Family Office Guide / Understanding Family Office Investment & Wealth Strategy

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.

Managing Director, Head of Wealth Strategy

Managing Director, Head of Wealth Strategy

10 minute read

To efficiently manage your family’s financial health, it’s important to have both an effective investment strategy and a wealth plan in place. In the complex world of wealth management, a family office strategy goes beyond simply selecting investments; instead, it involves a comprehensive approach that aligns with the family’s goals, risk tolerance, and hopes for their legacy. While a family office investment strategy focuses on asset allocation—choosing the right mix of bonds, equities, real estate, and other assets—a family office wealth strategy integrates these decisions with broader financial planning. Both are necessary for growing and preserving wealth, and this holistic approach helps make sure that investment choices align with other long-term objectives like estate planning and tax efficiency.

Below, we will discuss in detail the differences between an investment strategy and a wealth strategy and the ways in which they complement one another. By combining the technical aspects of investment management with personalized wealth planning, a family office may offer the solution you need to safeguard and enhance your family’s wealth over time.

The ultimate goal of a family office is to preserve wealth across generations while simultaneously seeking opportunities for growth. A family office investment strategy is just one aspect of a broader wealth management plan to achieve that goal. Because the primary focus of a family office is to provide holistic, integrated wealth management services, a family office investment strategy will take a similar approach, prioritizing the family’s long-term goals alongside their values and preferred level of risk.

Family office investment strategies will vary depending on the goals of the family, but across the board, strategies will be goals-based and customized to suit the family’s needs, values, and financial situation, ranging from conservative income-generating investments to more aggressive growth strategies.

What sets family office investing apart is their specific, customized approach. Like family office wealth management services overall, family office portfolio management should be comprehensive and flexible, with assets strategically allocated to achieve the family’s investment goals.

You may have heard the term “strategic asset allocation,” but what does it actually mean for your investment portfolio? In brief, strategic asset allocation refers to the deliberate and long-term distribution of investments across asset classes. This distribution serves to efficiently grow wealth, but does so while adhering to the family’s unique financial goals, risk tolerance, and investment horizon. The diversified asset classes serve distinct purposes, including:

In addition to the above asset classes, a family office may also allocate a portion of the portfolio to alternative investments, such as hedge funds, commodities, or infrastructure. Each investment is chosen specifically to further diversify the portfolio and enhance potential growth.

A family office will employ a combination of in-house professionals, external partnerships, thorough research, and input from the family to make investment decisions. Often, a chief investment officer will work with an investment committee, which will include both financial professionals and members of the family. A hallmark of the family office is that the family maintains control with guidance from a knowledgeable team, so including family members in investment decisions supports that ethos.

Above, we have covered the general direction that the investment portfolio will take, with assets strategically and diversely allocated. Many investments, such as private companies or real estate, will be managed directly by the family office. For specialized asset classes, a family office may allocate capital to external asset managers, private equity firms, hedge funds, or other investment vehicles. However, family offices tend to prioritize direct investments. Not only do they provide greater levels of control, they can also be a better value financially, since direct investments allow the family office to negotiate the terms, investment structures, and valuations.

In summary, family office investing works because family offices leverage their unique combination of internal expertise, external partnerships, and family involvement to tailor investment strategies, ensuring both control and growth while capitalizing on exclusive opportunities through their expansive networks.

If you decide to work with a family office investment manager, you will gain access to a comprehensive suite of services. These services will include, but may not be limited to:

Each of these services are designed to both preserve and grow your family’s wealth in both the short term and across generations. An investment manager will work alongside you and the rest of the family office team, offering personalized guidance and aligning investment strategies to your family’s goals and existing finances. They will act as a trusted advisor, handling all of the complexities that come with managing a diverse investment portfolio while providing transparency, communication, and flexibility. Even with a trusted ally in your investment manager, the family should stay at the center of the decision-making process.

While they may seem synonymous, your wealth strategy differs from your investment strategy, and it is important to understand both as you plan your financial future. A wealth strategy is an approach to managing your wealth that encompasses all aspects of a family’s financial life, and is therefore more broad than an investment strategy. A wealth strategy zooms out to view the larger picture, including tax optimization, estate planning, and generational wealth transfer, in addition to the investment strategy.

A wealth plan is a detailed roadmap that specifically outlines how a family will grow, manage, and protect their financial resources long-term. A family office wealth plan will integrate a variety of elements, including estate and trust planning, retirement goals, tax optimization, and more for a holistic approach to wealth management. A key component is a wealth investment plan, which, as described in greater detail above, will focus on strategic asset allocation to achieve financial growth. But the wealth plan goes beyond investing, providing a tailored, comprehensive approach to growing wealth.

A family office wealth strategy will be comprehensive, integrated, and bespoke. Armed with in-depth knowledge of every aspect of your family’s values and financial health, a family office will develop a wealth plan that is uniquely efficient for you and your family.

A variety of family wealth strategies might be employed by a family office in order to effectively manage and grow their clients’ assets. These will include:

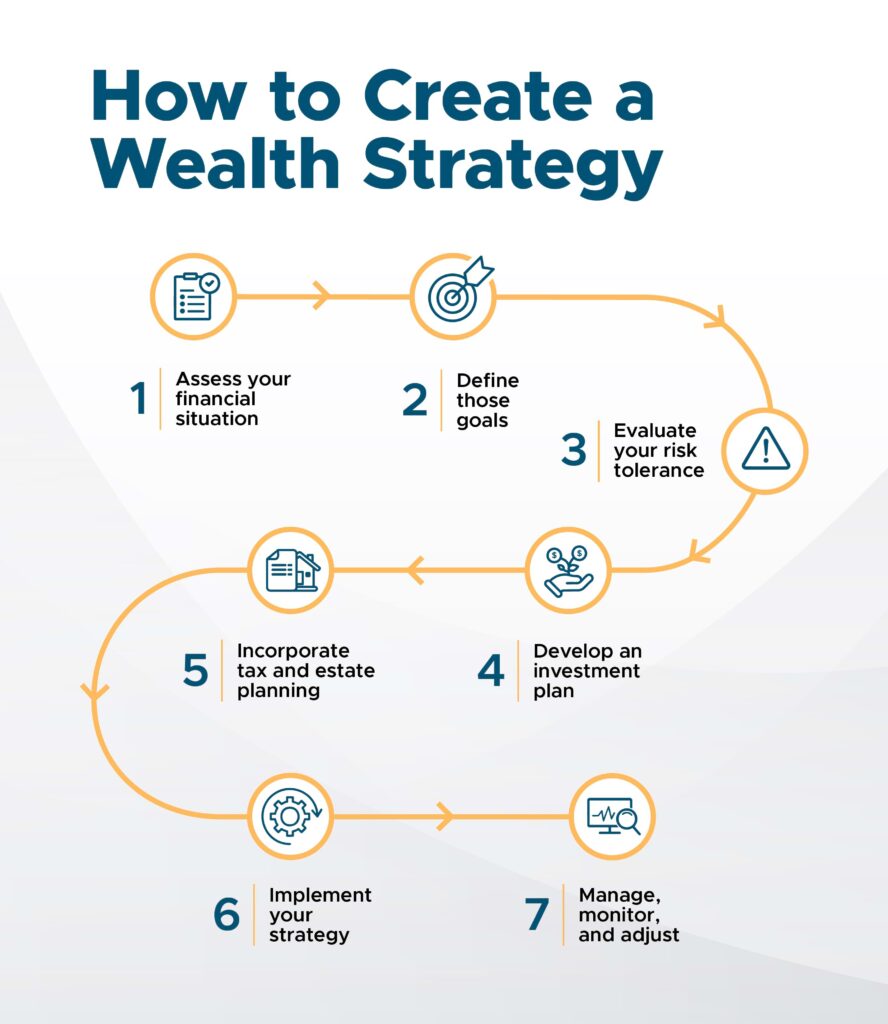

To create a wealth strategy, you will want to begin by working through the following steps alongside your wealth management team:

1. First, assess your financial situation. A detailed understanding of your current assets, liabilities, income, expenses, and existing investments will help you start with a clear picture and consider your goals.

2. Next, define those goals. Identify both short and long-term goals which reflect your values, lifestyle aspirations, and hopes for your family legacy.

3. Evaluate your risk tolerance. Before establishing an investment portfolio, you’ll need to establish your comfort level with market volatility and potential losses.

4. Develop an investment plan. Once your risk appetite is established, you can move on to creating a diverse portfolio with strategically allocated assets.

5. Incorporate tax and estate planning. A wealth strategy involves more than just investing, and employing strategies for efficiently minimizing taxes and transferring wealth across generations will go a long way towards achieving your wealth goals.

6. Implement your strategy. Implementation will involve making investments, establishing necessary legal structures, and establishing processes for ongoing management.

7. Manage, monitor, and adjust. Your team will manage your wealth plans according to your specifications, all while monitoring its efficacy and adjusting as needed. Clear lines of communication from your wealth management team are a necessity at this stage.

While these steps may feel daunting, a wealth planning strategist can use their professional experience and expertise to simplify the process and guide you through each stage.

It is one thing to know what services may be included in a family office wealth strategy, but it is another to understand how using those services will impact you and your family. Working alongside a wealth planning strategist will not only grow your wealth, it will ease the burden of day-to-day wealth management. A wealth advisor will understand your family’s intricate financial landscape and develop a comprehensive wealth management plan to support existing finances and aspirations beyond just investment management.

One crucial element of any wealth strategy is tax optimization and planning. These services help navigate the complex world of tax law to reduce tax impact overall, ensuring that your family retains as much wealth as possible. Part of reducing that tax impact is estate planning, which ensures efficient wealth transfer across generations. A wealth strategist will help you understand the many estate and trust options available so that you make the most effective choices for your circumstances and family. Many strategists also incorporate philanthropic giving, which can further strengthen the family’s legacy.

For clients, using these services means engaging in a highly personalized and hands-on process. The wealth strategist works with you and your advisor to create and coordinate all aspects of the wealth management plan, but does so alongside the family, so that they are benefited by the professional’s expertise, but never left out of the decision-making process. This approach not only simplifies managing family wealth by including all processes under one roof but maintains the family’s control over their own finances.

Understanding the difference between family office investment strategies and wealth strategies can help you effectively grow, manage, and preserve your wealth across generations. If you find yourself wondering whether you need a wealth plan or an investment strategy, it is important to remember that everyone can benefit from professional expertise when it comes to navigating the intricacies of investing and wealth management.

A family office’s holistic approach can help you maximize your financial growth and make sure that your family’s legacy is protected and passed down with care. If you are not sure what wealth and investment strategies might be right for you, set up a call with one of our founders today to discuss how your family can benefit from the guidance and support of a family office.

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.