaire investor Ray Dalio tackles these and other questions in his latest book, Principles for Dealing with the Changing World Order, as he takes a look at world history to understand how the rise and fall of past empires might give us insight into what the future might look like. In this engaging and informative session, Dalio will share his perspective on how to navigate the current uncertainty and where to look for opportunity as the world order continues to shift. As we examine today’s turbulent times in-depth, Dalio will offer practical advice about how to navigate and succeed despite the global uncertainty and upheaval.

Ray Dalio is the founder and co-chairman of Bridgewater Associates, which, over the last forty years, has become the largest and best performing hedge fund in the world. He is the author of #1 New York Times Bestseller and #1 Amazon Business Book of the Year, Principles. Dalio has appeared on the Time 100 list of the most influential people in the world as well as the Bloomberg Markets list of the 50 most influential people.