By Alex Penning, Managing Director, Head of Banking & Lending

A year after the failures of Silicon Valley Bank, Signature Bank, and First Republic Bank, business owners and entrepreneurs are rightfully wondering what the current state of business lending is and, more importantly, where they should turn for their capital needs.

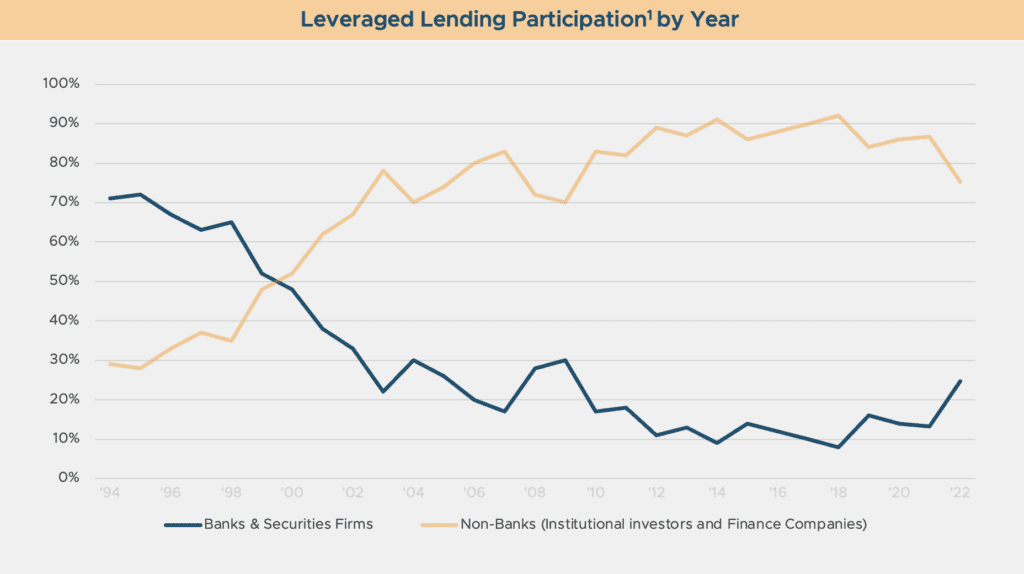

There has been a meaningful shift in where businesses are banking and borrowing money, and the turmoil in the traditional banking industry has accelerated that trend.

While some business owners have gravitated toward systemically important banks (also known as SIBs), which are generally large, well-known institutions, many others are now looking to direct lenders, also known as private credit funds. These firms are non-bank financial institutions that lend money directly to private companies.

The rise of direct lending has expanded the financing options available to businesses, especially those that previously relied on traditional banks.

In recent years, the direct lending market has experienced remarkable growth both in the number of direct lenders and in the amount of capital deployed, driven by a confluence of factors within the global financial ecosystem.

First, the stringent regulatory framework introduced after the 2008 financial crisis forced banks to tighten their lending standards, creating a financing gap for businesses, which direct lenders have eagerly filled. These lenders offer flexible terms and faster access to capital. Additionally, low interest rates following the financial crisis incentivized investors to seek higher-yielding assets, making private credit vehicles, with their attractive risk-adjusted returns, an appealing option.

The benefits of working with direct lenders:

- Enhanced Flexibility – Direct lenders are typically more flexible than traditional bank loans, with the terms structured to fit the specific needs of the company, such as offering longer maturities, more favorable covenants, or flexible repayment schedules.

- Greater Speed & Certainty of Execution – The decision process is typically more streamlined at a direct lender versus a bank, providing faster access to capital.

- No Personal Guarantees Required – Many direct lenders do not require business owners to personally guarantee a loan, which allows business owners to protect their personal assets.

- Preserve Existing Deposit Relationships – Direct lenders do not require you to disrupt any existing banking relationships.

In summary, the trend toward direct lending is reshaping the credit landscape, offering new opportunities for businesses to secure the financing they need to grow in an evolving economic environment.

Contact us to further explore how direct lending could benefit your business.

Subscribe to Entrepreneurial Edge

Sign up for our monthly newsletter with the latest thought leadership, event invites, and resources for entrepreneurs.

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.

About Cresset

Cresset is an independent, award-winning multi-family office and private investment firm with more than $237 billion in assets under management and advisement (as of 1/1/26). Cresset serves the unique needs of entrepreneurs, CEO founders, wealth creators, executives, and partners, as well as high-net-worth and multi-generational families. Our goal is to deliver a new paradigm for wealth management, giving you time to pursue what matters to you most.

https://cressetcapital.com/disclosures/