Key Observations:

- Hiring has slowed significantly since the pandemic rebound, but layoffs remain low

- Fewer openings and more competition for recent college graduates

- The US employment picture remains robust by historical standards

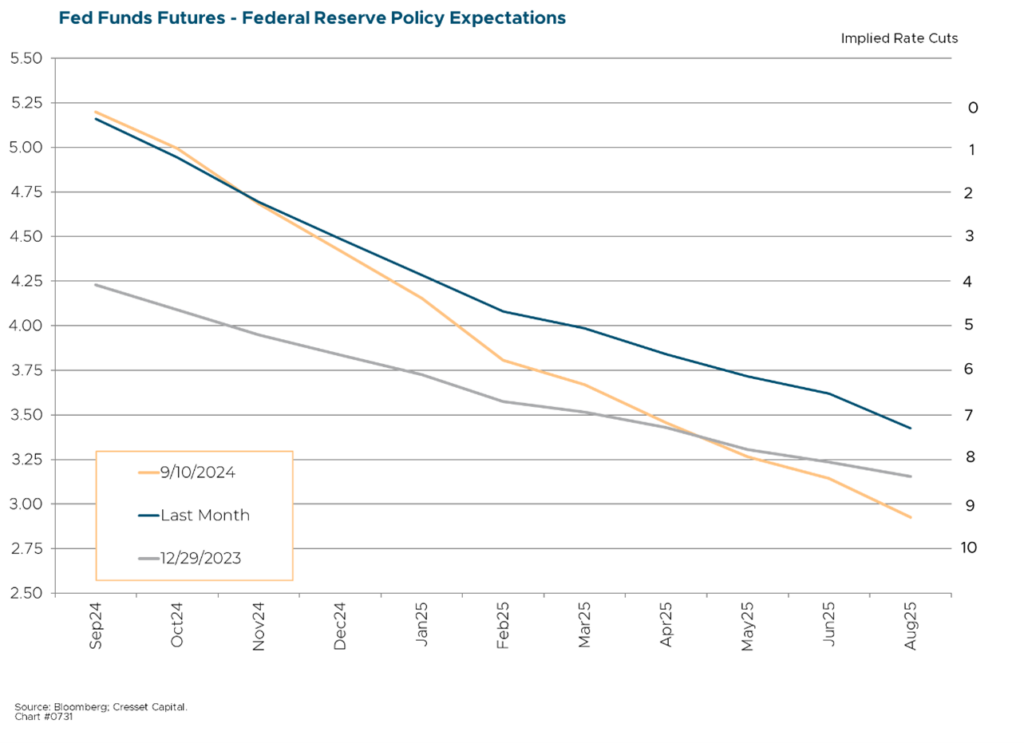

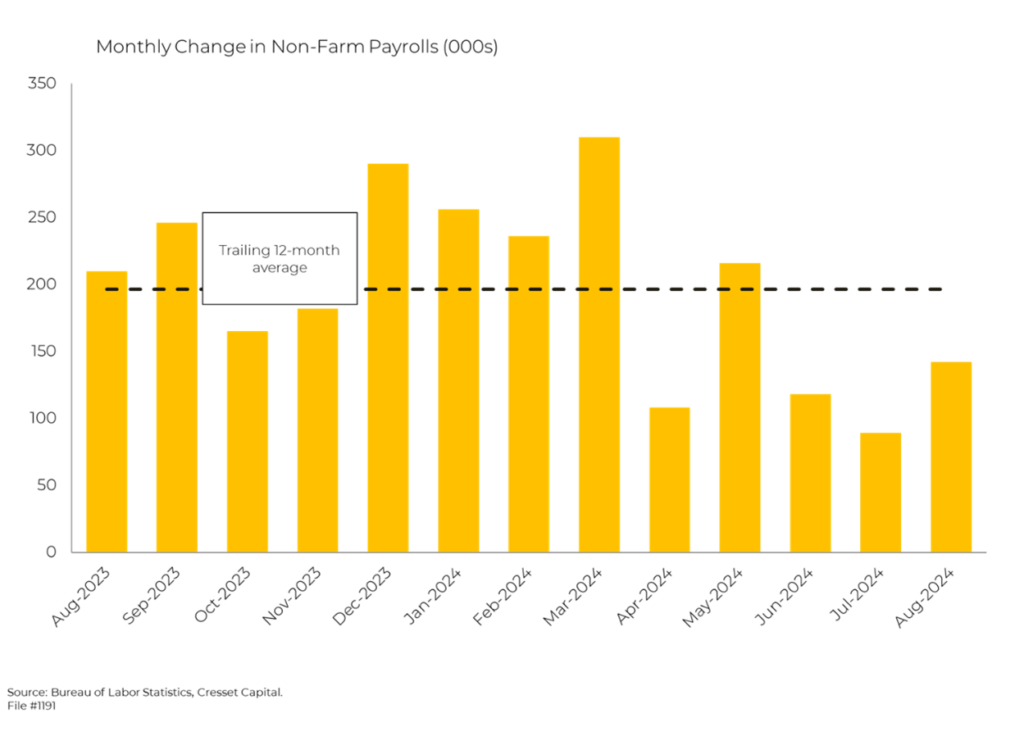

Last Friday’s US jobs report offered investors mixed signals about the labor market and the economy. Employers added 142,000 jobs in August, below expectations of 165,000. The previous two months were revised down significantly. Job growth has been below its 12-month moving average in four of the last five months. The unemployment rate, which ticked down to 4.2 per cent, alleviated some concerns, while wage growth came in higher than expected at 0.4% for the month. Meanwhile, job gains were concentrated in leisure/hospitality, construction, and healthcare, reflecting strength in services, while goods-producing manufacturing and the retail segment lost jobs. What does this imply for the pace of incipient monetary easing?

Labor Market Cooler, but not Cold

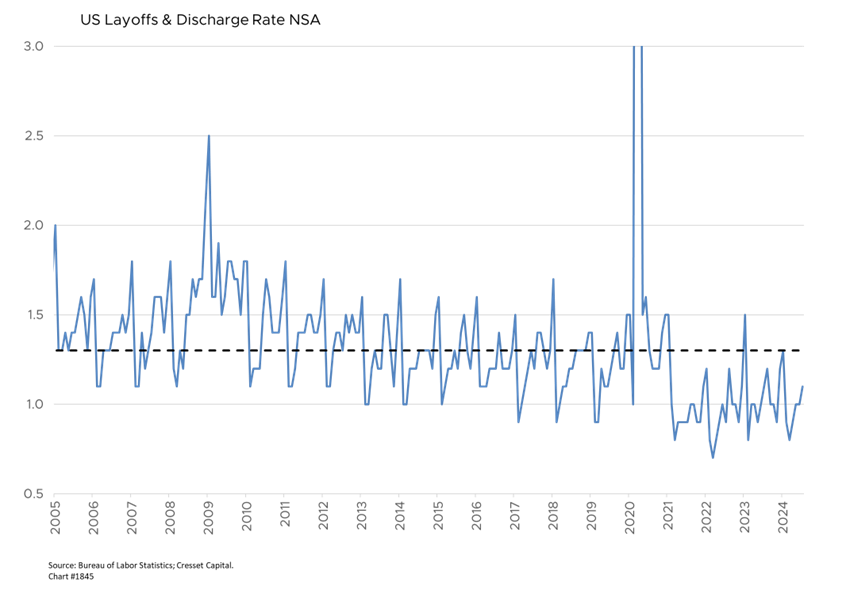

The labor market appears to be cooling but not collapsing. While hiring has slowed significantly from its post-pandemic pace, layoffs remain low. That could be reversing, however. According to a report from outplacement firm Challenger, Gray & Christmas, announcements of job cuts rose 193 per cent month on month in August. This could be a leading indicator of future layoffs, but for now the layoff rate remains near record lows, according to the Bureau of Labor Statistics.

Recent college graduates are facing a tougher job market compared to a year or two ago, with fewer openings and more competition. A spring survey by the National Association of Colleges and Employers found that hiring projections for the 2024 graduating class were below the previous year’s levels. The pace of hiring in professional and business services, a common destination for many young graduates, has decreased in recent months.

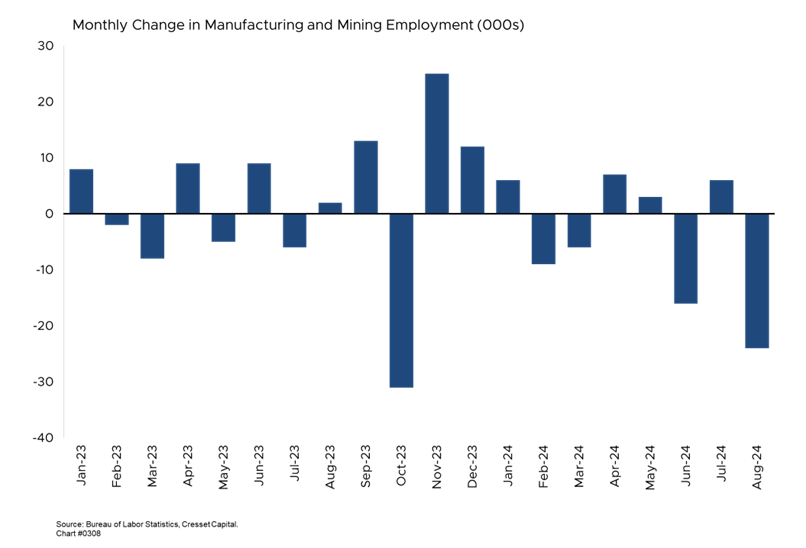

Other grey clouds include manufacturing, where job growth has stalled, possibly due to high interest rates and a strong dollar hurting exports. This year has witnessed a net decline in manufacturing jobs, punctuated by a stunning 24,000 net reductions last month, as goods spending has been flat this year.

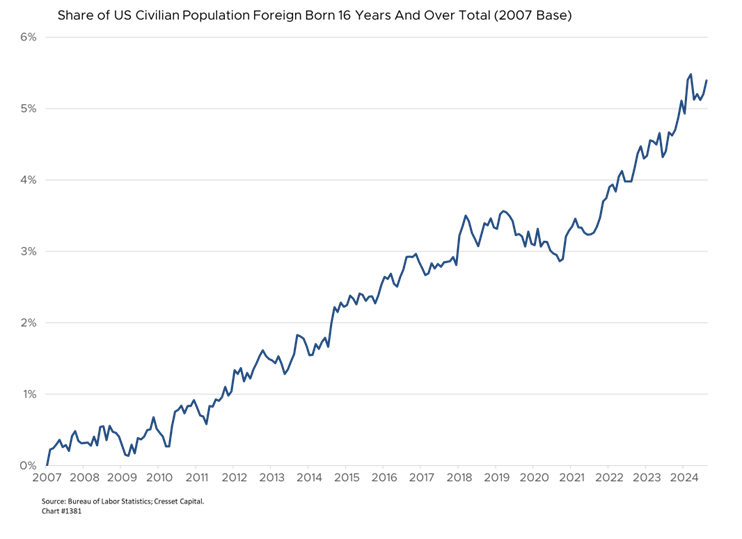

Immigration Has Been a Tailwind for the Labor Force

Immigration has also been a tailwind. It has significantly boosted the US labor force in recent years, helping to ease labor shortages in some sectors. It is estimated that immigration, both legal and illegal, added about five million people to the labor force over the last 12 months. Since the end of 2020, net migration to the US has exceeded nine million people. Immigrants tend to participate in the workforce at a higher rate than US-born Americans: 68 per cent of working-age immigrants either employed or looking for work, while 62 per cent of US-born, working-age Americans are engaged in the workforce.

Bottom Line:

Notwithstanding the arm flapping around last week’s employment report, the US employment picture remains robust by historical standards. Recent reports, however, depict a labor market that is gradually cooling after a period of exceptional strength. While this presents challenges for policymakers trying to achieve a “soft landing”, current conditions appear solid enough to justify a slow and steady approach to monetary easing. For that reason, we expect Powell & Company to cut 25bps later this month.