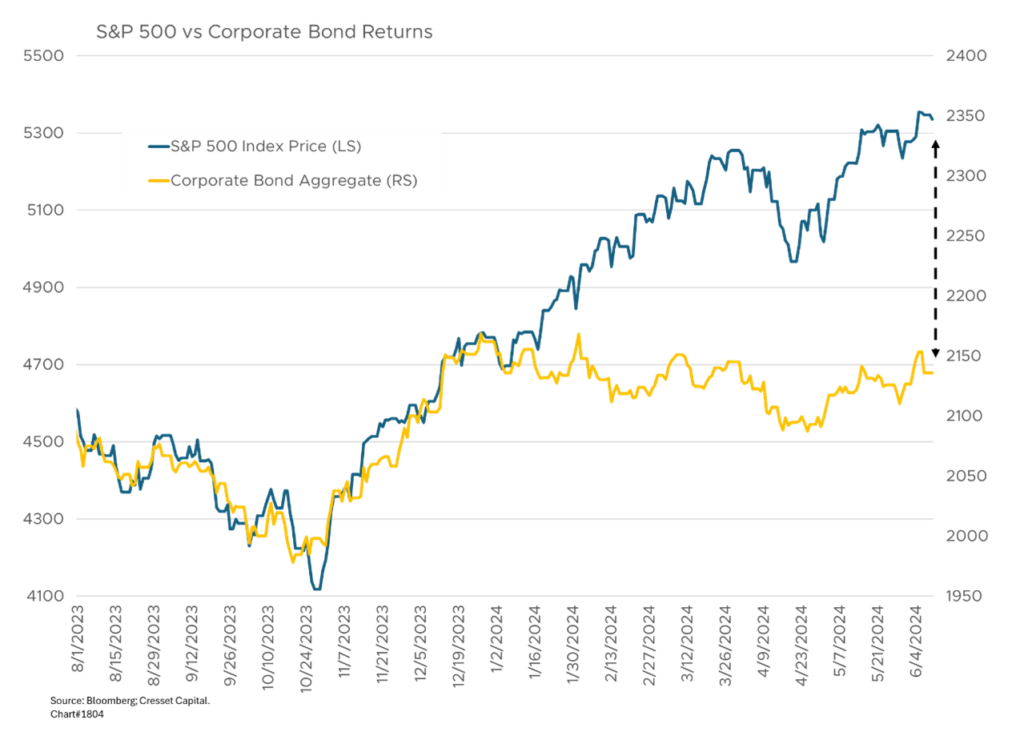

6.12.2024 The monetary narrative has boomeranged over the last six months. Last October, stock and bond investors excitedly anticipated a long-awaited Fed easing program this year in response to slowing inflation and conciliatory signals from Fed Chairman Jay Powell. Starting in 2022, the Fed embarked on its most aggressive rate-tightening program in over 40 years, hiking overnight rates to their highest level since 2001. Borrowing grew expensive, straining corporate and personal income statements. The ebbing tide of inflation last year was greeted by a collective sign of relief. The S&P, which had gained 10 per cent through October, surged an additional 15 per cent over the last two months of the year. The move was fueled by a sudden interest rate reversal. The benchmark 10-year Treasury yield plunged 120bps, driving bond prices skyward in sympathy with stocks. By early 2024, however, the febrile forecast faded in response to surprisingly strong inflation and job readings. The news suddenly staunched the bond rally – yet equities marched higher, in defiance of the Fed.

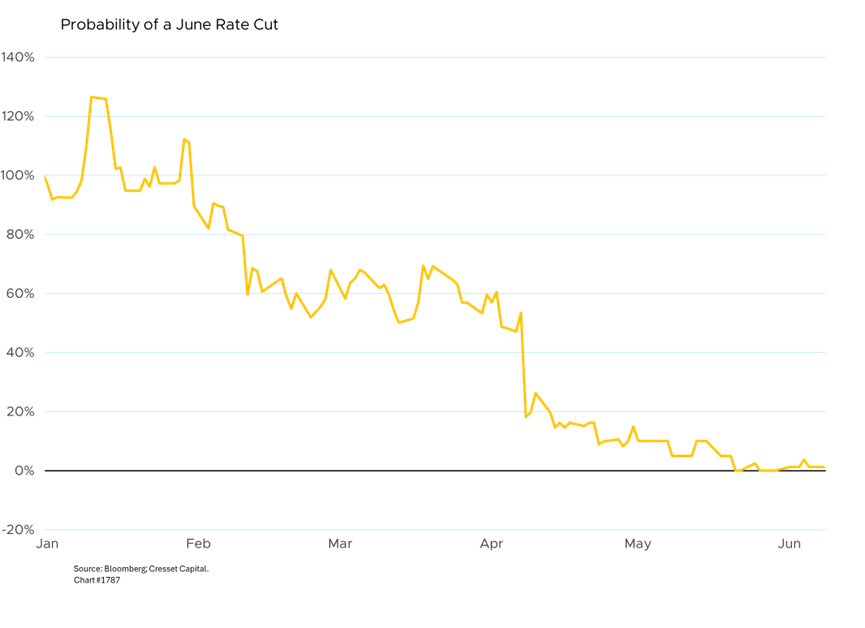

Fed funds futures trading exemplified the enthusiasm going into 2024. The likelihood of a June rate cut was a virtual lock at the outset of the year. In fact, its probability spiked to over 120 per cent, suggesting a probable March rate cut was in the works too. But the optimism quickly reversed: thanks to a series of stronger-than-expected inflation readings on top of a bevy of strong job reports, the chance of a June rate cut evaporated. Undaunted by the possibility of interest rates remaining higher for longer than expected, US large caps continued their advance, led by mega-cap technology names, gaining more than 10 per cent in the first quarter.

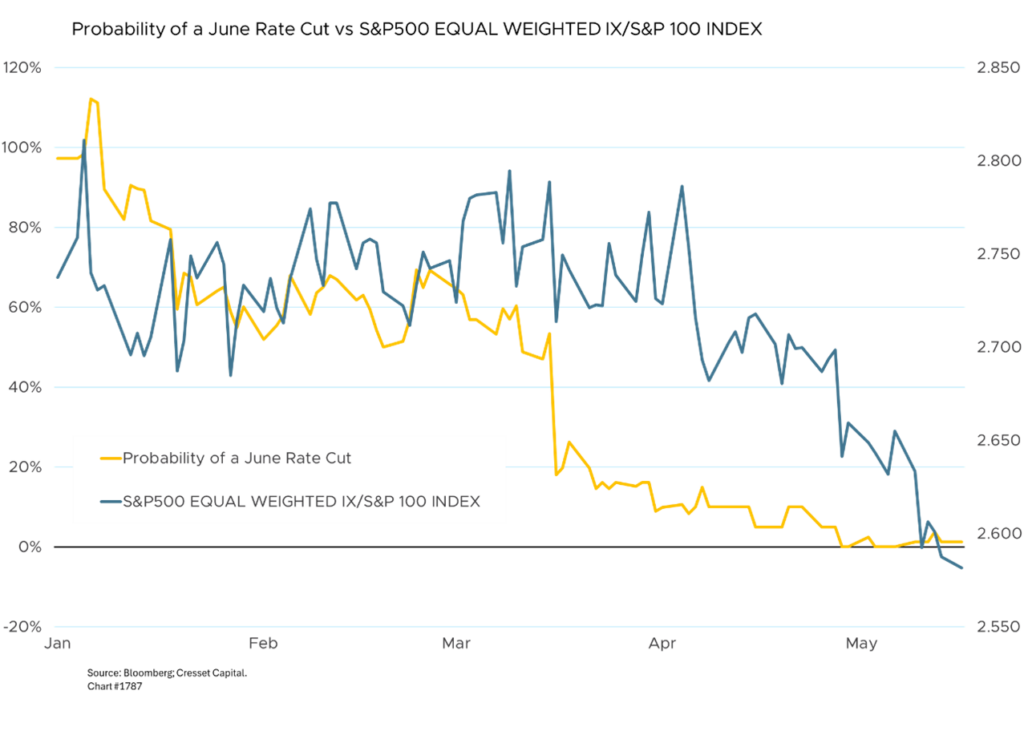

While large cap equities appeared to be shrugging off the Fed, beneath the surface investors were dancing to the monetary maestro’s syncopation. The average stock in the market underperformed the largest names by moving in lockstep with the likelihood of rate cuts, arguably because smaller companies have less access to capital than the mega caps. Smaller companies would disproportionately benefit from lower financing costs.

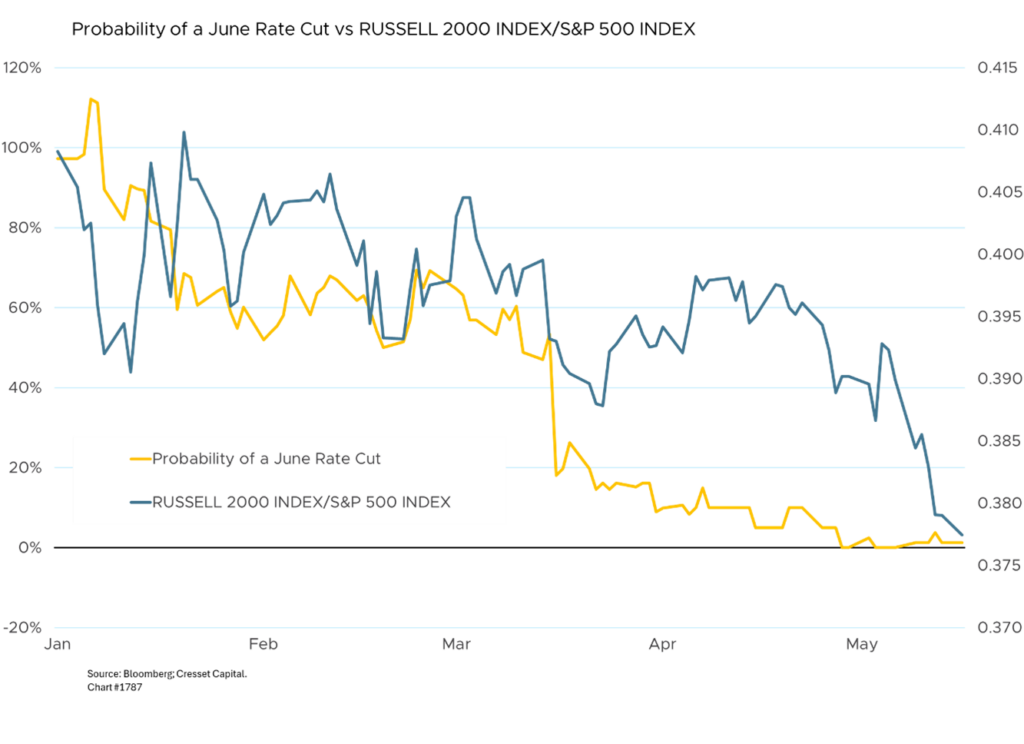

The same pattern emerges between the S&P 500 and the Russell 2000 Index of small cap stocks.

Bottom Line: On the surface, it appears that equity investors are shrugging off the Fed, given the divergence between bond and stock returns earlier this year. We don’t believe that’s true. We note that most of the stock market’s upward thrust has been powered by mega-cap technology companies engaged in AI. That sector, given its constituents’ size, balance sheet strength, and cash generating ability, are fundamentally impervious to variations in overnight interest rates, so the divergence is understandable. Underneath the surface, however, rates do matter, as evidenced by the outperformance of the largest 100 names in the S&P over the average stock in the Index as well as the relative performance between large caps and small caps. We expect those trends to continue and reverse once the investment community senses impending rate cuts. For now, we expect size and quality to outperform.