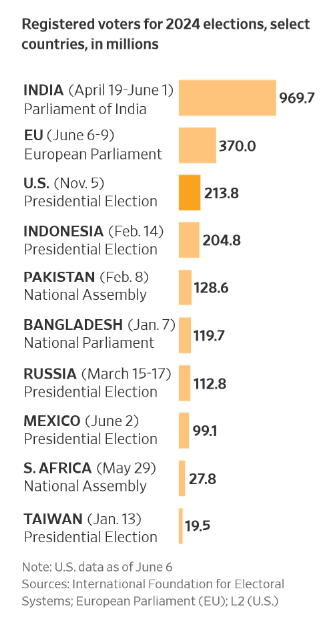

06.20.2024 The recent European Parliament election results carry political and economic ramifications across Europe, particularly in France, Germany, and the UK. The elections saw a significant shift to the right, with far right and nationalist parties making substantial gains. Moreover, elections over the last few weeks involved countries with nearly 1.1 billion voters, about half the total number expected to go to the polls this year. Elections in countries including France, Germany, the UK, Mexico, India, and South Africa have delivered unexpected results, with voters asserting their priority for their own personal economic prospects and in many cases delivering verdicts that ran counter to polling predictions. The results have surprised both the political establishments as well as global investors. What are their implications?

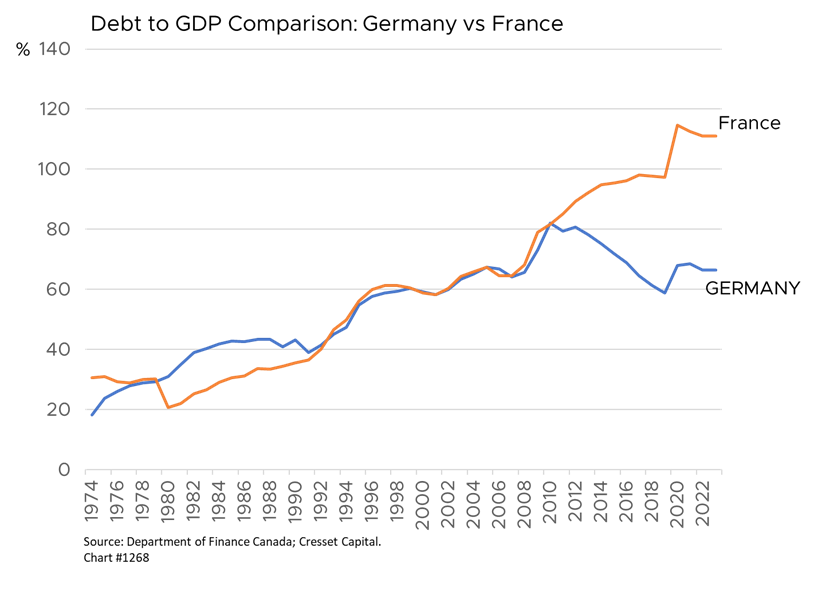

The rise of populist and nationalist parties is concerning to businesses and investors, who fear the potential economic consequences of their policies. To date, France has had little incentive to keep its finances under control, and Europe’s second-largest economy has been running huge budget deficits while racking up its national debt. Marine Le Pen’s far-right National Rally party emerged as the biggest winner in Frances’s contest, prompting President Emmanuel Macron to call for snap parliamentary elections. His decision has been met with trepidation, as it could lead to a power shift to a far-right government if National Rally performs well in the upcoming elections. The National Rally party is poised to become the largest single party in the European Parliament.

Credit rating agencies are worried: S&P Global downgraded France’s debt last month, due to a combination of high debt and deficits. The prospect of a cohabitation between Macron and a far-right prime minister, possibly Jordan Bardella, raises questions about France’s future domestic and foreign policies. Le Pen’s National Rally party promised higher spending, tax cuts and reducing the retirement age. Bond market vigilantes, should they emerge, could exert upward pressure on French borrowing rates and on its banking sector. Markets have already wiped out nearly €10 billion collectively from French banks’ equity valuations. France’s 10-year bond yield spiked nearly .06 per cent in response, widening its spread against Germany’s 10-year Bund. The French 10-year also yielded more than Portugal’s last week and is closing in on Spain’s 10-year yield.

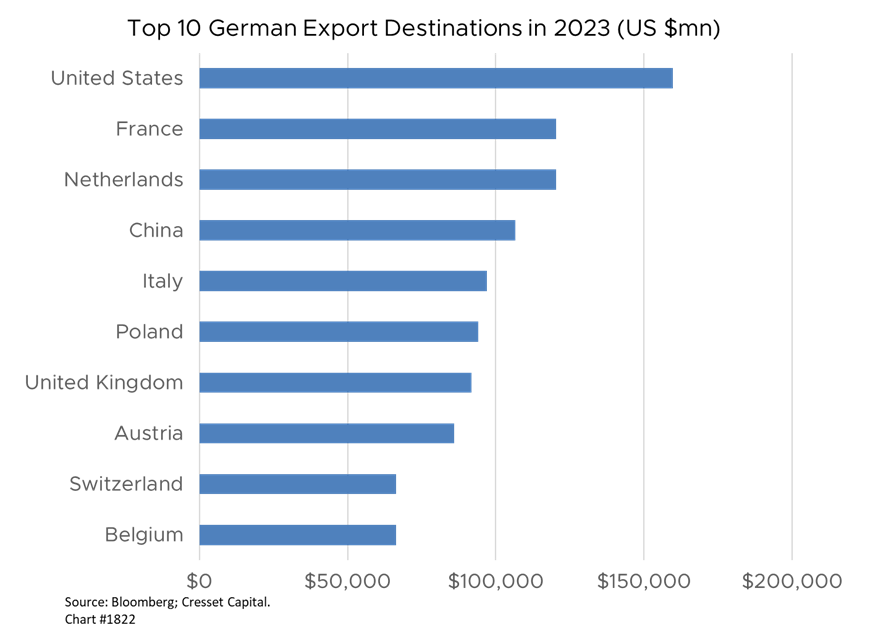

Fewer than one in four Germans are satisfied with their government, the lowest reading in more than a decade, according to the The New York Times. Germany has also witnessed a surge in support for the far-right Alternative for Germany (AfD) party, which became the second-most popular party after the conservative opposition Union bloc. AfD is not only anti-immigration but has also championed the idea of Germany exiting the European Union (EU). Though Chancellor Olaf Scholz’s governing coalition suffered losses, a snap election is unlikely due to the rarity of such events in Germany’s political system. However, the coalition’s weakened position could lead to increased tensions.

German business leaders are wringing their hands. As an export-led economy, Germany benefits from international trade and European unity. The EU is Germany’s largest export market. The New York Times cited a study that warned that Germany’s exit from the EU would reduce the country’s GDP by nearly six per cent over five years and cost the country 2.5 million jobs.

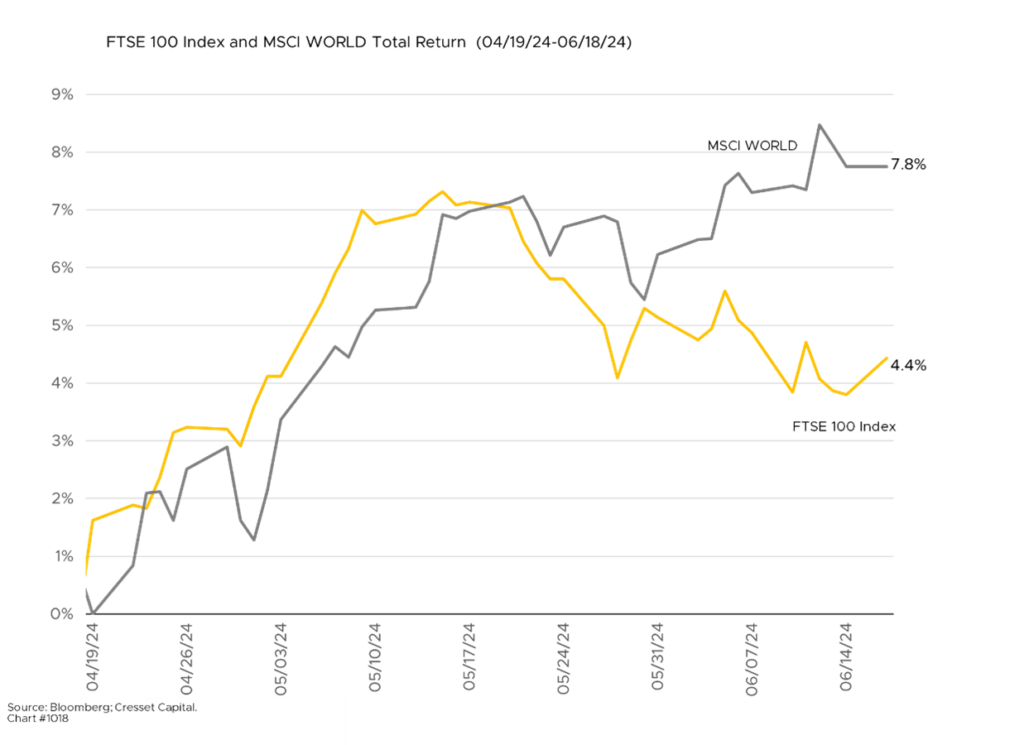

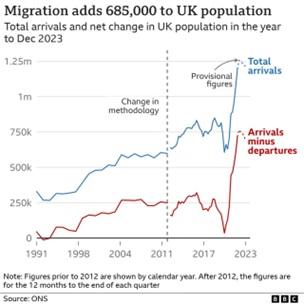

The UK Conservative Party – which has held power for nearly two-thirds of its 200-year history, and has controlled Parliament for the last 14 years – is predicted to lose the upcoming general election on July 4. Voters in former Labor strongholds that had swung to the Conservatives in 2019 are now returning to Labor, with the populist Reform UK party also gaining support. The country is mired in low growth, moribund productivity and price pressures. Britain’s tax burden is at its highest level in 70 years while the country’s debt-to-GDP is set to breach 90 per cent, according to the Financial Times. While the Conservative Tory party fell victim to COVID-19 lockdowns and the economic blowback from the war in Ukraine, it did usher in Brexit and chaotic leadership under Boris Johnson and Liz Truss. Voters who supported leaving the EU in 2016 have grown frustrated that immigration since Brexit has surged and asylum seekers continue to cross the English Channel. That has left an opening for Nigel Farage’s Reform party, which calls for tax cuts, adopting a comprehensive healthcare system and slashing immigration to “net zero.”

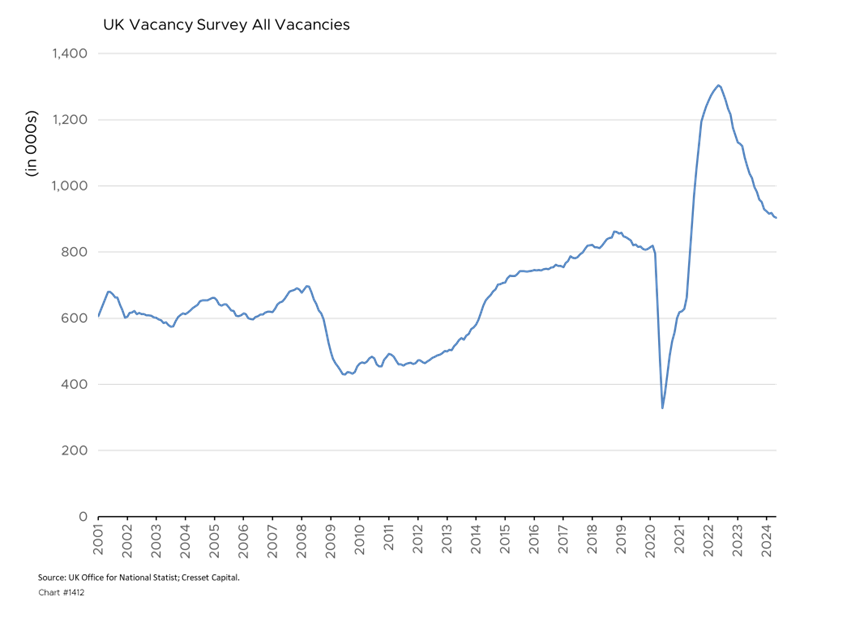

The rise of the far right across Europe poses a challenge to the EU’s ability to address its need for foreign workers, as populist parties often champion anti-immigration policies. Countries like Italy have managed this by quietly admitting large numbers of foreign workers while maintaining a tough stance on irregular immigrants and asylum seekers. However, the UK’s experience highlights the difficulty of balancing these competing priorities.

Overall, the recent European elections have highlighted a significant shift towards populist and nationalist parties, raising concerns about the future of the EU and the economic stability of its member states. As countries grapple with the challenges posed by these political upheavals, the need for economic reforms, a balanced approach to immigration and public spending, and clear messaging about these needs will be crucial in the coming years.

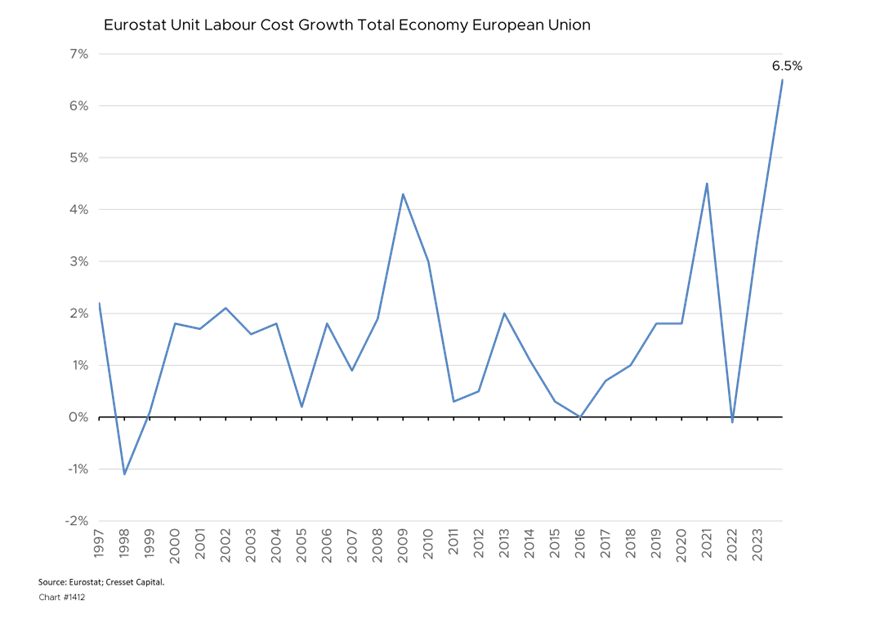

Bottom Line: Far-right parties across Europe, though their platforms are not perfectly aligned, agree that immigration must be curtailed. Yet anti-immigration sentiment comes at a time when job openings are high across the Continent. The EU job vacancy rate, which spiked during the COVID lockdown, has failed to fall back to pre-pandemic levels. According to the Financial Times, there are acute labor shortages across the EU in construction, technology and engineering occupations. That’s particularly true in Belgium, the Netherlands, Austria and Germany, where anti-immigrant sentiment is strong.

The rise of populist and nationalist parties across the EU could lead to increased economic instability and uncertainty. If these parties were to gain power and implement proposed policies such as increased government spending and anti-immigration measures, this could put pressure on the EU’s economic recovery and long-term growth prospects. Investors should prepare for higher inflation in economies where slower immigration and labor shortages collide. We would also expect a reversal, or at least a slowdown, in the “green” energy transition, as Green party support has ebbed. Such a move would keep demand for fossil fuels, including coal, elevated. While the election results will clearly push European policy to the right, divisions among far-right EU parties will likely result in legislative gridlock, blunting the possibility of implementation of some of the most extreme measures. These trends present a fundamental headwind for Europe in an increasingly competitive global economy.