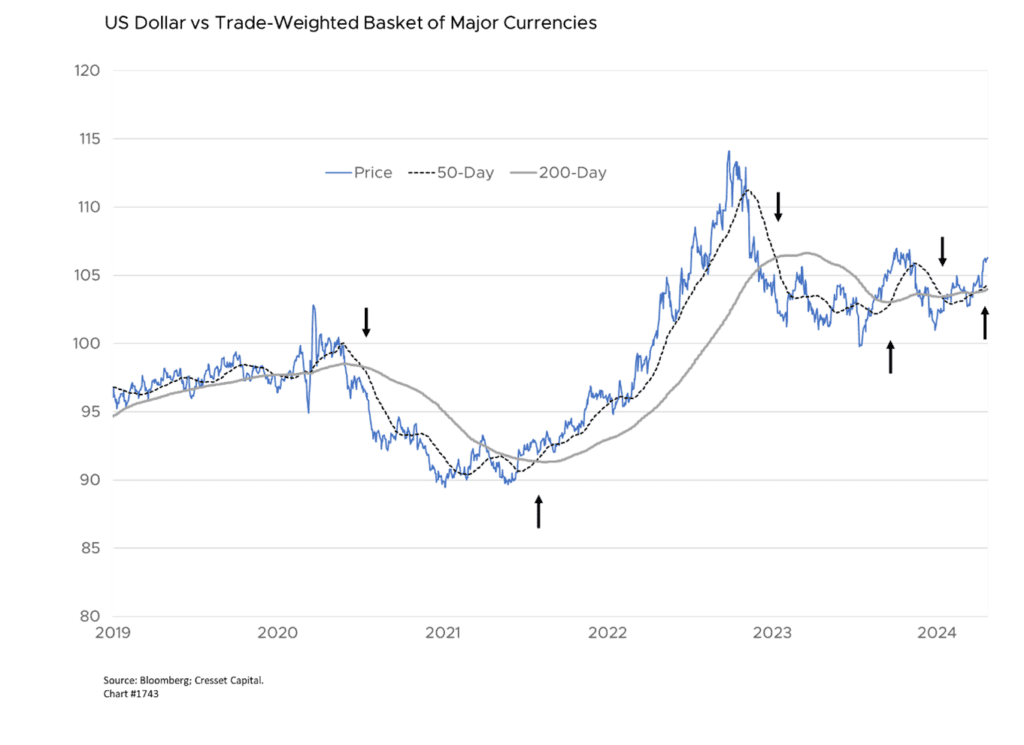

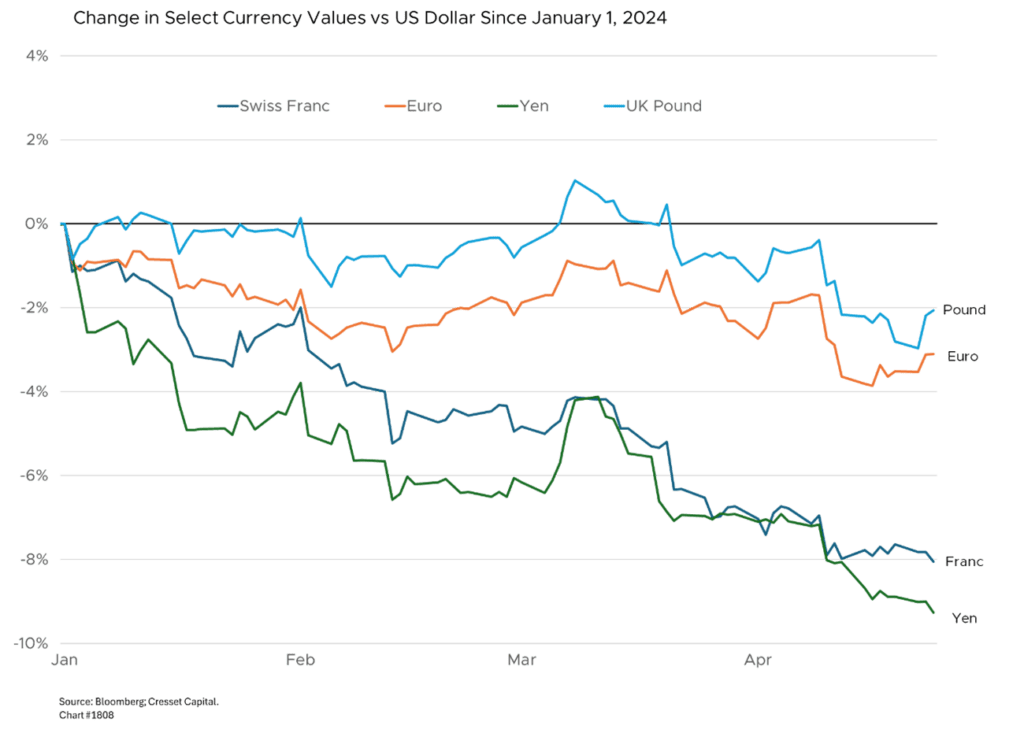

4.25.2024 The US dollar continues to climb: since the beginning of 2021, it has gained 18 per cent in value against its major trading currencies. The dollar just hit a 34-year high against the Japanese yen, which is trading around 154 yen/dollar. The greenback owes its strength to a resilient US economy and higher-for-longer Fed policy. The surprising strength of the dollar has significant implications for global financial markets, particularly in Asia and Europe where central banks are grappling with the challenge of managing their currencies and monetary policies in response to the dollar’s strength and its impact on their economies. The dollar’s strength is also affecting other Asian currencies, such as the Korean won and the Chinese yuan. The People’s Bank of China has allowed the yuan to move lower against the dollar after weeks of trying to support its currency. In this note we explore the global and domestic implications of a strong US dollar.

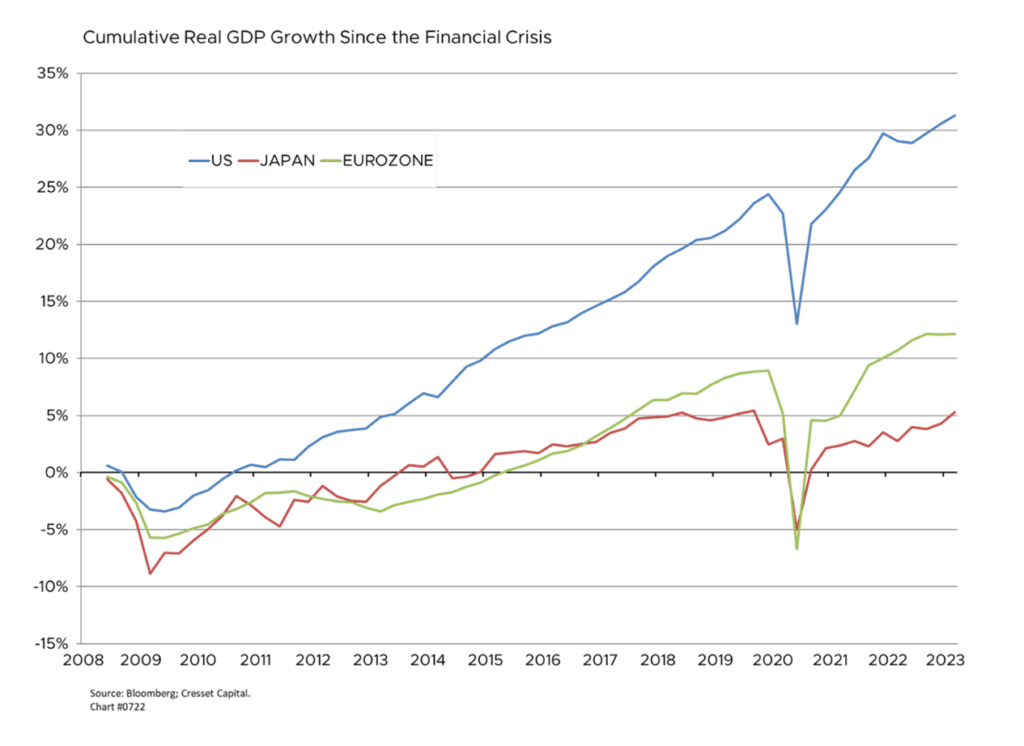

Over a market cycle, a currency’s strength or weakness relative to another currency is a function of several factors. These include its country’s relative economic growth rate, real interest rate, trade surplus or deficit, and relative political stability. Since the pandemic, US economic growth has run circles around the economies of our developed-market trading partners. US economic activity has expanded at nearly three times the rate of the Eurozone economy and more than six times that of Japan, adjusted for inflation.

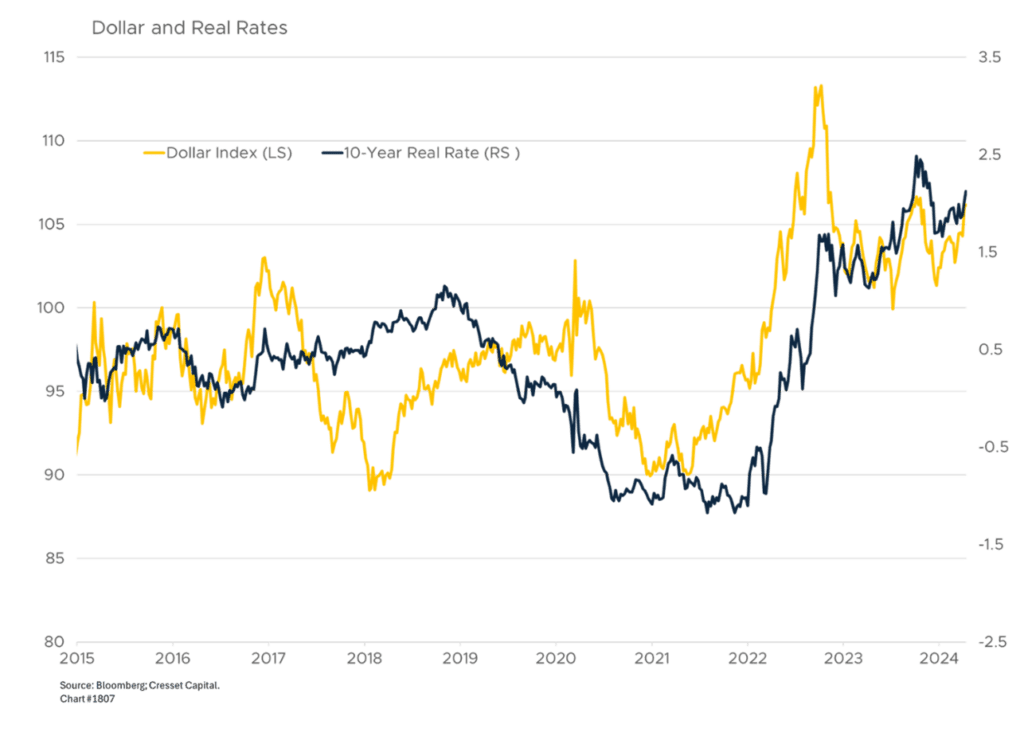

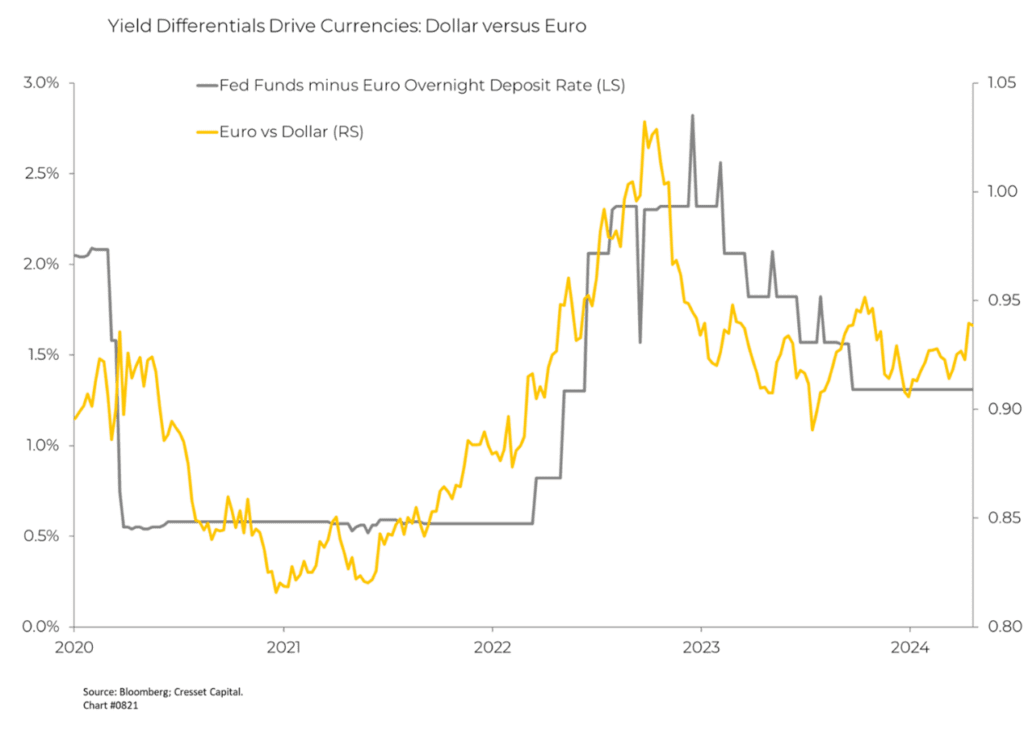

Moreover, US real interest rates hit their highest level in nearly 20 years thanks to aggressive Fed tightening. The dollar has been moving in lockstep with US real interest rates since 2020. A stubborn Fed will likely keep US real interest rates, and the dollar, elevated.

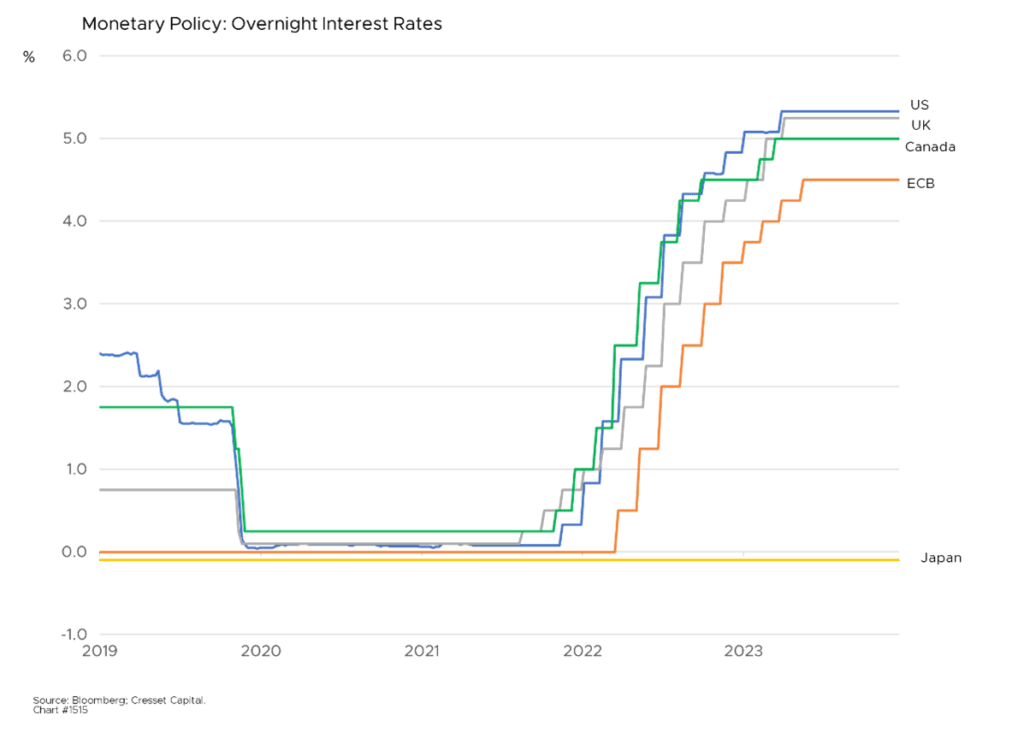

Over the short term, developed-market capital tends to flow into the currencies that offer the highest nominal rates. The dollar wins on that front as well thanks to the Fed’s higher-for-longer policy, resulting from a stronger-than-expected jobs market and hotter-than-expected inflation readings. Investors, at one point anticipating as many as six rate cuts this year, have slashed their easing expectations to one.

The dollar’s remarkable strength is putting many of the world’s central banks in a bind. The Bank of Japan (BoJ) is a case in point: though it ended its negative interest rate policy and removed its cap on the 10-year sovereign bond yield last month, Governor Kazuo Ueda has signaled that future rate hikes will be gradual. However, the yen’s continued weakening may force the BoJ to tighten its policy faster than planned to combat inflationary pressures caused by the increasing cost of imported goods. Doing so could imperil the country’s incipient economic recovery.

Business activity in Europe is mixed, with the two largest economies, Germany, and France, expected to remain stagnant while other member states expand. The European Central Bank is hoping to cut interest rates in June as inflation falls close to target, and growth remains sluggish. However, doing so would further weaken the Euro at a time when the common currency flirts with its lowest value against the dollar since November, below its pre-pandemic level.

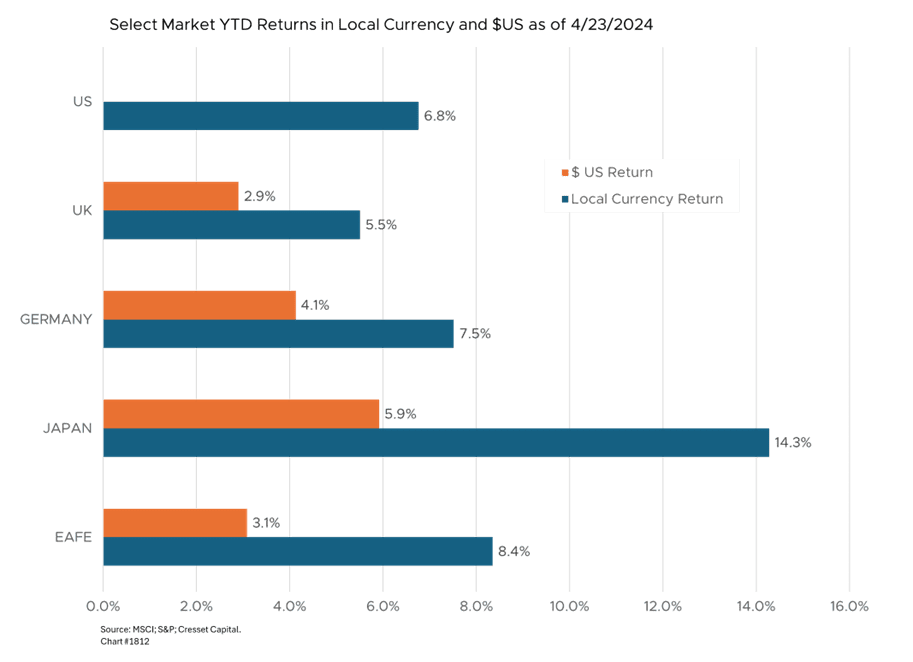

Bottom Line: For an import-oriented economy like the US, a strong dollar is more of a blessing than a curse. Dollar strength, however, reduces the competitiveness of US exports, making US goods more expensive for foreign buyers and potentially reducing demand, and negatively affecting US companies that rely on international sales. Translating foreign sales into dollars crimps profits for US multinational corporations when the dollar is strong, which can have a negative impact on their financial performance. It should be noted that 62 per cent of S&P 500 revenue is earned abroad, according to S&P Global. Dollar strength attenuates returns to US investors holding foreign stocks and bonds. It’s interesting to note that most developed markets are beating the S&P 500 this year in their local currencies. We expect dollar strength to continue this year as long as foreign central banks cut rates while the Fed stands pat.