Family Office Guide / Family Governance

Knowledge Base

Knowledge Base

Table of Contents

Subscribe to Family Office Insights

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.

Related Topics

Family Governance 101: Importance, Structures, & Strategies for High-Net-Worth Families

By Whitney Webb

Managing Director, Head of Family Governance

By Whitney Webb

Managing Director, Head of Family Governance

10 minute read

Table of Contents

Family governance is the framework that directs how a family makes decisions together. Governance looks different for each family and plans are tailored to individual needs and circumstances. In families with a business or significant shared assets, governance often addresses three interconnected areas: ownership, family, and business. In other families, these may be adapted to focus on shared assets, philanthropy, or family culture. Ultimately, family governance creates clarity, reduces conflict, and ensures wealth and legacy are stewarded with intention.

Progressive governance frameworks, such as those we use at Cresset, go beyond financial oversight. We help families integrate human capital (skills, education, values), social capital (relationships, networks), and cultural capital (traditions, identity) alongside financial capital. This holistic approach acknowledges that thriving families invest in much more than money—they invest in their people and their purpose.

What Is Family Governance?

Family governance is the system of principles, structures, and practices that guide how a family manages wealth, shared assets, and interpersonal dynamics. It establishes alignment around shared purpose, values, and goals, while providing practical tools for decision-making and communication. For some families, this may take the form of family constitutions or councils; for others, it may center around defining how family members engage with wealth and opportunities across generations.

Example: A family with multiple real estate holdings may develop governance structures that define how decisions are made about acquisitions, sales, and distributions. Another family might use governance to clarify how family members can access shared resources to pursue their individual goals, while balancing the long-term needs of future generations.

Frameworks for Family Governance

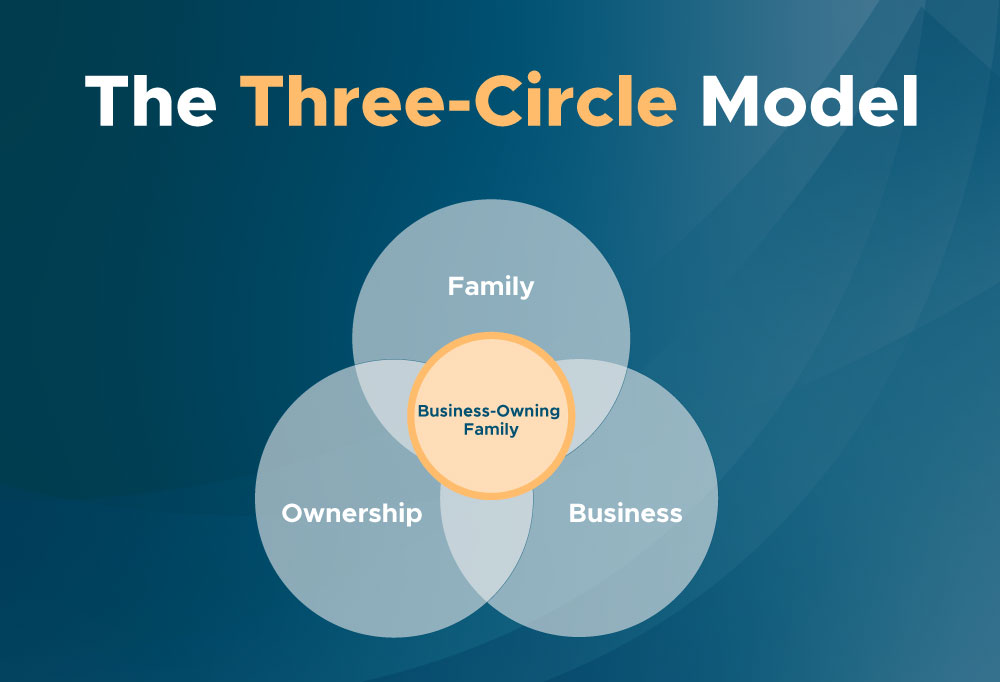

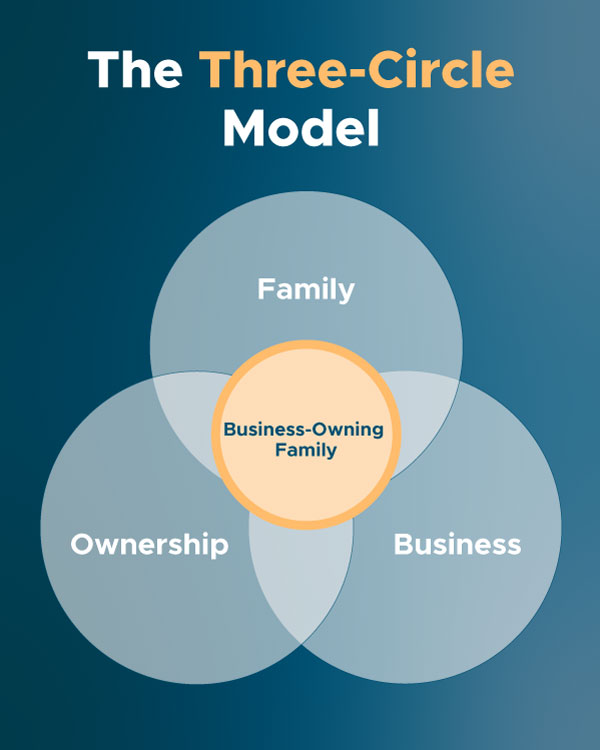

The Three-Circle Model: Business-Owning Families

For families who own an operating business, governance often relies on the Three-Circle Model, which was developed through a Harvard research study. It provides a framework for understanding family businesses by highlighting the overlapping dynamics of:

- Ownership: Rights and responsibilities of shareholders, succession, and transfer of ownership.

- Family: Engagement, communication, and values alignment.

- Business: Management, strategy, and oversight of the enterprise.

Example: In a multigenerational manufacturing company, the Three-Circle Model can help distinguish between family members who are shareholders, those actively employed in the business, and those not directly involved.

Other Models: Families Without Businesses

For HNW and UHNW families without an operating company, other models may be more relevant, such as:

- Family — Assets — Legacy: Focusing on the family’s relationships, the assets they steward, and the long-term legacy they wish to build.

- Family — Wealth — Purpose: Centering on the meaning of wealth, shared goals, and individual as well as collective purpose.

Example: A family may create guidelines for how wealth can be accessed to support education, entrepreneurship, or home ownership, while setting clear expectations around sustainability for future generations.

Whether through the Three-Circle Model or other family governance frameworks, the goal is to clarify the essential components of governance—the structures, roles, and principles that allow families to make decisions together and sustain their wealth across generations.

Why Family Governance Is Important for HNW Families

High-net-worth families often experience increased levels of interdependence and face complex challenges: differences in expectations across generations, diverse financial structures, and competing values. Governance provides:

- A framework for making decisions consistently

- Structures for conflict resolution

- Clarity in succession planning

- A way to align wealth with values and purpose

Example: Without governance, siblings inheriting a vacation property may disagree about usage and expenses. With governance policies in place, expectations are clarified and disputes minimized.

Family Governance Structures & Examples

Family Constitution or Charter

A family constitution documents shared values, vision, decision-making processes, and succession principles. It provides continuity and clarity for future generations.

Example: A constitution might outline how family members can responsibly request funds for personal pursuits—such as education, starting a business, or travel—while maintaining safeguards for preserving wealth long term.

Family Council

A family council serves as a representative body that helps oversee governance, coordinate education, and set family policies.

Example: A family council may establish clear processes for supporting members with career coaching or mentorship opportunities, ensuring fair access without creating entitlement.

Family Assembly

A family assembly includes the broader family, often spanning multiple generations, and provides a forum for communication, connection, and shared visioning.

Example: An annual family assembly may include conversations around evolving definitions of success, discussions on how to balance individual aspirations with collective responsibility, and updates on shared resources.

Family Office

A family office manages not only investments but also facilitates governance, philanthropy, and education. At Cresset, our family office services often include family retreats, rising generation programs, and curated support for navigating wealth.

Example: A family office may design frameworks that help family members access capital for ventures aligned with family values, while maintaining structures that ensure fairness and accountability.

Board of Directors or Advisory Board

For families with businesses, boards add structure and independent oversight, ensuring alignment between family priorities and enterprise strategy.

Succession Planning

Succession planning ensures continuity of leadership, whether for a business, a family office, or shared family initiatives. It involves preparing successors with education, mentorship, and structured opportunities for leadership. When it comes to any succession planning, the process is often more valuable than the policies created. It is important to bring all relevant voices to the table in an authentic yet efficient way.

Example: A family business may invite younger family members to shadow senior leaders before a formal transition, ensuring they feel both prepared and heard. In another case, a family may host structured discussions to align expectations about how leadership roles in family councils or philanthropy committees are chosen.

For complex family enterprises, Cresset partners with trusted experts to guide succession strategy.

Family Governance Policies

Governance policies are the family’s “operating manual.” Common policies include:

- Conflict resolution frameworks

- Family employment standards

- Wealth access guidelines for rising generations

- Education and development requirements

- Financial literacy and career coaching pathways

Example: A policy might establish criteria for family members to request capital for ventures, ensuring that opportunities are accessible while protecting the family’s financial future.

Cresset facilitates the creation of these policies to ensure families operate with fairness and foresight rather than ad hoc decisions.

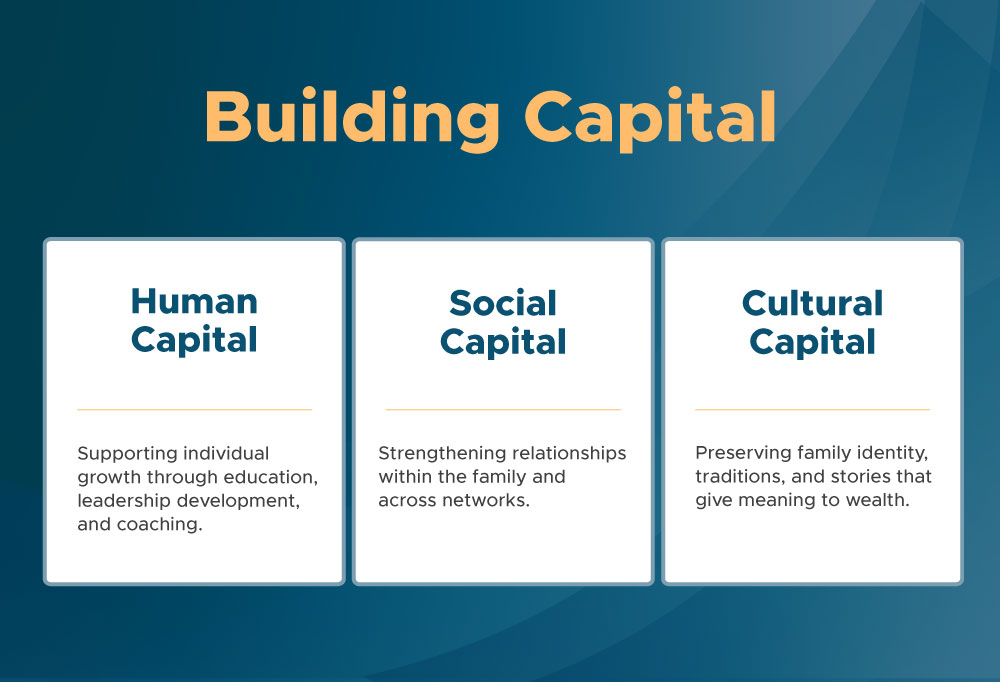

Beyond Structures: Building Human, Social, & Cultural Capital

At Cresset, we believe governance is not only about structures but also about investing in multiple forms of capital:

- Human capital: Supporting individual growth through education, leadership development, and coaching.

- Social capital: Strengthening relationships within the family and across networks

- Cultural capital: Preserving family identity, traditions, and stories that give meaning to wealth.

Example: Families may design mentorship programs where older generations support younger members in defining success or create storytelling traditions to reinforce resilience and identity.

When families cultivate all four types of capital—financial, human, social, and cultural—they create sustainable legacies that extend well beyond money.

Family Governance Consulting

Families often seek guidance to design and implement governance systems. At Cresset, we act as facilitators, educators, and coaches, tailoring governance to each family’s culture and goals. For highly complex needs—such as family business governance or succession tied to ownership—we work with trusted partners to ensure specialized expertise is available.

Example: For a family navigating how to balance individual financial requests with collective goals, we may guide conversations that lead to clear policies, while engaging external experts for technical design when needed.

Case Study: The Johnson Family

The Johnson family illustrates how governance can bring clarity across multiple dimensions. The family includes three siblings who inherited their parents’ small but growing manufacturing business, alongside a family foundation established a generation earlier. Over time, questions emerged: Who should lead the business? How should philanthropic commitments be managed? And how could younger family members access wealth in ways that aligned with their own goals?

Through a structured governance process, the Johnsons created a family constitution that clarified roles in the business, established a family council to oversee philanthropy, and developed guidelines for how family members could request support for education, entrepreneurship, or personal pursuits. Importantly, the family engaged in facilitated conversations about the purpose of their wealth and what a successful life meant to each member. For one, success meant building a career outside of the family enterprise; for another, it meant stewarding the family foundation’s impact; for the youngest, it meant pursuing entrepreneurship with family backing.

By addressing business, philanthropy, and individual purpose in an integrated governance framework, the Johnsons found a path forward that honored their shared legacy while empowering each member to define and pursue their own vision of success.

FAQs About Family Governance

What are the principles of family governance?

The principles of family governance include shared purpose, transparency, fairness, and accountability. These ensure that decisions are made with integrity and clarity.

What is governance in a family office?

Family office governance refers to the structures and processes that guide decision-making around investments, education, philanthropy, and family engagement.

What are the different types of family governance?

Common structures include family constitutions, family councils, assemblies, and advisory boards. Each serves different functions depending on family needs.

What is an example of a governance structure?

A governance structure could be a family council tasked with designing policies for career development and philanthropy participation, or a constitution outlining shared values and conflict resolution processes.

What is family governance consulting?

It is the process of working with experts to design and implement governance frameworks, policies, and education tailored to the unique needs of each family.

What is a governance meeting?

Family governance meetings are structured gatherings where members make collaborative decisions on shared assets, businesses, and values to preserve family unity and ensure the long-term success of their enterprises.

Conclusion

Family governance is not a one-size-fits-all approach. Whether guided by the Three-Circle Model for business-owning families, or frameworks like Family–Assets–Legacy for wealth-only families, governance is about creating clarity, alignment, and shared purpose. When paired with investments in human, social, and cultural capital, governance provides families with the tools to thrive across generations.

At Cresset, we help families navigate governance, education, and philanthropy with a focus on aligning wealth with values and fostering enduring impact. To explore how governance can strengthen your family, schedule a call with our team.

This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact [XYZ] or consult with the professional advisor of their choosing.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.Subscribe to Family Office Insights

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.