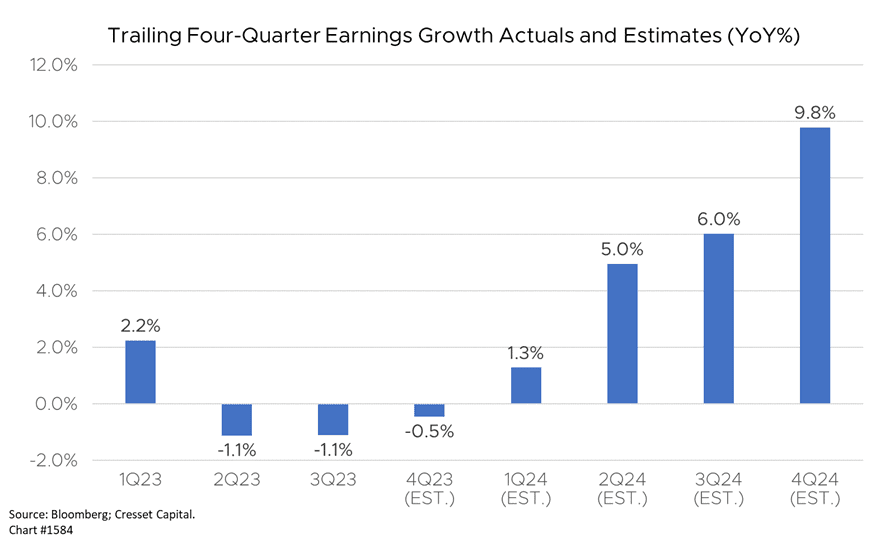

1.24.2024 US large caps have rallied nearly two per cent so far this year – recently pushing through an all-time high – fueled by optimism and little else. Economic data have so far failed to fit into the slowing growth, slowing inflation narrative; the job market is tight and retail sales remain strong. December posted a year-over-year increase in the inflation rate. Earnings season is in full swing and results have been tepid so far, weighed down by the big banks which each took a one-time FDIC charge in response to last year’s banking sector brouhaha. Overall, S&P 500 profits are expected to have slipped 0.5 per cent in Q4/23 over the previous four quarters, representing the fourth quarter out of the last five in which profit growth contracted. Without the help of tech companies, S&P 500 profits are expected to be two percent in the red. Mega-cap tech names are expected to continue to drive overall earnings growth, likely delivering 46 per cent year-over-year profit growth in Q4. While that’s down slightly from the 53 per cent profit pop in Q3/23, mega-cap tech still casts a long shadow over the rest of the market. Where are we headed from here?

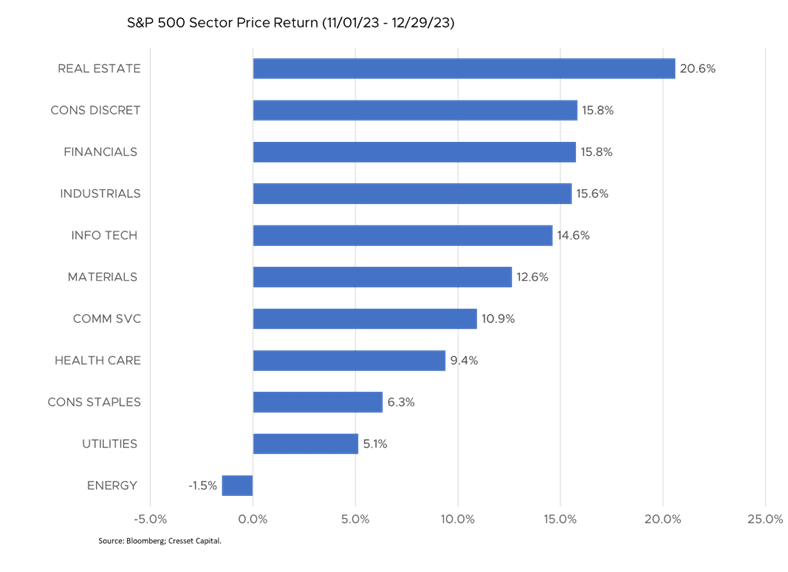

We believe this year will likely shape up to be a good environment for stocks, but not a great one. Arguably, a fair portion of 2024-related optimism was pulled forward into late 2023, leaving less upside for this year. The S&P 500 advanced nearly 13 per cent over the last two months of 2023, fueled by the growing belief that Jay Powell’s Fed would begin cutting overnight rates in 2024. Interest rate-sensitive real estate shares surged more than 20 per cent in response. Discretionary consumer and financial stocks were not far behind. Like last year, the technology sector, fueled by semiconductor stocks, has helped push US large caps to new highs this year. While tech is up nearly 10 per cent year to date, five sector groups are in the red, with energy and utilities both off around six per cent.

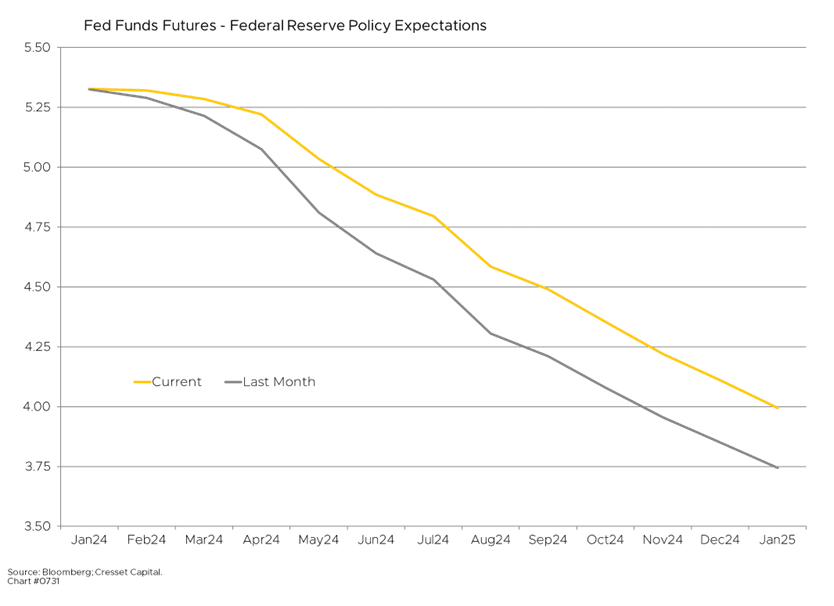

Investors’ confidence that the Fed could slash rates as early as March is waning. What was a near certainty a month or two ago is now a coin flip, although we believe it’s a matter of when, not if. According to Fed fund futures trading, investors have taken one anticipated rate cut off the table this year, going from five cuts to four cuts. Still, lower short-term rates are needed to ease financial conditions and give highly-leveraged companies, particularly small caps, financial relief.

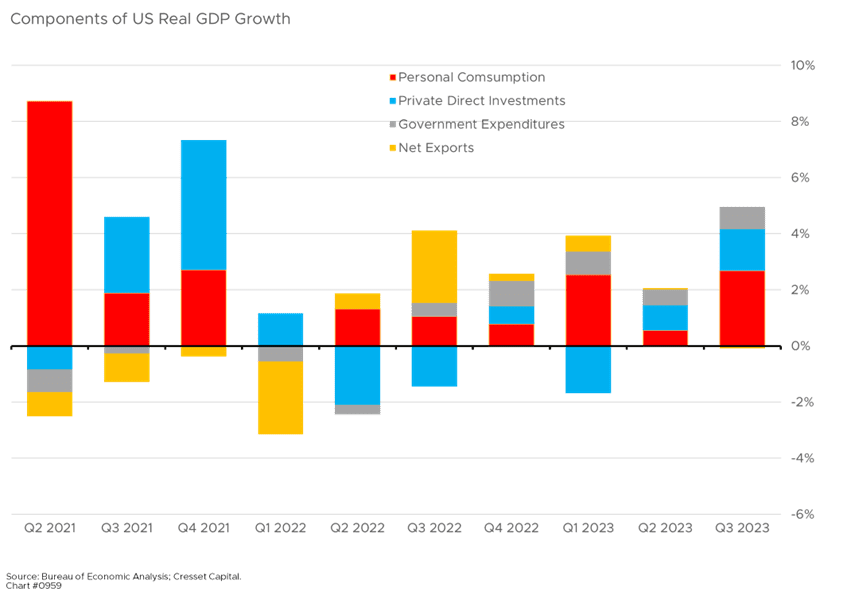

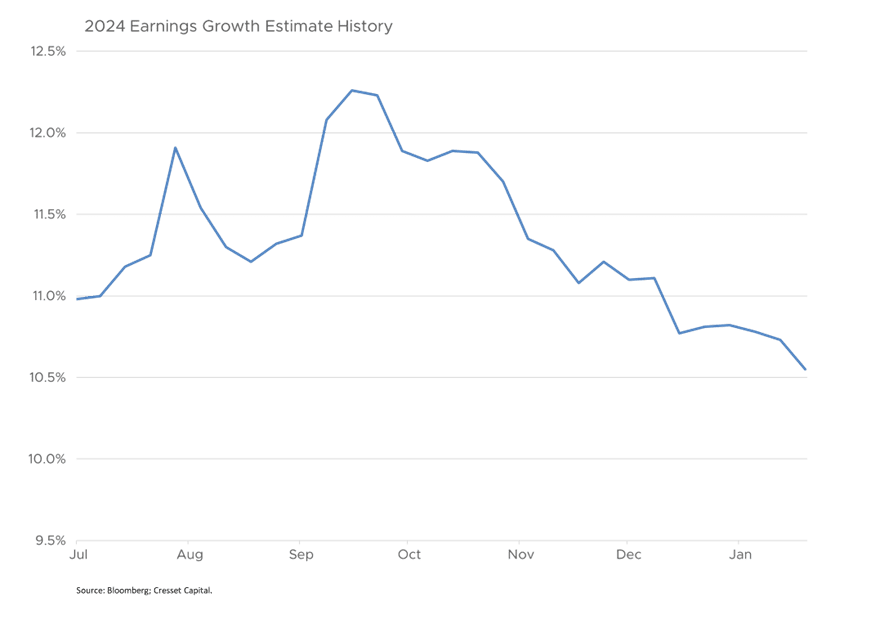

Expectations for accelerating earnings growth are expected to be a catalyst for further market gains this year. Street consensus calls for 11 per cent earnings growth in 2024, which helps bolster the bull case. The good news is the economic backdrop is strong. US GDP expanded at an annualized 4.9 per cent rate in Q3/23 and is expected to have gained two per cent annualized last quarter. Personal consumption, the main driver of US growth, added 2.7 percentage points to growth in Q3, while business investments were strong. Meanwhile, inflation pressure is easing. December 2023 CPI grew 3.4 per cent, down from 6.5 per cent in December 2022, helping make the case for easier monetary policy this year. Q4 GDP numbers, due later this week, are expected to show the economy advanced two per cent on an annualized basis.

Bottom Line

Fundamental market conditions are favorable for risk taking, but we note several threats:

- The Fed could be forced to keep rates higher than expected for longer due to stubbornly hot inflation readings. While pricing trends are propitious, exogenous shocks to oil prices, or a global trade disruption, could push inflation the wrong way.

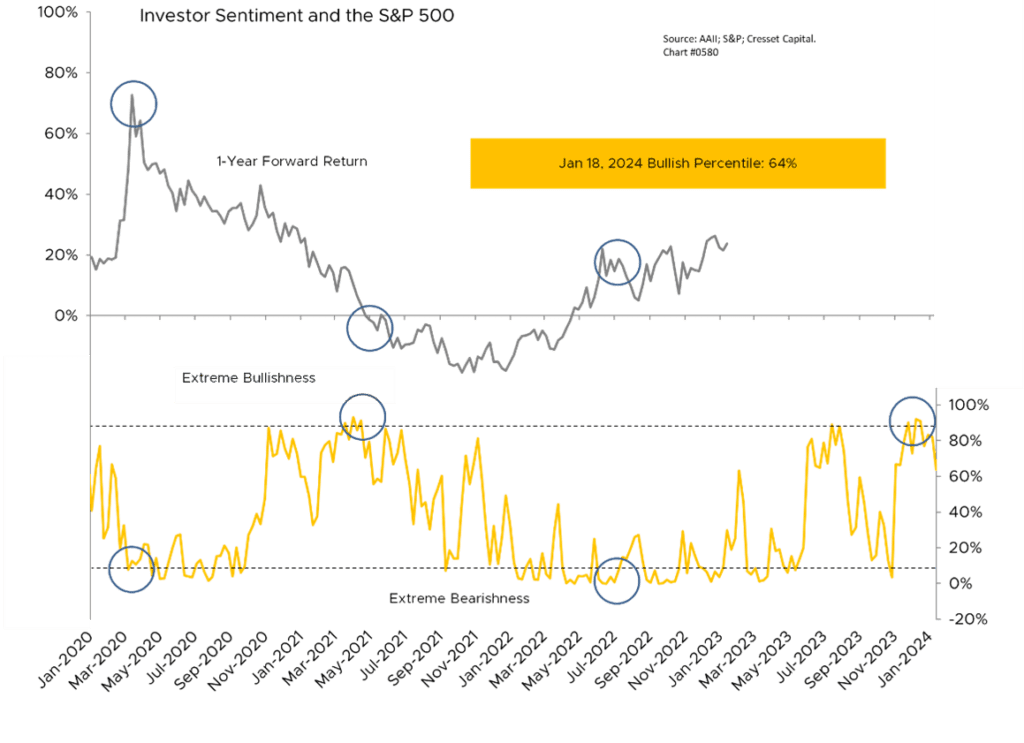

- High investor expectations are a smaller risk. Investor optimism pushed extreme levels at the outset of the year, boosting expectations of perfection. In a market that responds to the intersection of reality and expectations, extreme bullishness makes markets vulnerable to disappointment. The good news is that investor bullishness is off the boil and is trending back toward neutral.

A substantial reduction in profit growth, without a concomitant reduction in intermediate interest rates, could pose a problem for equities. For now, that’s not in the cards. Equities will take their cue from earnings trends this year, since we believe intermediate rates, the determinant of the market multiple, are situated around fair value. Earnings growth expectations for Q4/23, which are currently flat as we navigate earnings season, were as high as seven per cent as recently as September, prompting corporate managers to guide analysts to lower the bar. Analysts are anticipating 10.5 per cent earnings growth for 2024, a number that will likely mirror equity returns nearly one-for-one this year. We expect growth estimates for the year to be cut incrementally, leading ultimately to mid-to-high single-digit returns.

We therefore recommend investors stay focused on quality companies across the capitalization and regional spectrums. We believe companies with strong balance sheets, low debt, and high debt service coverage possess the financial flexibility to navigate the uncertainty that never seems to dissipate.