Family Office Guide / 2025 Year-End Tax Planning: Checklist & Tips

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.

Director, Tax Manager

Director, Tax Manager

8 minute read

As 2025 draws to a close, investors and business owners face a shifting landscape shaped by inflation normalization, higher interest rates, and the implementation of the recently enacted One Big Beautiful Bill Act (OBBBA), which extends or modifies many provisions of the Tax Cuts and Jobs Act (TCJA) that were previously scheduled to expire after 2025. Several tax thresholds, including retirement plan contribution limits, gifting exclusions, and income tax brackets, have been adjusted for inflation this year, creating fresh planning opportunities and considerations.

While year-end tax planning is always important, the current dynamic economic environment makes it particularly timely to review your financial plan with your advisor. It is important to focus on key tax provisions that could affect your situation before they potentially change. This checklist is designed for high-net-worth and ultra-high-net-worth individuals, business owners, corporate executives, retirees, and multigenerational families who want to ensure a coordinated and tax-efficient end to the year.

Please reach out to your advisor, who will work with our tax and planning specialists and external advisors, to discuss any of these topics in more detail.

Inflation adjustments in 2025 have increased a number of key thresholds, including the standard deduction, marginal income tax brackets, retirement plan contribution limits, and the annual gift tax exclusion. Additionally, the lifetime federal estate and gift tax exemption, which is currently at a historic high, is $13,990,000 per individual in 2025 and, under the OBBBA, will increase to $15,000,000 per individual ($30,000,000 for married couples) beginning in 2026 with no scheduled sunset (subject to future legislation and inflation adjustments).

Understanding these updated amounts helps clarify how much you can save, gift, deduct, or strategically recognize in income before year-end. Reviewing these figures with your advisor ensures your tax and estate strategy remains aligned with your broader goals, particularly in a potentially changing tax-law environment.

These updated limits also influence decisions around charitable giving, Roth conversions, retirement plan contributions, funding trusts or 529 plans, and accelerating or deferring income.

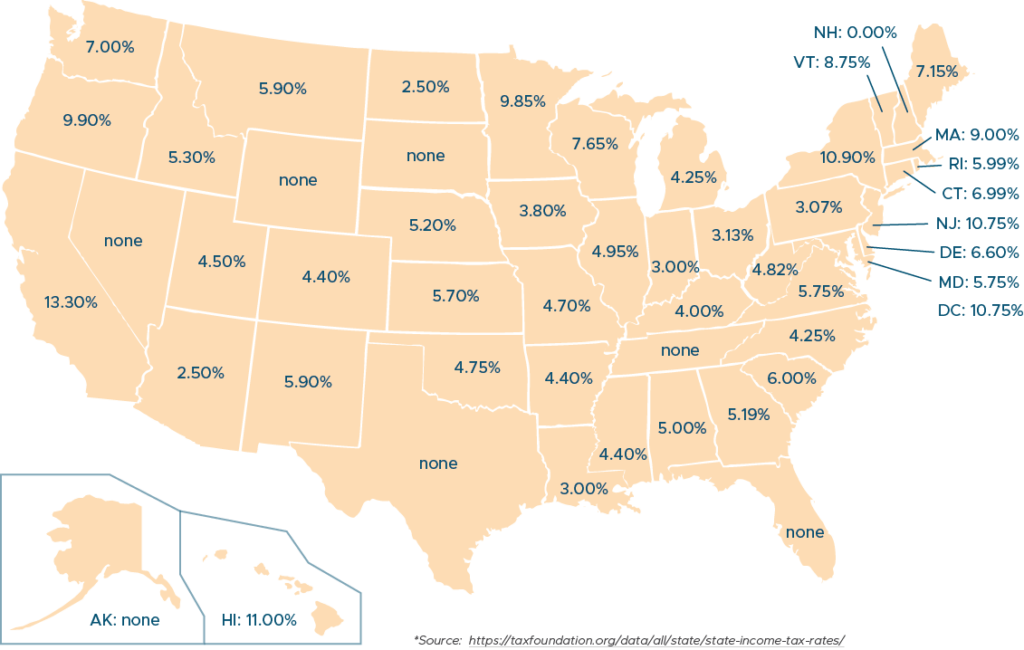

State income tax rates continue to diverge widely across the U.S., with top marginal rates ranging from zero in several no-income-tax states to more than 13% in higher-tax jurisdictions. For families with multistate residences, business operations, or trust structures, understanding state-by-state differences is critical to effective planning.

Relocation trends, remote-work flexibility, and shifting business footprints mean your state tax exposure may not be static. Whether you are considering domicile planning, timing income recognition, launching or relocating a business, or structuring a trust, state-level tax rates can have a meaningful impact on long-term after-tax wealth.

This is not an exhaustive or comprehensive list of tax items to consider, but is meant to prompt a discussion with a professional tax advisor to determine how any of these would apply to your particular facts. Circumstances and other issues not disclosed here may also apply to you and your family’s personal situation.

1. Tax-loss harvesting, avoiding the wash-sale rule: Recognizing capital losses is a common way to lower your current year tax bill. However, if you do not time this carefully or purchase the wrong assets, the wash sale rule could prohibit a loss from being recognized.

2. Year-end mutual fund distributions: Mutual funds announce capital gains to be distributed to shareholders at year-end. If you rebalance your portfolio at year-end, this can be problematic.

3. Review state Pass-Through Entity Tax (PTET) elections: Many states allow partnerships and S corporations to elect to pay state income tax at the entity level, generating a federal deduction that is not subject to the individual SALT deduction cap. Review whether a PTET election has been made for 2025, confirm that required estimated payments have been made, and model with your CPA whether making elections for 2025 and 2026 is beneficial in light of the new $40,000 SALT cap and its income-based phase-out for higher income taxpayers.

4. Small business owners/self-employed individuals: SEP IRAs, tax deductible contributions up to the lesser of 25% of eligible compensation or $70,000 for 2025.

5. Small business owners/self-employed individuals: Defined benefit plans, maximum annual retirement benefit of up to the lesser of $280,000 or 100% of highest average compensation over a consecutive three (3) year period for 2025.

6. Retirement account contributions: You may contribute $23,500 to an employer sponsored 401(k), 403(b), most 457 plans and the government’s Thrift Savings Plan ($ 31,000 if over 50). In addition, for 2025 certain plans must permit a higher “super catch-up” contribution for individuals age 60–63, which can increase the total elective deferral limit to $34,750, subject to plan design. You may also contribute $7,000 to an Individual Retirement Account (IRA), or $8,000 if you are over the age of 50.

7. Required minimum distributions (RMDs): Beginning in 2023, the SECURE 2.0 ACT raised the age that you must begin taking RMDs to age 73. If you reach age 73 in 2025, you must take your first RMD on April 1, 2026.

8. Review RMDs for inherited IRAs under 2025 rules: Confirm that 2025 RMDs have been taken not only from your own IRAs and employer plans, but also from any inherited IRAs. Identify which beneficiaries are subject to SECURE Act 10-year “clean-out” rules versus life-expectancy payouts, and whether the original owner died before or after their required beginning date, to ensure any required 2025 distributions are not missed.

9. Consider Qualified Charitable Distributions (QCDs): For IRA owners or beneficiaries age 70½ or older, evaluate using QCDs to direct some or all of their IRA RMDs to charity so the amount is excluded from income while still satisfying the RMD, coordinating this with overall charitable giving and income-tax planning.

10. Roth IRA conversion: It might make sense to convert all or a part of your eligible retirement account, such as a 401(k), traditional IRA, or other non-Roth account, to a Roth IRA before year-end. Caveat, this is very specific to the unique circumstances for each IRA owner and hinges mainly upon what expectations are for tax rates in the future.

11. Equity-based compensation (RSUs/PSUs vs. options) and AMT: For RSUs and PSUs, confirm year-end vesting events, share delivery, and whether withholding will be sufficient to cover the ordinary-income inclusion. For stock options, separately evaluate whether to exercise vested nonqualified stock options (NSOs) and incentive stock options (ISOs) before year-end, modeling the ordinary-income impact of NSO exercises and potential alternative minimum tax (AMT) from ISO exercises and coordinating any exercises with projected income levels, tax brackets, and anticipated liquidity events.

12. Charitable giving, adjusted gross income limitations on deductions:

13. Annual exclusion gifting/paying directly for education/health care: You can give $19,000 each calendar year to as many people as you like without paying any gift tax or utilizing any of your lifetime exclusion amount (be careful not to over-gift if you are relying on Crummey Powers to fund life insurance policy premiums within an insurance trust). You can also pay education and health care expenses directly to the provider on behalf of beneficiaries without the payment being considered a taxable gift.

14. Accelerate charitable giving into 2025: The One Big Beautiful Bill Act (OBBBA) introduces new limits on charitable deductions for contributions made on or after January 1, 2026. As a result, a charitable gift made in 2025 will generally yield a larger tax benefit for top bracket taxpayers than the same gift made in 2026. To maximize your deduction, consider accelerating any planned 2026 contributions into 2025. Funding a DAF can provide flexibility to make the gift now and decide on recipients later.

15. Funding section 529 plans: You can contribute up to $19,000 per year per beneficiary to a 529 account without it being considered a taxable gift and may accelerate up to five years of contributions into a single year (for a total contribution of $95,000 per individual or $190,000 per married couple). 529 plan funds may now also be used to pay up to $10,000 for elementary and secondary school expenses.

Under certain circumstances, 529 accounts can be used to fund up to a lifetime limit of $35,000 in a Roth IRA (subject to annual Roth IRA contribution limits). Section 529A allows individuals with disabilities and their families a tax-advantaged way to save money for disability-related expenses using Achieving a Better Life Experience (ABLE) accounts (also called 529A accounts). Caveat, many states have not conformed their state tax laws with this specific change in federal income tax laws, resulting in a state income tax liability for utilizing 529 plans to cover elementary and secondary school expenses, i.e., specifically classifying them as a “non-qualifying” withdrawal, [e.g., there would be a 2.5% penalty tax for such withdrawal in the State of California].

As you evaluate your year-end tax planning strategy, consider focusing on the following must-do items for 2025:

As always, we recommend consulting your Cresset advisor and professional tax counsel to tailor these strategies to your individual circumstances.

What are the 5 Ds of tax planning?

Commonly referenced in proactive tax strategy, the “5 Ds” include Deduct, Defer, Divide, Distribute, and Dodge (legally avoiding unnecessary taxes through compliant planning). These principles guide strategies such as deferring income, accelerating deductions, splitting income among family members or entities, timing distributions, and utilizing exemptions and credits.

How can I prepare for year-end taxes?

Gather income records, review realized gains and losses, project your year-end tax liability, confirm withholding and estimated payments, evaluate retirement contributions, update charitable giving plans, and meet with your advisor to finalize strategies before December 31.

What do I need to do at the end of the tax year?

Review capital gains, RMDs, retirement contributions, gifting opportunities, business deductions, state tax exposure, insurance coverage, trust funding, and major life changes. Ensure all documents—including beneficiary designations—reflect your current intentions.

What are the biggest tax mistakes people make?

Frequent mistakes include missing RMDs, triggering wash sales, underutilizing retirement plans, overlooking state residency rules, failing to document charitable contributions, not planning for mutual fund distributions, and delaying estate or trust updates.

What if I’m close to the estate-tax exemption threshold—should I gift now or wait?

With the federal lifetime estate and gift tax exemption at $13,990,000 per person in 2025 and scheduled under the OBBBA to increase to $15,000,000 per person ($30,000,000 for married couples) beginning in 2026, , many clients near the threshold may benefit from making strategic gifts in order to remove future appreciation from their estates and hedge against the risk of future legislation reducing the exemption. . The optimal strategy depends on liquidity needs, asset type, state tax exposure, and family planning objectives.

How do wash-sale rules apply if I use tax-loss harvesting across taxable and retirement accounts?

Wash-sale rules apply across all accounts under your control, including IRAs, Roth IRAs, and taxable accounts. If substantially identical securities are purchased within 30 days before or after a sale at a loss, the deduction may be disallowed.

Does contributing to a donor-advised fund or private foundation affect my long-term estate plan?

Yes. Contributions remove assets from your taxable estate and can support multigenerational philanthropic planning. A DAF provides flexibility and simplicity, while a private foundation can offer additional control but adds governance requirements.

How often should I update my trust/titles and beneficiary designations?

Review annually and following any major life event (marriage, divorce, birth, death, liquidity event, business sale, or relocation). Even well-drafted documents can misalign with current intentions if titles or beneficiaries remain outdated.

Should I consider insurance or asset-protection trusts as part of year-end planning?

For families facing estate tax exposure, business risks, or succession planning needs, insurance trusts or domestic asset-protection structures may be appropriate. These strategies require careful implementation and coordination with your advisory team.

What are the most important tips related to the One Big Beautiful Bill Act?

Key considerations include accelerating charitable gifts into 2025, evaluating whether income should be recognized before 2026, and reviewing business deductions that may be limited under the new rules. Early planning maximizes flexibility before the new restrictions begin.

What is the impact of the new $40,000 SALT cap?

The increased cap may offer additional deduction opportunities for taxpayers in high-tax states but will still be insufficient to fully offset property and income taxes for many UHNW families. The new enhanced SALT cap is subject to phaseout limitations for taxpayers with adjusted gross income exceeding $500,000. Modeling your adjusted gross income and itemized deductions is essential.

Are there any special considerations for family members?

Yes, consider annual exclusion gifting, 529 plan funding, family limited partnership strategies, and ensuring healthcare/education payments are made directly. Families should also revisit guardianship and trust provisions as circumstances evolve.

Do digital assets impact my year-end tax planning strategy?

Digital asset transactions—including cryptocurrency sales, staking rewards, and NFT dispositions—are taxable events. Proper documentation, loss harvesting, and wallet security practices should be reviewed before year-end Additional, many digital assets are exempt from the wash sale rules under current IRS guidance. Taxpayers should consult their tax advisor before implementing any sale and subsequent repurchase strategy of their digital assets.

What should I know about foreign business interests in tax planning?

Ownership of foreign entities may require additional reporting (Forms 5471, 8938, FBAR), unique tax treatment under GILTI (now known as NCTI) and Subpart F rules, and careful coordination with local counsel. Year-end is an ideal time to confirm compliance and identify planning opportunities.

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.